China EV & Battery Industry: Q3 2022 Review

Listen

Battery demand in China remains very solid, with various ongoing capacity expansion plans. Demand is supported by a strong pipeline of new and competitive electric vehicle (EV) models in China, led not only by the new EV startups and BYD but also by traditional automakers shifting focus from internal combustion engine (ICE) vehicles to EVs. However, the uncertain macro environment and US-China relations are two main concerns that could potentially drag the sector’s development.

Key Takeaways

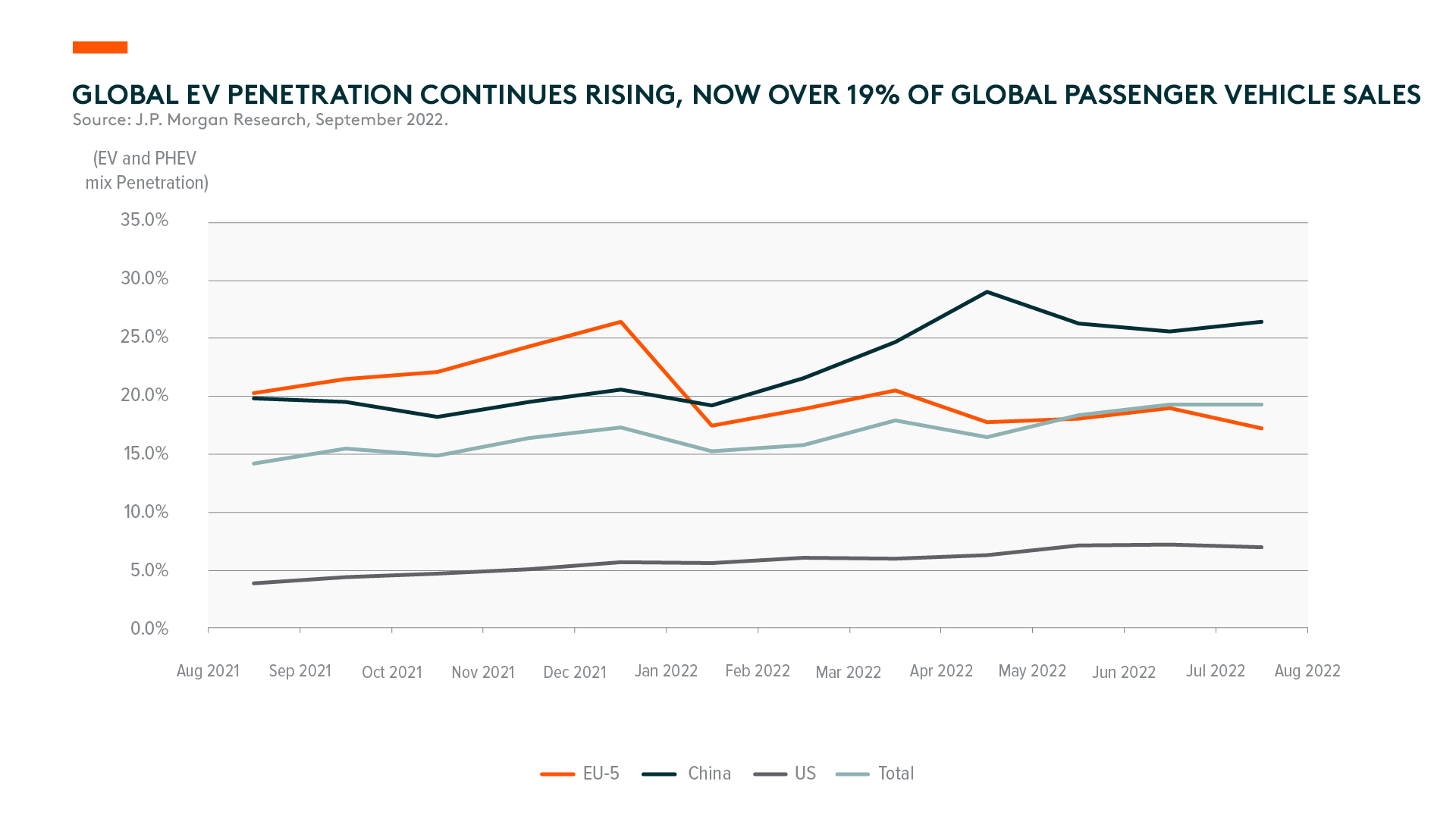

- Solid EV and plug-in hybrid EV (PHEV) sales are accelerating the decline of ICE vehicles’ market share, particularly in the mass segment. Battery makers are the key beneficiaries of this structural shift, given the strong pipeline of competitive EV models.

- Macro weakness may negatively impact auto demand. However, we remain positive on the EV segment amid favorable policies and close-to-cost parity versus ICE cars.

- The US Inflation Reduction Act is unlikely to have a meaningful impact on China’s battery supply chain. The act is not a law outrightly banning the participation of Chinese battery and EV companies in the US supply chain.

Looming Case of ICE Vehicle Market Share Collapse

We’ve witnessed a sharp increase in EV sales volume in China over the last three years, with many new popular and competitive car models launched by Chinese manufacturers. With more competitive EV products available in the market and many of these models on the roads, we expect that could create a virtuous cycle to attract more new customer interest in buying EV models over ICE vehicles.

Notably, BYD’s PHEV and battery EV (BEV) models like Qin, Han, and Song are gaining market share from popular ICE models such as Passat and Lavida (VW), Teana and Sylphy (Nissan), Lacrosse (Buick), Accord (Honda), Haval H6 (Great Wall), and most Hyundai and Kia models (Sonata, Tucson, etc.). For example, the lowest model price for BYD’s BEV, Qin, is RMB 140,000 with no purchase tax, no license fee in top-tier cities, almost no maintenance fees, full lifespan battery warranty, and close to zero energy costs. As a result, it is much more competitive than most joint venture and local brands’ A-segment ICEs, especially within the customer segment that is very price sensitive.

To our surprise, PHEVs have been gaining meaningful popularity. BYD showed that PHEVs can co-exist with pure BEVs as a product positioning strategy in the longer run. Based on their monthly sales figures, BYD replaced SAIC-VW and ranked top in August EV sales volume.1 It also ranked second in accumulated year-to-August EV sales. Consequently, many other local brands have quickly caught up this year to launch PHEV or BEV models in similar price ranges.

Volkswagen, Geely, and Great Wall all confirmed PHEV as striking a good balance between carbon emissions reduction and profitability.2 Beforehand, people highlighted range anxiety as one of the key bottlenecks to EV transition. However, now with the availability of competitive PHEV models, especially from BYD, this provides an easy and cheap solution to the transition. Thus, we expect the increase in popularity of PHEVs could accelerate the collapse of ICE vehicle market share.

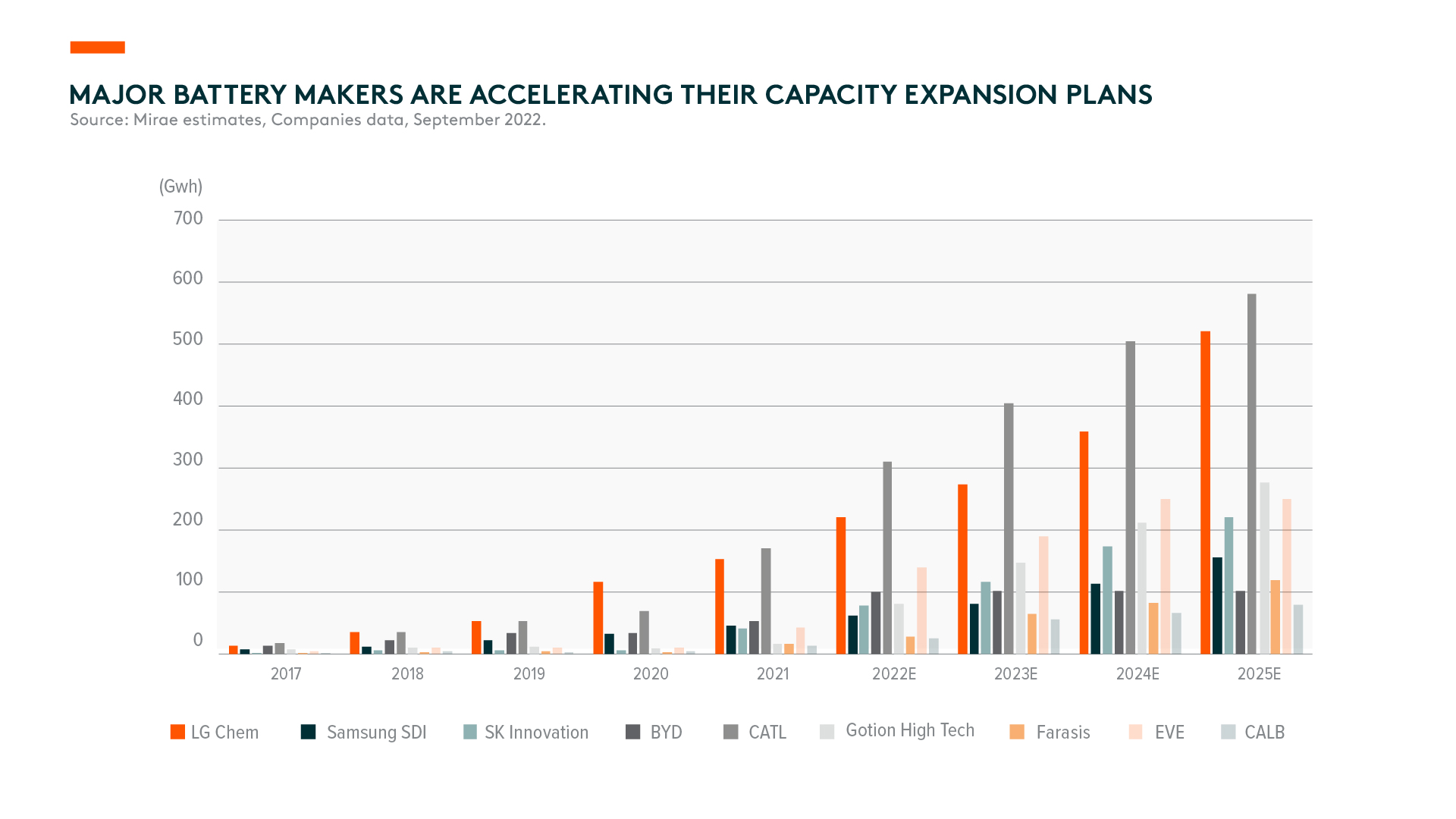

With a strong pipeline of competitive EV models in the mass segment and rising EV penetration, we expect the battery industry to be a key beneficiary. On the other hand, it might not be an ideal environment for EV startups, considering that competition is intensifying. But it’s good news for battery makers, given they don’t need to rely on the popularity of a single-car model to achieve good corporate returns. Leading battery makers are able to build a broad range of customer penetration and can be equipped in various car models, which lowers their operational risk. For instance, CATL has been the key battery supplier for most major auto original equipment manufacturers (OEMs) globally. Individual car brands are only a small fraction of CATL’s total revenue.

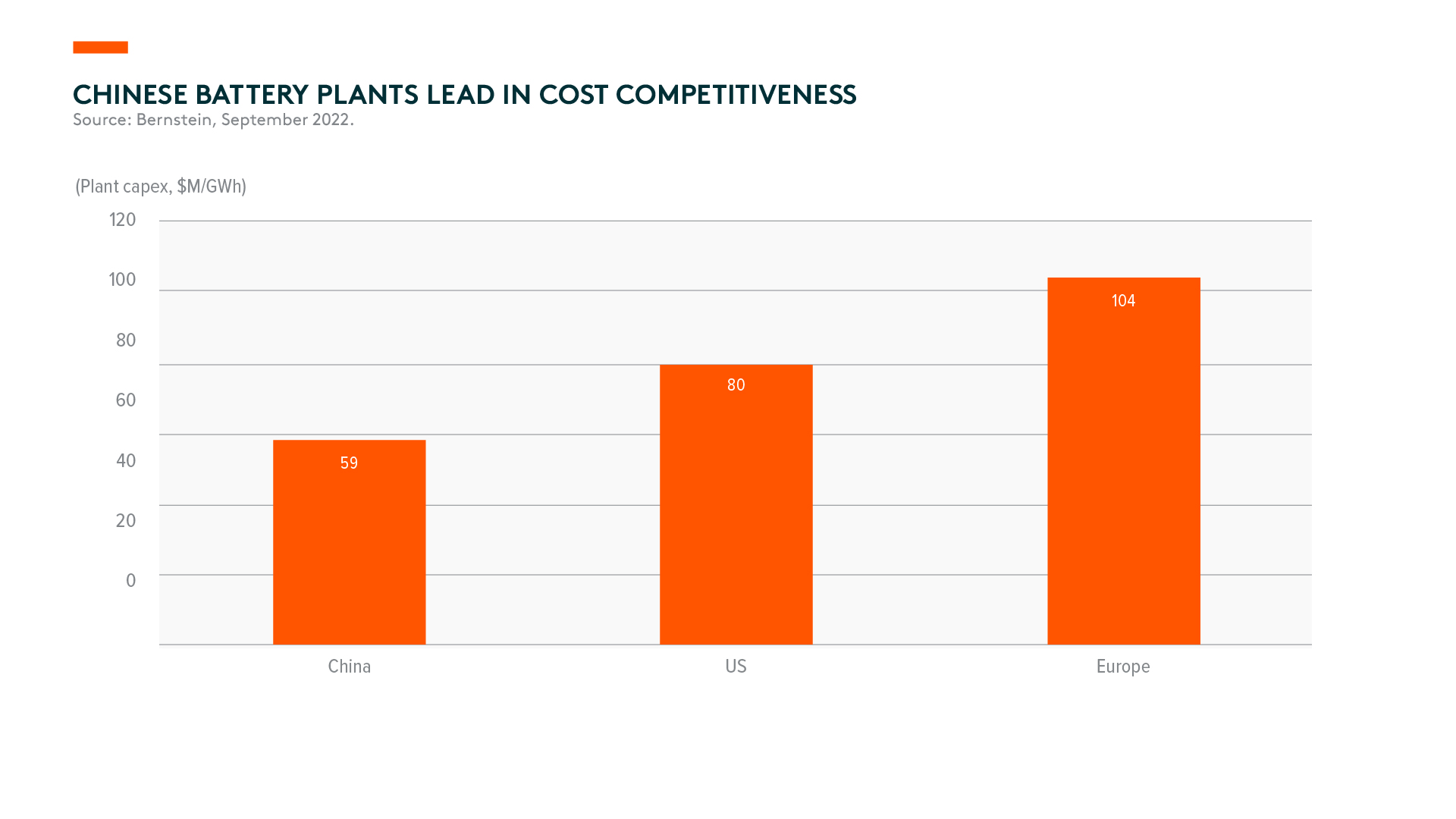

In order to penetrate more leading OEMs, battery makers are focusing on the innovation of their battery manufacturing technology and cost optimization. Leading battery makers are able to expand faster, backed by strong order backlogs and good access to funding, which, ultimately, enables them to invest more in research and development (R&D) and enjoy greater economies of scale. As a matter of fact, the battery value chain has now achieved a high degree of quality and cost competitiveness after leading battery producers enhanced their footprint more globally, resulting in EVs achieving closer-to-cost parity against ICEs.

Concerns on Economic Slowdown and Softening Demand

We are positive about the global vehicle electrification transition in the foreseeable future. However, we must admit the macro weakness in major economies, particularly China and Europe, will significantly impact EV demand in the near term. We have ongoing concerns about China’s weak property market and pandemic disruptions, while in Europe, the energy crisis lowers an individual’s disposable income. Additionally, there are growing concerns about an economic recession in the US. All of these uncertainties weaken consumer confidence and reduces consumer discretionary spending. As a result, although the EV penetration ratio is unlikely to reverse, the whole auto market could go into a deep down cycle.

On a positive note, China considers its automobile industry, especially EVs, as a vital tool to boost the economy. Central and local governments have posted a series of favorable policies and subsidies to encourage people to buy cars, with some of these supportive policies to last into next year. For example, the Chinese government extended the purchase tax waiver for EVs to the end of 2023. Combined with the currently low car and EV penetration in China, we could see China’s EV sales growth remain resilient in times of macro uncertainty.

Meaningful Impact Unlikely from US Inflation Reduction Act

The US Inflation Reduction Act (IRA) was passed in August 2022, with part of the spending aimed at accelerating the localization of EV and battery supply chains in the US. However, we believe the market is overly concerned about the US IRA’s impact on Chinese battery companies.

Firstly, the IRA is not a law outrightly banning any exposure to Chinese companies in the US EV and battery supply chain. There are still high chances for Chinese battery makers, battery materials manufacturers, and electric vehicle producers to expand their footprint to the US, as long as it proves profitable to do so. It is challenging to exclude China from the entire supply chain, given its dominance across key critical materials produced in China or supplied by Chinese players.

Secondly, based on our analysis, the IRA only covers a small fraction of EVs expected to be sold in the US over the next ten years. The total budget amount is insufficient to achieve a meaningful impact on the US battery supply chain. We expect the IRA could bring forward many corporates’ investment plans, but we don’t expect it to have a material influence on long-term battery capacity investment decisions.

Thirdly, battery plant investment in the US is higher than in China. It is impossible to get both land and productive manufacturing workers anywhere in the world that is as cheap as in China. Thus, as technology innovation continuously brings battery costs down, importing EVs could be a price-competitive solution versus subsidizing local production in the US. Eventually, it could end up competing on costs, similar to traditional manufacturing industries.

Last but not least, the US is just a part of the global auto market. The other two important consumers are China and Europe. Europe is proactively accelerating its EV transition, prioritizing climate change initiatives and consumer benefits over protectionism. They are open to Chinese battery investments to satisfy their growing demand, which also helps to improve local employment and the economy. Hence, we saw Chinese battery makers like CATL invest in new battery plants in Hungary. The IRA actually impacted Europe more than it did China, as it undermined Europe’s pursuit of establishing its battery supply chain by attracting more companies away from Europe. For example, Tesla is said to be scrapping its plans to build a battery factory in Europe after the IRA. Thus, we believe Europe is more likely to stand with China in developing its own EV value chain.