China Electric Vehicle and Battery Industry Review and Outlook

Strong Industry Momentum in 2021

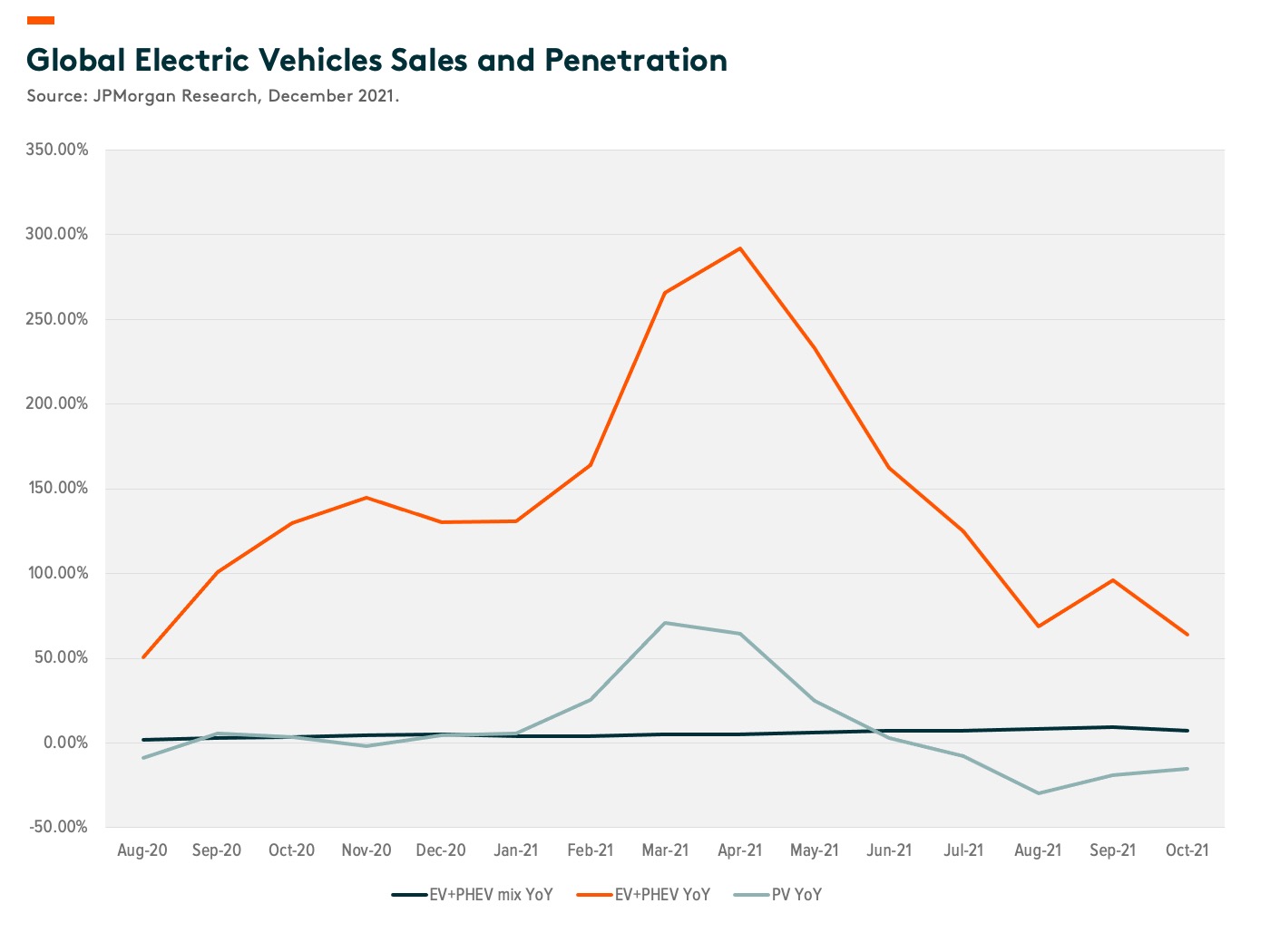

Global electric vehicle (EV) sales continued strong momentum in the second half of 2021 despite numerous headwinds, including the global chip shortage, COVID-19 resurgence, and slowing demand for passenger vehicles. EV penetration in China, Europe, and the US continued to rise (Exhibit 1), though this was partially due to lower deliveries of traditional internal combustion engine (ICE) vehicles amid supply chain bottlenecks. Aside from these leading three regions, other markets in the early stages of EV development, such as India, also showed great interest in boosting the proportion of EVs within their auto manufacturing and sales. In addition, we’ve also witnessed an increasing number of successful battery-powered electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) models that are stimulating consumer interest in EVs. Also supporting consumer interest is the improving accessibility for EV owners, including the growing footprint of charging stations, smart parking areas, and other infrastructure facilities.

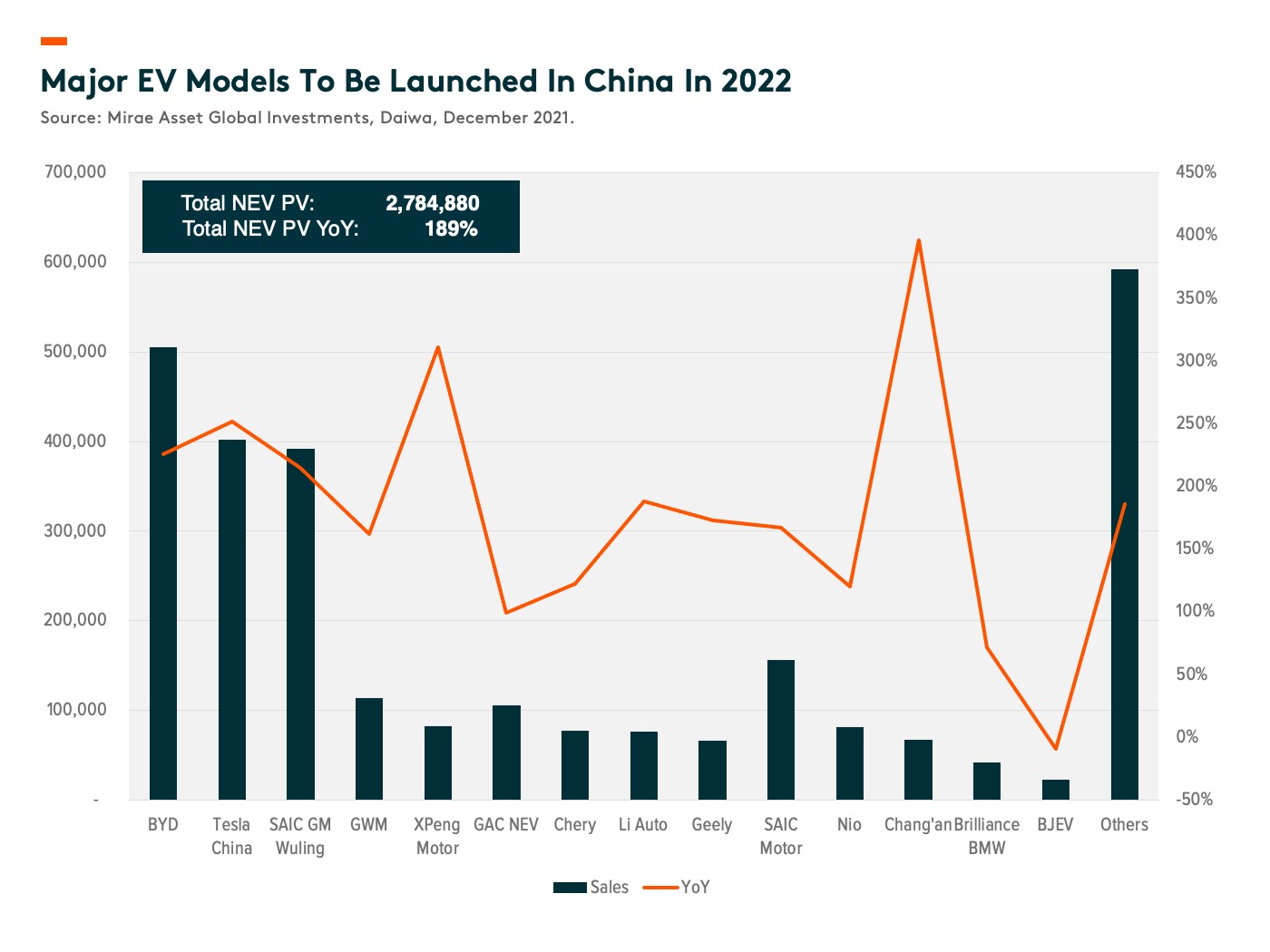

In China, local brands have replaced traditional joint venture (JV) brands to lead EV product strategies, production, and sales. Some of these local models are even generating five to ten thousand sales per month in the end consumer market, for example, BYD’s Qin, Han, and Song models, NIO’s ES6, Xpeng’s P7, GAC’s Aion, and Wuling’s Hongguang Mini EV.1 By November 2021, BYD, Tesla, and SAIC (which focuses on lower-end products) dominated nearly half of the total sales in China.2 Leading models from the three companies have significantly helped accelerate EV penetration in China. In addition, Chinese brands are also proactively expanding overseas, which is a big step and differs from earlier ICE times when local brands were considered weak, even among the domestic competition.

The battery market has also seen rapid growth throughout 2021 due to the boom in EV demand. In response, major battery players have announced plans to expand capacity aggressively. For example, CATL expects its capacity to exceed 650GWh by 2025, implying a 5-year CAGR of over 40%.3 To fund the near-term plan of 150+GWh, the company recently posted an RMB 45 billion placement.4 BYD and SVOLT (a subsidiary of Great Wall Motors) are also accelerating their fundraising efforts and are reaching out to more external suppliers for battery production and shipment in light of their robust pipeline of new in-house EV models. In addition, EVE Energy, a second-tier manufacturer in consumer electronic batteries, announced they’ll be breaking into the production of large cylindrical batteries in late 2021. Before this, they’ve also provided lithium iron phosphate (LFP) products to some major electric vehicle original equipment manufacturers (OEMs). As a result, these battery makers have shown greater confidence in their outlook for EVs than they did just one year ago, which, in turn, supports the expansion on the OEM side.

2022 Market Outlook

Looking ahead to 2022, pent-up demand is expected to remain strong in most major markets (Europe, the US, and China) due to supply chain bottlenecks, and we are optimistic about sales for the year, especially in the first half. China’s EV sales are estimated to exceed 5 million units provided the chip shortage eases, reaching the original government target much earlier than expected.5 Some major OEMs have guided very optimistic targets (e.g. BYD and Xpeng). However, estimates already reflect a volume recovery in 2022 as supply improves. As such, we expect surprises to the upside are more likely to occur in manufacturers with successful models, faster supply chain easing, and robust product pipelines.

We also remain bullish on long-term EV demand and cost decline. Global traditional OEMs with a large customer base and profound R&D capabilities are accelerating their transition toward EVs. Companies such as VW, Daimler, BMW, and Volvo, have all announced dates of when they’ll stop producing or selling ICEs and prepare to bring in more popular EV models. These looming deadlines imply that competition, especially in China’s auto market, could significantly increase over the coming years. As a result, the market may be concerned about the performance of some OEM players. However, we believe what matters more is to focus on the growing market share of EVs versus ICEs. EV OEMs, especially those with good product strategies and a solid supply chain, will continue to be the key beneficiaries of this trend, though it’s too early to say who will be the ultimate winner. Regarding new Chinese startups, the market was quite optimistic due to the large market size and the low base of these companies. However, we are reminded that their current high valuations could also mean high risks carrying forward if performance fails or if there are any delays to delivery.

On the battery side, valuations have also been running hot. The introduction of new technologies on cell-to-pack (CTP) and blade batteries since 2020 has made LFP batteries attractive in terms of their performance-to-price ratio. Several popular LFP-based new energy vehicle (NEV) models, such as Tesla’s Model 3, BYD’s Han, and Hongguang’s Mini EV, have further stimulated LFP demand. In 2022, major battery players such as CATL, BYD, and EVE Energy, are expected to implement new capacity plans for LFP, not only for power batteries but also for energy storage battery products of lower property requirements. Overseas battery manufacturers focusing on high-nickel ternary batteries have also begun to realize the value of LFP products. For example, in September 2021, LG Chem (a leading Korean battery manufacturer) announced it would broaden its product mix by building up its LFP production lines for energy storage applications first. However, despite its cost leading and better safety properties, we don’t see LFP as having an absolute competitive advantage, as high-end EVs still require higher energy density with ternary cathodes. Each battery type has its own application scenario and may be more optimal for specific criteria.

This kind of competitive landscape will likely last for some time yet into the future. The battery industry will never give up searching for materials that are cheap, widely stored in the earth, safe, and environmentally friendly. The race for innovation in commercial applications and massive production will become increasingly challenging but will continue to drive the industry players forward. Research on cost cuts and metal replacements has already been happening continuously in the background. New battery materials cheaper than LFPs are already on the way for commercialization. This increases the investment risks from the technology side, though leading players will enjoy first-mover advantages in technology, capacity, and sales channel in the visible near-term. Moreover, we hold a conservative view on unanticipated short-term oversupply due to mismatches in supply and demand. After all, EV sales are still, to some extent, driven by policies that vary widely across countries and frequently shift back and forth. We will closely watch for sales of new models, collaborations between OEMs and battery manufacturers, and the ramp-up of new batteries capacities.