Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Innovator Active ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- Due to the concentration of the Fund’s investments in companies involved in Innovative Business, which are characterised by relatively higher volatility in price performance when compared to other economic sectors, the performance of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. In addition, the performance of the Fund may be exposed to risks associated with different sectors and themes, including industrial, consumer discretionary, healthcare, financials, information technology, robotics and artificial intelligence as well as technology (such as internet, fintech, cloud, e-commerce and digital). Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Fund.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Unit on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may be traded at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

Global X China Innovation Active ETF (3058) Allocation Over 2023 Q2

Listen

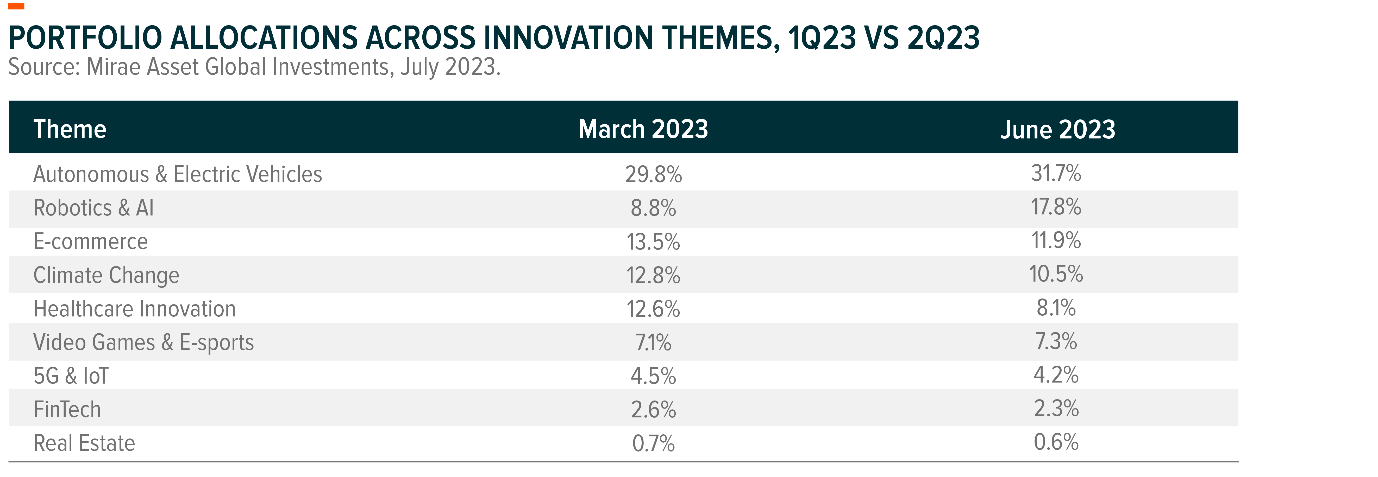

During the quarter, we reduced our exposure to consumer stocks and names that are generally more sensitive to China’s weakening economy. Instead, we allocated the weight to AI-related names, such as Baidu, iFlytek, and Envicool. Among EVs, we took some profit from BYD and shifted more weight to battery plays like CATL.

Headwind From Multiple Fronts

After a short-lived re-opening boost in 1Q23, China’s economy moderated in the second quarter. Despite a low base, 2Q23 GDP growth was below expectation at 6.3% year-on-year (YoY), while sequential growth slowed to 0.8% from 2.2% in 1Q23. The slowing property market and tight fiscal conditions at the local government level are the main drags, apart from the relatively weak external demand and heightened geopolitical risks.

What the market was disappointed with is that despite the weakening economic data, policymakers this time have been surprisingly constrained and reluctant to roll out large-scale stimulus policy. It seems that this government is very committed to transitioning away from the land-fiscal growth model and is willing to tolerate more pain from slower growth.

As a result, we see most policies coming from policy-supportive sectors (e.g. NEVs) and regulation fine-tuning (e.g. internet platforms). The Global X China Innovator Active ETF has been positioned for these themes and has been underweighting property and local government debt-exposed financial and property sectors. However, under a weakening macro environment, those policies have become less effective, while supply-side supportive policies partly contributed to oversupply issues, especially when demand slows down.

Geopolitical tension has been another drag, especially for tech and emerging sectors (EV battery, solar, semiconductors, etc.). However, we think sentiment has already been priced in (e.g. valuation of LG Energy Solution 62x vs. CATL 18x). While de-risking is not de-coupling, localizing supply chains can still provide growth opportunities for Chinese leaders in overseas markets if they can deliver better products with competitive costs.

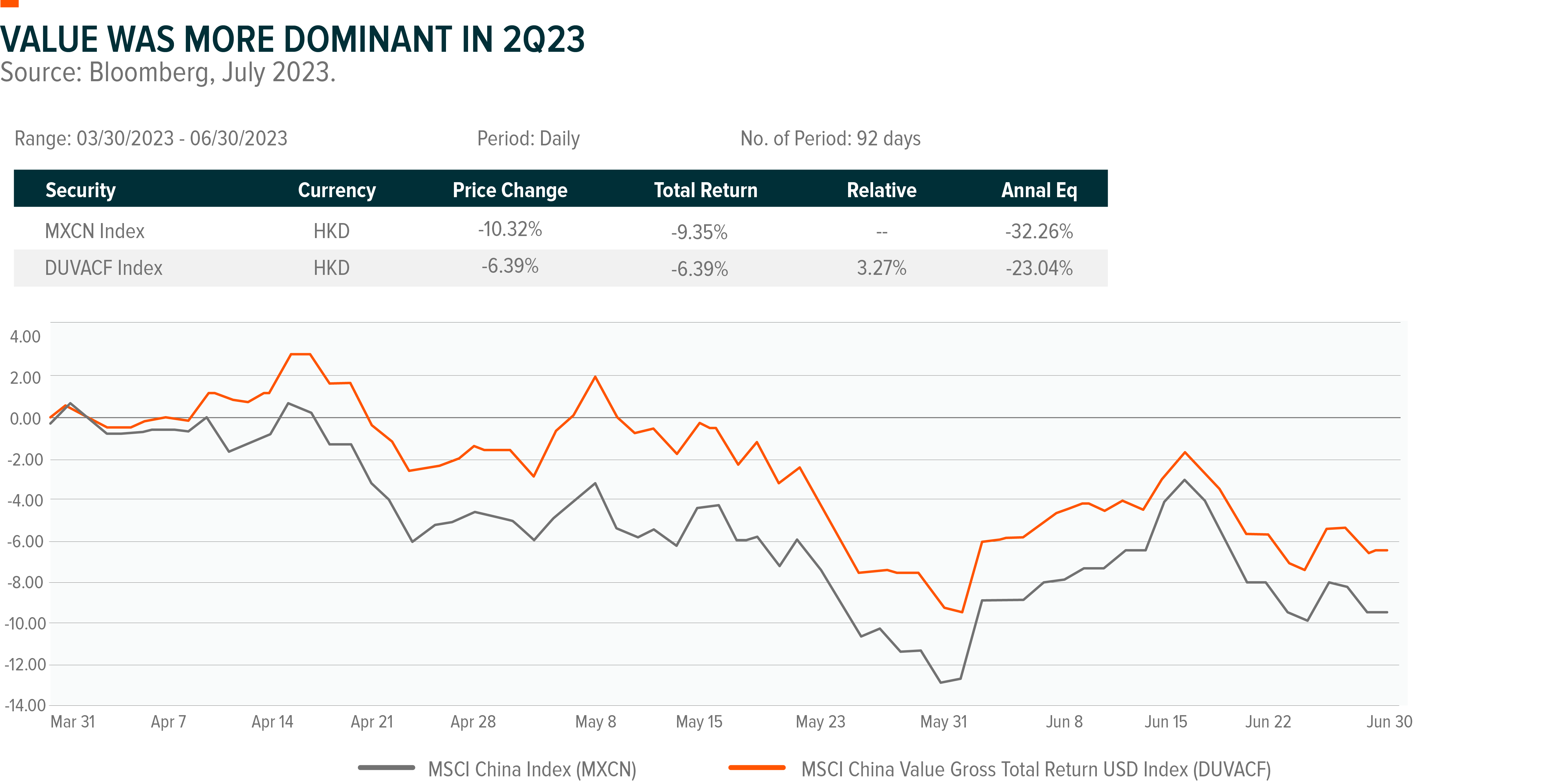

Growth Style Underperformed

Value was a more dominant factor in 2Q23 as investors were seeking safety in a weak sentiment market, which also affected Global X China Innovator Active ETF’s performance as it is more tilted for growth opportunities. However, as the market stabilizes and policymakers roll out more industry policies and policy blueprints, we believe that growth style will come back as investors return to focus on long-term opportunities, especially during a low-interest rate environment in China.

Strategy on AI

We were relatively cautious in the AI trade in 2Q23 as we saw market movements way ahead of fundamentals, while many rallies were based on speculation. We were also concerned about the potential geopolitical risks from the US. Therefore, we only invested in two industry leaders (Baidu and Iflytek) who have already demonstrated large language model (LLM) capabilities with reasonable valuations.

However, although China and the US have started laying out more policy frameworks and the risks are becoming more transparent, we are still very positive about the AI theme and will look for opportunities to benefit this powerful secular trend. We believe AI will not only be limited to AI-generated content (AIGC) but also see potential opportunities in robotics, autonomous driving, etc.

Fund Strategy for Next Quarter

We are closely following policy signals (especially July’s politburo meeting) and policy frameworks for emerging industries. We will continue to look for opportunities in AI-related sectors or companies that could benefit from the development of this technology.