Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Capitalizing on China AI Development Using Global X HK ETFs

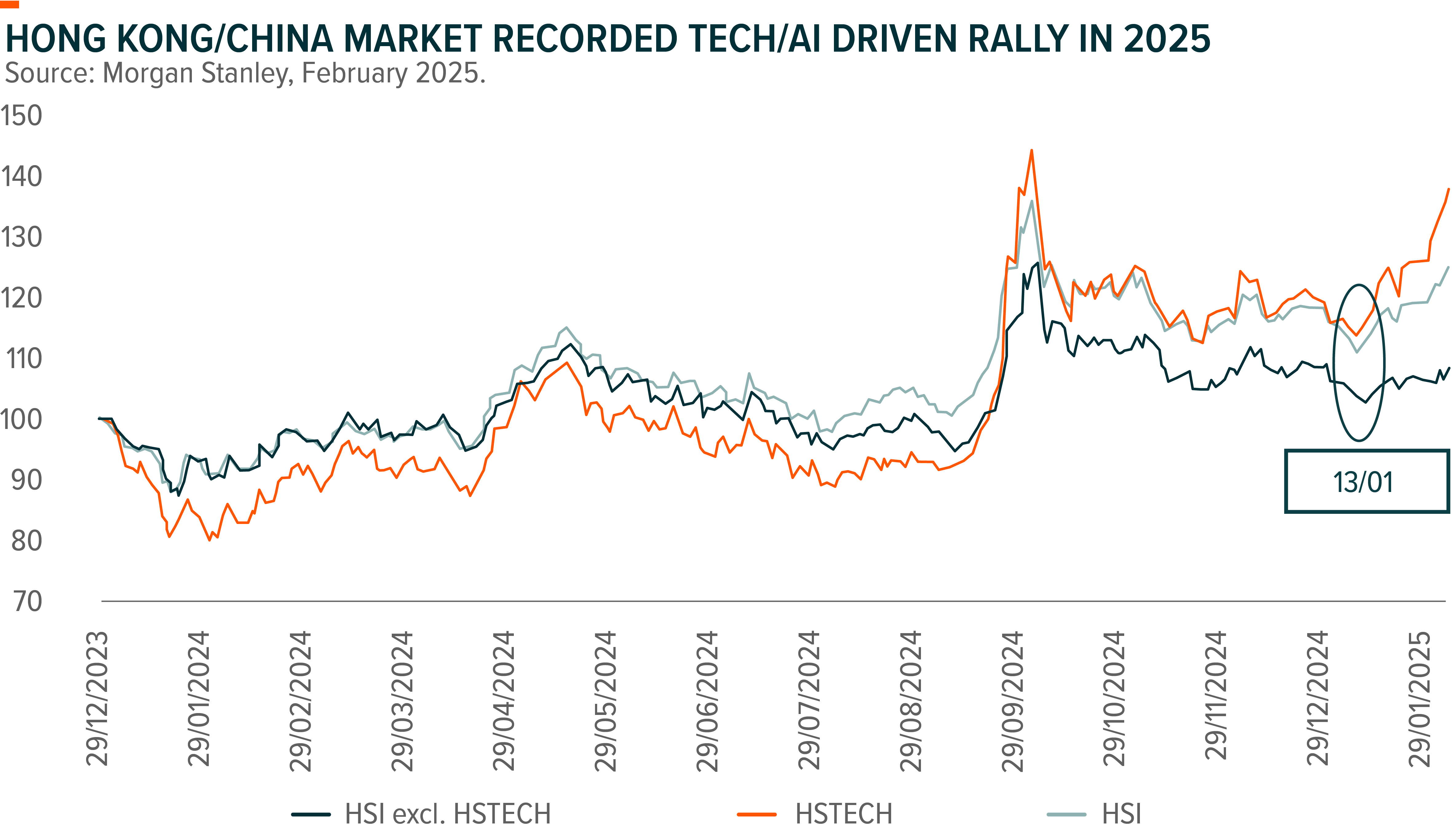

A Tech-Driven Market Rally

Hang Seng Index gained 12% YTD, outperforming other global markets. Different from what we saw in September 2024 which was a market-wide rally driven by policy pivot, this time we see a significant divergence between Tech/AI related names (HS Tech + 21%) and non Tech/AI sectors. The substantial pivot in China AI development led by DeepSeek V3/R1 models featuring high performing and low costs ignite hopes for more independent AI development in China, and we pick relevant Global X ETFs that help investors capitalize on the AI wave.

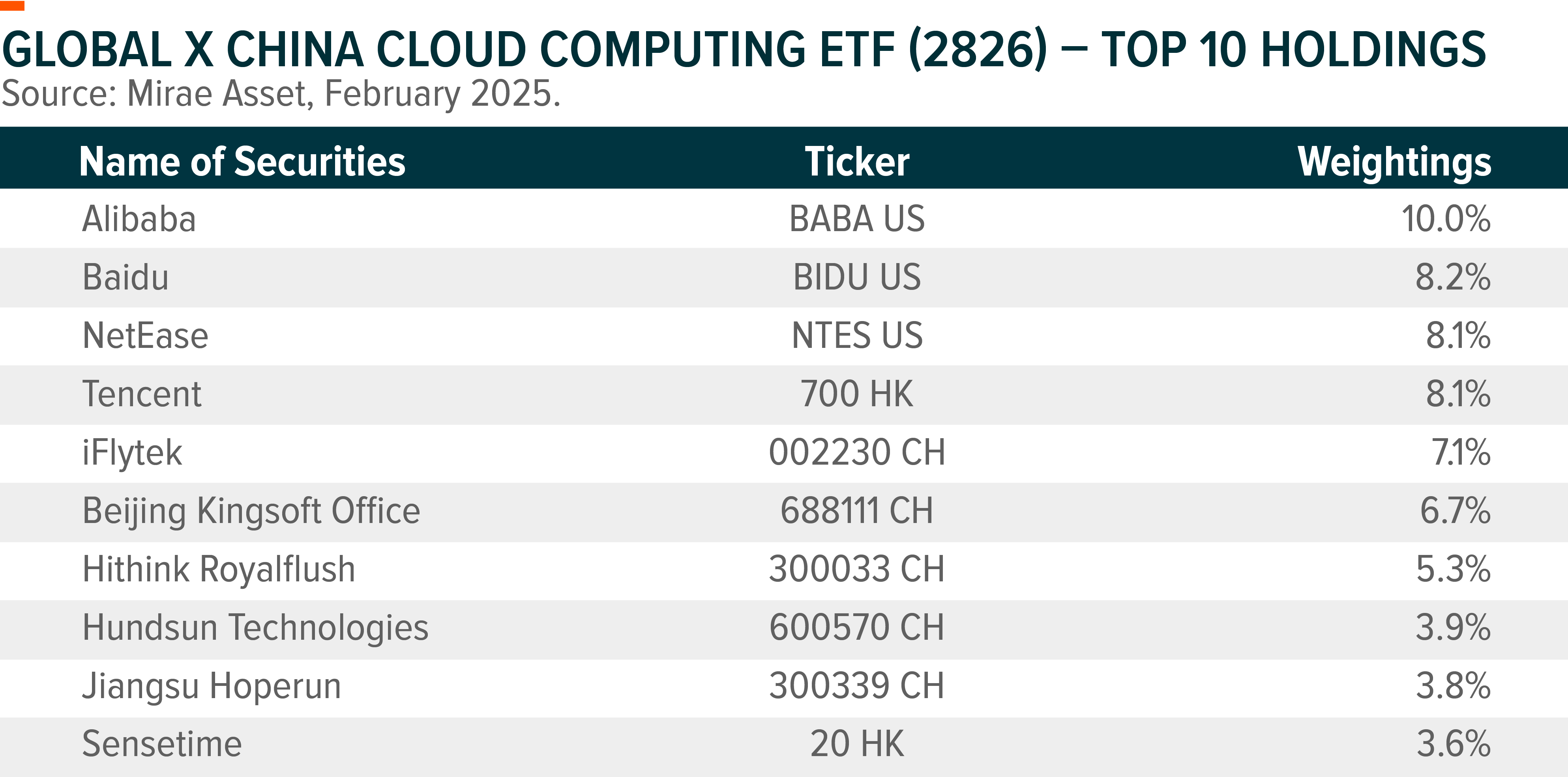

Global X China Cloud Computing ETF (2826)

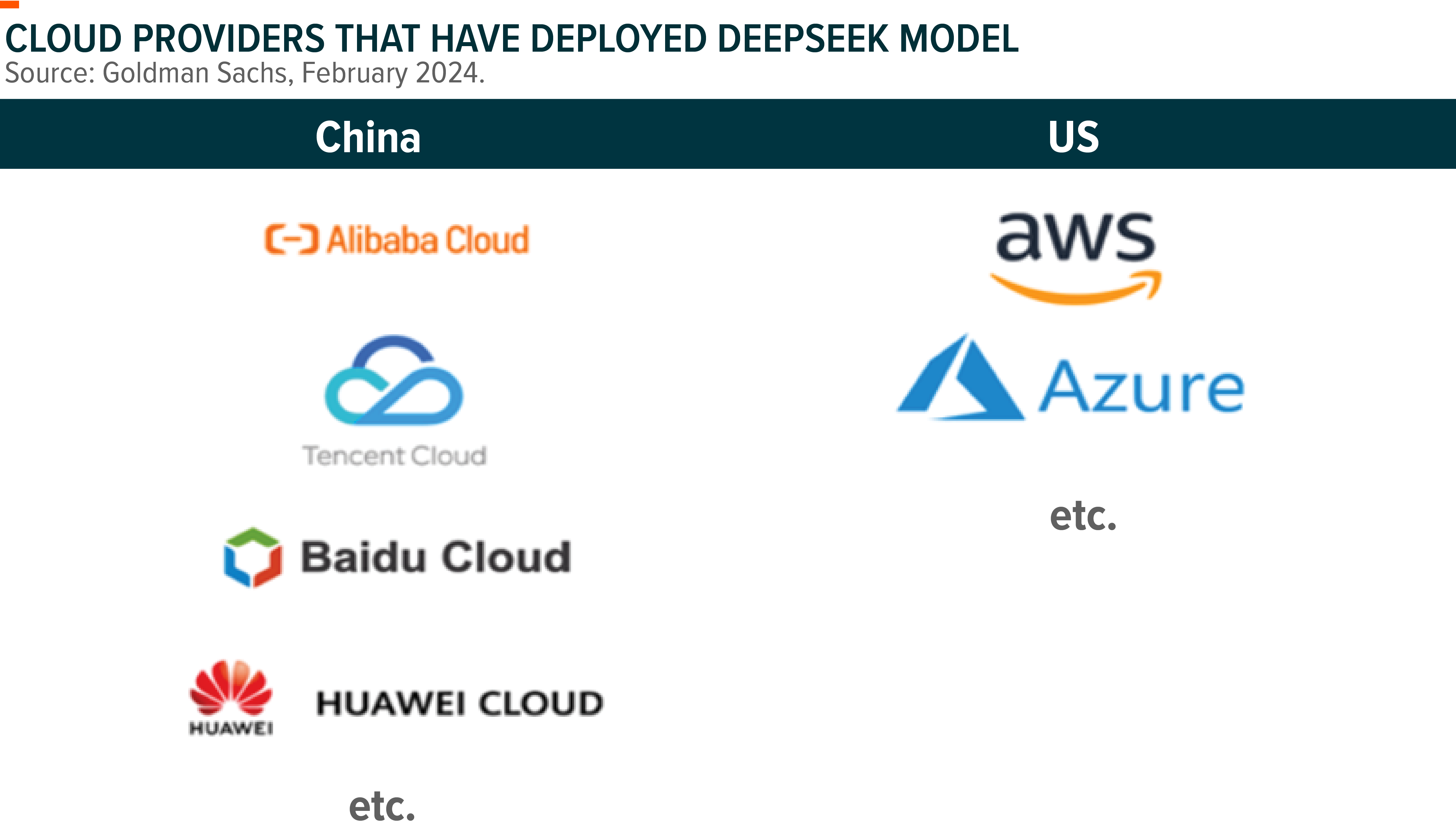

The ETF invests in major internet platforms (cloud service providers) and software companies. China internet giants that operate large scale cloud computing platforms and have been investing substantially into AI will be among the key beneficiaries of the generative AI breakthrough in China. Alibaba Cloud, Tencent Cloud and Baidu Cloud have all announced supports of DeepSeek V3/R1 model in their platforms, which could benefit from rising usage from consumers and business with the strong traction gained by DeepSeek globally. Alibaba and Tencent are among the top 3 public cloud providers in China, and AI has been an increasingly important driver for cloud revenue growth while at the same time being margin-accretive for their cloud computing business. Additionally, Alibaba also launched its Qwen2.5-Max, a large-scale MoE model with leading performance results as compared to global peers. Alibaba Cloud is the major provider for its Qwen LLM as it is currently not fully open-sourced, and Alibaba’s stock price has recorded substantial outperformance vs peers since the launch of Qwen2.5-Max.

The cost efficiency demonstrated by DeepSeek accelerates AI adoption and applications, and internet giants like Tencent are poised to be the key beneficiary of To-C AI applications thanks to the large digital ecosystem built over the past 2 decades. Superapps like Weixin that consists of social and transaction capabilities presents unparalleled potential and use cases for To-C AI applications.

Global X China Robotics and AI ETF (2807)

The ETF invests in robotics and AI related companies, and is benefiting from the rapid development of humanoid robots and AI in China recently.

Humanoid robot theme is gaining traction recently as bolstered by a few catalysts: 1) Elon Musk announced plans for massive production of Optimus Robot in 2026; 2) Unitree’s humanoid robot model gained massive tractions after its performance in China’s Spring Festival Gala, and several videos of Unitree G1 model performing complex tasks went viral on the internet globally; 3) Huawei officially engage in humanoid robot industry with the establishment of its innovative center in the end of 2024. Global X China Robotics and AI ETF invests in key humanoid robot components companies across the supply chain including Shenzhen Inovance, Leader Harmonious Drive, and Zhejiang Shuanghuan. Additionally, through inclusion of software companies, the ETF can also ride on the accelerating AI adoption trend in China.

| Global X China Cloud Computing ETF (2826) |

Global X China Robotics and AI ETF (2807) |

|

|---|---|---|

| Listing Date | 25 Jul 2029 | 07 Aug 2020 |

| Reference Index | Solactive China Cloud Computing Index NTR1 | FactSet China Robotics and Artificial Intelligence Index |

| Primary Exchange | Hong Kong Stock Exchange | Hong Kong Stock Exchange |

| Total Expense Ratio | 0.68% p.a.1 | 0.68% p.a.1 |

| Product Page | Link | Link |

Source: Mirae Asset; Data as of February 2025.