Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

China Market Outlook 2025: China Consumer Sector

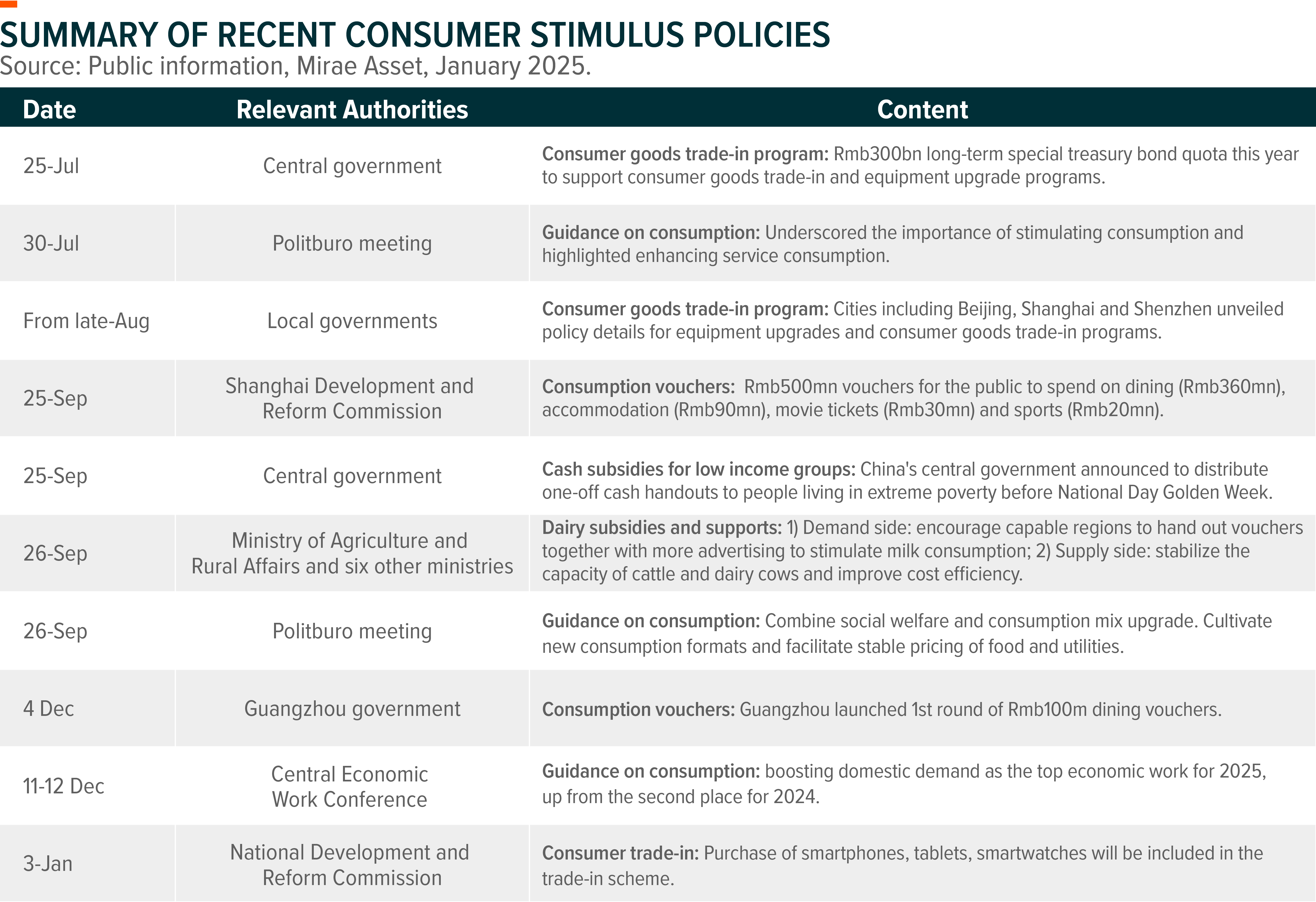

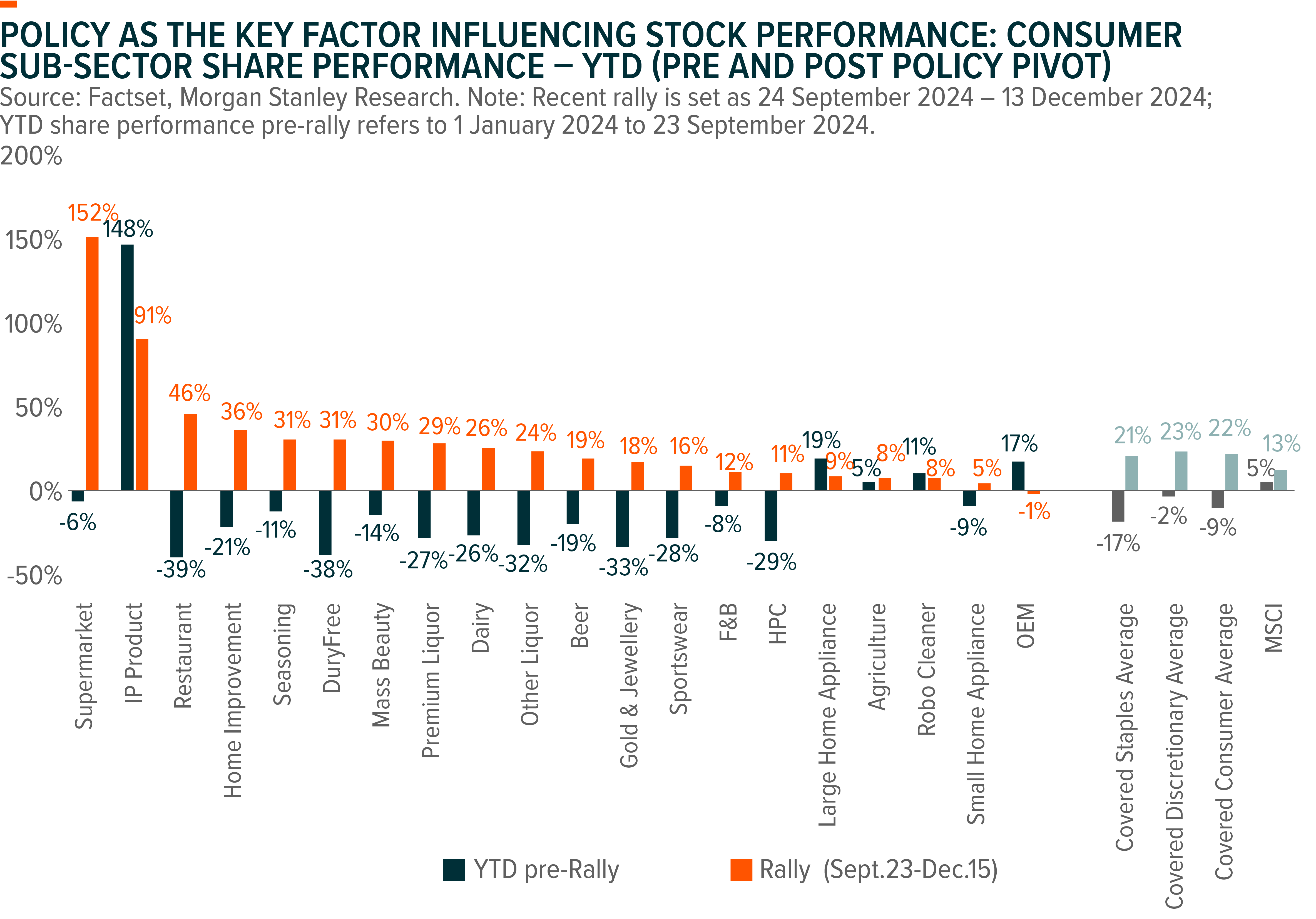

The key theme for China consumers in 2024 will be ‘Policy.’ Since 2H24, both central and local governments have consistently provided support to stimulate consumption. The central government has identified consumption as a critical policy priority. Policy is the key factor driving consumer stock performance, with most consumer subsector stocks facing pressure initially but recording strong rebound following the forceful stimulus policies introduced since September.

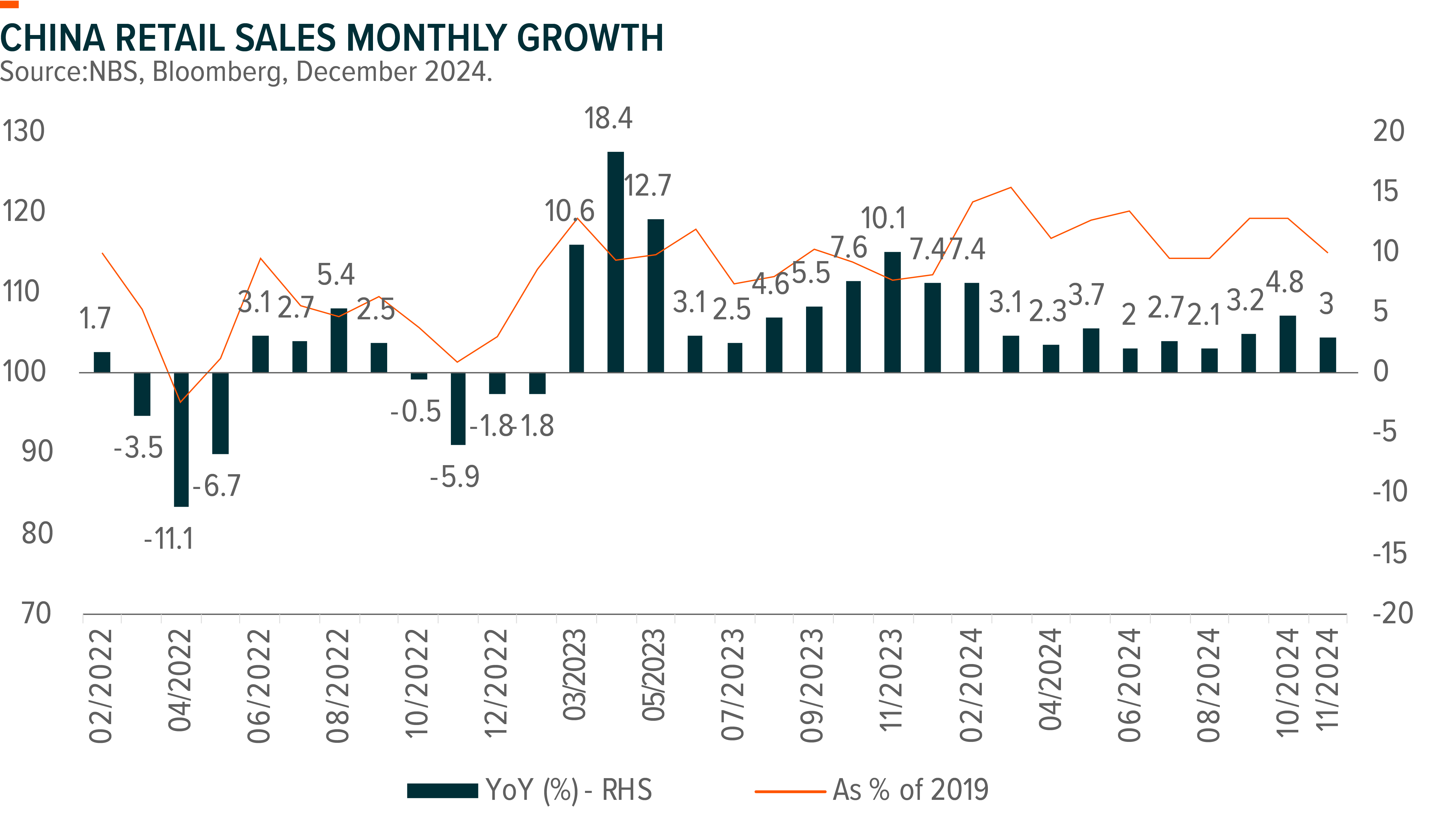

Despite policy efforts, household consumption in China was weak in 2024 overall. The contribution of final consumption expenditure to headline GDP growth declined, falling to only 29% in Q3, down from 47% in Q2 and 59% in pre-Covid levels in 2019. In November, total retail sales grew by 3.0% YoY, down from 4.8% in October, bringing a YTD increase of 3.5% for 11M24. This slowdown in November’s retail sales growth can be partially attributed to a diminished Double-11 effect, as many transactions were shifted to October. We believe that the ongoing lackluster consumption data will necessitate additional stimulus policies in 2025.

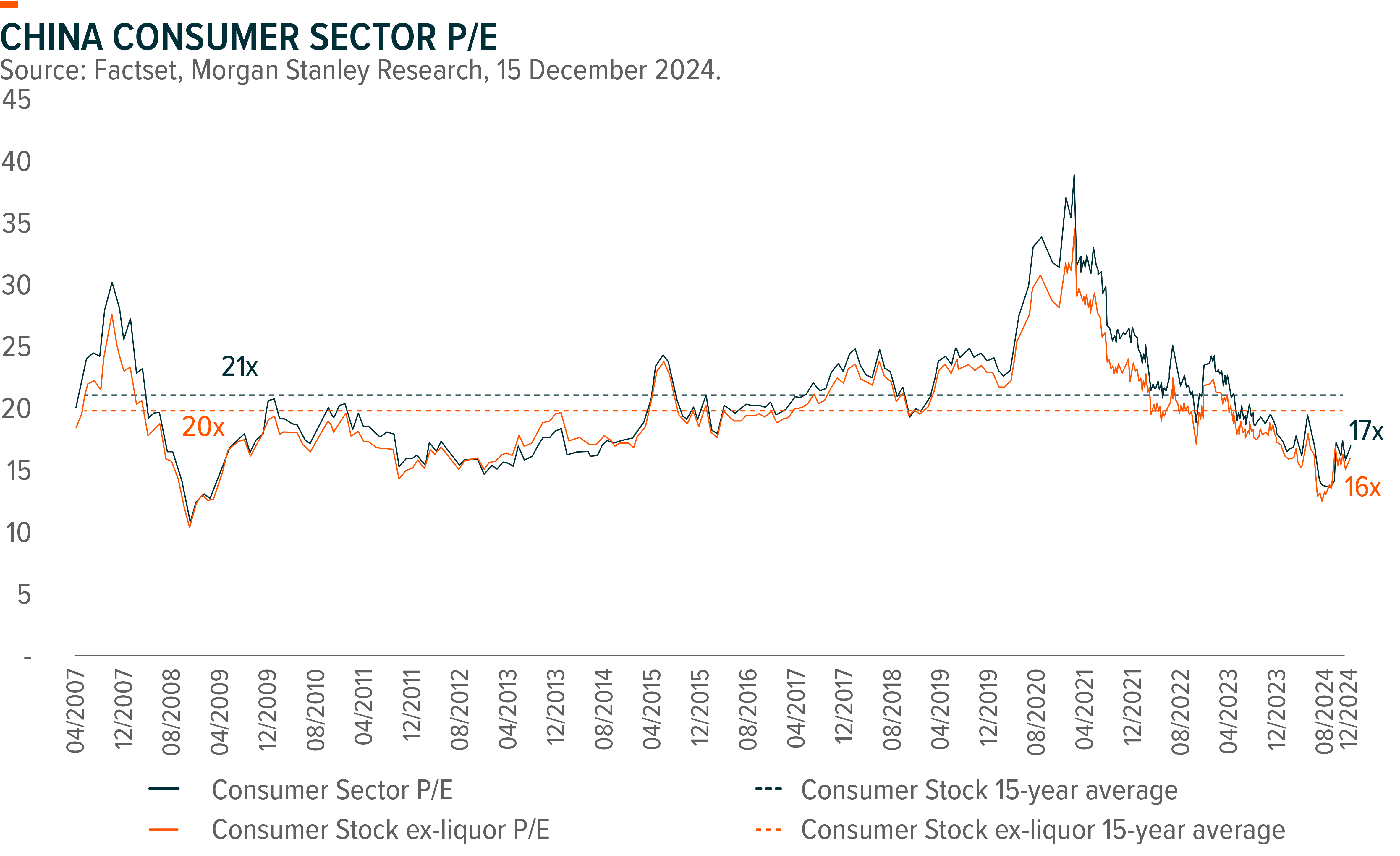

The consumer sector tends to be a late play in the recovery cycle. Therefore, it has faced compressed valuations during the past few years of economic uncertainty. As of early September, the sector was trading at 11x PE, 2std below its long-term average. Even after the rebound prompted by recent stimulus policy, the sector is currently trading at c.16x PE, still far below its long-term average.

Industry Outlook

We believe policy stimulus remains key to enhancing consumer sentiment and bolstering stock performance for China consumer in 2025. We expect that macroeconomic recovery, supported by supportive policies, presents the largest upside risk for China’s consumer sector in 2025, especially given that demand was under pressure across nearly all subsectors in 2024.

However, the path of policy rollout remains unclear. Therefore, we expect consumption recovery to unfold gradually, with a more noticeable improvement likely in 2H25. More time will be needed before fundamentals improve under the current policy setup. Key events to watch include the Two Sessions in March 25. By subsector, we like sectors that are direct focus of stimulus policies, such as home appliance under extended consumer goods trade-in programs, as well as sectors sensitive to macroeconomic changes, such as Baijiu. These two subsectors are also the top holdings of our Global X China Consumer Brand ETF (2806/9806).

Home appliance

We maintain a positive outlook on the home appliance sector, supported by the ‘trade-in’ subsidy programs. Domestic appliance sales were weak for most of 2024 until the implementation of the central government’s consumer goods trade-in initiative. This support will extend into 2025, as the China National Development and Reform Commission (NDRC) announced to increase investment in major projects and expand the scope of trade-in programs on 3 January 2025. We anticipate that more local governments will launch initiatives to stimulate local consumption during the Chinese New Year at the end of January 2025. Furthermore, we expect companies with greater domestic exposure and industry leaders, especially those with higher sales contributions from Level 1 energy-efficient and premium products, to benefit more than their peers.

While we maintain a positive long-term outlook on export trends, we anticipate potential risks of slowing export growth in 2025, primarily due to a high comps and concerns regarding potential U.S. tariffs.

Baijiu

2024 is challenging for Baijiu industry, particularly after the summer, marked by low depletion rates, reduced margins across channels, and inventory destocking. For 2025, we see Baijiu companies are adopting more cautious growth targets and shifting their focus toward achieving long-term sustainable growth. This is positively read by investors; therefore, we believe that the slower growth pace in 2025 will not further impact stock prices. Considering Baijiu’s high sensitivity to the macroeconomic environment and business activity, we expect it to be the subsector that will quickly recover after stimulus policies are implemented. We still like leading players, such as Moutai and WLY, due to their high visibility and strong channel control.

Catering

Under a clear policy direction aimed at boosting domestic consumption, local governments have recently distributed rounds of consumption vouchers to drive sales recovery and enhance consumer sentiment. The catering sector has been a significant beneficiary of these consumption vouchers, as seen in previous stimulus practices in cities like Shanghai and Guangzhou. The characteristics of the catering industry, including high frequency and relatively low ASP, may help stimulate other local consumptions to some extent.

We have observed an easing competition among restaurants. Catering sales have rebounded since October, primarily due to a low base, while the total number of restaurants has continued to decline YoY. Pricing trends appear to be stabilizing, with KFC announcing price increases on select products, indicating an approximate 2% average price hike. Most catering brands have been experiencing a positive trend in same-store sales growth (SSSG) since 3Q24, and further improvement is likely.