Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Debunking Myths about China’s Battery Industry

Listen

In this article, we debunk some myths about China’s battery industry to explain why the Global X China EV battery ETF (2845 HKD) is an attractive investment.

- Miscalculating the impact of the IRA

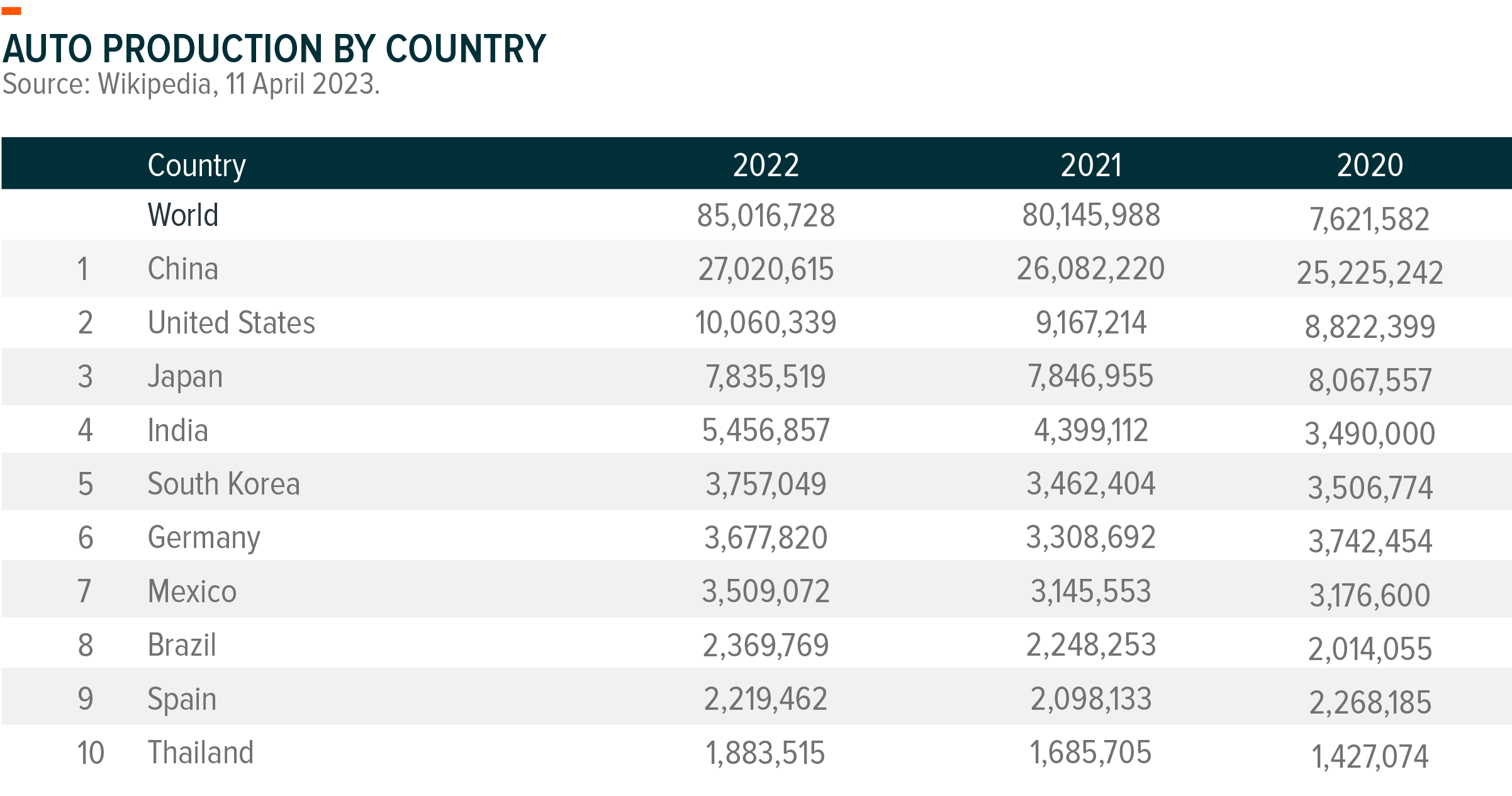

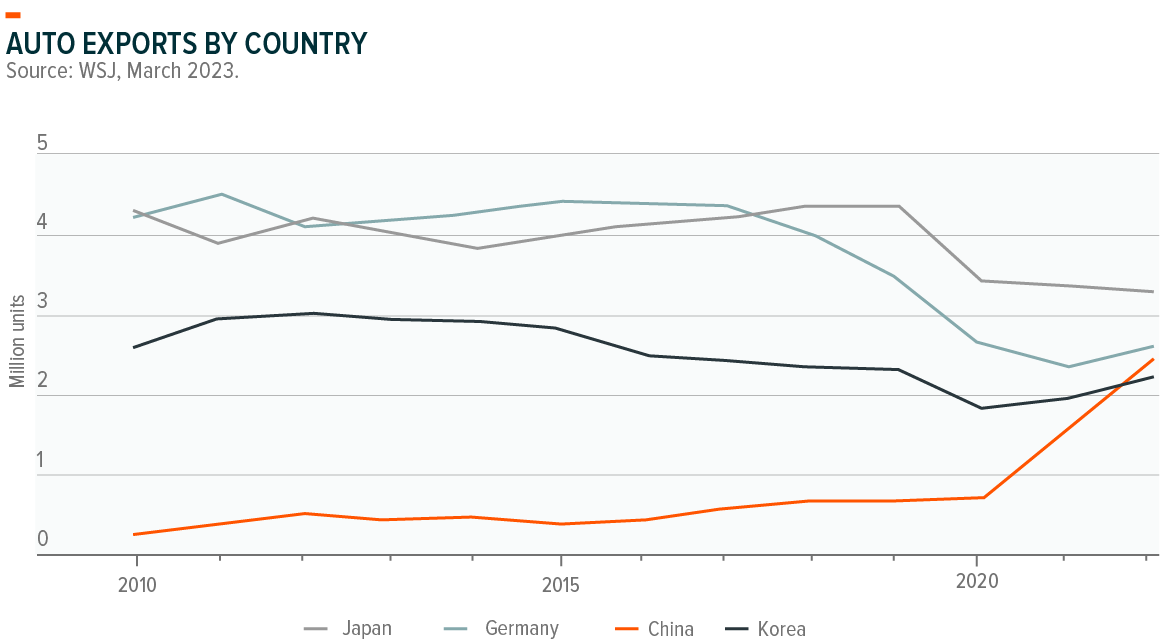

US protectionist policies (such as the Inflation Reduction Act (IRA)) might limit Chinese battery companies’ US market penetration. However, we should not exaggerate the size of the US auto market, which accounts for only 15% of the world’s demand.1 China can still penetrate 85% of the world’s auto market. Europe and other regions also need Chinese batteries because it is cost competitive and helps in the battle against climate change.

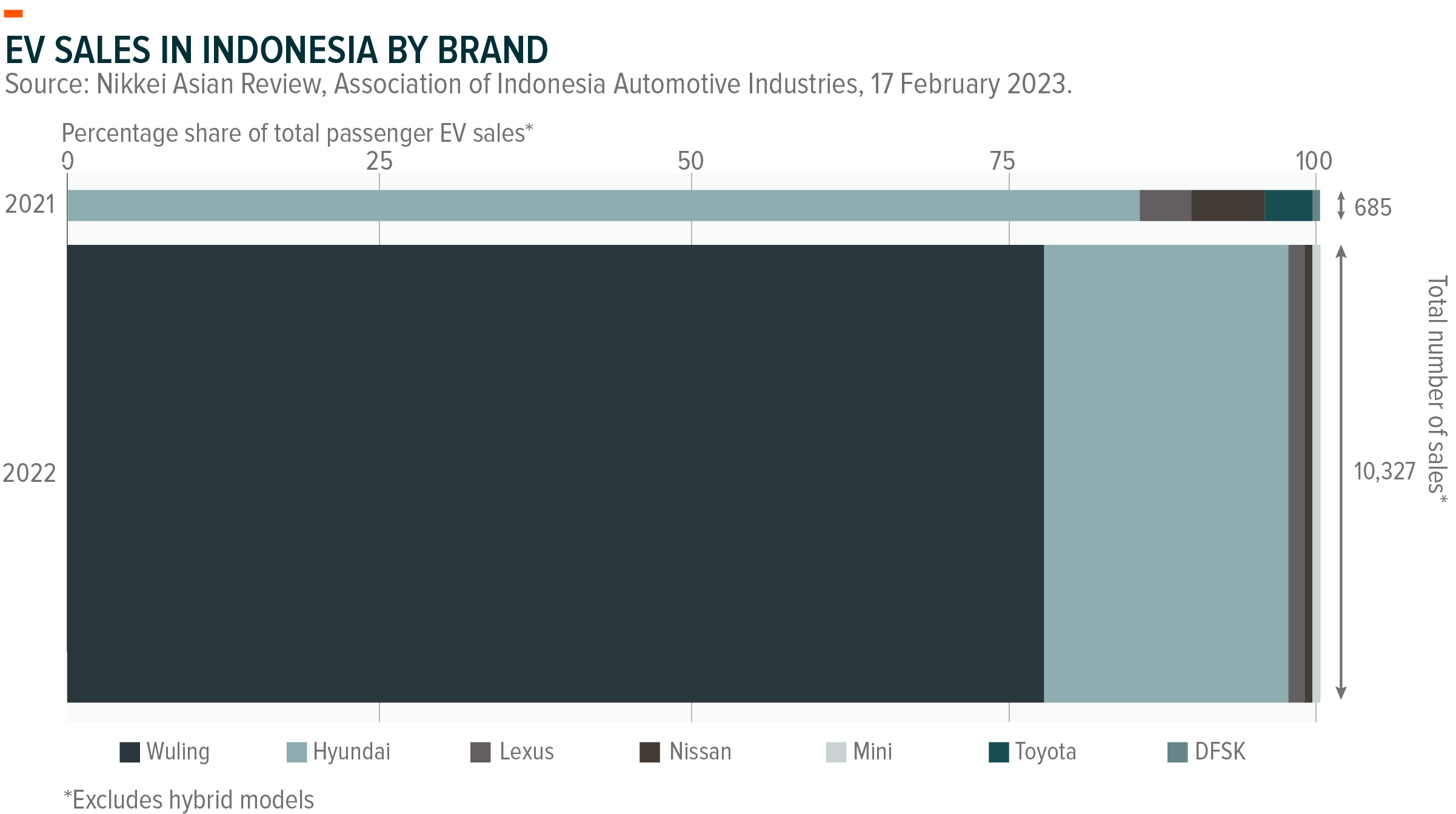

For instance, in the Indonesian market, Chinese automaker Wuling suddenly became the no.1 EV seller in 2022, exceeding the Korean automaker Hyundai.2 This shows just how cost-competitive Chinese batteries and EVs are compared to peers.

It’s also worth noting that 85% of the global addressable market is big enough. China’s auto market accounts for 30% of the global car market.3 It might be almost impossible for non-Chinese battery companies like Korean and Japanese ones to enter the Chinese market due to their higher cost, especially when they use the US (a high-cost country) as their manufacturing hub. From this perspective, the market penetration potential for Korean automakers is no more than 70% of the world market.

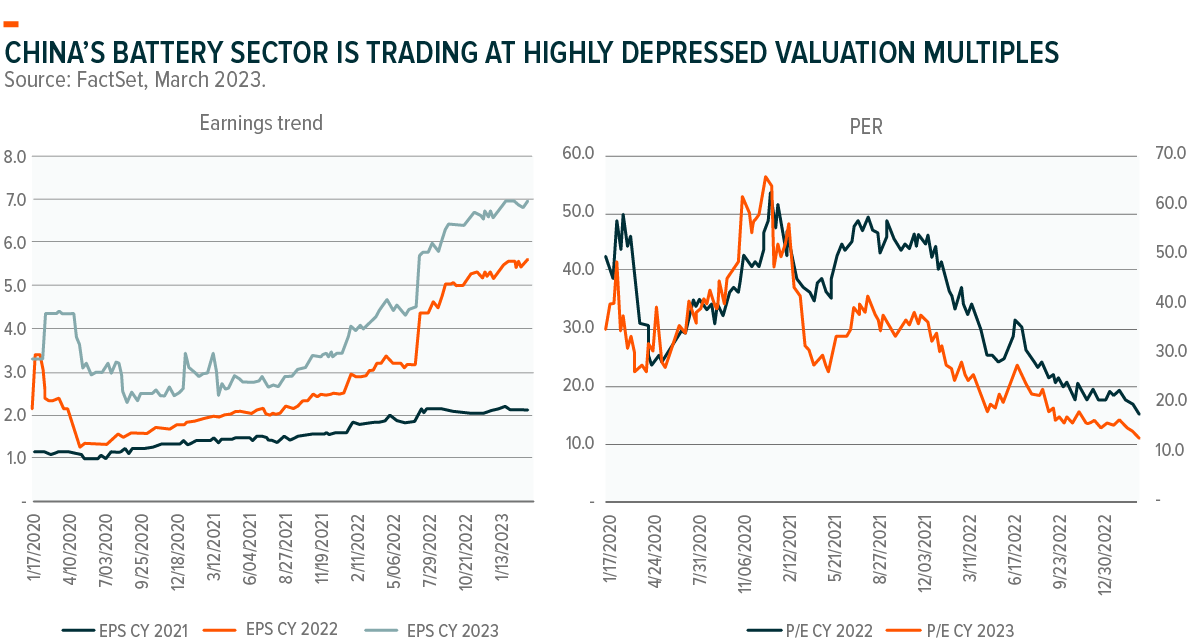

But, the leading Korean battery cell stock, LG Energy Solution, is trading at 80 times for 2023 while the leading Chinese battery cell maker, CATL, is trading at 22 times for 2023.4

- Penetration in China is Not High

The penetration ratio of EVs (Battery EV + PHEV) is high in China at 26% for 2022 and it’s likely to exceed 30% in 2023.5 In certain industries, 30% penetration ratio looks high. However, it depends on how it is disruptive. For instance, an e-commerce penetration of 30% already is high, considering people still want to purchase goods offline. That’s reason why e-commerce transaction slowed down across the world.

However, EV is different. 30% penetration should be called the early stage as we believe the EV penetration ratio can eventually reach more than 90%, given its superiority vs traditional engine cars.

Let’s take another disruptive force. Internet companies were a really disruptive force in the advertisement industry, and their penetration ratio into the whole ad market was around 30% in 2012.6 Since then, many internet stocks in China have increased their revenues multiple times. As of 2022, the ad penetration ratio of internet stocks has exceeded 80%7. At this point, we can say internet business models have reached a mature stage.

- Fears on Car Demand and Price War in 2023

There has been a serial car price cut led by Tesla recently, which was interpreted as weaker demand due to the global economic slowdown. In most cases, we saw around Rmb10k price cut.

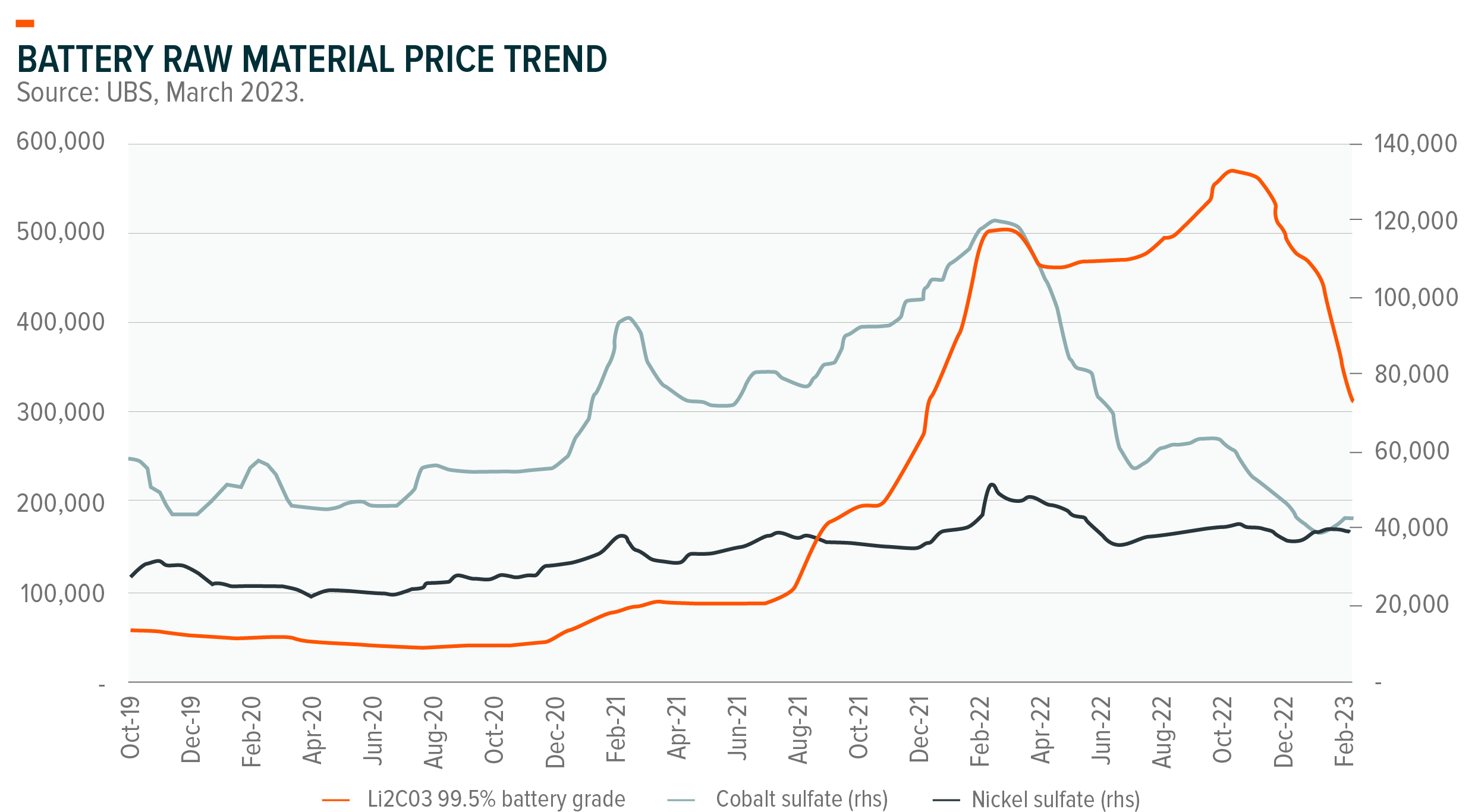

However, the price cut reflects the latest deflationary trend for raw battery material costs like lithium, which accounts for 20-30% of EV manufacturing costs. Lithium price alone fell more than 50% from the 2022 peak8, which can save about Rmb250/kWh in battery costs, implying a roughly Rmb10k saving in EV cost.

Stepping back, EV prices went up a lot in the last two years due to rising raw material costs. Now we are seeing price normalization, though lithium price was Rmb60k per ton before 2021 compared to the current spot price below Rmb200k per ton. Lowering material costs will enhance the cost advantage of EVs vs traditional engine cars and increase the penetration ratio. Battery cell makers will also benefit from falling raw material costs.

As the EV price have fallen more than 10% year-to-date9, on average we expect EV sales to easily exceed the market consensus of 8 million units in 2023.

- China’s Battery Sector is Trading at Highly Depressed Valuation Multiples

The valuation multiple of its underlying index is only 14 times for 2023 earnings10. So it doesn’t seem to reflect the long-term growth opportunities.