China Embraces the Cloud Computing Age

Cloud Computing Age

The term “cloud computing” describes the storing and accessing of data and software using remote servers, and it’s one of the fastest-growing sectors of the IT industry.

Most personal computer users are already familiar with the concept of storing files or photos online instead of on internal hard drives. For businesses, the concept is the same, and it offers multiple advantages.

Firstly, it’s a lot cheaper. A company can save up to 30% of its IT costs by switching from on-site data management to cloud services. And the benefits extend far beyond just storage. Once a company’s IT resources have been moved to the cloud, there is a growing universe of big-data and artificial intelligence tools that can help enterprises develop their commercial strategies. Cloud computing provides the scalable resources to gather, analyse and store all kinds of data for a variety of advanced applications, such as sales analysis or personalised services for customers.

What’s more, unlike traditional on-site IT services, cloud computing generates recurring revenue, making it a more predictable, service-oriented business model.

According to technology research firm Canalys, worldwide spending on cloud computing accelerated to more than USD80 billion in 2018, from USD55 billion the year before1.

Having a big-data strategy is increasingly seen as essential for all corporate management activities. The ability to identify and respond to consumers is now a key factor in measuring enterprise competitiveness, and cloud tools offer the best and most cost-effective means of leveraging the vast amounts of data that companies generate.

Cloud companies, especially first movers, already benefit from economies of scale and network effects, and there is no sign of those advantages being eroded. Growing use of the public cloud creates greater demand for scale, as we have seen with companies such as Amazon and Alibaba.

Cloud Computing in China

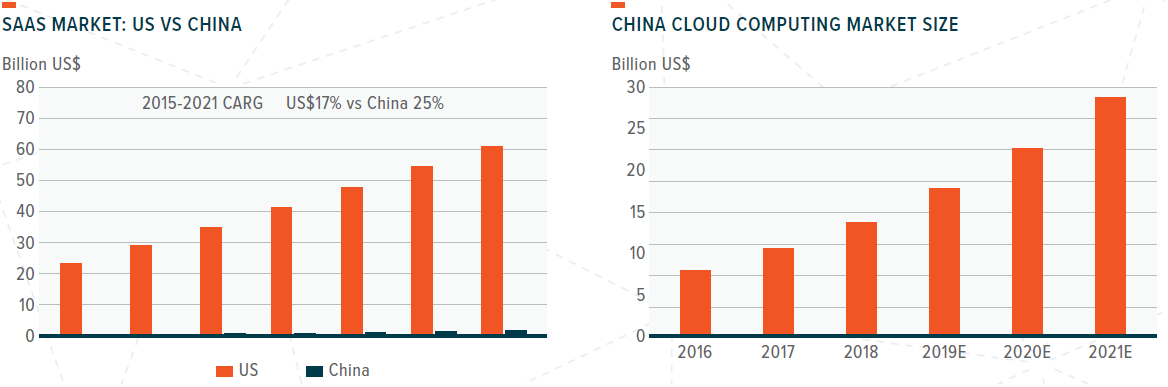

For investors, it’s important to know that China is still in the early stages of this global trend and is racing to catch up, meaning its cloud market not only has much greater room for expansion, but at a faster pace. While its enterprise IT market is enormous, the proportionate share of cloud computing remains relatively low. According to Bain, it stands at about 5% of the total market, compared with the global average of 11%2. Further, its cloud software industry is only 3-10% of the size of its US counterpart, yet China’s GDP is 70% of the US’s.

As a result, Bain expects China’s spending on the cloud to grow as 40-45% a year, reaching USD20 billion in 2020, far outpacing the broader IT industry. The Chinese government has identified cloud technology as a strategic priority – it was a prominent feature in both its 12th and 13th Five-Year Plans3. Thus, the sector is expected to receive a significant boost from government policies promoting and subsidising cloud technology adoption, such as the 20% support offered to companies to help them switch to the cloud.

In addition, China’s state-owned telecom companies invested approximately USD180 billion between 2015 and 2017 in fixed-line and wireless connectivity to support Internet access and cloud services.

What Next?

Investing in the IT sector, as we already know, can be a bumpy ride. The internet sector, in particular, is still relatively young, and prone to sudden changes in government regulations and restrictions that can affect business practices, operational costs, user growth and development speed. The industry also has to deal with unpredictable spurts and slowdowns in growth, and frequently fierce competition for top talent.

IT is a fast-moving business, and companies at the forefront of technology today can find their products and services becoming rapidly obsolete – and their share prices following suit – if they don’t continually evolve (think 3D printing companies a few years ago). Software errors, bugs and vulnerabilities can also rapidly decimate consumer confidence in a product.

Nevertheless, investors have already begun catching on to growth potential of cloud computing in China. In the 12 months through the end of July 2019, the Solactive China Cloud Computing NTR Index (the underlying index for the Global X China Cloud Computing ETF) rose 12% in the 12 months through August 2019, almost double the gain in the Shanghai Composite Index.