Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Innovator Active ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- Due to the concentration of the Fund’s investments in companies involved in Innovative Business, which are characterised by relatively higher volatility in price performance when compared to other economic sectors, the performance of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. In addition, the performance of the Fund may be exposed to risks associated with different sectors and themes, including industrial, consumer discretionary, healthcare, financials, information technology, robotics and artificial intelligence as well as technology (such as internet, fintech, cloud, e-commerce and digital). Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Fund.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Unit on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may be traded at a substantial premium or discount to the Fund’s net asset value.

China Innovator Active: Q3 2022 Review

Listen

In Q3, global and Chinese equity markets were in a bear market mode. Any bad news that might have been ignored in normal times now tends to trigger a big sell-off. However, we think there’s been an overreaction in China markets on three points: 1) Chinese stocks were directly affected by the US-China tensions, 2) forced labour legislations may have impacted perceptions on China’s solar supply chain, and 3) China’s property downturn and zero-COVID policy put a lot of pressure on the economy.

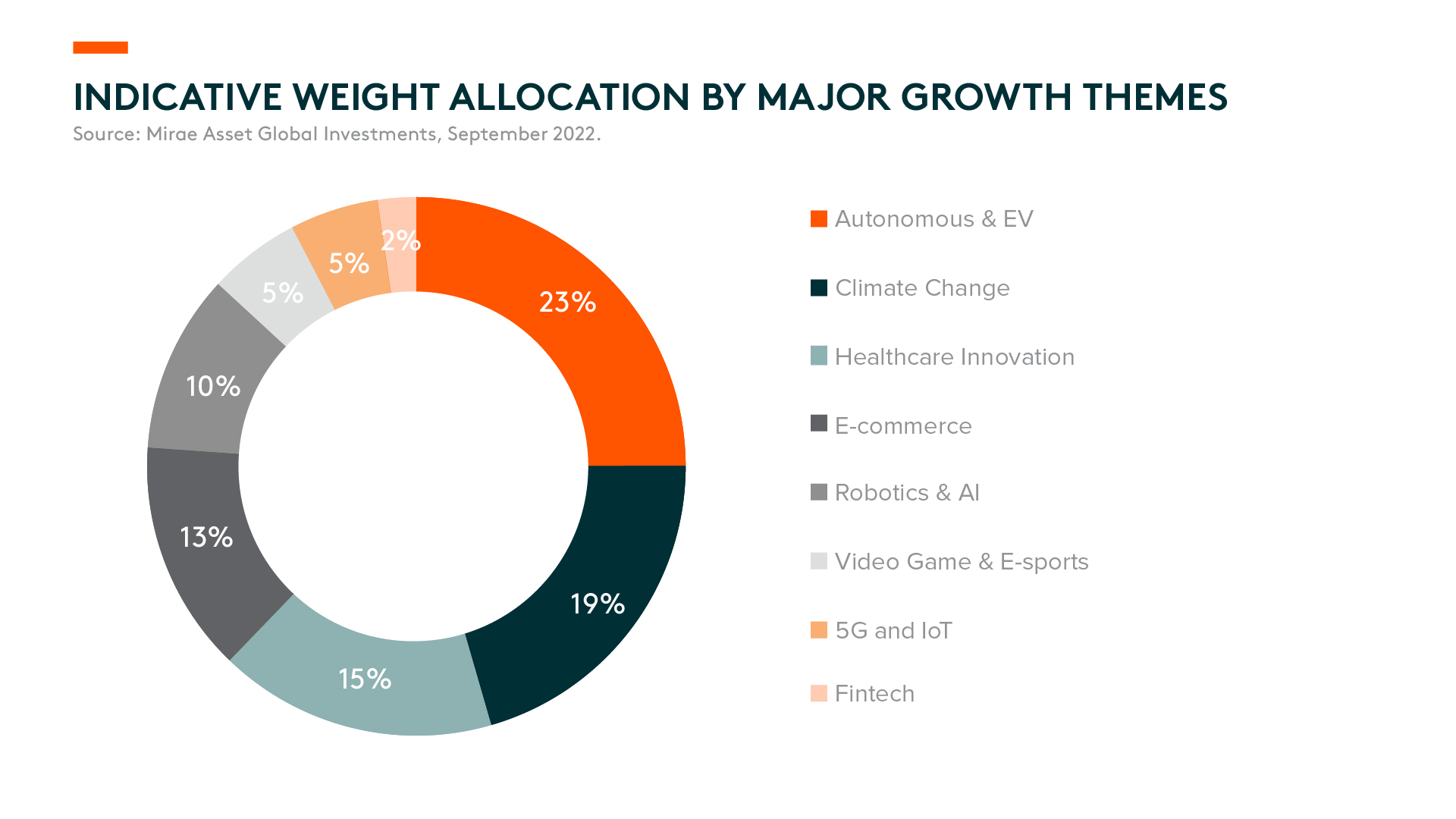

Our portfolio has meaningful exposure to the EV & Battery and solar industries. Though recent market overreactions have resulted in negative performance for us in Q3, we still think there are big mispricing opportunities on these stocks.

Regarding the geopolitical tensions, over the last two months, the Biden administration has been frantic to introduce apparently anti-China laws such as the Inflation Reduction Act (IRA), the semiconductor & science act, and the bio-production presidential executive order (EO). One reason for the rush is that the Biden government is likely to lose its majority in the House or maybe both, and this summer is the only period for the administration to show action. Market participants have been terrified by US’ ongoing anti-China actions, and in some sense, this has been a major reason for our underperformance YTD. However, we are not too concerned, as we believe this only provides greater opportunities in the near future.

Given the US’ more dominant position in the semiconductor industry, we agree that the US can suppress China’s development of semiconductors. This is why we don’t have meaningful exposure to China’s semiconductor industry. However, it’s a completely different story when it comes to the EV battery and solar industries. In short, it is too late for the US to become a dominant force in the EV battery and solar industries.

The IRA is a somewhat belated action to try and bolster the importance of these newly emerging industries. The reason? First, EV battery and solar are typically manufacturing tasks, and we believe Americans have been poor at or shown little commitment to the management of manufacturing jobs over the past decades. For batteries, America-made batteries are likely to be much more expensive than China-made batteries. Second, the US demand market is less dominant than China and Europe. For instance, in the vehicle market, the US accounts for only 18% of global consumption and 11% of global production.1,2 In contrast, China accounts for 30% of global consumption and 32% of global production,3 and it’s a similar story for solar installations.

In general, China’s consumption market in most manufacturing goods is already bigger than that of the US. Counterintuitively, China already exceeds the US in terms of GDP measured by purchasing power parity (PPP).4 This has profound implications. If any company is forced to choose between China’s consumer market or the US’s, it would be better to side with China because China’s market is already bigger than the US’s and will continue to grow. But the market has currently ignored this simple factor.

Let’s look at the battery industry, for example. Chinese battery makers might not capture growth opportunities in the US due to the IRA and subsequent acts. However, this doesn’t matter to them because they can still cover nearly 90% of the global market. After all, Europe has welcomed Chinese investments (e.g. CATL announced a 100 GW battery factory investment in Hungary in September), and China can still export to the US market regardless of subsidies (e.g. Chinese maker Gotion announced a USD 2.4 billion investment in Michigan state in October). In contrast, US-centric battery makers are unlikely to export to other markets because their production cost is too high.

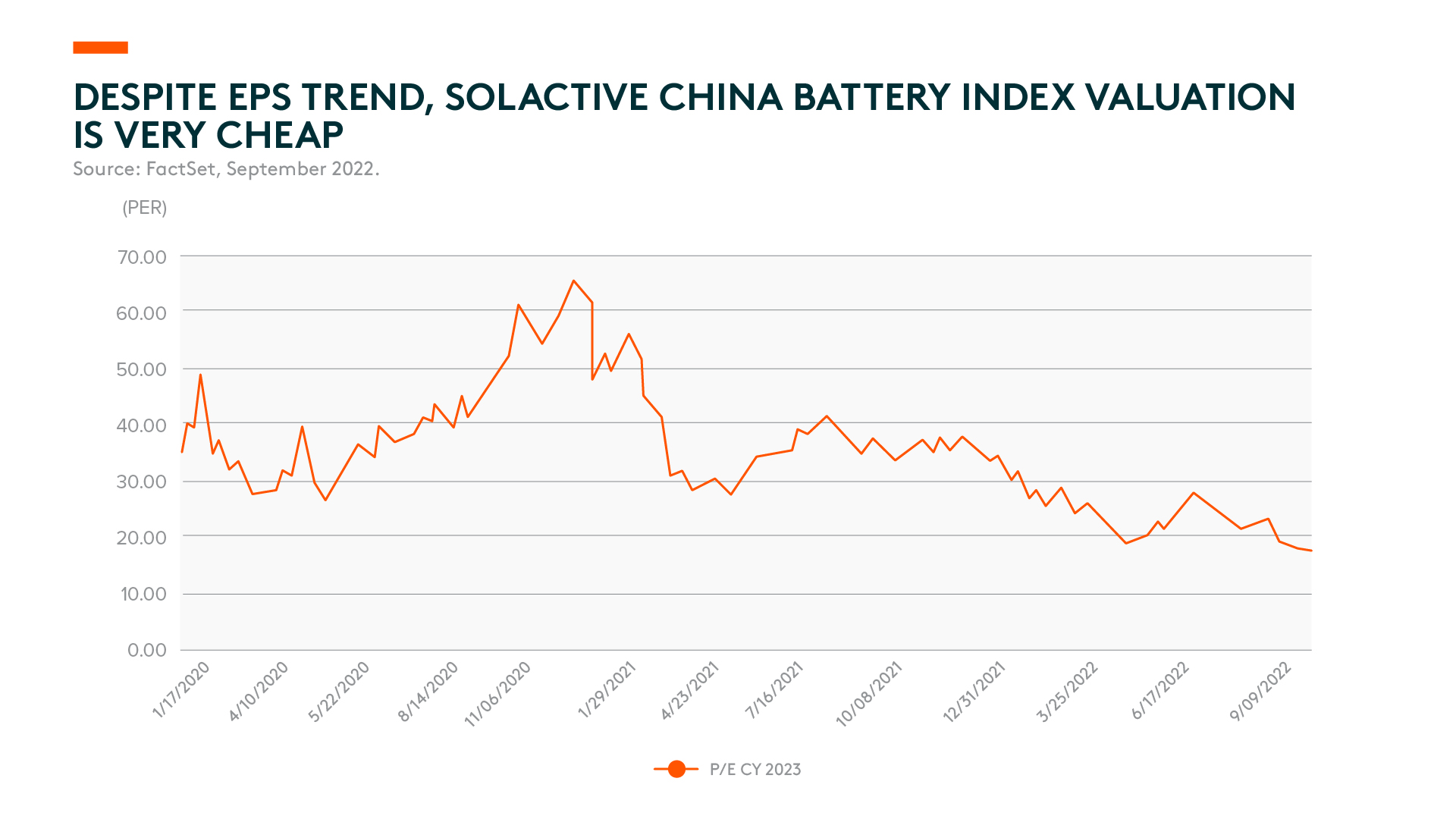

The perception that Chinese battery makers can’t enter the US market is heavily misguided. This perception has created a bearish sentiment toward the industry. For instance, the world-leading battery maker, CATL, one of our top 3 holdings, pre-announced its 3Q results in early October with a profit range of 169-200% y/y.5 The growth is clearly remarkable, but JP Morgan’s recent report on CATL’s results began by stating it was “better than feared”.6 What level of growth rate would be a level to be feared? Maybe around 100-150% y/y. Should we feel fear at a three-digit percentage growth rate? Especially when its share price is trading around 30x 12-month forward earnings per share (EPS)?

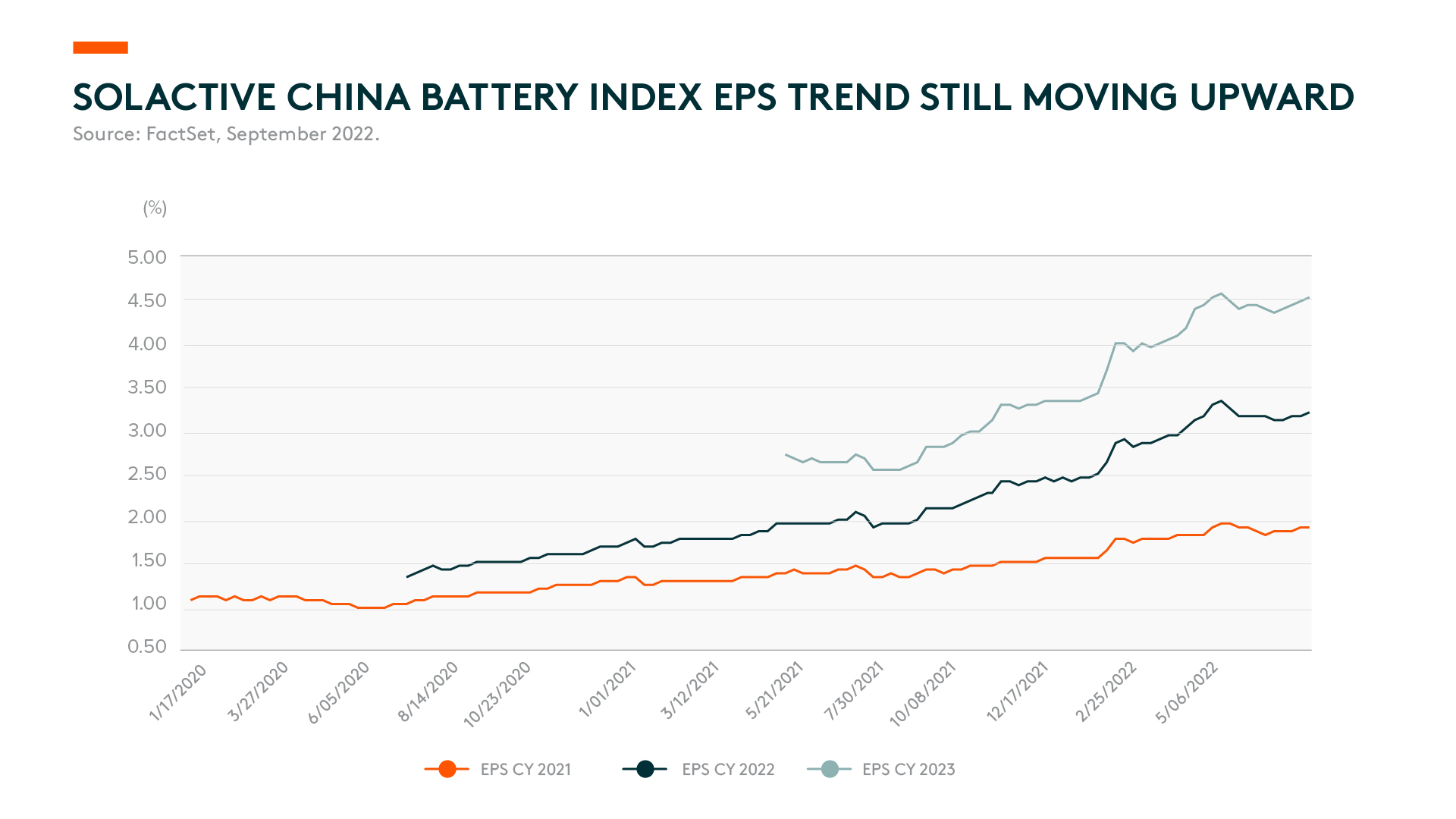

As a reference, let’s look at the Solactive China Battery index, which captures broader trends in the China battery supply chain. As of the end of September, it traded at 17x 2023 EPS, while the index is likely to deliver 32% growth in 2022 and 39% in 2023 (as of the end of September), implying 0.5 times price-earnings to growth (PEG).7 So yes, it’s incredibly cheap due to the wrong perceptions and the bear market sentiment.

On the third point regarding recent forced labour legislations, we believe this should have a limited impact on our Chinese solar holdings. For context, the European Commission recently made a proposal to ban the import of products made using forced labour. While no specific industries were mentioned, there have been debates that China’s solar industry could be a potential target. However, we have not seen any clear evidence of forced labour in the solar supply chain. By nature of its operations, the solar supply chain is not labour intensive and, thus, forced or cheap labour is not a factor for economic advantage. On the contrary, the solar manufacturing process is extremely CAPEX intensive and requires skilled workers to run expensive machines. The reason many solar companies have production facilities in Xinjiang is not because of the availability of cheap labour, but because of globally-competitive electricity costs.

Moreover, many Chinese solar companies have a presence in non-Xinjiang regions, such as Yunnan and Inner Mongolia, which also have provisions for globally-competitive electricity costs and further is also free from geopolitical allegations of forced labour. In our view, the negative sentiments that may arise from these debates could deviate perceptions away from the industry’s positive contributions or deter much-needed progress on the transition to clean energies.

Finally, on the third point regarding China scepticism, we broadly understand and agree with the rationales in the near term but hold a different view for the mid and long term. We think China’s current problems have been too centred on the government’s stubborn and draconian zero-covid policies. Even the property market downturn has been mainly attributed to Covid policies (i.e. because people have reduced consumption and economic activity, leading to lower confidence in their future incomes and lower property purchases). Chinese households saved a lot during the pandemic. Their excess deposits since Covid have accumulated more than RMB 12 trillion, amounting to 10% of GDP, according to Citi. Also, local governments were seriously undermined as they spent ~1% of GDP on quarantine-related expenses, which would’ve otherwise been used for other matters such as software, cloud, and other medical services. Currently, there is no visibility on when the zero-Covid policy will end. However, we think that it will eventually end, at least around March 2023. With each variation of the virus becoming less lethal and more like the flu, we expect this increases the likelihood for Covid policies to be relaxed.

Overall, these misperceptions and fear have made Chinese market valuations extremely cheap, and we expect this will create great opportunities sooner or later.