China’s Leading Position in Solar Glass and EVA Industry

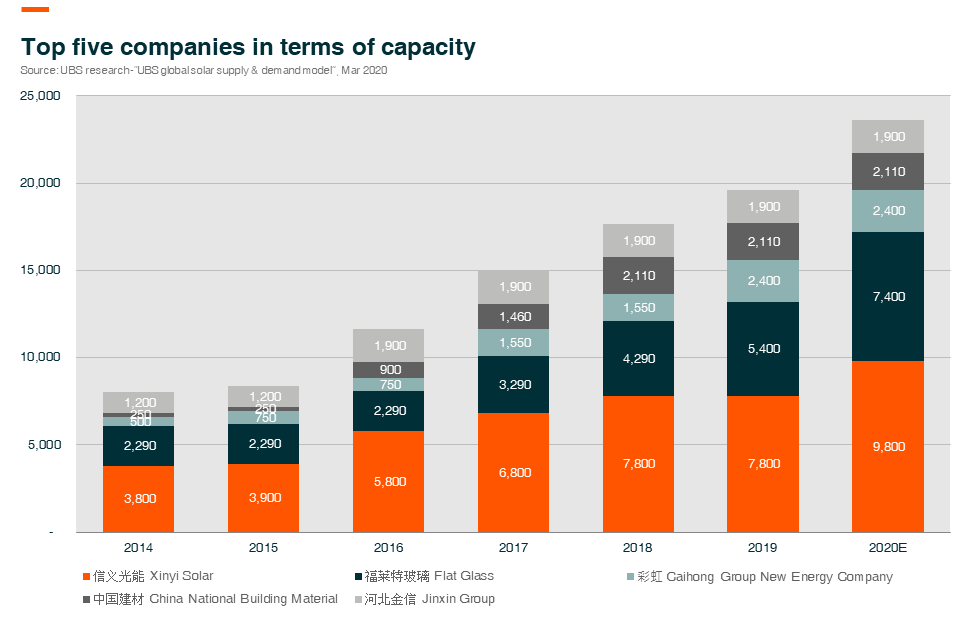

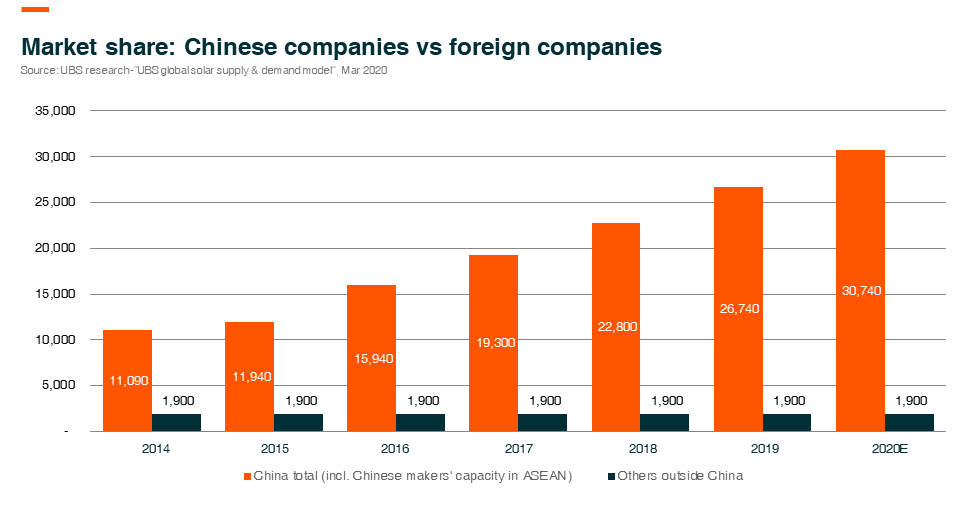

China is absolutely the leader in solar glass and Ethylene Vinyl Acetate (EVA) film manufacturing. The top five Chinese solar glass producers took up a total market share of 68.5% in terms of capacity by the end of 20191, while the top Chinese EVA filmmaker took up nearly 60% of the global market share2. In this article, we would like to see what has been going on in solar glass and EVA industries in the last years and explore why Chinese players are able to consolidate the markets. We try to answer if the current leading players will keep the competitive advantages in the future and under what kind of conditions.

Development in the Last 15 Years

Solar glass is one of the important parts of the module that is used to protect solar cells inside. German companies first adopted glass on passive solar houses dating back to the 1930s, followed by the United States, UK, Japan, and France. Before 2006, the top four solar glassmakers were Pilkington Glass Company in Britain (acquired by NSG later), Saint Gobain in France, AGC and NSG (Nippon Sheet Glass) both in Japan which started the business from architectural glass or automotive glass with higher added value and accordingly higher margin. The top four glass makers only had limited capacities for solar glass, and as a result, asked for relatively higher prices. Global solar glass price had hiked to CNY80 per square meter before 20063.

As the solar market switched from Europe to China between 2008 and 2012, Chinese glassmakers, such as Flat Glass, Xinyi Glass (which spun off the solar glass business later into Xinyi Solar) and others entered into the solar glass industry successively. The key difference of solar glass compared to standard clear glass is that the former is manufactured with lower iron content and produces a much clearer glass structure with no green tint visible through the glass. It has a higher light transmittance of over 90% vs 83% for regular glass, which as a result increases the module conversion rate.

There are five inputs to produce solar glass: soda ash, quartzite ore, power (natural gas, heavy oil and electricity), equipment and labor. Citing Flat Glass’s cost structure4, soda ash and quartzite ore accounted for 37% to 41% of the total production cost, while power cost took up 40% to 41% followed by labor cost of 3.8% to 5.5% and the rest attributed to equipment depreciation and amortization and others. The moat located in: 1) technical advantages and operations management to raise production yield rate; 2) good access to funding for the economy of scale; 3) visible stable sales to downstream module customer to reduce the account receivables and inventory holding pressure, thanks to the continuous production process of glass; 4) glass qualifications authority.

As China becomes the largest module maker in the world and Chinese government proactively supports the industry, solar glass makers benefit in 2) and 3) with a funding-friendly capital market, stable supply chain and less international trade frictions such as tariffs. After Chinese makers self-developed the know-how on lower iron content, they took off in a short period and consolidated over 80% of the global market share by now.

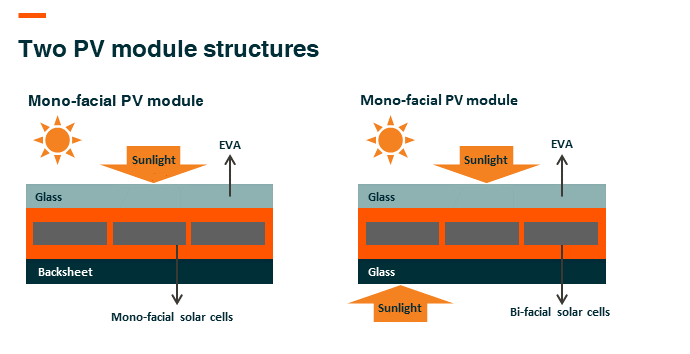

EVA film (Ethylene Vinyl Acetate) is another important part of solar module. EVA film is essentially a thermoset adhesive material that is used to connect the solar cell with backsheet (if there is) and solar glass as shown in Exhibit 1. The key inputs to produce EVA film are EVA resin, power and others (depreciation and amortization, labor), which take up 80%+, 2% and 10%+ respectively5, according to Hangzhou First’s report. The key moat locates in the formula and the according to equipment and production process management. EVA film accounts for around 5%6 of module cost, but is strictly required to maintain good quality for a long time, such as non-yellowing, no delamination or crack since the lifetime of module should be over 25 years. Before 2006, the key producers were Specialized Technology Resources (STR) from the US, Mitsui Chemicals and Bridgestone from Japan, and SKC and Hanwha from Korea. These companies are experienced in petrochemical products, and EVA was a very small part of their product mix with little significance. To cut costs and stabilize supply as well as quality, Suntech Power, the Chinese module leader at that time, spent a lot of time and money preparing a Chinese EVA maker that was called Hangzhou First later. Hangzhou First started its business in the chemical industry. They researched and developed EVA products with Suntech Power, improved the manufacturing method and equipment design based on feedback from Suntech Power. After years of trials and errors, Hangzhou First realized production line self-design and mastered formula know-how, becoming one of the top three EVA providers globally by 2008.

Further Consolidation in the Future

Solar glass and EVA film are typical chemical manufacturing businesses, where technology matters but the innovation is at a slow pace. Companies keep on improving yield rate and cost structure. It is not easy for new entrants to break in, thanks to technological know-how, scale moat, qualification authority, and customer relationship. The competitive landscape hasn’t changed too much in solar glass and EVA film since 2010, which is very different from what has happened to other solar materials.

The top five Chinese solar glass producers took up a total market share of 68.5% in terms of capacity by the end of 20197. As glass production is a continuous process that cannot stop for years, it requires a stable sales channel before building up any capacities. Moreover, it usually takes six months for qualification authority and another six months for a capacity ramp up, which creates huge pressure on cash collection. Therefore, it is not attractive to manufacturers who have no knowledge or customers in the glass industry to enter. Know-how in lower iron content and yield rate and cost advantages from the economy of scale stopped regular glassmakers to some extent, too. Thus, we do not expect big changes in the solar glass competition landscape in the long term unless great innovations in solar panels appear.

Hangzhou first takes up nearly 60% of the global market share, and the top three Chinese EVA makers account for 80%8. Similar to solar glass, qualification authority and module makers’ requirement on stable quality and supply prevent new entrants to the EVA market. The current top players are likely to further consolidate their leading positions in the long term. The only thing we would like to emphasize is EVA resin relies on imports in China. Should any player realize domestic substitute, it may affect the cost significantly, followed by the competitive advantages. However, EVA resin is a petrochemical product. It is believed that it is very challenging for the current EVA makers to integrate into the upstream.

In conclusion, Chinese solar glass and EVA filmmakers have first-mover advantages in scale, qualifications, know-how, and sales channels. They are likely to further consolidate their leading positions in the future unless significant solar technology innovation takes place.

Global X China Clean Energy ETF, representing the high growth potential through companies critical to further advances and increased adoption of clean energy in China, could be your right choice to capture the evolving opportunities of the solar glass and EVA Industry.