China Consumer Industry: H1 2022 Review

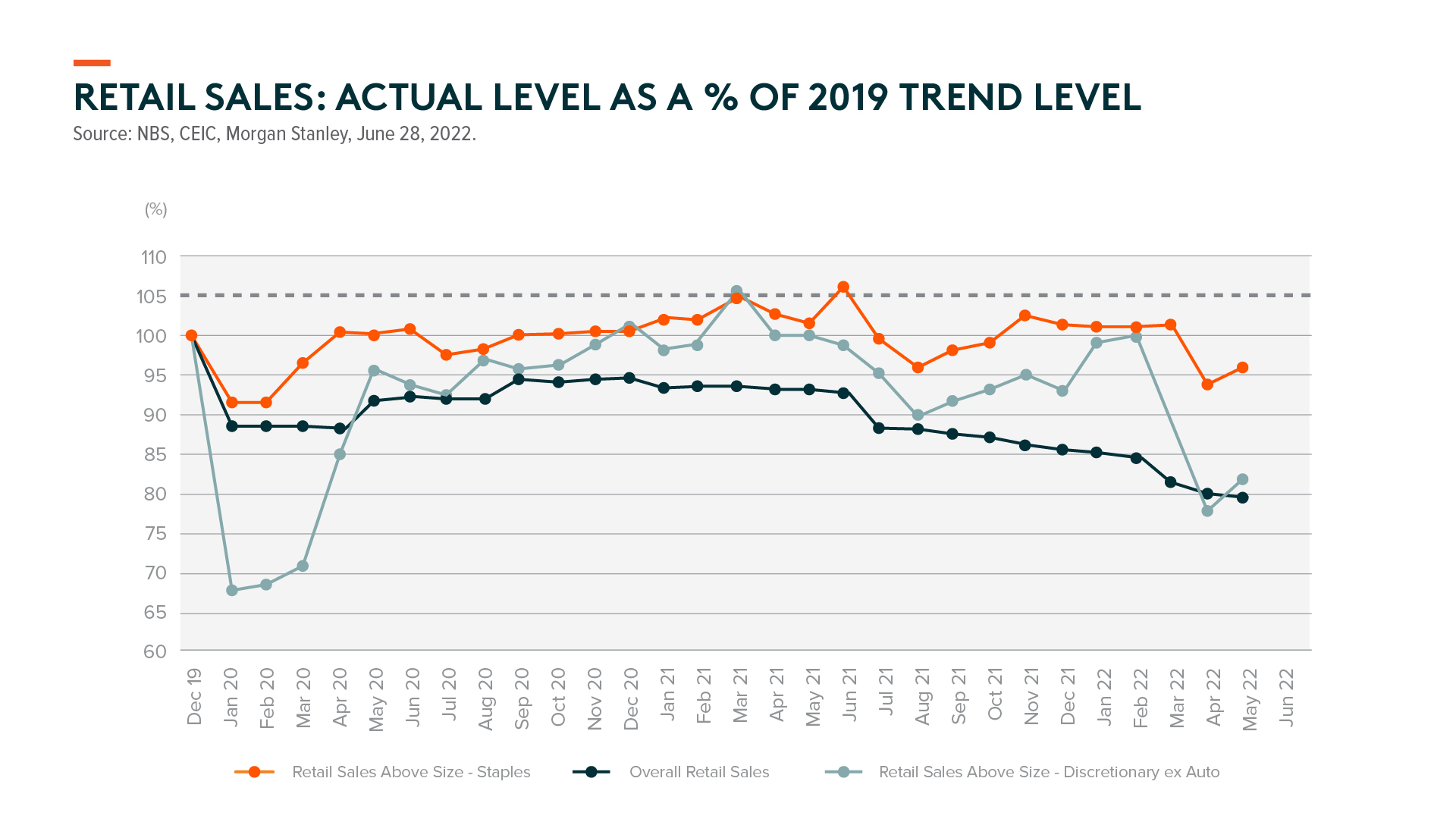

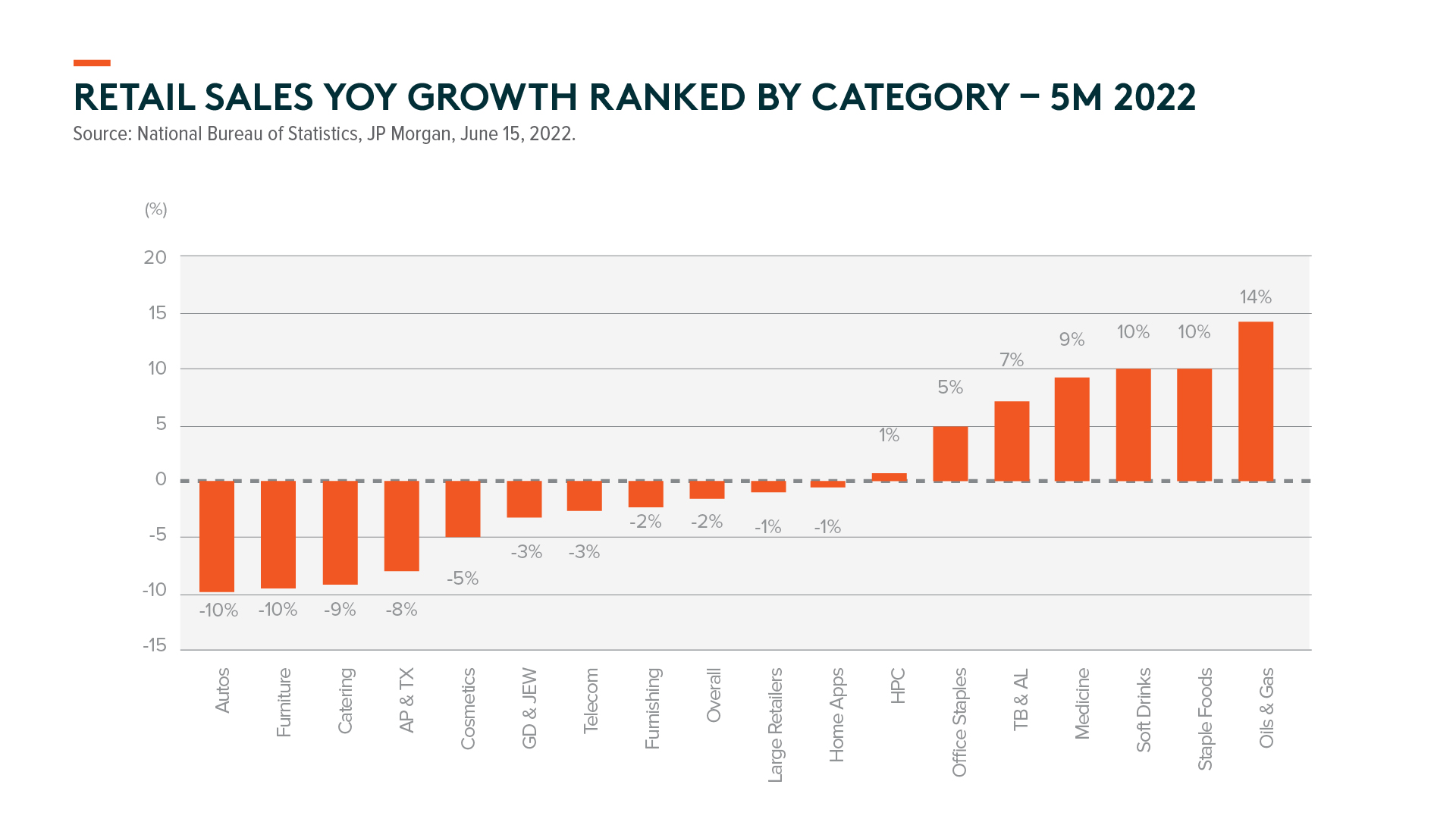

China’s consumption was weak due to the pandemic in the first half of 2022. Consumption initially showed a decent recovery in the first two months of the year until the resurgence of Omicron in March. Retail sales slowed sharply and was down 11.1% year-on-year (yoy) in April with the lockdown of key cities. The situation improved sequentially in May (-6.7% yoy) and is expected to see further improvements in June with an earlier-than-expected reopening. E-commerce was also impacted in April during the lockdowns due to supply chain and logistics disruptions. Total online physical retail sales declined by 5% yoy in April but improved in May to +7% yoy.1 The 618 shopping festival sales turned out better than the market expected, with the gross merchandise value (GMV) on all platforms growing +20% yoy, according to data from Syntun.2 While the dynamic zero Covid policy will stay for a while, it is unlikely that there will be another citywide lockdown as in Shanghai earlier this year.

Consumer staples were more defensive than discretionary and service sectors amid lockdowns in H1 2022. Premiumization is still the mainstream trend across different categories, albeit weak consumer confidence. At the same time, local brands continued to gain consumer attraction this year in various consumer sectors such as sportswear, cosmetics, and electric vehicles. We expect to see a gradual consumption recovery, particularly in consumer discretionary and the services industry, in the latter half of this year.

Premiumization Remains Mainstream

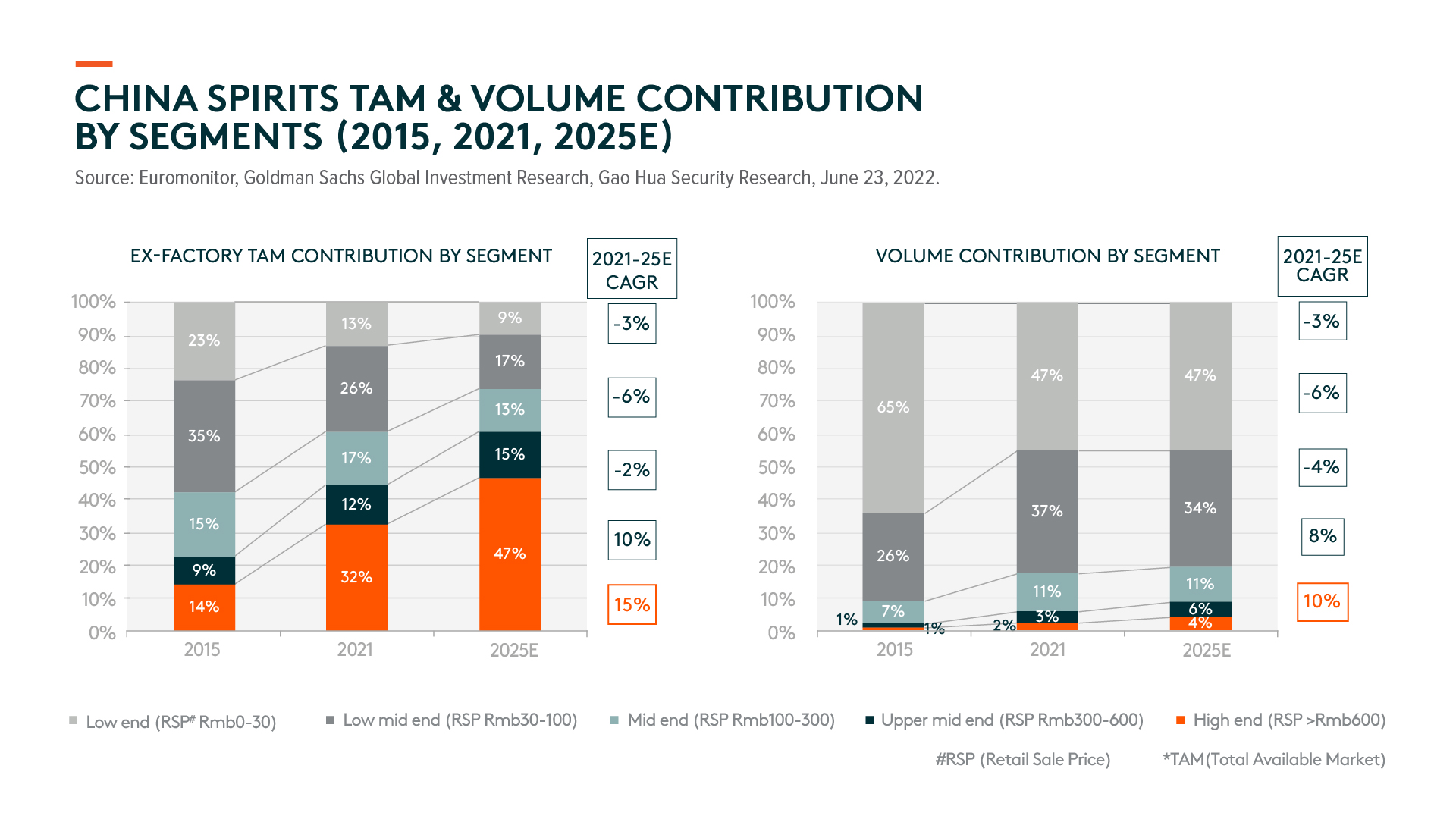

Despite weak consumption, the premiumization trend remains the mainstream in China as affluent consumers are generally under less financial pressure than the lower class. Across different categories, the premium segment has been growing faster than the value segment. For example, China Resources Beer expects its premium portfolio volume to deliver double-digit growth, outperforming its overall volume growth in the first half of this year.3 A similar trend has been seen in the home appliance industry as well. As one of the largest home appliance platforms, JD saw high-end appliance sales surging nearly five folds compared to a year ago during the 618 festival, but overall sales growth was only 10% yoy during the same period.4 In addition, super premium spirits continued to show resilient demand, with Kweichow Moutai’s sales and profit growing 18% yoy and 24% yoy, respectively, in Q1 2022.5 The company’s management guided revenue growth of 15% yoy for the full year in FY226, and so far, sales have been trending better than the guidance.

Local Brands Keep Gaining Consumer Attraction

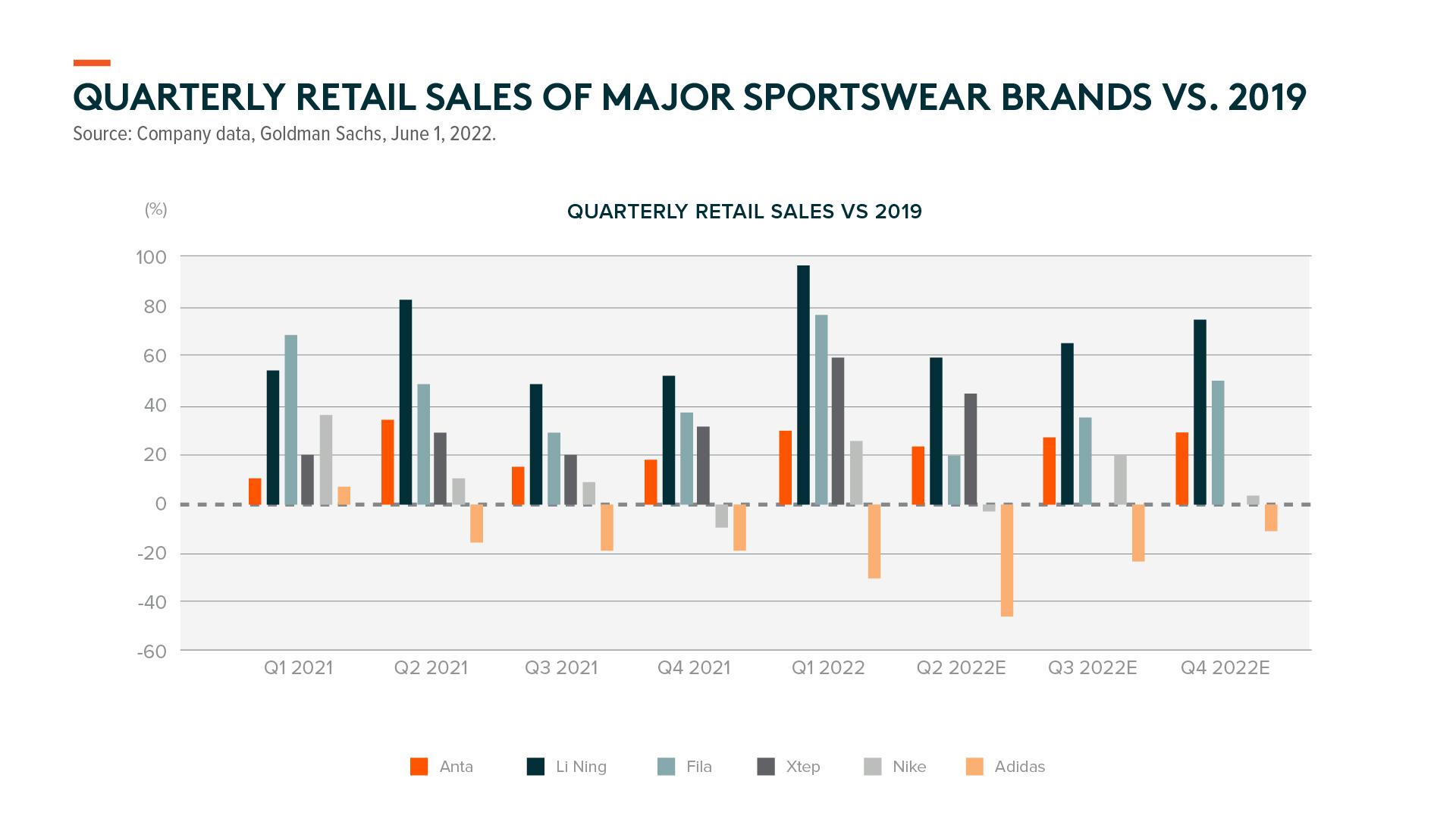

“Guochao(国潮)” has been a strong theme since last year, particularly in the sportswear industry after the Xinjiang cotton issue. Sales of Li Ning and Anta grew faster than international brands like Nike and Adidas. While overall sportswear sales were impacted amid lockdowns in Q2 2022, local brands were generally more defensive and kept gaining consumer attraction. In addition, there are rising local brands in cosmetics, albeit most are still in the mass market segment rather than premium. For example, Proya, which ranked no.1 among Chinese cosmetics brands on Tmall during the 618 festival, has continued to beat market expectations this year with +39% yoy sales growth in Q1 2022.7 According to Morgan Stanley estimates, the company maintained such growth in Q2 2022 despite the Covid disruptions and is expected to deliver +30-35% yoy sales growth in Q2 2022.8 The company’s core Proya brand ranked no.5 among total cosmetics on Tmall, with a GMV growth of 133% yoy during the 618 festival.9

Additionally, local brands are gaining a greater share of China’s electric vehicle (EV) market. EV sales of BYD, GAC AION, Geely, and new startups have grown multiple times compared to a year ago in the first five months of 2022, despite the lockdown in Shanghai and price hikes at the beginning of the year. For example, BYD’s passenger EV sales grew 260% yoy in May.10 Overall, EV sales are expected to be resilient with rising EV penetration in China on the back of the government’s policy support as well as surging oil prices. Exhibit 4. Quarterly Retail Sales of Major Sportswear Brands vs. 2019

We expect China’s overall consumption to have a gradual recovery in the second half of this year. April was likely to be the bottom with citywide lockdowns, which we do not expect to happen again, albeit the zero-Covid policy is to stay for a while. Consumption slowed down in H2 2021 due to the resurgence of Delta, and thus the base was low. More importantly, China will likely focus more on economic growth, especially after the 20th Party Congress in October/November, and may announce more meaningful stimulus policies to boost domestic consumption. Overall, we are more positive about leading local consumer brands, particularly discretionary and services companies severely impacted by the zero-Covid policy in the past year.