China’s Travel Retail Sees New Pocket of Growth

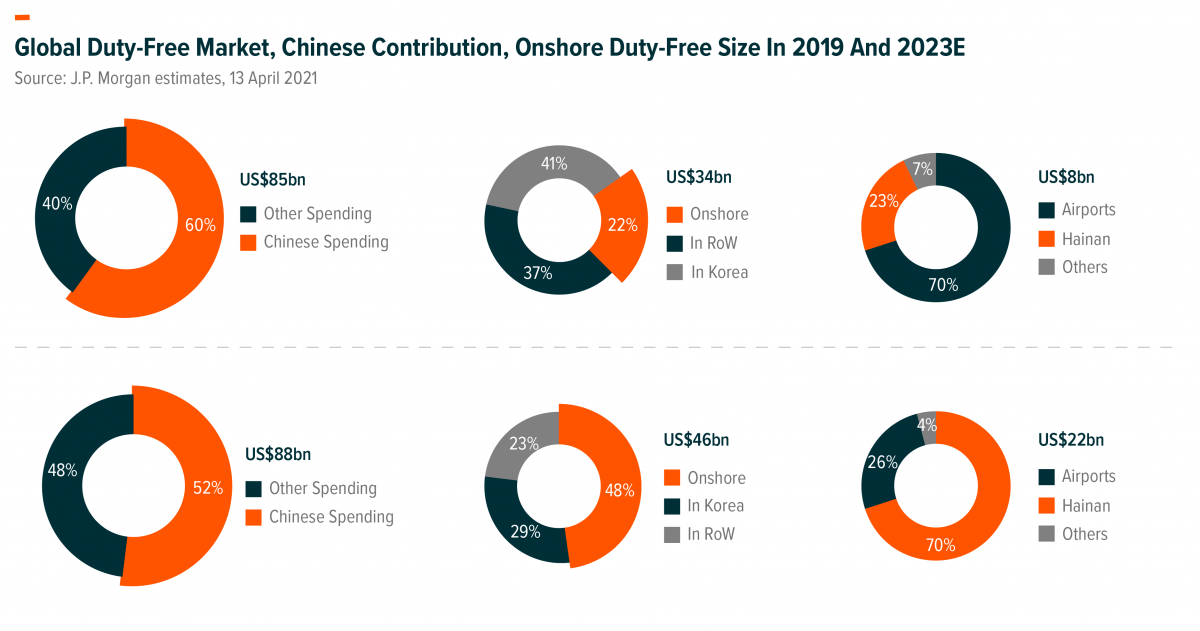

Duty-free retail industry is at a sweet spot riding on rising demand of tourism in China, as well as that of luxury goods and cosmetics. More importantly, the industry is getting strong government support particularly in Hainan province to foster the industry growth as China aims to repatriate overseas spending back into its domestic market. The COVID-19 pandemic has accelerated the repatriation pace as suspended international trips have forced Chinese consumers to shop in the domestic market . This has led to changes that global luxury brands such as LVMH, Hermes, and Estee Lauder are taking Hainan much more seriously and will likely open flagship stores there in the future. China’s duty-free market was only USD 8bn or 9-10 % of the USD 85bn duty-free market in 2019 while Chinese spending accounted for about 40% of the market, according to J.P. Morgan (13 April 2021). We expect to see robust growth of duty-free industry in China thanks to strong global duty-free/luxury industry growth as well as market share gains by Chinese duty-free operators on the back of government support.

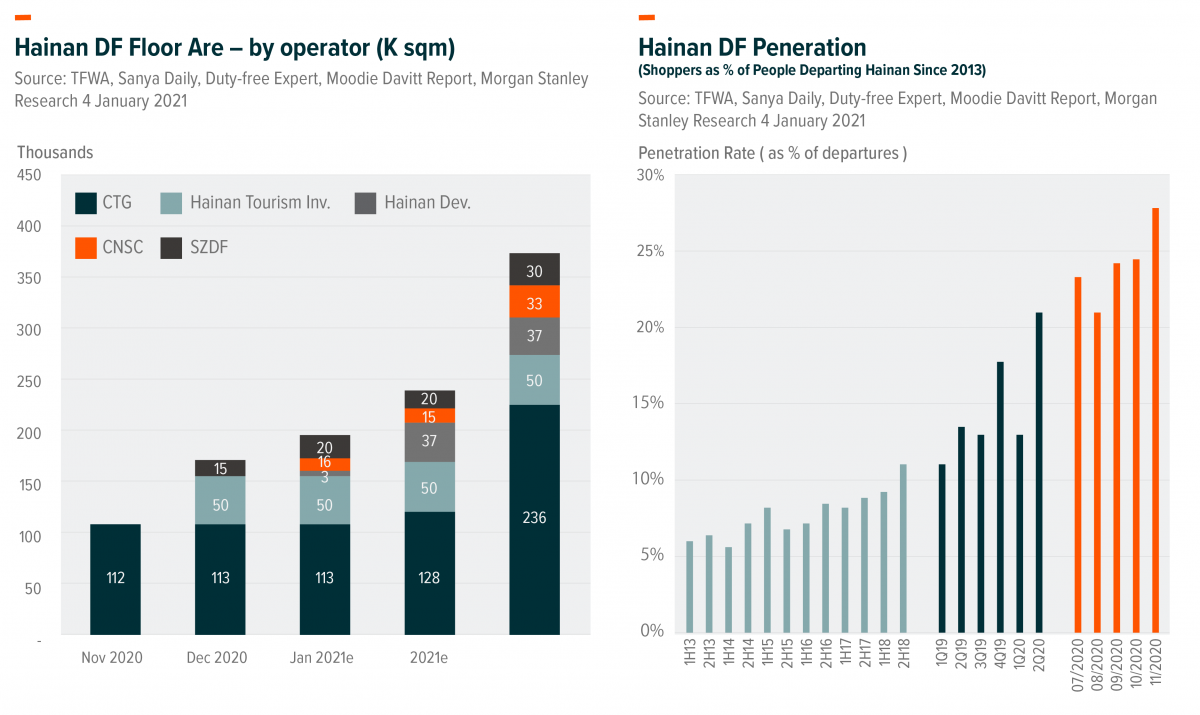

Travel retail is generally an attractive industry globally because the industry benefits from the globalization trend and steady traffic growth. More importantly, they take prime locations, mostly airports, with wealthy consumers who are forced to shop before flying off. However, it may not be a high-quality business because it is a license business strictly controlled by the government. Also, the operators have to enter into contracts with airports which tend to monopolize in each city with strong bargaining power against duty-free operators. However, this is less of an issue in the case for Chinese travel retailers as the government has only given the licenses to state-owned companies. Meanwhile, China has a very strong intention to bring overseas consumption back to its domestic market, which means this industry will continue to receive favorable policies from the government. This is also in line with the government’s effort to develop Hainan as a special economic zone or a tourist destination. We believe there is a big opportunity ahead for Hainan’s duty-free industry which will make the lower margin airport business’s revenue contribution to be relatively smaller for Chinese operators compared to that of global peers. Airports in Shanghai, Beijing, Guangzhou and HK contributed around two-thirds of total duty-free sales in China prior to COVID-19 (according to China Tourism Group Duty-free), but we expect Hainan may contribute two-thirds of duty-free sales in the next three to five years. Travel retail industry in China is uniquely positioned to enjoy both domestic tourism growth to Hainan as well as outbound tourism. In the near term, outbound tourism may not pick up as fast as expected and many Chinese will still travel within China. Going forward, once international travel resumes, the government still has many tools on hand to attract more Chinese to spend onshore rather than overseas and to boost the industry growth. For example, downtown duty-free stores are currently only allowed for foreigners in China but if they are opened to locals, this can be another game changer for the industry considering the experience of Korea.

We believe the real inflation today is at the high end. Luxury goods will continue to benefit the most from strong consumer spending after COVID-19 because wealthy consumers have not suffered much during the pandemic. Instead, many have become even wealthier thanks to the rising asset prices. In fact, luxury companies have been reporting better than expected earnings results this year. Despite rising guochao (国潮) or local brands trend in China, we think luxury including high-end cosmetics will still largely be dominated by western brands for the foreseeable future. Duty-free retail will also be one of the beneficiaries of rising luxury demand in China. According to Goldman Sachs, Chinese luxury spending is estimated to be nearly USD 120bn in 2021E and expected to grow by 11% CAGR in the next five years to reach nearly USD 180bn by 2025E. (Goldman Sachs Jan 25th 2021) Meanwhile, Global duty-free sales market size is expected to grow from around USD 89bn in 2021E to nearly USD 149bn by 2025E, of which Chinese spending will increase from 48% of global DFS market to 56% by 2025E, i.e. USD 83bn. (Goldman Sachs Jan 25th 2021) If China can bring back half of such spending, this would mean USD 42bn compared to China’s DFS market size of USD 8bn in 2019. (Goldman Sachs Jan 25th 2021)

Lastly, we also see changing consumer behaviors supporting China duty-free industry growth. Chinese consumers, especially the younger generation, are increasingly willing to spend more time on experience rather than shopping when they travel overseas. The development of China duty-free industry also satisfies consumers needs. Thus, we believe travel retail industry in China is well supported by Chinese consumers, luxury brand owners, as well as the government to sustain its robust growth in the coming years.

(TPWA: Tax Free World Association)