China E-commerce and Logistics Industry Review and Outlook

A Tough Year for E-commerce

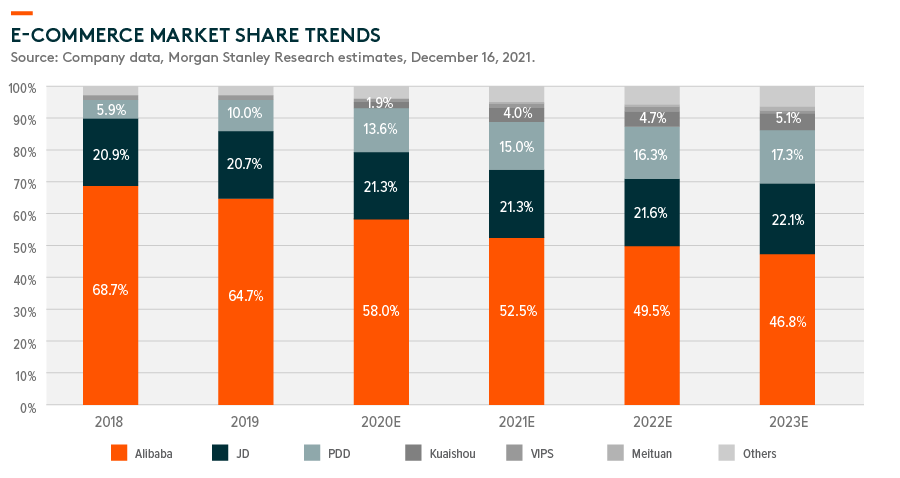

Chinese e-commerce companies struggled in 2021 from a series of government regulations which began with the suspension of Ant Group’s IPO in November 2020, followed by a slowdown in consumption over the second half of 2021. Stricter anti-trust regulations have accelerated market share shifts from Alibaba to second-tier players such as JD.com, while Meituan, a leader in the online food services industry, managed to maintain its dominance without losing significant share to its peers.

Leading platform companies, including Alibaba, Tencent, and Meituan, have taken on more social responsibilities under “common prosperity” by making donations, providing more social benefits to gig workers such as delivery riders, and supporting small and medium merchants on their platforms. At the same time, these companies have also increased investments in new business areas such as online grocery, penetrating lower-tier cities, and expanding into overseas markets. While their costs and investments heightened in 2021, top-line growth slowed down in the second half, along with the overall macro slowdown in China. In addition, the resurgence of COVID-19 over the summer led to stricter social distancing rules, and consumer confidence softened with various macro issues, including concerns on the property market in China.

Inflection on Logistics Parcel Pricing and Competition

The Chinese logistics sector remained highly competitive during 1H21 after J&T Express (a logistics company backed by Pinduoduo Inc.) accelerated its growth in 2020. However, in April and July 2021, we began to see government intervention, targeting the unhealthy price competition among logistics players and also protecting the delivery couriers’ welfare.

Since then, industry players have coordinated efforts to prioritize quality and margins over quantity and scale. Major express delivery operators including ZTO, Yunda, YTO, STO, BEST, and J&T Express announced the decision to raise last mile delivery fees by Rmb10 cents in late August – the first government-ordered price increase for the industry in many years. The hike occurred in the lead up to China’s peak consumption season with Double 11 (i.e. Single’s Day) in November and Double 12 in December. Logistics companies like ZTO and SF Holdings took advantage of this period to further hike logistic fees and improve their margin outlook. ZTO’s recent results have guided a healthier price competition into 2022, signaling other logistics players to join forces.

Outlook for 2022

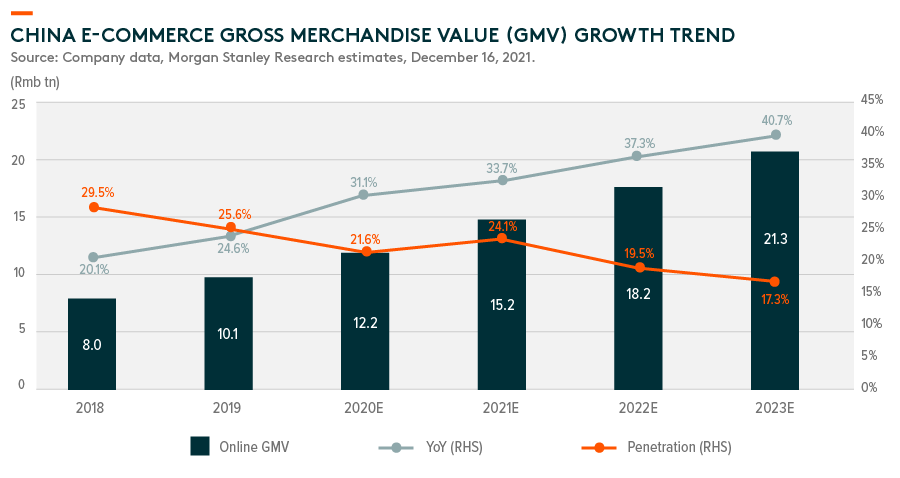

The Chinese government has now shifted its policy stance to support domestic consumption and spur overall economic growth. In addition, we expect social distancing measures to become more relaxed after the Beijing Winter Olympics in February 2022 and as vaccination rates rise in the country. Furthermore, while there may be some remaining regulatory details to address, the major regulations on the e-commerce sector have been announced in 2021. Overall, we expect a gradual recovery of the e-commerce industry in 2022.

On the logistics side, parcel volume growth in China remained healthy in 2021, staying at around +20% year-on-year growth in 2H21, benefiting from China’s resilient e-commerce demand growth. The market continues to consolidate, with the lowest cost leader, ZTO, continuing to gain market share. However, looking ahead to 2022, there are growing concerns around the industry parcel volume growth and whether the property market slowdown and overall economic weakness could lead to marginally slower consumption trends. Companies like SF Holdings have also mentioned the same risks in their results calls and, as a result, have scaled down their capex investments on express accordingly.