Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

China EV and Battery ETF – Impacts from Potential Trade War 2.0

With Trump victory and Republican Sweep in the US Election, potential trade war 2.0 became a real threat for China economy and stock market performance. Though a 60% tariff on China imports as commented by Trump earlier might not be fully implemented considering its inflationary impacts on US Economy, additional US tariffs will inevitably weigh on China exporters. In this note, we analyse the potential impacts from higher US tariff and recent developments on the key companies across China EV supply chain – BYD, CATL and Fuyao Glass. These 3 companies are among the top five holdings of Global X China Electric Vehicle and Battery ETF with combined weighting of 44%.

Top 10 Holdings

| Name of Securities | Net Assets (%) |

|---|---|

| CATL | 20.4% |

| BYD | 17.8% |

| Li Auto | 6.9% |

| Shenzhen Inovance | 5.9% |

| Fuyao Glass | 5.4% |

| Zhejiang Sanhua Intelligence | 3.7% |

| Eve Energy | 3.7% |

| Ningbo Tuopu | 3.5% |

| Ganfeng Lithium | 2.8% |

| Huizhou Desay | 2.8% |

Source: Mirae Asset, data as of 19 November 2024

BYD

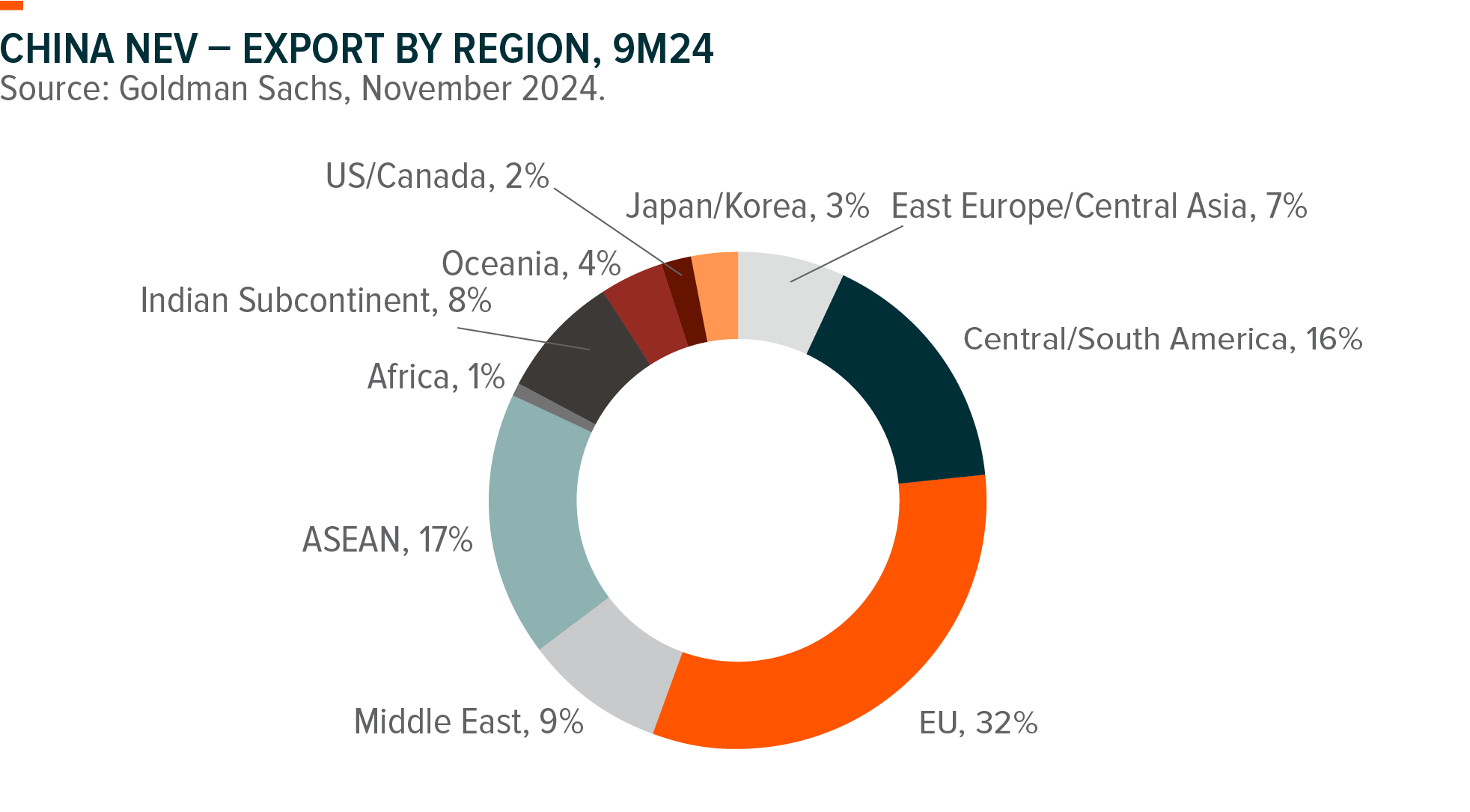

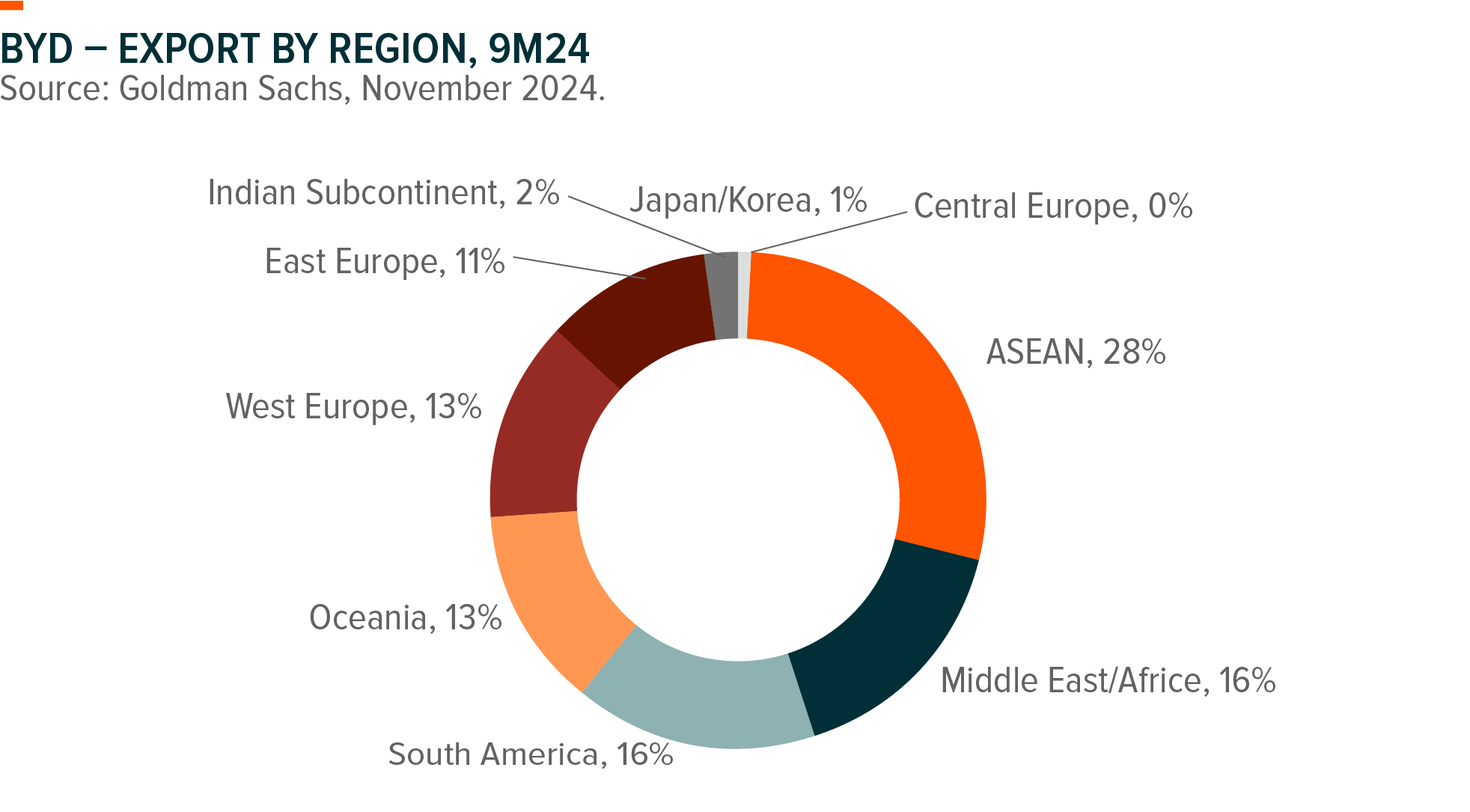

Although China overtook Japan and became the largest Auto exporter globally, US and Canada only account for less than 3% (mostly JV brands) of China’s total auto exports. Major Chinese EV brands, including BYD and Li Auto, have very limited exposure to the US market, thus should be less vulnerable to the US tariff hike. Emerging markets such as ASEAN and South America have become the major export destinations for China EV brands, and we see potential for further penetration in the EM market with the compelling value-for-money EV model offering from China OEM. EU accounted for 32% of China EV exports but the majority are from the China production bases of overseas brands such as Tesla. Leading Chinese brands such as BYD have been building overseas production facilities to cope with EU tariffs, and BYD should be less affected as current EU tariffs target BEV while a larger portion of BYD’s exports are PHEV.

CATL

CATL has c.10% of total shipments exported to US, including c.7% of EV battery shipment and c.30% of ESS battery shipment. While a potential US tariff hike could affect CATL’s ESS battery exports to the US, CATL’s unique product competitiveness presents limited alternatives within the supply chain and CATL may continue to remain a key supplier for ESS batteries in the US. For EV battery, current licencing agreement between CATL and Ford is in an IRA-compliant way, and potential tightening or removal of the regulation under Trump administration could prevent US subsidies from flowing indirectly into the China supply chain.

On the bright side, Trump stated in an previous interview that he is open for Chinese automakers to build factory in the US, and recently CATL chairman Mr. Zeng also stated that CATL would consider major US investments if policy allows. CATL has strong customer base in the US as it remains the major battery supplier of the leading US OEMs and ESS markers, namely Tesla and Fluence. Overseas battery production should also be profit accretive for CALT as it enjoys higher profit premiums thanks to protective policies. After scaling down of IRA subsidies in the US, CATL could be in a better competitive position thanks to its technology and costs advantages over foreign peers.

On another note, CATL continues to launch new products to enrich offering portfolios and tap into new markets. In October, CATL launched Freevoy, a dedicated solution for the PHEV and EREV. Freevoy battery is the world’s first EREV/PHEV battery that can achieve over 400km driving range and support 4C rate fast charging, which should help CATL to further capture the fast expanding hybrid EV market. In addition, with the launch of Tianxing Battery in July, CATL is also moving beyond passenger vehicles and tapping into commercial vehicles, expanding the total addressable market for EV battery through driving the second adoption curve.

Fuyao Glass

Fuyao Glass is the world’s largest auto glass maker commanding c.30% of global market share. North America market accounts for c.17% of Fuyao Glass’s total revenue, including 5% exports from China and 12% US local production (Goldman Sachs estimates). Impact from US tariff hike should be manageable for Fuyao Glass, considering: 1) China-US export only accounts for 5%, and Fuyao Glass can pass through part of the tariff to downstream customers (as they did in 2018 trade-war 1.0 when they passed through >50%); 2) Fuyao Glass has the optionality for further scaling up US local production. The company has strong balance sheet to support further Capex, and owns 10 years of operational experience in US local production.

A recent report by Bloomberg indicated that a major global auto glass manufacturer, Saint-Gobain, is exploring the potential sale of its auto glass unit. This, together with previous strategic decisions by other major players to scale back auto glass capacities, should provide a more favorable competitive landscape in the industry. Fuyao Glass is well positioned for continued global market share gain on the back of its manufacturing strength and effective R&D investments.

| Global X China Electric Vehicle and Battery ETF (2845 HK) |

|

|---|---|

| Inception Date | 17 Jan 2020 |

| Reference Index | Solactive China Electric Vehicle and Battery Index NTR |

| Primary Exchange | Hong Kong Stock Exchange |

| Total Expense Ratio | 0.68% p.a. |

| Product Page | Link |

Source: Mirae Asset; Data as of November 2024.