Asia Innovator Active: Q2 2022 Review

Overview

Within the portfolio, we maintain meaningful exposure to the growth themes of Autonomous & Electric Vehicles (EV), Climate Change, Semiconductors, E-commerce, Robotics & Artificial Intelligence (AI), among others.

Review

Asian equity markets have been volatile during the second quarter of 2022. Earlier in the quarter, the market was hammered by the tragedy in Ukraine and Shanghai’s two-month-long lockdown. The portfolio suffered as EV batteries and all growth stocks plummeted, especially when the price of raw materials rallied on speculation of supply shortages. However, later in the quarter, most of our holdings recovered thanks to the economic recovery after Shanghai’s lockdown was dissolved and raw material cost pressures were reduced.

EV Battery Stocks Withstanding the Biggest Risk

For some time, EV battery experts have warned that the supply of key materials like lithium and cobalt might not be sufficient, leading to sharp cost increases. As a result, demand for EVs may be sluggish, and the battery supply chain may experience a margin squeeze.

That’s exactly what happened in 2022 H1 when lithium prices increased seven-fold in just 12 months to March 2022.1 Naturally, the share prices of relevant stocks were corrected between January and April.

However, to the surprise of many, we witnessed that the EV penetration story didn’t stop; instead, it gained momentum. In China, the EV (+PHEV) penetration ratio reached 26% in May 2022, up from 20% in December 2021.2 There were two backdrops to this rise. First, while EV battery cost was rising, maintenance costs for traditional engine vehicles rose at nearly the same rate. In China, retail gasoline prices increased 60% y/y between March 2021 and June 2022. In simple math terms, we found that the maintenance cost gap widened to nearly USD 2,000 per annum between EVs and ICE vehicles when considering June fuel prices.3

Second, consumers now feel familiar with and are more comfortable buying EV models, regardless of cost. This is because consumers have started to appreciate the various value propositions of EVs, ranging from design, acceleration function, wider interiors, and camping usage, among many others.

Therefore, after withstanding the biggest risk, we’ve now gained more confidence that EV penetration will be maintained in the foreseeable future.

Asia Less Likely Under Inflationary Pressure

Inflation fighting and the subsequent recession risk have become a major headwind for global equity markets this year. Luckily, or unusually, China doesn’t seem to be affected by inflation this year.

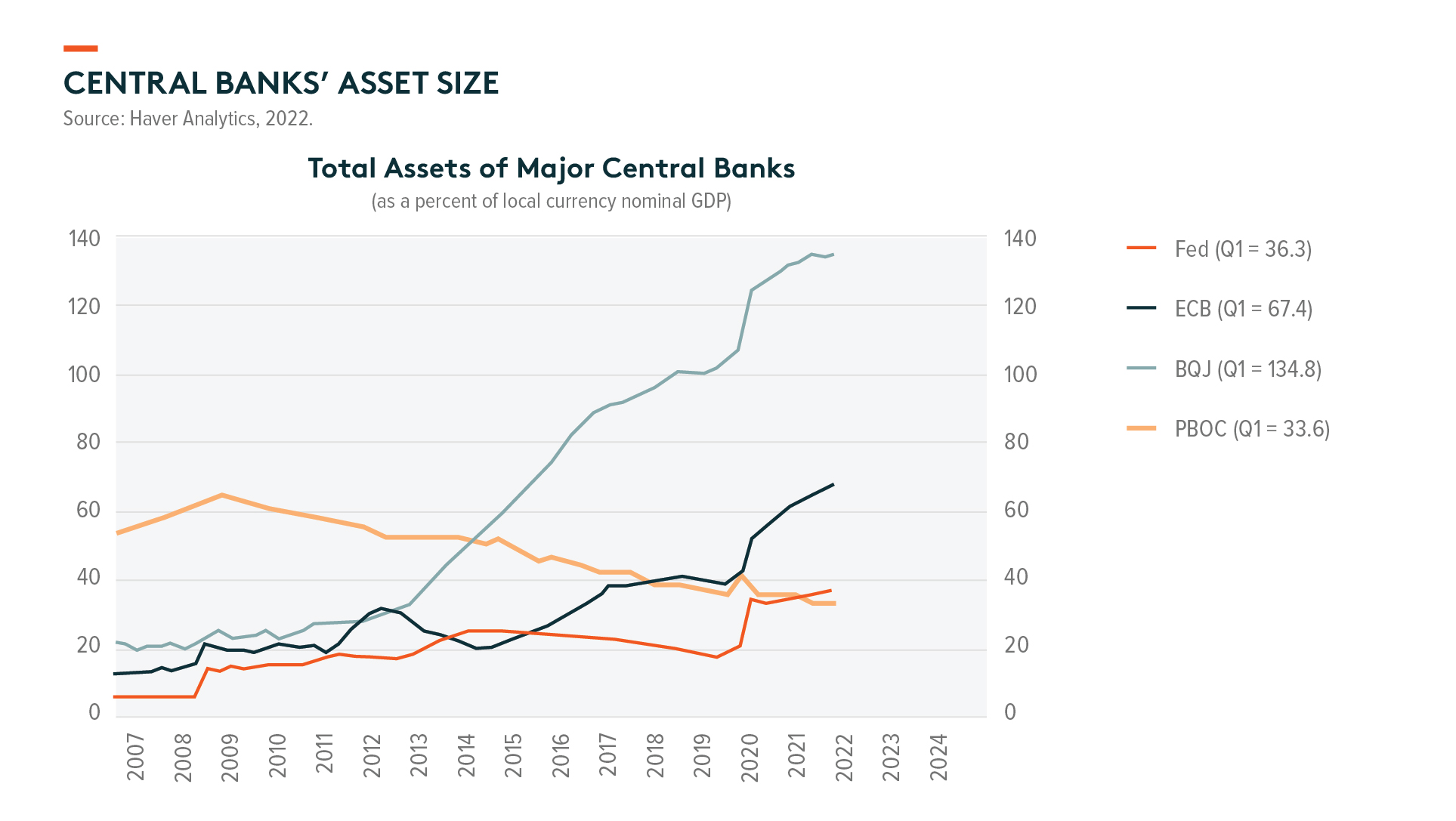

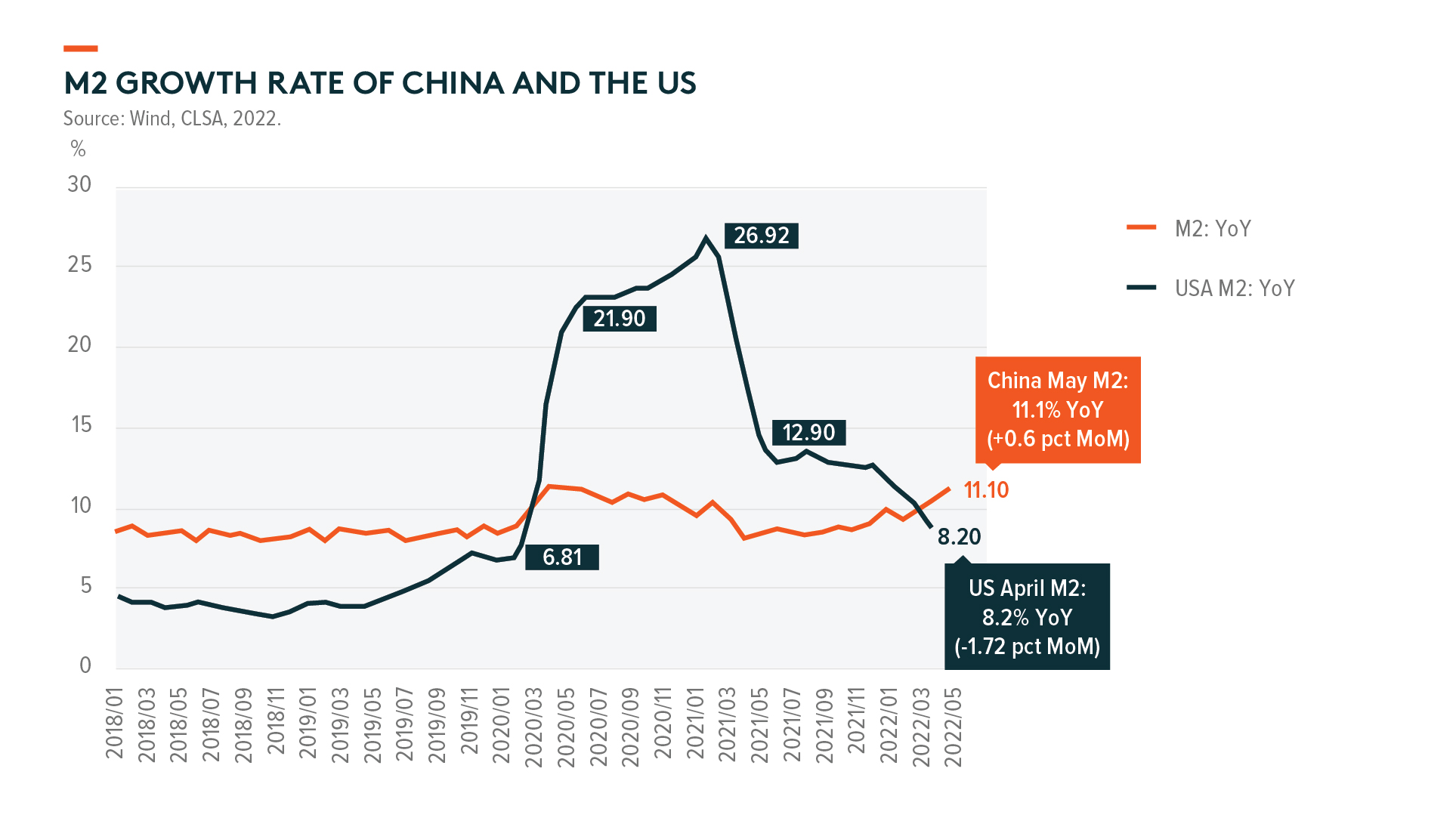

Other than the tragedy in Ukraine and COVID-led supply disruptions, the main cause of current inflationary pressure originated from the advanced economies’ excessive fiscal and monetary policies over the last two years. During the early days of COVID fighting, aggressive handouts and subsidies in the US were successful in boosting the economy and labour market. However, it eventually contributed to elevated and excessive demands for goods, port congestion, and inflation.4 Therefore, in a bid to cool down inflation, the US has turned to introducing certain cooling measures like rate hikes.

To the surprise of many, and also differing from prior actions during the GFC, China didn’t do as much to boost its economy over the last two years. This was due to the government’s continued focus on its deleveraging campaign in the property industry and other over-supplied industries. The Chinese government also introduced lots of regulations on internet businesses, resulting in halted business decisions and hiring cancellations. On top of that, China’s zero-COVID policy lowered the chances for money multipliers to rise even though the central bank loosened its monetary conditions. In aggregate, these actions suggest that China has been under a tightening economic mode over the last two years. New total social financing (TSF) growth rate, a popular gauge of liquidity conditions, was -10% in 2021.5

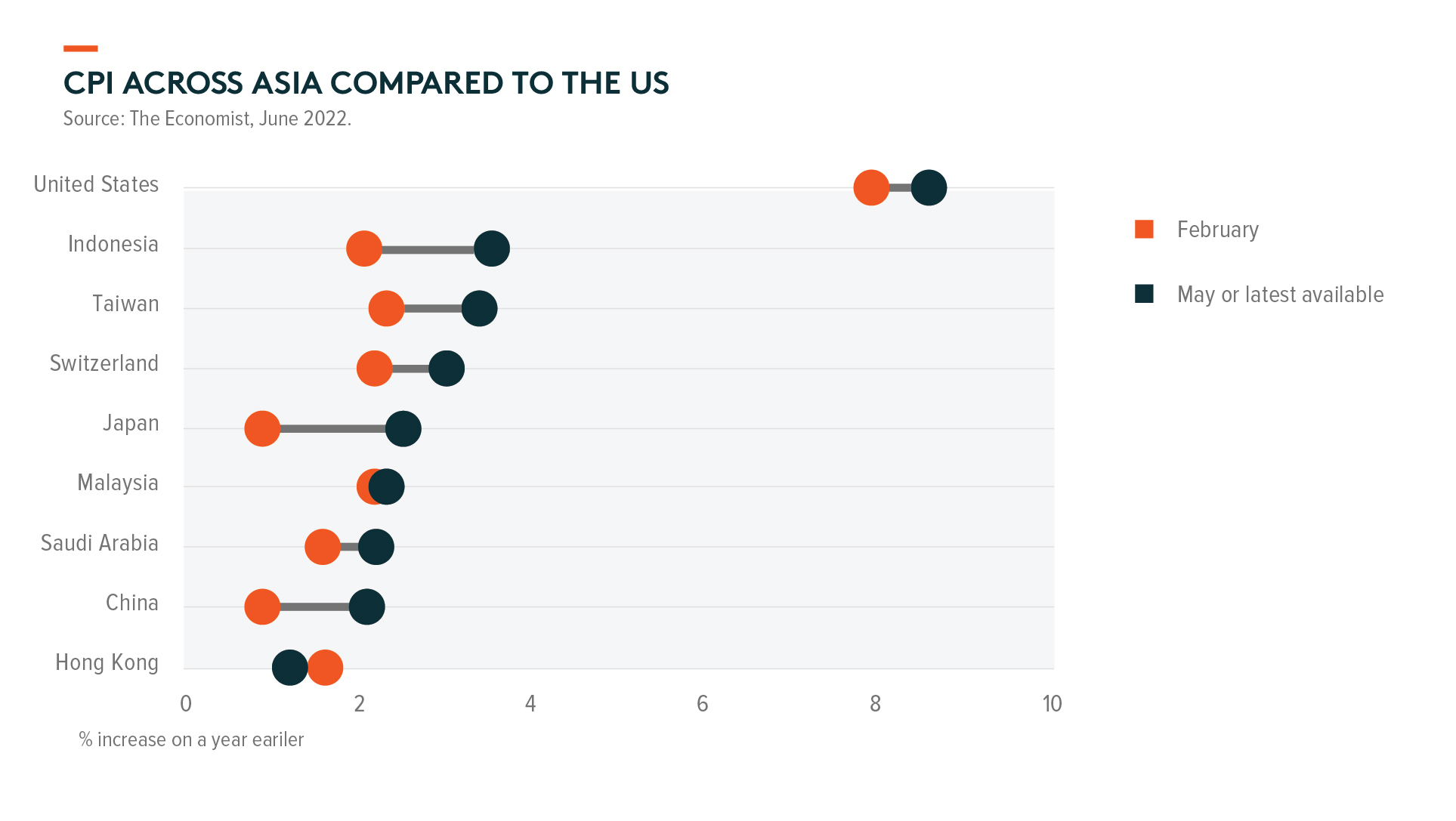

As a result, China now has only about 2.5% CPI in June, while US CPI reached 9.1% in the same month. We expect China can manage CPI to around 3% by the end of the year, given the crack in the labour market.

Largely speaking, the Asia region has similar features to China, as most of them have been less generous in handing out subsidies. As such, inflation pressures should be less severe than in the US and Europe, which are also more directly affected by Russia’s invasion of Ukraine. In absolute terms, the inflationary environment is not good for Asia. In relative terms, however, Asia is better positioned than other major markets over the coming quarters.

India as an Emerging Market Role Model

Indian equity markets have been resilient, outperforming other Asian markets year to date. The market suffered when commodity inflation was more severe in 1Q but has recently rebounded on the rising prospects of falling commodity prices, given India is a net importer of commodities. On top of that, we’ve continued to see strong tax revenue growth in recent quarters, which enables the government to spend more on public capex. As an emerging market (EM) investor, we have long observed that strong tax revenue in an emerging country brings lots of virtues – to form social infrastructure synergies and boost productivity gains. It sounds counterintuitive because most developed countries have struggled with high taxes. However, for EMs in general, it’s the opposite problem – tax sources are too scarce for the government to provide public goods. We believe that India has finally established a large tax revenue source through its decisive tax reform in 2017. Overall, we like India as a typical case study of an EM that can now enjoy its low-hanging fruits, as well as its late comers’ advantage.

Taiwan Semiconductor

The Taiwanese market has suffered from rising tensions between China and the US after Nancy Pelosi, Speaker of the US House of Representatives, visited Taiwan despite China’s strong urge to deter the visit. People fear a potential military conflict between China and Taiwan will break out, but we don’t see the chances of this being any higher. Furthermore, Taiwanese stocks have suffered from another fear of weak semiconductor demand in the coming quarters. We have reduced our exposure to Taiwanese stocks over the last few months, however, we believe that valuations are becoming more attractive and will wait for a favorable entry. For instance, MediaTek, the best Asian chip design house, is trading at 8 times forward P/E with an expected 11% dividend yield. In the end, semiconductor demand will return as it is necessary for modern life and the connected world.

Can China Win With a Zero-Covid Policy?

Like most observers, we don’t fully understand why China still maintains a draconian zero-COVID policy while new COVID variants have become less fatal. At least, however, we now have a better understanding of what is required for the zero-COVID policy to be successful: quick detection of those infected and immediate partial lockdowns.

Shanghai suffered a two-month-long total lockdown while China’s equity market corrected even more on fears that Shanghai’s demise might repeat in other cities. However, we found that it’s less likely for a total lockdown to occur in other major cities.

In hindsight, Shanghai, a city with 27 million residents, wasn’t ready to fight the Omicron variant that had spread much faster than Delta because the city officials kept the same protocols that worked well whilst Delta was dominant. In contrast, Shenzhen updated its protocol to keep the Omicron variant at bay. Firstly, the city increased the number of test samples in one go which helped to identify infected individuals much quicker. Secondly, it immediately implemented partial lockdowns when a cluster was found. The result was quite encouraging – Shenzhen’s city suffered only a one-week total lockdown in late March and recovered to normal economic activity soon after.

After identifying which policy against the virus is most effective, most cities in China now follow the Shenzhen-style model: very quickly identifying those infected and quick lockdowns for the affected region. That’s why we don’t expect another disastrous Shanghai-like lockdown, though partial lockdowns will occasionally occur.