China Market Review and Outlook 2025

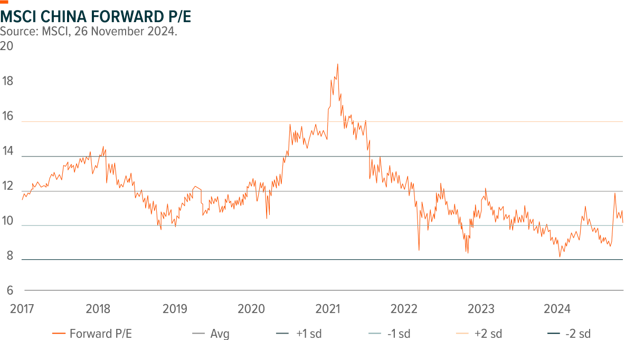

In 2024, Chinese stock market had a strong comeback with MSCI China and SHCOMP up 16.3% and 9.6% (USD term) respectively, reverted a three year downward trend. Nonetheless, the process has been rather volatile with market crash in first quarter and sharp rallies with large fall in mid-April to mid-May and end of Sept (especially). Sharp market swings, large style shift, and policy unambiguity (before October), along with deteriorating fundamentals, made it very difficult to invest (and outperform benchmark).

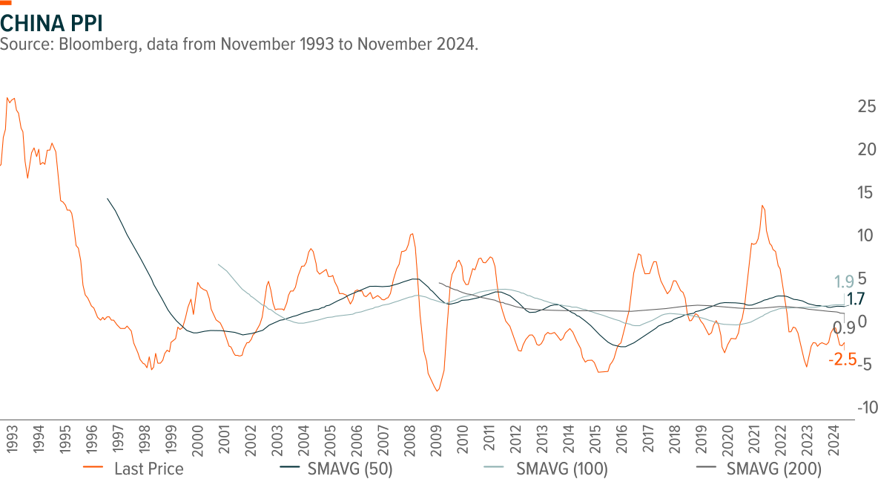

However, we believe September policy shift is momentous, which signalled a deliberate effort from the top leaders to address the key challenges: revert deflationary narrative, stabilize asset prices and bring back confidence. The policy makers finally become more proactively reoriented the deleveraging campaign on local government debt (debt swap) and property. Those are very difficult tasks but not impossible. China’s current problems (including deflationary pressure) are somewhat similar to the combination of mid-late nineties’ debt and fiscal transition and mid 2010’s over-capacities and property weakness. China should know the formula how to get out of those problems, if they decide to do.

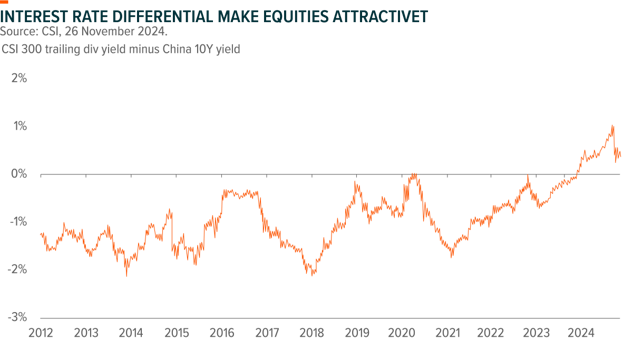

Since September, we have seen a wave of policies. The PBoC has been more decisive on policy easing and has created more policies tools to stabilize asset prices and allow rates to move down significantly. Yet, monetary policies are important, but as old monetary/credit transmission mechanism which have been property and local government spending centric is partly crippled, fiscal policies (especially on property and consumption) become more important. Top ministries (including MOF, NDRC, MOHURD, etc.) have all come out delivering policies guidance on supporting economy. After a round of policy roll-out, we started to see some green shoots. We see some initial stabilization of the housing sector owing to stimulus and policy triggered pent-up demand. Retail sales growth picked up partly thanks to the trade-in program.

In 2025, we expect more local government special bond to be utilised on land inventory purchase and more PSL to utilized on monetary resettlement (to digest excess inventory). And likely we will see more policies on consumption support (from expanding trade-ins programs and other services related consumptions) and job creation from/after Two Sessions next year. We are could also expect more policies on encouraging child-birth, expanding equipment replacement, pull-in more national level major infrastructure projects (not property related), social welfare transformation from central government. Particularly, in order to see more sustainable growth, we still hope to see more structural reforms particularly in areas that improve the basic public service system and allocate effective investment toward “soft infrastructure” projects closely tied to people’s daily lives and social safety net, to bring confidence for consumption spending and growth transformation.

Nonetheless, to transform from an investment/manufacturing driven economy to a consumption/welfare-oriented economy is a long-term goal and is not an easy task to achieve in near term. In 2025, we still expect promoting emerging industries to climb up technology tree and supporting domestic substitution remain policies priorities. Among them, AI+ we think is the most important one (along with semiconductor), after EV and new energy push in the past 5 years. We have seen China’s AI development catching up fast after US despite US policy restrictions. MAU of Bytedance’s Doubao APP has reached 60mn by Nov. 2024 (2nd to Open AI), and DeepSeek V3 has surpassed GPT-4o in key metrics. China has been very efficient in application innovation.

Yet, one of the biggest overhangs in near term, is the tariff and US policies, given we are likely to see a most consolidated and most China hawkish US admin, and currency has been one of the main concerns from the market. However, we think Chinese policy makers are more prepared this time with more policy combo (including more open-up and divert trade to non-US market, etc.) instead of solely relying on currency, hence could be less than market has feared. Despite of rebound in 2024, China equity market remains attractive (especially with strong support from policies makers on the downside).