Important Information

nvestors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X MSCI China ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- The Fund has a portfolio investing in companies whose operations are primarily in the PRC and therefore is subject to emerging market risks such as risks associated with uncertainty concerning PRC laws and regulations and government policies. Generally, investment in emerging markets such as the PRC are subject to greater risks than developed markets due to greater political, economic and taxation uncertainty and risks linked to volatility, market liquidity, foreign exchange, legal and regulatory risks.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region i.e. the PRC. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

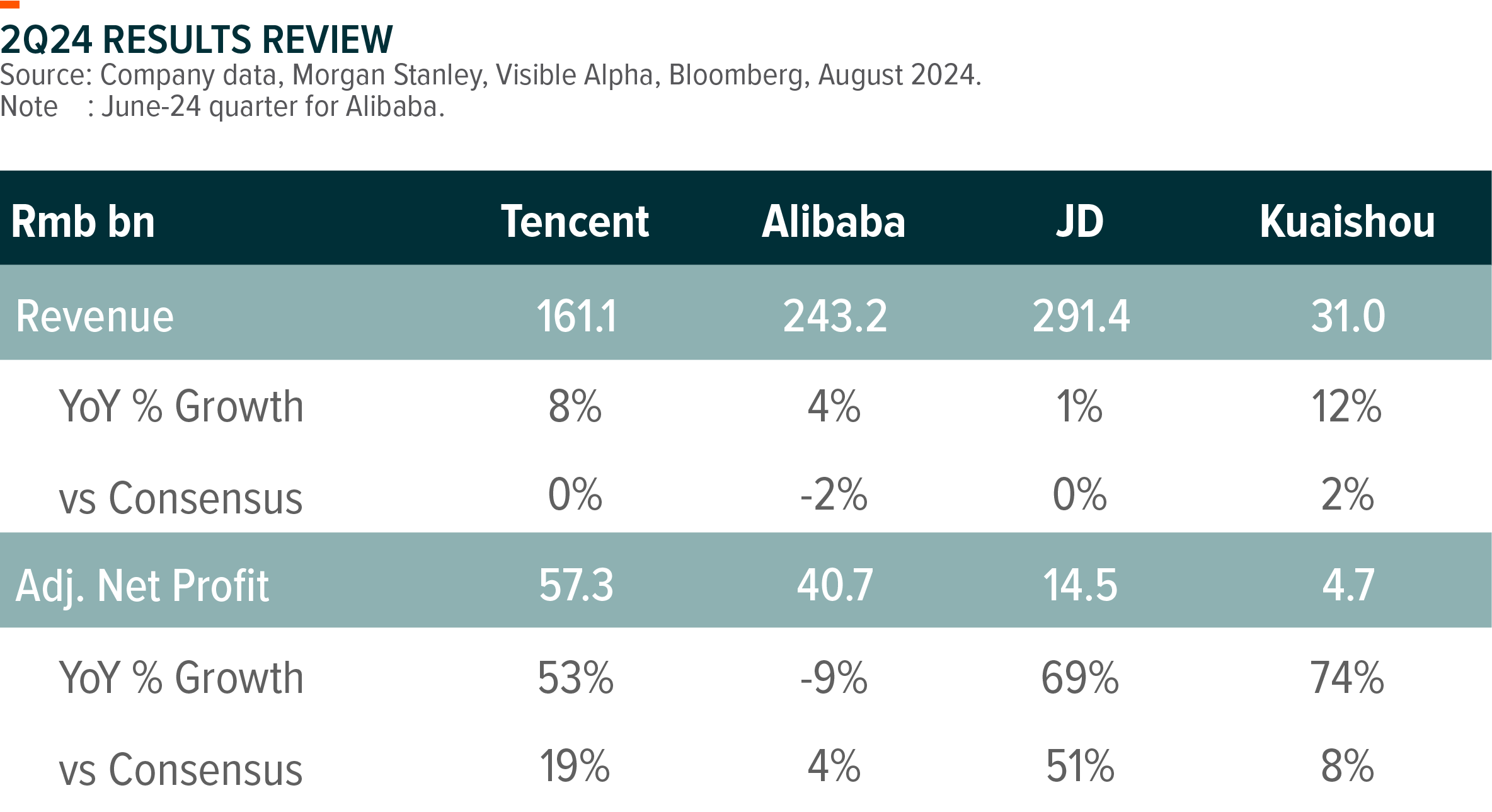

China Internet 2Q24:

In-line Revenue Growth; Continued Margin Expansion and Share Repurchase

Several large cap internet companies (Tencent, Alibaba, JD, Kuaishou) reported 2Q24 results over the past week. Revenue growth was in-line across the board, with slight upside surprise in net profit coming from elevated operational efficiency and business optimization.1 By vertical, online gaming was resilient with Tencent gaining traction thanks to strong new game performance in both domestic and international market, while macro uncertainty and soft consumption weigh on advertising, ecommerce, and fintech (payment) growth. Short video platforms (Tencent Video Accounts and Kuaishou) continue to gain share2 despite weak advertiser spending.

Tencent (700 HK)

Revenue and Adj. Operating Profit was largely in-line with consensus expectation. Adj. Net Profit beat consensus by a large margin driven by share of profits from JV and Associates.

By segment, 2Q24 online game revenue recorded +9% YoY growth driven by strong performance of new games such as DnF mobile and rejuvenation of legacy titles including HoK and PKE. Game revenue growth should further accelerate in 2H24 as gross receipts outpaced revenue growth in past quarters for both domestic and international game business.3

Macro headwinds and consumption weakness continue to weigh on advertising and payment business. Nevertheless, Tencent continue to deliver faster than peer advertising revenue growth (+19% YoY) thanks to Video Accounts monetization warp up and enhanced advertising efficiency through AI adoption.

Alibaba (BABA US/9988 HK)

Results were generally in line with market expectation. Higher than industry GMV growth for Taobao and Tmall Group implies encouraging trend of market share loss stabilization, but lower Customer Management Revenue growth (+1% YoY) points to a decreasing take rate due to the strategy of prioritizing users and GMV growth. Alibaba could further ramp up monetization as driven by 1) Site-wide marketing tool ramp up that enhances advertising efficiency; 2) adoption of 0.6% software service fees on completed GMV.

Public cloud posted double digit revenue growth in the quarter, with solid guidance for external revenue to resume double-digit growth in F2H25, as driven by robust AI demand in the pipeline. International business will continue to focus on high quality growth with improving operational efficiency.4

JD.com (JD US/9618 HK)

JD delivered strong earnings beat in 2Q24 with net profit of Rmb14.5bn, +69% YoY, showcasing JD’s operational efficiencies and long-term profit potentials, though its revenue growth was muted at +1% YoY against the backdrop of weak consumption and intense industry competition. For FY24 outlook, management reiterated the target of above-NBS retail growth with double digit profit growth for JD group. 5

Kuaishou (1024 HK)

2Q24 Revenue growth was in line, with adj. net profit came in better than expectation driven by gross margin and tax benefit.

Notably, Kuaishou’s external advertising growth accelerate to c.30% YoY driven by rising demand from emerging verticals incl. mini-drama and games, with sustainability to extend in 2H24. General consumption weakness and intense competition led to the deceleration of livestreaming ecommerce business, though buyer penetration continue to improve with stabilized purchase frequency. 6

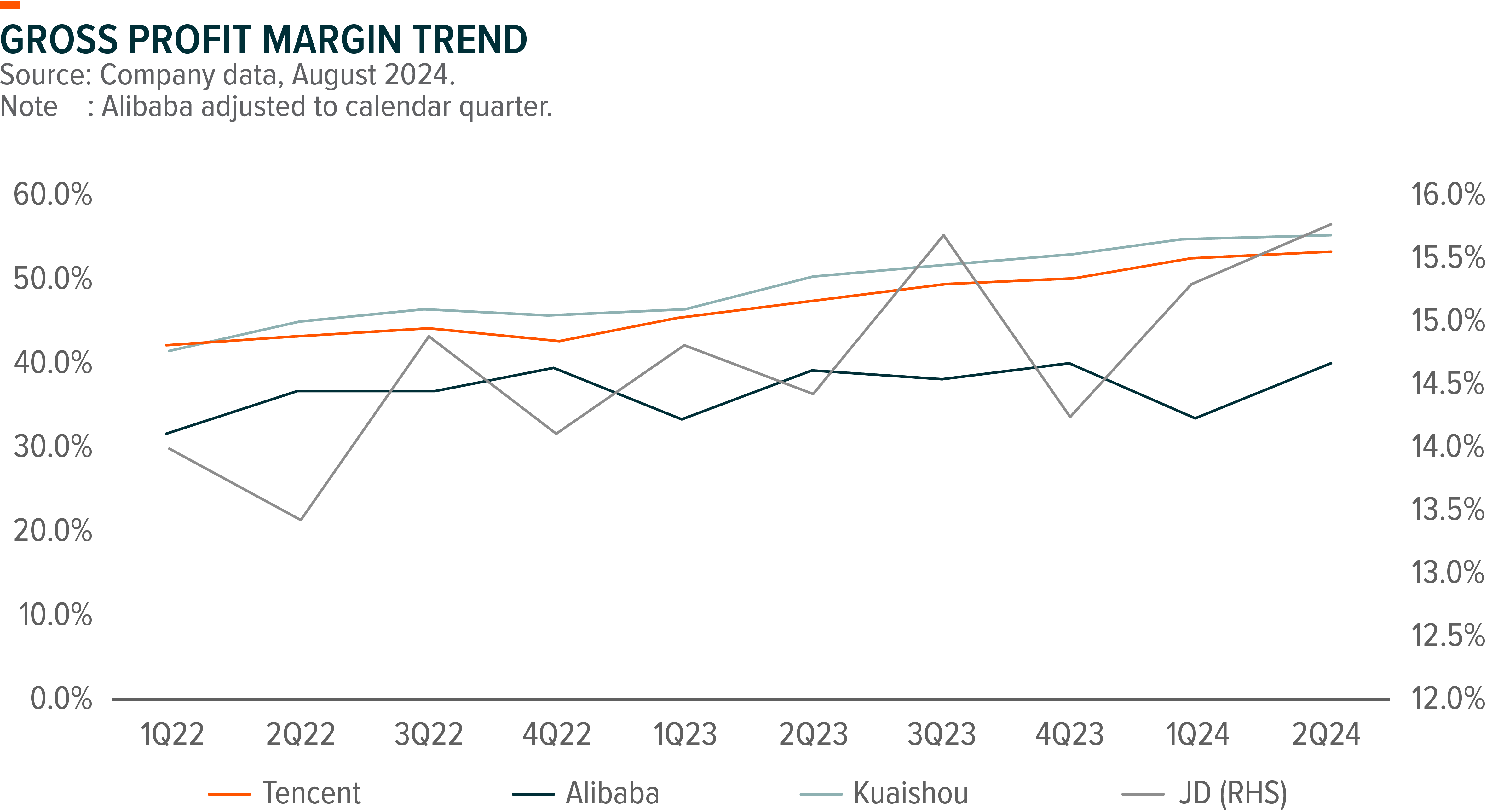

Margin Expansion and Share Repurchase Remains the Key Theme

Margin expansion and shareholder return ramp-up remains the overarching theme for China internet stocks. We are seeing a continued trend of margin expansion over past quarters as driven by positive operating leverage, revenue mix shift, and more prudent cost and expansion strategy.7 Shareholder return is the key focus as investors continue to monitor execution of buyback and overseas cash available for buyback. Overall, major internet companies are offering attractive shareholder returns through share repurchase and dividend, which should support share price performance and revive investor sentiments.

Related Global X ETFs’ Product8

| Global X MSCI China ETF (3040 HK) |

Global X Hang Seng TECH ETF (2837 HK) |

|

|---|---|---|

| Inception Date | 17 June 2013 | 30 March 2023 |

| Reference Index | MSCI China Index | Hang Seng TECH Index |

| Primary Exchange | Hong Kong Stock Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.18% p.a. | 0.44% p.a. |

| Product Page | Link | Link |

Ongoing Charges Over A Year: The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. The ongoing charges figure is an annualised figure based on the ongoing expenses of the Fund, expressed as a percentage of the Fund’s average Net Asset Value of the Listed Class of Units of the Fund over the same period. This figure may vary from year to year. The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. The ongoing charges of the Fund is equal to the current rate of the management fee of the Listed Class of Units of the Fund. For the avoidance of doubt, any ongoing expenses of the Fund exceeding the ongoing charges of the Fund (i.e. the management fee) shall be borne by the Manager and shall not be charged to the Fund. Please refer to the Key Facts Statement and the Prospectus for further details.