China Market Outlook 2025: China EV and Battery Sector

A Strong 2024 as Bolstered by Supportive Policy

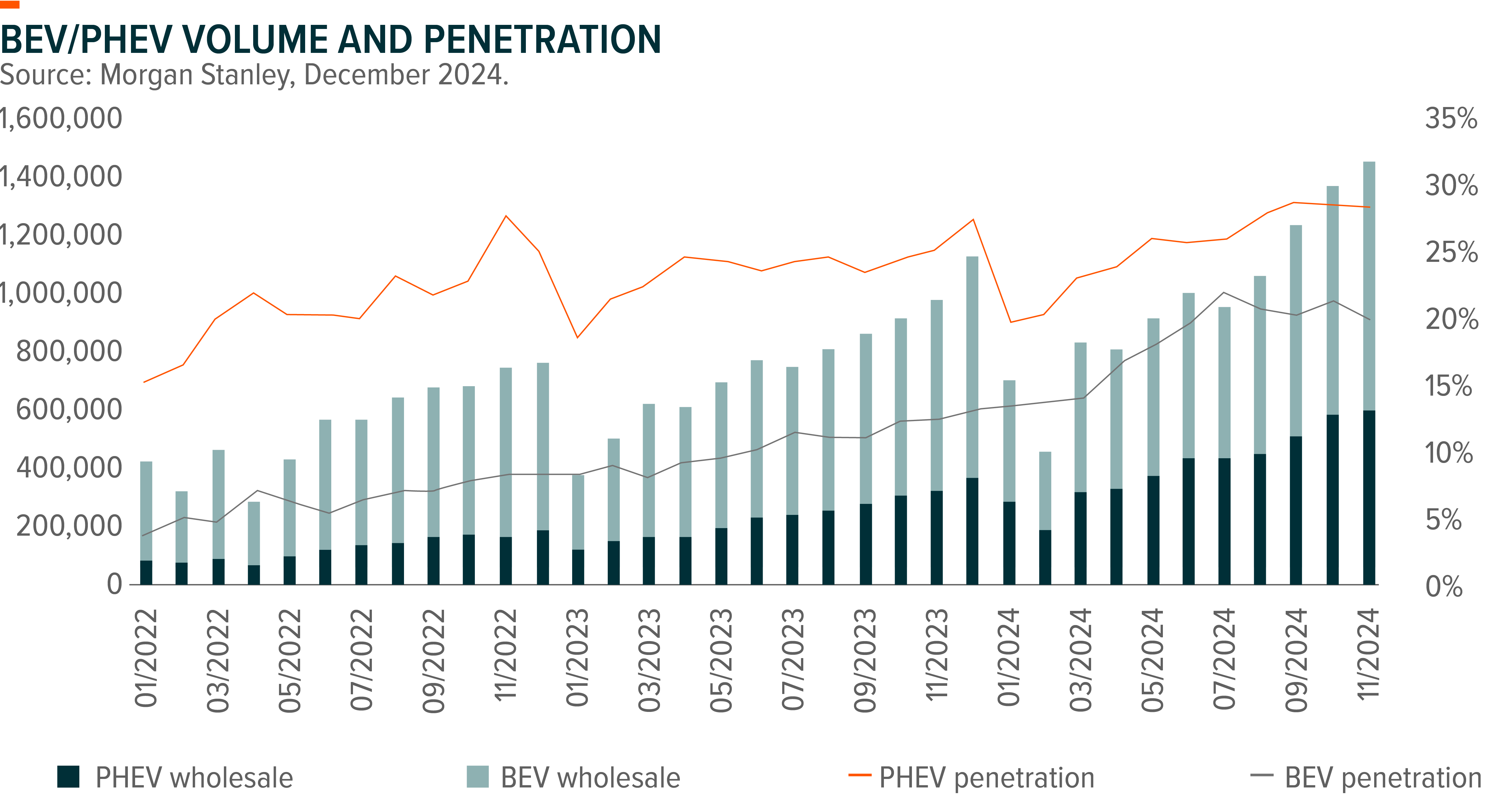

China NEV wholesale volume reached 11mn units in 11M24, +37% YoY, with NEV penetration nearing 50% in November 2024. Much of the strong sales momentum can be attributable to the support from government’s vehicle trade-in policy, while other factors like price-competitive high quality EV models and improving EV charging infrastructure in China also contributed to the acceleration of auto electrification. By individual brands, BYD (4.25mn), Li Auto (501k), XPeng (190k) and NIO (222k) all delivered record-breaking annual sales in 2024. New entrants like Xiaomi also garnered significant attention, having shipped 130k units of Xiaomi SU7 model throughout the year and aiming to deliver 300k units in 2025.

China EV Outlook: Another Year of Solid EV Growth

We remain positive that the strong EV sales momentum will continue into 2025. On 8 January, NDRC announced that the auto trade-in policy will be extended, with amounts of subsidies remain unchanged at Rmb20k for NEV purchases and Rmb15k for ICEV. Separately, the NDRC also announced that local governments will offer trade-in subsidies of up to Rmb15k for NEV purchases and Rmb13k for ICEVs (more details to be disclosed at later stage). This should help to sustain the strong purchase demand.

Looking beyond trade-in policy, we see multiple tailwinds supporting EV sales growth, including 1) solid new model pipeline; 2) improving EV ecosystem including charging and insurance premiums; 3) further rollout and application of intelligent features; and 4) battery technology breakthrough that eases range anxiety and lower costs further. These should drive further increase in EV penetration in2025 from current 50% level.

Competitive Landscape

Amid fierce competition in the domestic PV market, the still-fragmented China PV market could see further consolidation in 2025 as leading EV brands command better cost competitiveness and product pipeline. We already see the rising market share for leading EV brands over the past quarters, with BYD’s PV retail market share reaching 18.6% in 10M24 from 12.4% in 10M23. Mass market JV ICE OEMs have experienced substantial market share loss in 2024 as they failed to keep up with the price competition initiated by domestic EV brands, and we expect domestic brand share gain could further extend into premium market segments as Chinese leaders are accelerating premiumization progress. Current EV penetration in premium segment (c.30% for >Rmb300k in 10M24) is still significantly lagging behind overall market, offering ample room for further electrification. In 2024, domestic brands like Li Auto, AITO and NIO have expanded their presence, and BYD will launch a number of premium products priced >RMB300k in 2025. Rather than engage in deeper discounts, local players tend to compete by offering more features at the same price range.

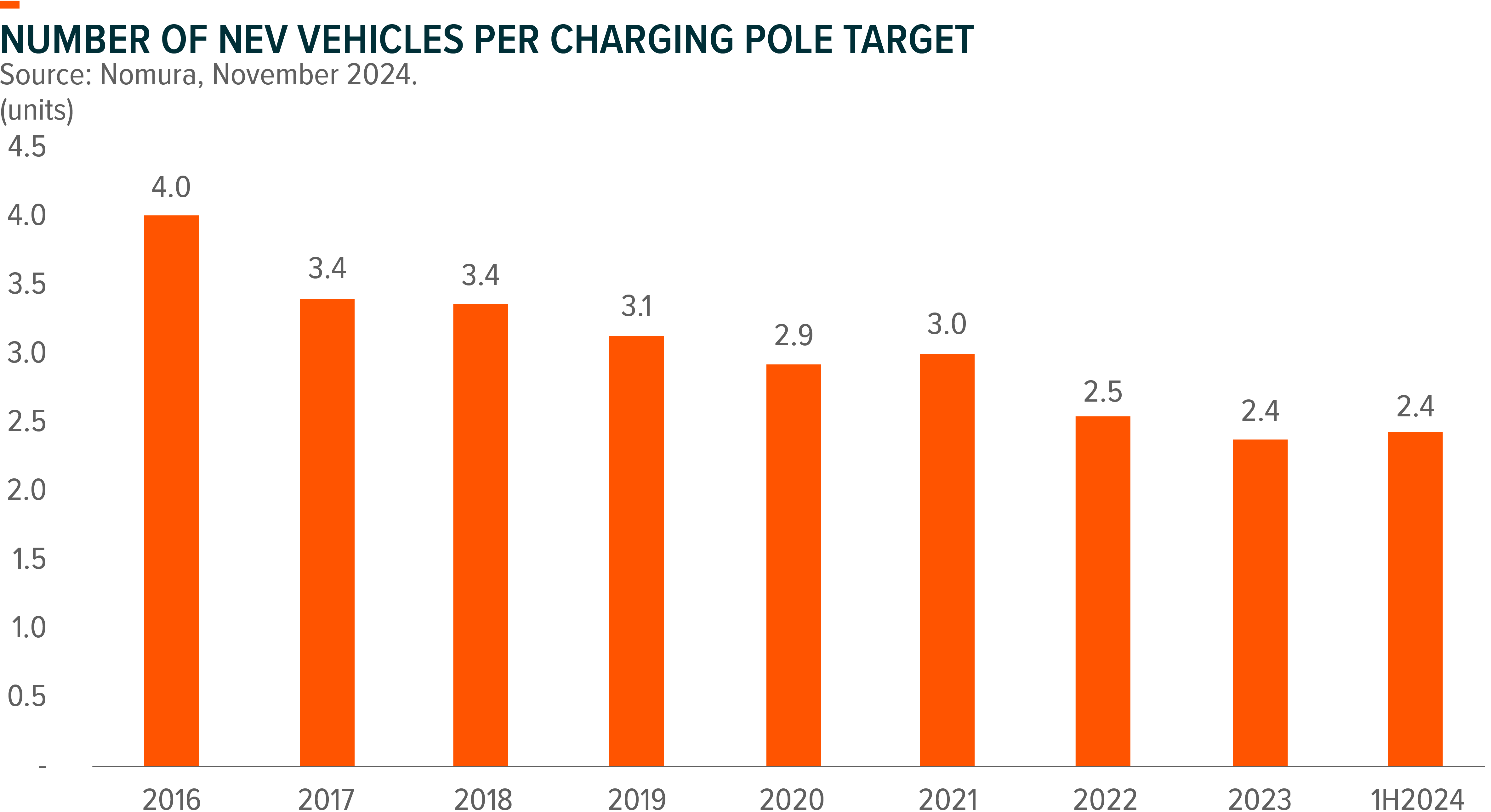

By powertrain, hybrid EV (PHEV + EREV) delivered +86% YoY growth in 10M24, outpacing its BEV peers by a large margin. The strong sales momentum for hybrid model is poised to continue in 2025 as range anxiety still persist especially in lower tier cities where charging facilities are insufficient. The number of NEVs sharing one charging pole has remained at 2.4 units/pole since 1H23, with no meaningful improvement over the past year. Consumer survey also showed that BEV owners are not satisfied with charging experience, leaving hybrid EV a reasonable choice during transition period. Of note, EREV is gaining traction and rapidly capturing market share from a lower base. The robust momentum is set to persist in the upcoming year as additional newcomers, such as XPeng and Xiaomi, introduce new models into the market. CATL’s new ‘Freevoy’ battery that specifically designed for EREVs will also support rising EREV adoption.

Export Story Intact Despite Uncertainty

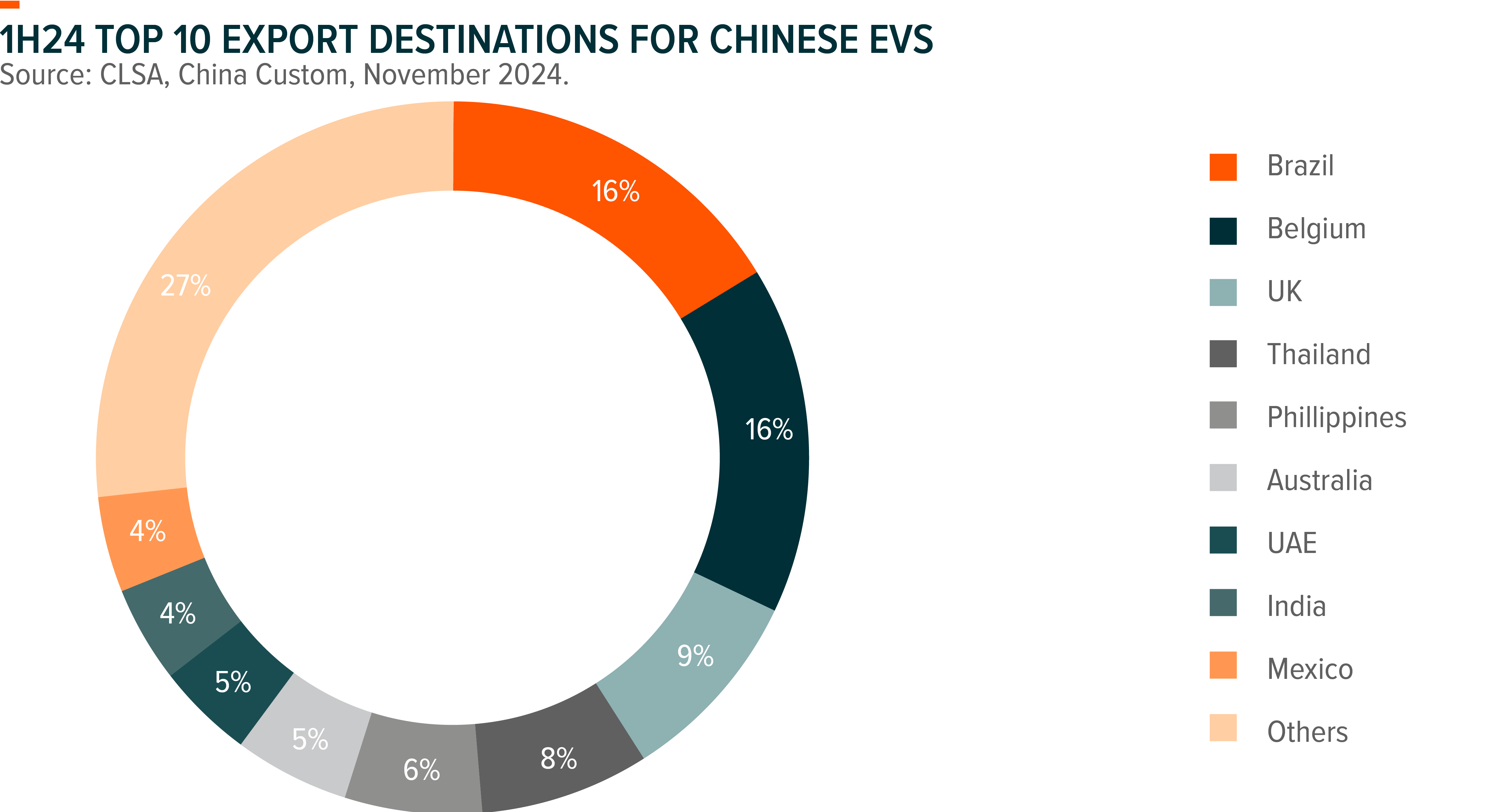

Despite tariff uncertainty and geopolitical tensions, China is on track to become the largest auto exporter globally for the second consecutive years, with 10M24 PV export volume reaching 4.1mn units (+24% YoY), among which 25% are NEV. In 1H24, Brazil (16%) steps up to be the largest EV export destination for China, followed by Belgium (16%) and UK (9%). Emerging markets with favourable tariff conditions presents appealing opportunities for China OEMs. Southeast Asia and Latin America markets are at the early stage of EV transition and have been dominated by Japan and US brands that are relatively slow in EV development, offering a significant opportunity for Chinese brands to further penetrate into these regions.

Tariff remains a major overhang for China EV exports, and we already see several regions including EU, US, Canada and Turkey imposed incremental tariffs on China EV. As one of the major destinations for China auto exports, EU and its tariff decisions have been under spotlight in 2H24. Though the finalized EU tariff inevitably affects profitability, it also offers better visibility for Chinese brands to formulate market entrance strategy and local production facilities. Tariff negotiation between China/EU is still ongoing, and a recent news report flagged a potential breakthrough on agreement about a minimum price guarantee for EVs exported into EU instead of tariffs. This also presents an upside scenario for China EV brands in 2025. Localization efforts by leading Chinese brands will also continue to support their inroads into overseas markets.

Autonomous Driving (AD) function is becoming a more important selling point for EV models. We are seeing increasing adoption of Autonomous Driving for leaders like Huawei and XPeng in their premium models, and the rapid cost down efforts will accelerate the adoption in mass market models in 2025. Major EV players, including BYD and Li Auto, have revealed active plans for autonomous driving adoptions, making intelligent driving functions a new field of competition and differentiation point for China EV brands.

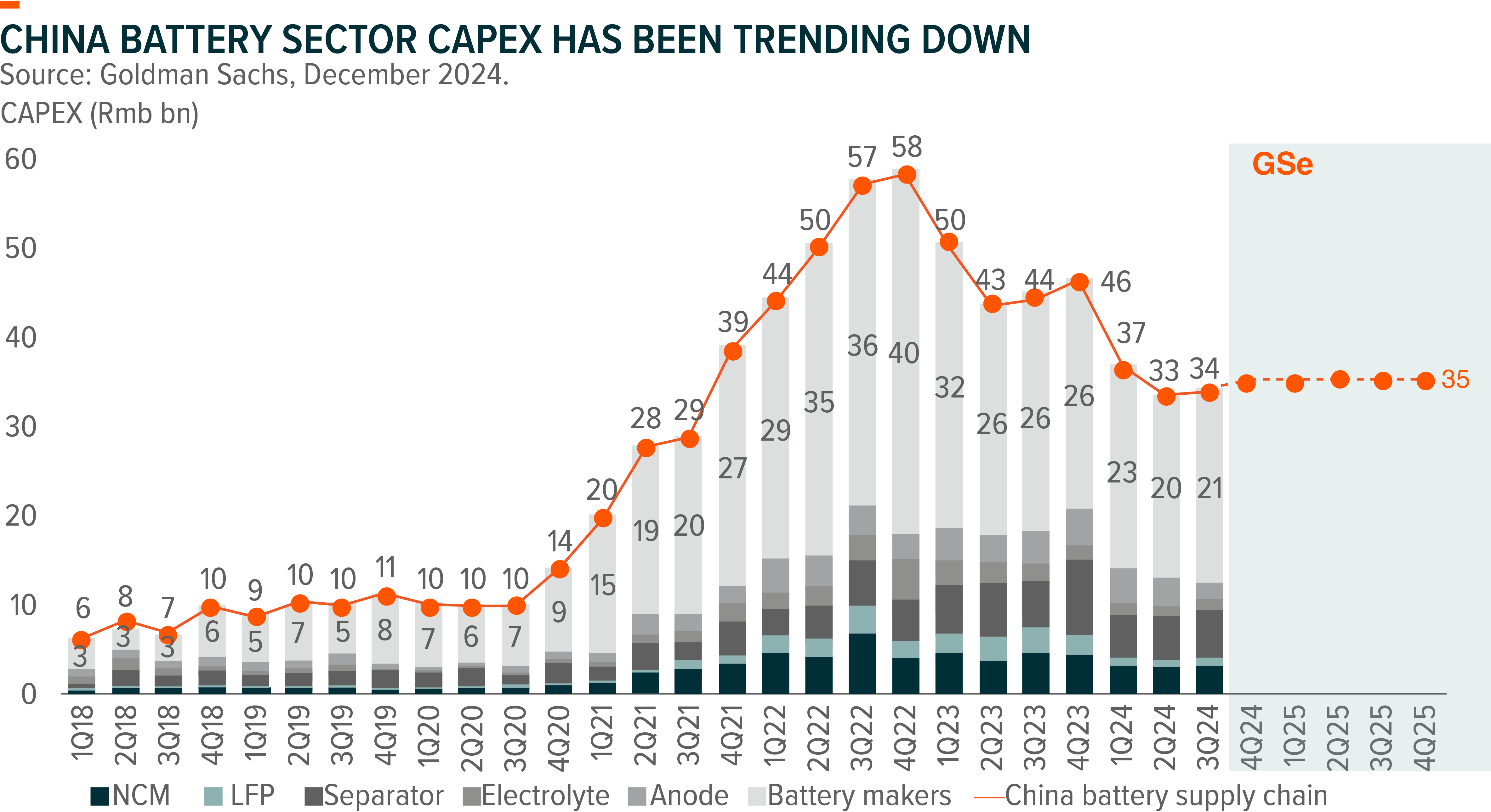

China Battery Outlook: Improving S-D Dynamics

We are positive on battery demand growth in 2025 as bolstered by solid demand for both EV and ESS. EV demand in China is likely to continue its fast growth pace in 2025 with strong push from hybrid EV growth, though EV demand in US is under uncertainty due to Trump’s stance on IRA. EU demand could see potential upside if EU were to comply with carbon emission targets. ESS will also see robust demand growth in 2025 as driven by “energy shifting” (~70% of demand) – for renewables integration, reliable supply in cases of power outage and peak system demand. The lower PV and battery costs will also drive utility-scale demand. On supply side, battery makers are scaling down their capex plan or delaying the new project construction in the past quarters. Though overcapacity still remains, the improving supply-demand dynamics could drive gradual recovery in utilization rates. Current low inventory level is also leading to higher restocking demand.

Leading Chinese players such as CATL has demonstrated technology, costs, and manufacturing excellence that have helped them to obtain market share, maintain stable margin and achieve earnings growth. CATL’s extensive partnership with global EV and ESS players and continuous new technology/product launches bodes well for further global share gain, and potential IRA repeal in US under Trump administration also have positive implication on leading Chinese players at the expense of Korea/Japan players. Many overseas startups are struggling to keep up with quality product and players like Northvolt even filed for bankruptcy, leaving more room for Chinese brand’s global expansion.