China’s Global Leaders in Manufacturing Sector

In recent years, more and more Chinese companies have emerged as global leaders in manufacturing sector. In this article we will explore the key reasons behind this trend.

Talent and infrastructure support global companies

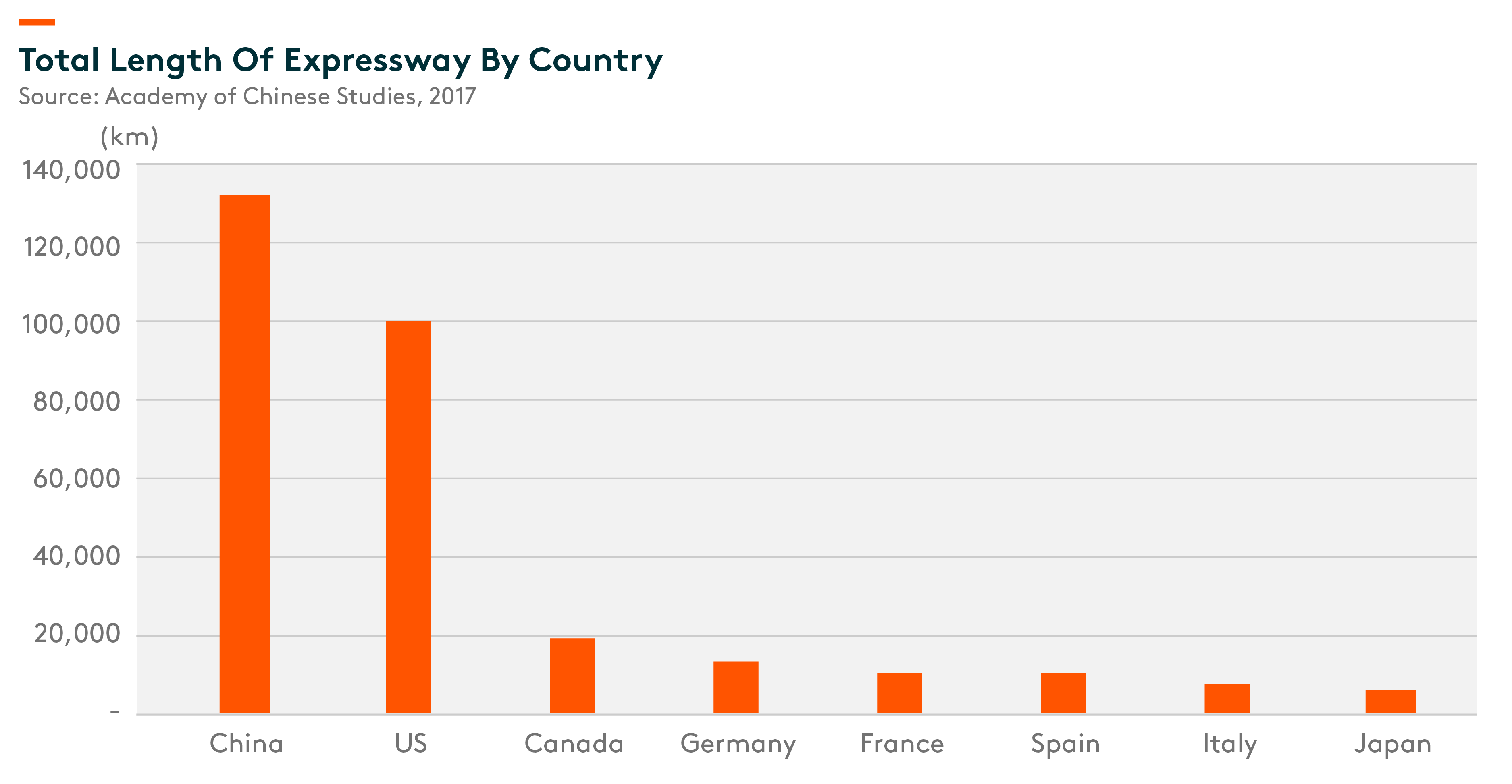

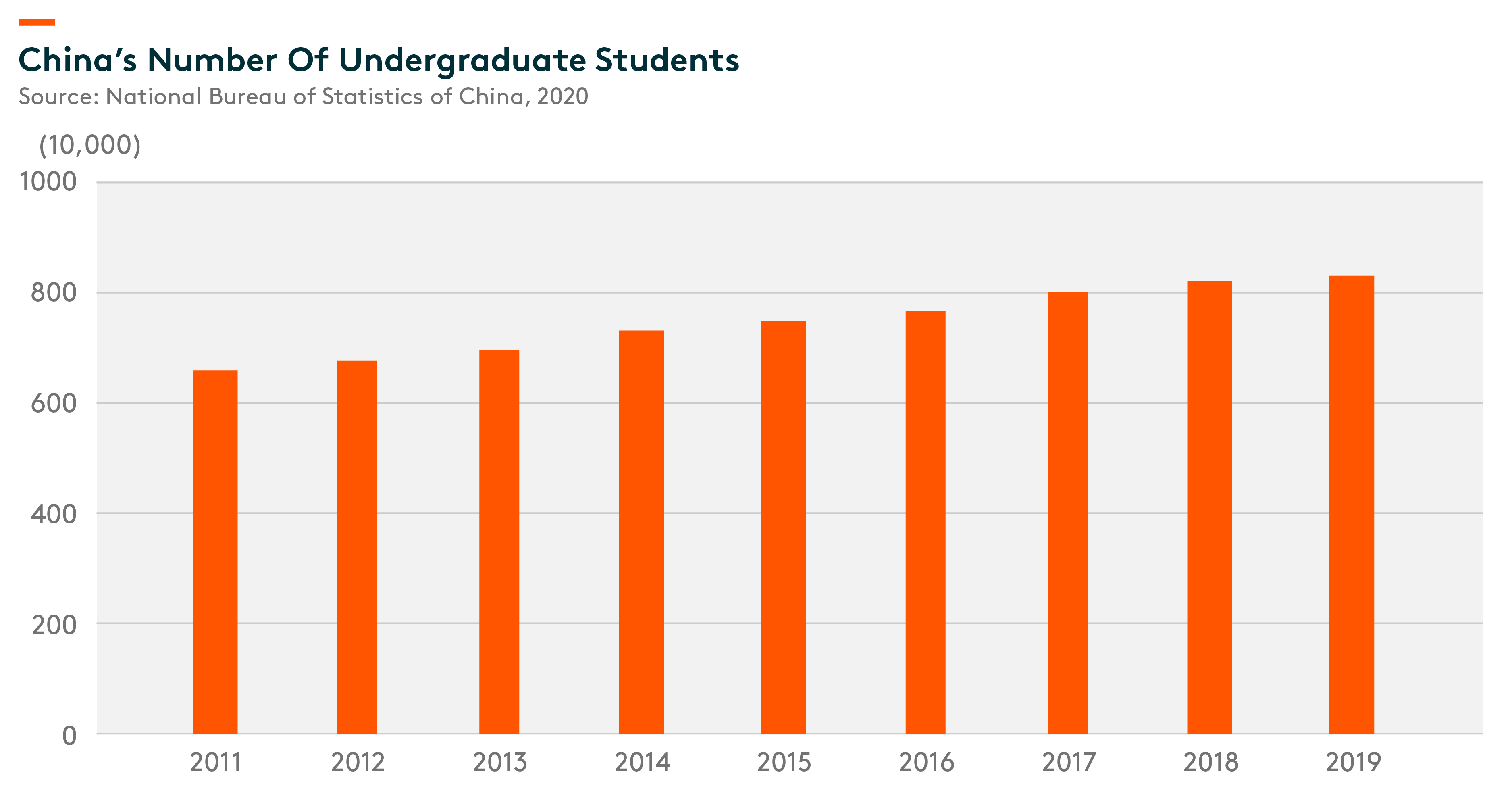

China has been investing heavily in building up strong infrastructures to support its manufacturing sector. In 2018, US infrastructure spending as a percentage of GDP was 2.62%, compared to 19.6% in China. China’s infrastructure spending was RMB 17.6 trillion, 4.7 times the size of US infrastructure spending over the same period. (Wind, 2020) With sufficient investment, a modern network of expressway, railroad and other infrastructures have been built in China. As wages have been going up in China, the quality of talent has also improved with more college graduates every year. The combination of solid infrastructure and abundant human capital supply continues to fuel local manufacturing sector.

Companies are moving up the value chain and gaining market share

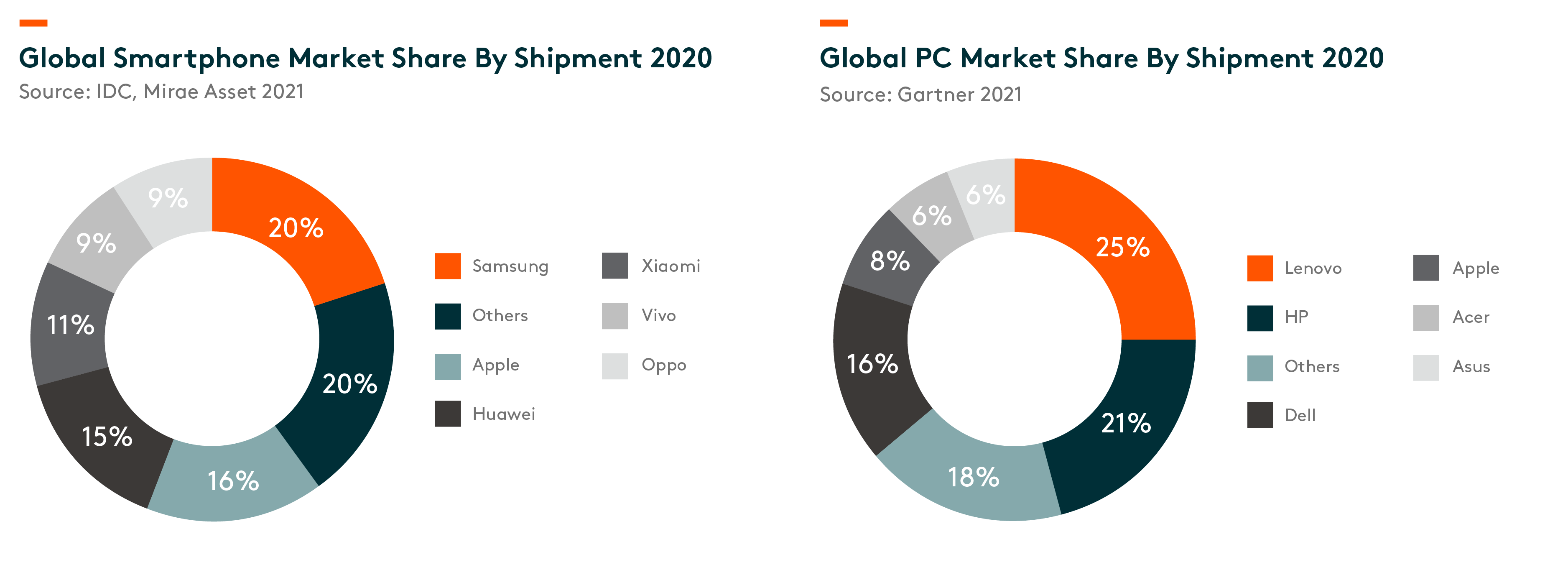

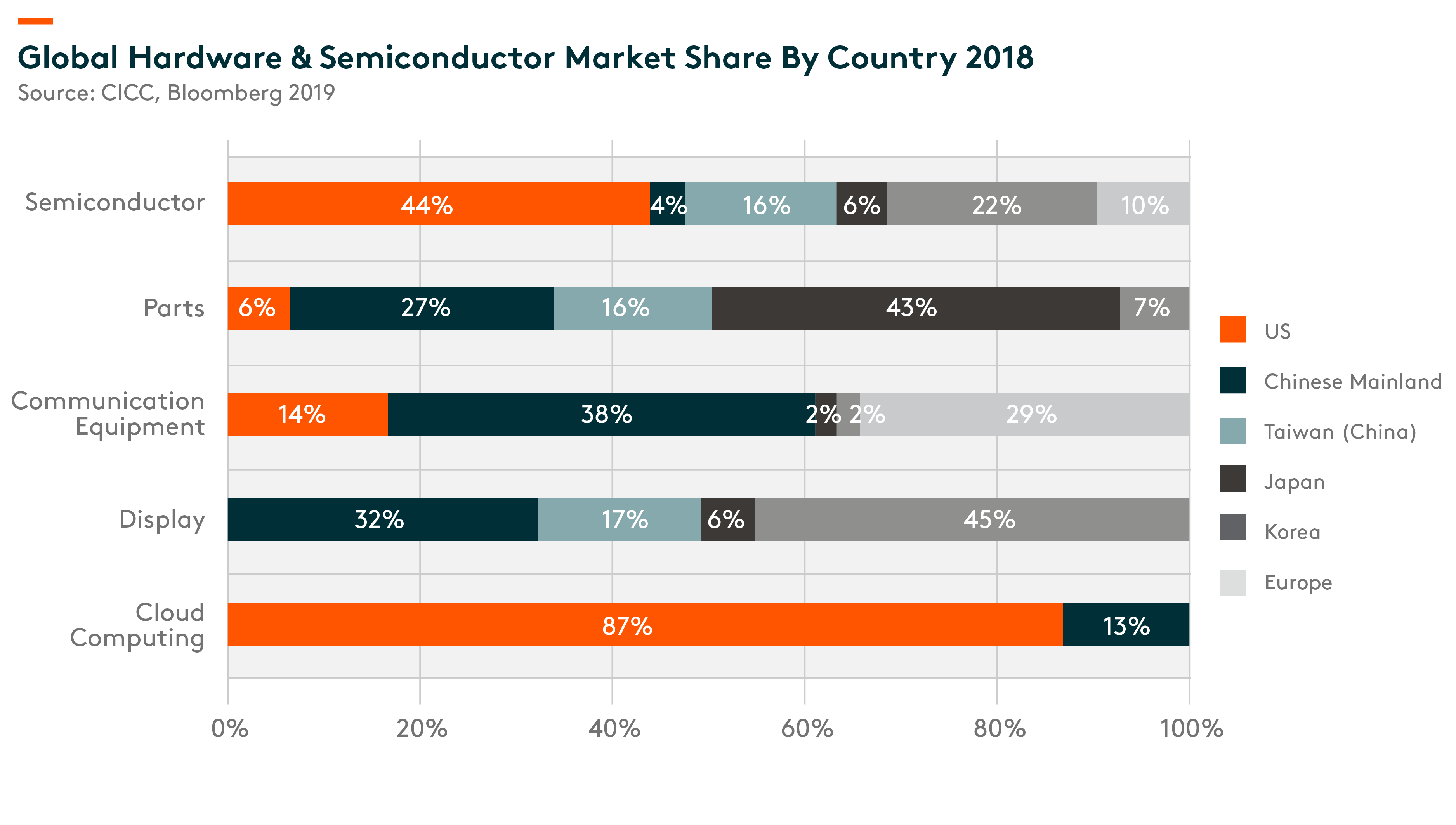

China started from providing relatively low value-added, labor intensive manufacturing services. Over the past 20 years, companies like Huawei, Lenovo, and Xiaomi have emerged to move up the value chain and build up global brands. In smartphone sector, the top four Chinese brands combined made up 44% of global shipment in 2020 (IDC, 2021). In PC sector, Lenovo has been the largest PC supplier for multiple years, and in 2020 it had 25% market share in terms of shipment (Gartner, 2021). In telecom equipment sector, Huawei and ZTE combined had around 36% market share globally in 2018. (Dell’Oro Group, 2019) Terminal makers have larger bargaining power over the supply chain which gives China flexibility to support its domestic upstream companies.

Policy support nurtures local industries

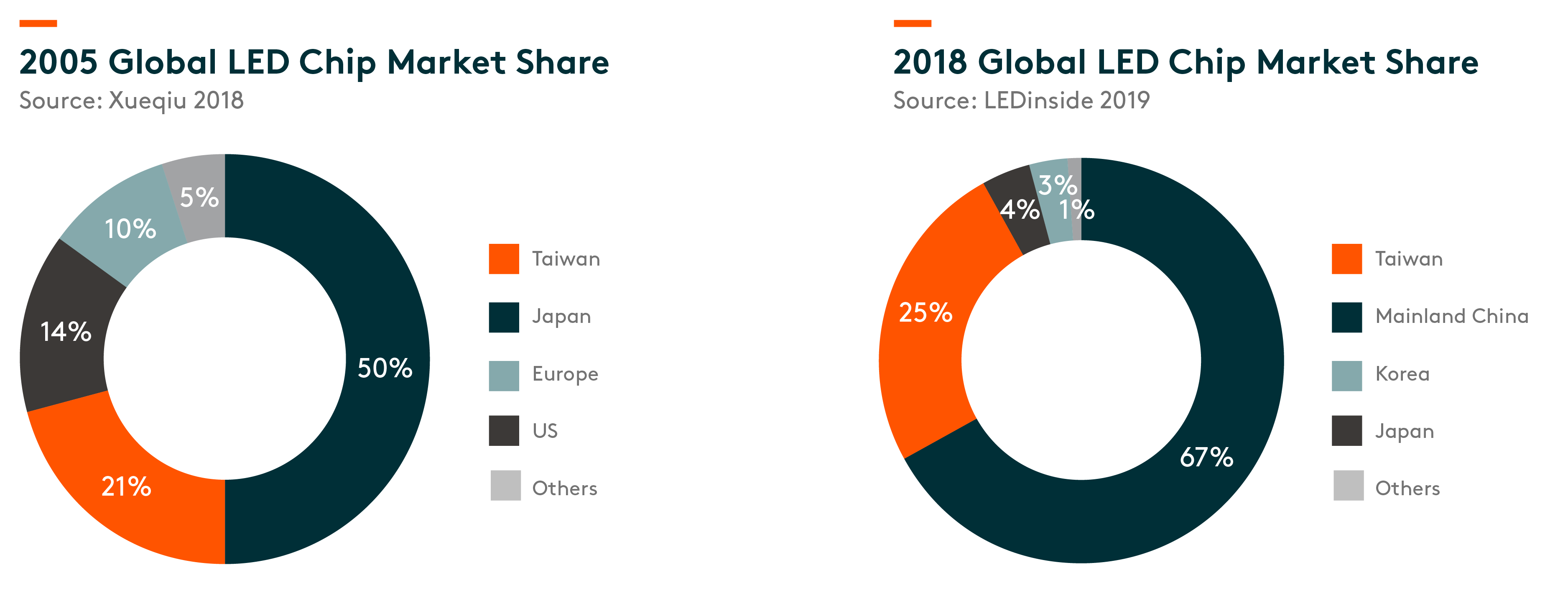

The Chinese government has been supportive of its domestic manufacturing industry in a number of ways. The ability to nurture a sub-sector at its infant stage allows manufacturing companies time to develop and compete in the global stage. The LED industry, for example, was dominated by Japanese, Korean, and Taiwanese companies. But since 2009, the Chinese government has provided high subsidies (around 60%) for the purchase of MOCVD (metalorganic chemical vapour deposition) (key equipment) by LED chip manufacturers. The rapid growth of the domestic industry puts significant pressure on price and margin, which has squeezed out other players. Chinese companies had 67% global market share in LED chip by 2018. We see similar support in high-tech manufacturing, such as domestic semiconductor industry.

Growing home market

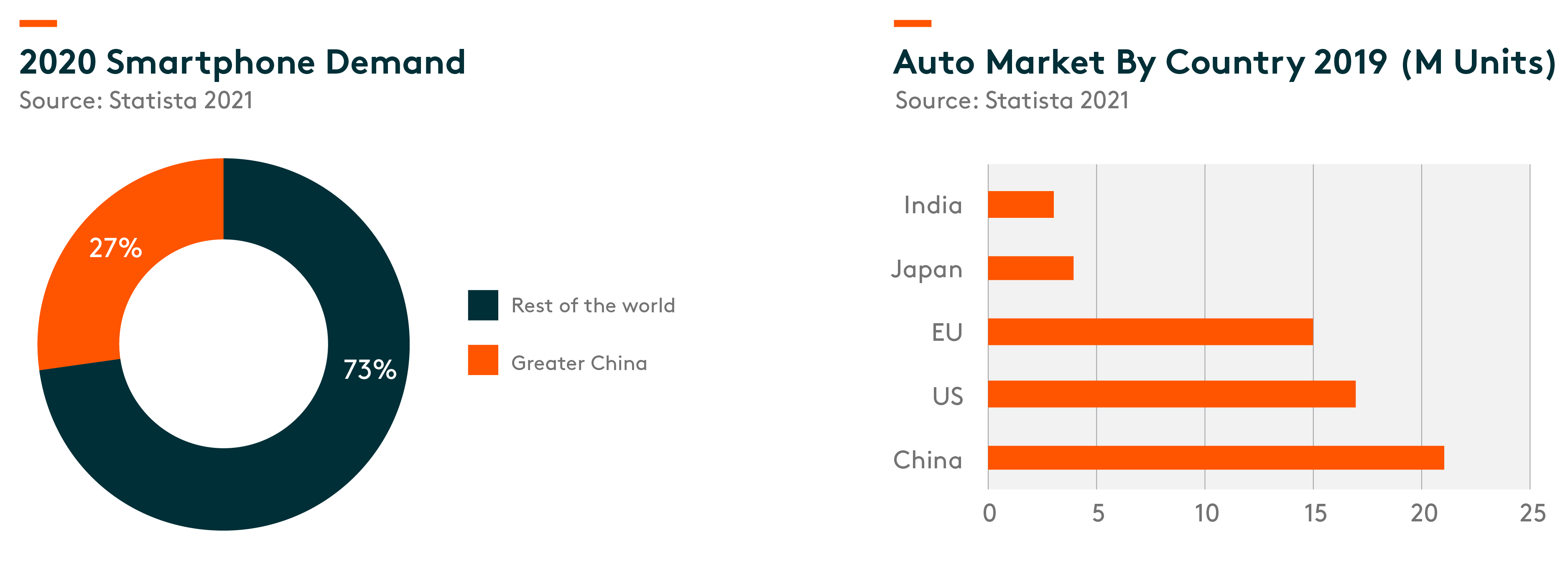

Domestic companies do not have to look far to find their customers because China has become one of the largest markets in many sectors. In 2020, Greater China was the largest smartphone market globally, accounting for around 27% of global smartphone sales. (statista 2021) China is also the world’s largest auto market with around 21million cars sold in 2019. (statista 2021) Being closer to end demand reduces export/import tax frictions and provides room for companies to expand locally before moving to overseas markets.