| China | 204,700 |

| European Union | 131,700 |

| United States | 75,900 |

| Japan | 63,000 |

| India | 49,200 |

A Clean Energy Future for China

In a single trade, gain access to 20

Chinese clean energy companies

2809 HKD / 9809 USD

Stock Code (Read more)

China Clean Energy Index^

Underlying Index

HK$ ...

AUM1 (截止 ---)

0.68%

Ongoing Charges

Over A Year2

2020/01/16

Inception Date

The first

“ESG and Green Fund”

listed in Hong Kong,

accredited by SFC3

The Underlying Index captures

Chinese companies with significant

exposure to “Affordable

and Clean Energy” - one of the

United Nations

Sustainable Development

Goals (SDGs)4

![]()

![]()

Return of Global X

China Clean

Energy ETF#

82.20%

Average Return of

ETFs in Hong Kong at

the same period*

12.69%

Cumulative Performance (%)#

| 3M% | 1Yr% | 3Yr% | 5Yr% | YTD | Since Listing |

| 31.98 | N/A | N/A | N/A | 82.80 | 82.20 |

Calendar Year Performance (%)#

| 2020 | 2019 | 2018 | 2017 | 2016 |

| 82.80^ | N/A | N/A | N/A | N/A |

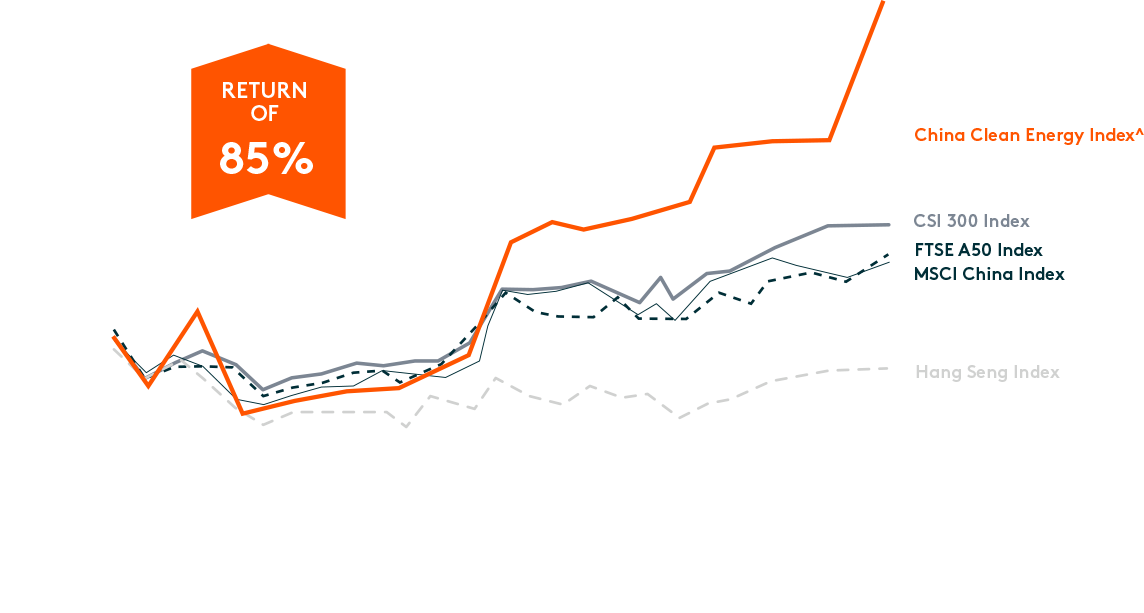

Comparison between China Clean Energy Index^ and Various

Major Broad Market China and Hong Kong Indices%

From 17 July 2020 to 31 December 2020

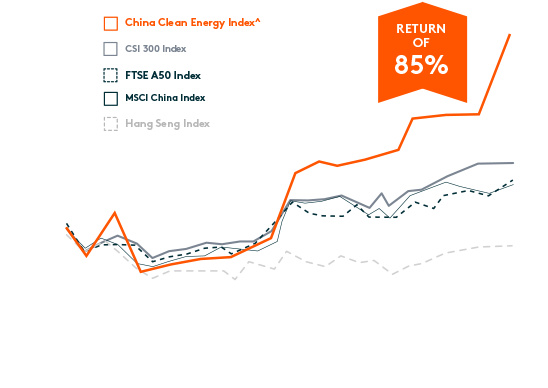

Comparison between China Clean Energy Index^ and Various Major Broad Market China and Hong Kong Indices

From 16 January 2020 to 30 October 2020

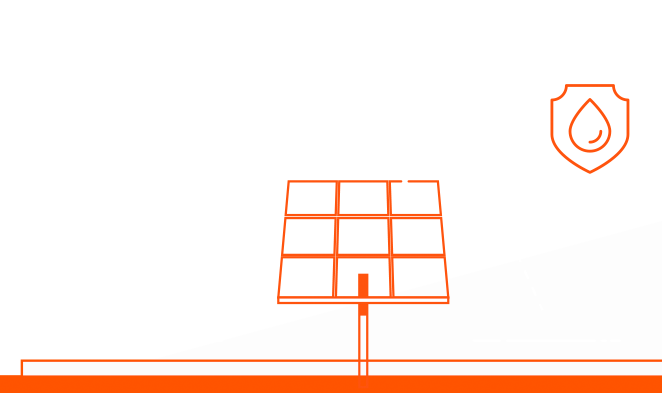

CHINA PLEDGES TO HIT

PEAK CARBON EMISSIONS

BEFORE 2030 AND ACHIEVE CARBON NEUTRAL BY 2060.

CHINA PLEDGES TO HIT

PEAK CARBON EMISSIONS

BEFORE 2030 AND ACHIEVE CARBON NEUTRAL BY 2060.

Carbon

Neutrality

is achieved when the same amount of carbon dioxide is emitted into the atmosphere as it is removed by different means.5

SEVERE AIR

POLLUTION

RESPIRATORY

DISEASES

Achieving Carbon Neutrality

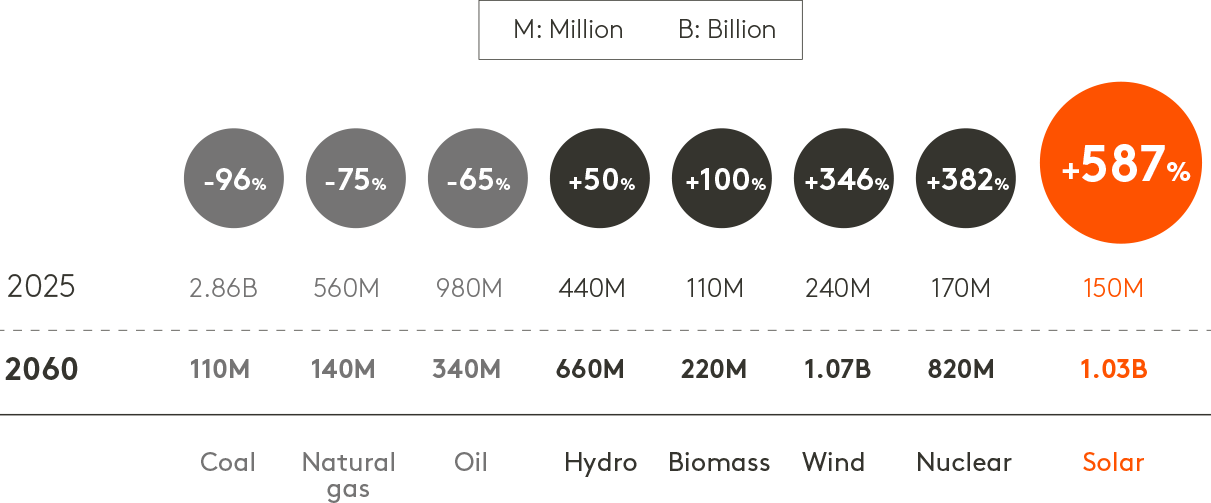

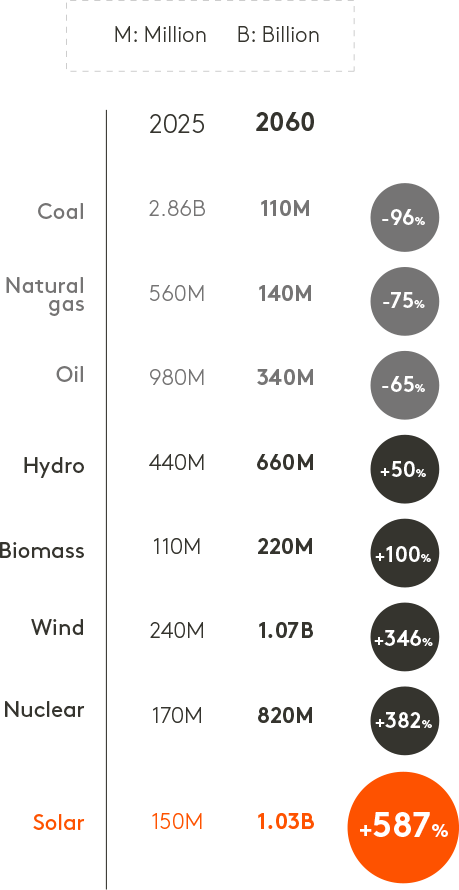

In order to achieve the carbon neutrality goal in 2060, China energy mix would undergo a drastic transformation with a significant boost on clean energy.

Coal

Oil

Natural Gas

Nuclear

Hydro

Renewables

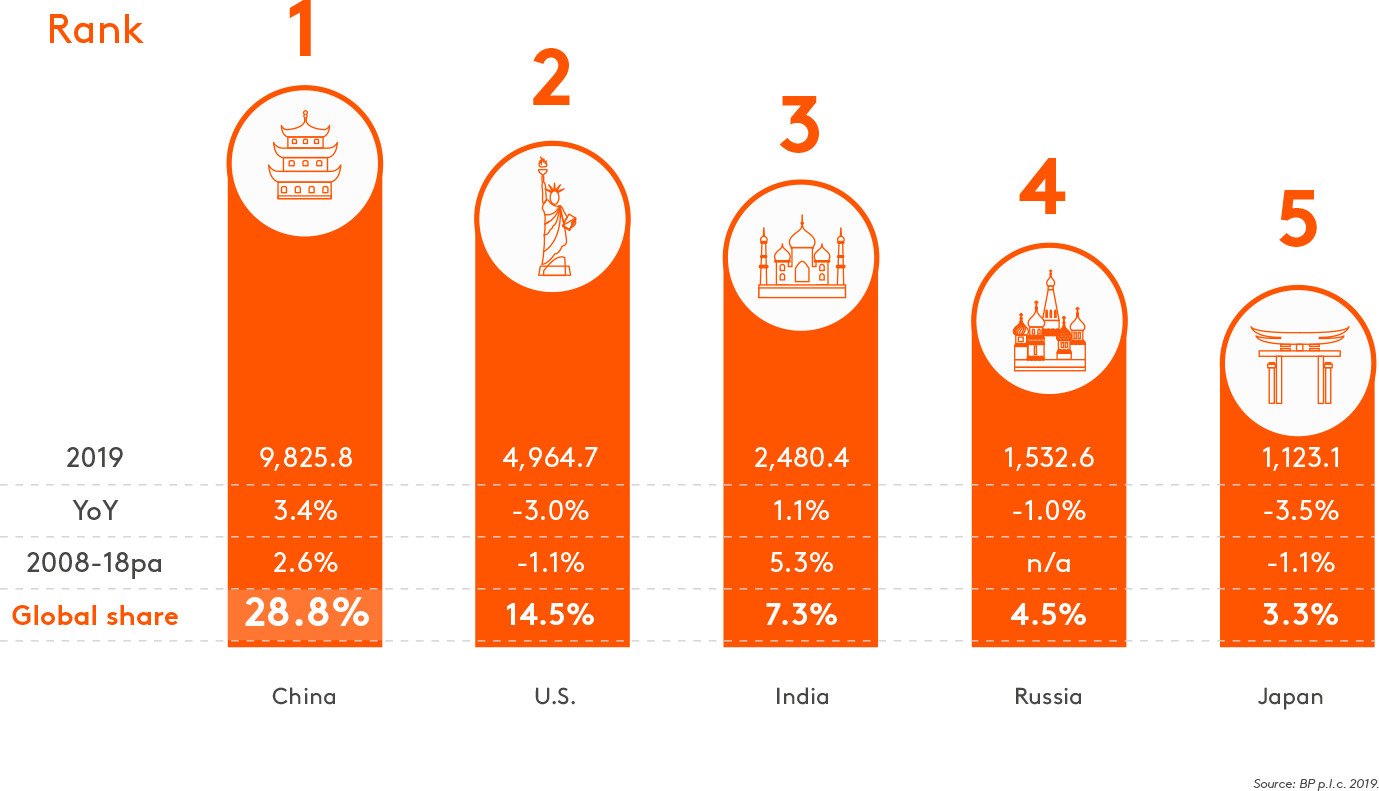

China’s Global Leadership in Clean Energy

China is a clean energy leader globally in terms of power production capacities and technology innovations. Approximately one out of three global solar panels and wind turbines are made in China.8

| China | 204,700 |

| European Union | 131,700 |

| United States | 75,900 |

| Japan | 63,000 |

| India | 49,200 |

| China | 23,6402 |

| European Union | 192,020 |

| United States | 105,466 |

| Japan | 37,506 |

| India | 25,808 |

| China-Three Gorge Dam | 22,500 |

| Brazil/Paraguay-Itaipu Dam | 14,000 |

| China - Xiluodu | 13,860 |

| Venezuela - Guri | 10,240 |

| Brazil - Tucurui | 8,370 |

China accounted for 29% of the Renewable Energy Patents Worldwide

Survey time period: 2016

29% China

18% U.S.

14% European UnionEurop-ean Union

14% Japan

9% South Korea

15% Rest of the World

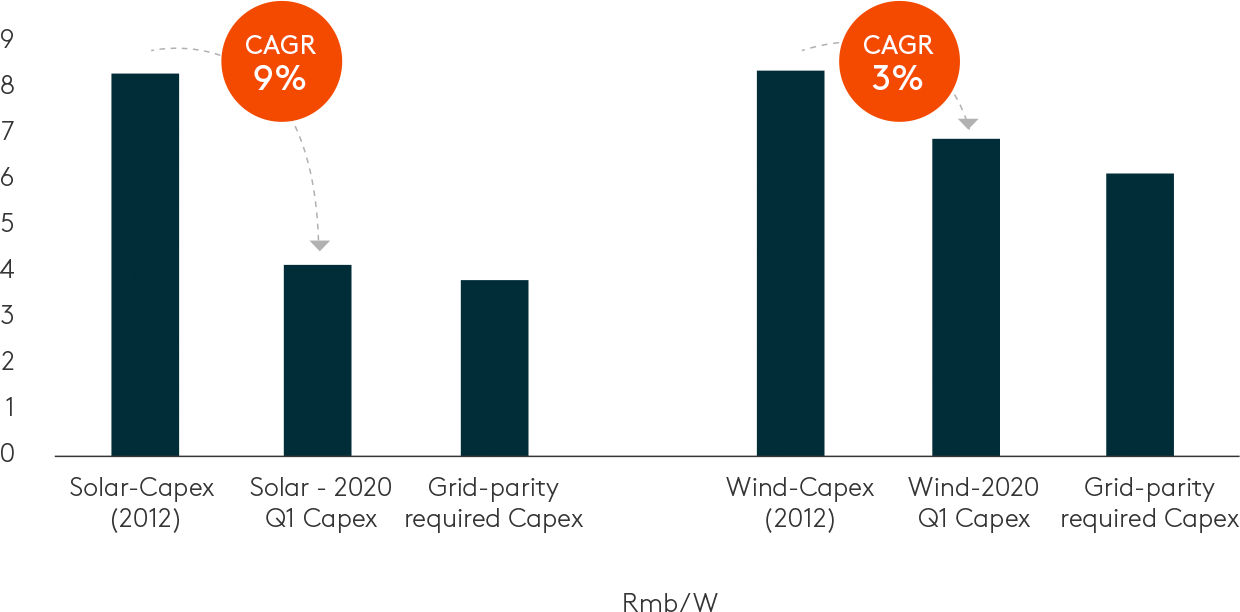

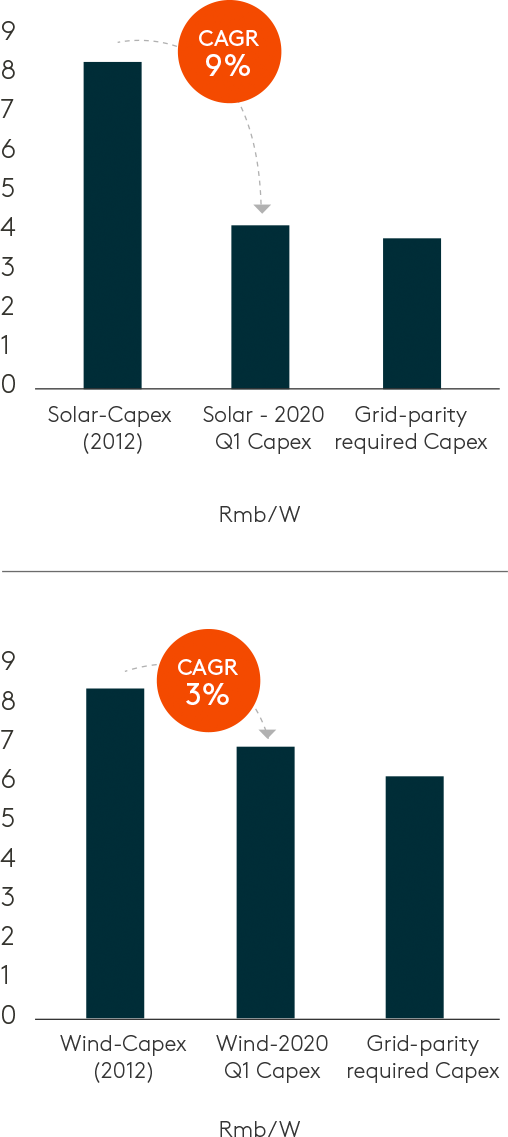

COST

ADVANTAGE

Solar and Wind Power Reaching Grid Parity

Solar/wind’s unit capex trend

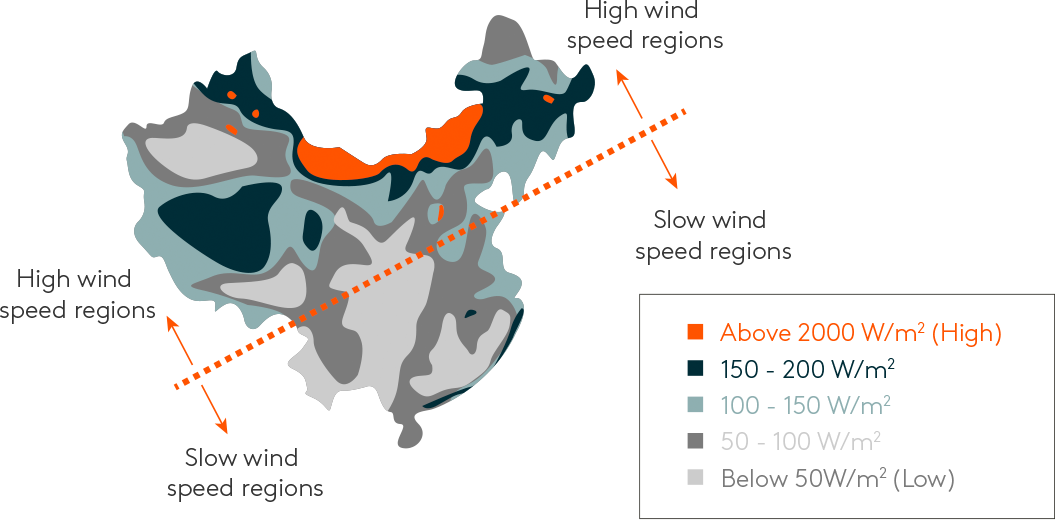

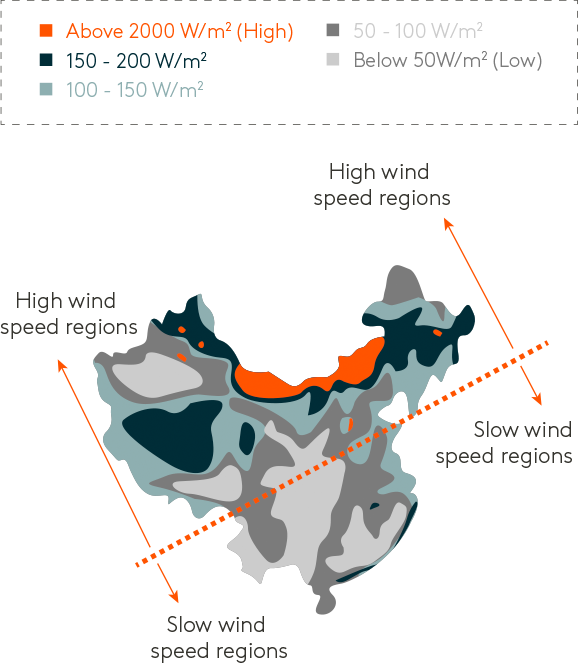

LARGE LANDMASS

AND LONG

COASTLINE

ONSHORE WIND RESOURCES IN CHINA

POLICY

SUPPORT

RELATED ARTICLES

RELATED VIDEOS

^ Underlying Index: Solactive China Clean Energy Index

This website is intended for Hong Kong investors only. Your use of this website means you agree to our Terms of use. This website is strictly for information purposes only and does not constitute a representation that any investment strategy is suitable or appropriate for an investor’s individual circumstances. Global X was acquired by Mirae Asset Global Investments and Mirae Asset Global Investments is the holding company of Mirae Asset Global Investments (Hong Kong) Limited.

The information contained in this website is for information purposes only and does not, constitute any recommendations, offer or solicitation to buy, sell or subscribe to any securities or financial instruments in any jurisdiction.

Investment involves risk. It cannot be guaranteed that the performance of the Product will generate a return and there may be circumstances where no return is generated or the amount invested is lost. Past performance is not indicative of future performance.

Before making any investment decision to invest in the Product, investors should read the Product

Certain information contained in this website is compiled from third party sources. Whilst Mirae Asset Global Investments (Hong Kong) Limited (“Mirae Asset HK”), the Manager of the Product, has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information. Mirae Asset HK accepts no liability for, any loss or damage of any kind resulting out of the unauthorized use of this website.

The Products are not sponsored, endorsed, issued, sold or promoted by their index providers.

For details of an index provider including any disclaimer, please refer to the relevant Product

The contents of this material is advertising in nature and is prepared by Mirae Asset Global Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Mirae Asset Global Investments (Hong Kong) Limited.

COM-2020-11-18-HK-R-MKT