Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Five Investment Points of the Global X Asia Semiconductor ETF (3119)

The AI revolution is fundamentally reshaping the semiconductor industry. We explain why the Global X Asia Semiconductor ETF (3119) is ideally suited to this shift beyond 2026. Here’s a brief summary of the five key investment points presented:

- Asian Semiconductors are more attractive than the US ones

- Hynix and Samsung: absolute leader in AI Memory chip

- TSMC and its ecosystem companies

- China’s Semiconductor Rise

- Diversification to offset geopolitical risk

1. Asian Semiconductors are more attractive than the US ones: “Entering an era of manufacturing beyond chip design”

While US fabless (chip design) companies focused on software innovation, Asian companies built physical barriers to entry through tens of billions in capital expenditures. The Asian region, which controls 75% of global semiconductor manufacturing capacity, is not just a beneficiary; it is the “infrastructure itself” of the AI industry to come. (Counterpoint Research, December 2025)

Particularly, as of 2026, the global investment landscape is shifting from the US-centric chip design (Fabless) theme to the Asia-centric hardware manufacturing theme.

The driving force behind the US semiconductor theme has been its overwhelming “design capabilities,” represented by NVIDIA. However, as of 2026, the design sector is entering a fiercely competitive landscape. This is because so-called “hyperscalers”—big tech companies like Google (TPU), Amazon (Trainium), Meta (MTIA), and Microsoft (Maia), burdened by NVIDIA’s monopoly and high prices—are rushing to invest in developing their own ASIC chips. Design is no longer the exclusive domain of a single company, and with the proliferation of alternative chips, pricing power among design firms is weakening, leading to a downward trend in margins.

On the other hand, the “manufacturing capability”—the ability to translate even the most complex and sophisticated codes into actual semiconductors—is a domain of exclusive scarcity, completely dominated by Asian companies. The exponentially increasing difficulty in yield management and billions of dollar in facility investment costs have effectively blocked the entry of latecomers.

The recent unprecedented delivery delays for NVIDIA’s next-generation AI accelerators, the Blackwell (B200/GB200) series, symbolize this shift in manufacturing power. The delay in its mass production by nine months, compared to the original plan, was not rooted in the design itself. The core of the delay was the exponential increase in the difficulty of high-end manufacturing processes, including the dire yield issues arising from TSMC’s next-generation packaging (CoWoS-L) process and the inability of SK Hynix and Samsung Electronics to meet the demand for HBM3e chips needed. Even NVIDIA, a chip design powerhouse, had to endure billions of dollar in backlog demand until its Asian manufacturing partners resolved the physical process challenges.

Ultimately, the key to semiconductor hegemony by 2026 lies not in flashy chip design blueprints, but in Asia’s overwhelming manufacturing capabilities.

2. Hynix and Samsung: absolute leaders in AI Memory chip

For AI servers to think like humans, they must process massive amounts of data in an instant. The only key to resolving this bottleneck is high-bandwidth memory (HBM). This ETF has exposure to approximately one-quarter of its weights to Korean memory giants, who effectively dominate the global HBM market, securing the most reliable source of profit in the AI era.

As of 2026, SK Hynix, NVIDIA’s most trusted partner, is maintaining a technological lead by establishing a mass production system for its next-generation 16-layer HBM4 products. With pre-orders already backlogged for over a year, the market is dominated by memory manufacturers. Meanwhile, Samsung Electronics has made a bold move with its Customized AI Semiconductor (ASIC) strategy. Beyond simply selling memory, it maximizes profitability by combining HBM with its foundry capabilities, which handle everything from design to manufacturing according to customer orders. As memory semiconductors transform from a “general-purpose product” to a “high-value-added, customized strategic asset,” the profit contribution of Korean stocks within the fund is expected to rise sharply.

3. TSMC and its ecosystem companies

Even the most advanced AI chip designs are useless without a manufacturer capable of implementing them. TSMC, one of this ETF’s top three holdings, accounts for over 70% of the world’s advanced semiconductor manufacturing. (Counterpoint Research, December 2025) TSMC is the undisputed leader in the global AI ecosystem. From NVIDIA’s accelerators to Apple’s processors, the world’s smartest chips will all utilize TSMC’s 2nm (N2) process line. The surge in demand for AI semiconductors is strengthening pricing power, contributing to the ETF’s robust fundamentals.

Furthermore, the companies that form the semiconductor ecosystem surrounding TSMC are expected to perform well. MediaTek is also participating in the design of Google’s next-generation AI chips, the TPU v5 and v6 series, and has been selected as the supplier of cutting-edge 3nm and 5nm SerDes IP for Google’s TPU production. While Google designs its own chips, it leverages MediaTek’s expertise in core communications technologies for data processing, which is expected to drive demand for custom chips from major technology companies in the future.

4. China’s Semiconductor Rise

Ironically, geopolitical restrictions have opened up tremendous opportunities for domestic Chinese semiconductor companies. China boasts a semiconductor market with an annual purchasing power of approximately $250 billion, driven by purely Chinese brands, excluding subcontracting orders from US companies like Apple.

This ETF captures this explosive growth through SMIC, a symbol of manufacturing independence, and Cambricon, often referred to as the “China Nvidia.” Cambricon is rapidly expanding its market share with its Siyuan series of proprietary AI accelerators, designed to replace Nvidia’s high-performance GPUs. As US export restrictions on China forced major Chinese technology companies to opt for domestically produced solutions over Nvidia chips, Cambricon has established itself as the standard for China’s AI infrastructure, achieving unprecedented growth.

Cambricon’s vision is being realized by SMIC, China’s largest foundry. SMIC is strengthening its dominance in mature process fields while simultaneously meeting the advanced processing demands of domestic fabless companies, pushing technological boundaries. Backed by support from Chinese brands that dominate the global market, such as Xiaomi and BYD, the collaboration between these two companies is creating a unique Chinese semiconductor revenue ecosystem distinct from the global supply chain.

5. Diversification to offset geopolitical risk

This ETF’s powerful investment strategy focuses on assigning unique roles to each Asian regions in a portfolio encompassing the entire semiconductor supply chain. Semiconductors are a broad value chain industry spanning design, etching, and packaging, and no single region can monopolize this sector. This ETF leverages each region’s unique strengths to further diversify the portfolio.

Hynix, Samsung, TSMC: These are key drivers that directly translate “AI demand,” the semiconductor industry’s largest growth driver, into performance. Korea’s memory competitiveness and TSMC’s market dominance are complementary. Every AI server sold generates manufacturing revenue in Taiwan and memory sales revenue in Korea, effectively absorbing the double trickle-down effect of growth.

The Chinese semiconductor industry is quite distinct from other markets. Even amidst global economic fluctuations, China’s commitment to semiconductor growth and domestic production remains steadfast, acting as an independent variable.

Japanese Semiconductor equipment and component: Tokyo Electron (high end equipment), Hitachi (etching and test), and Sony occupy (image sensor) irreplaceable positions at the backbone of the supply chain. Even if the US-China conflict escalates or yield issues arise at specific manufacturers, Japan’s high-precision lithography equipment, metrology systems, and key photoresists remain essential for cutting-edge chip production.

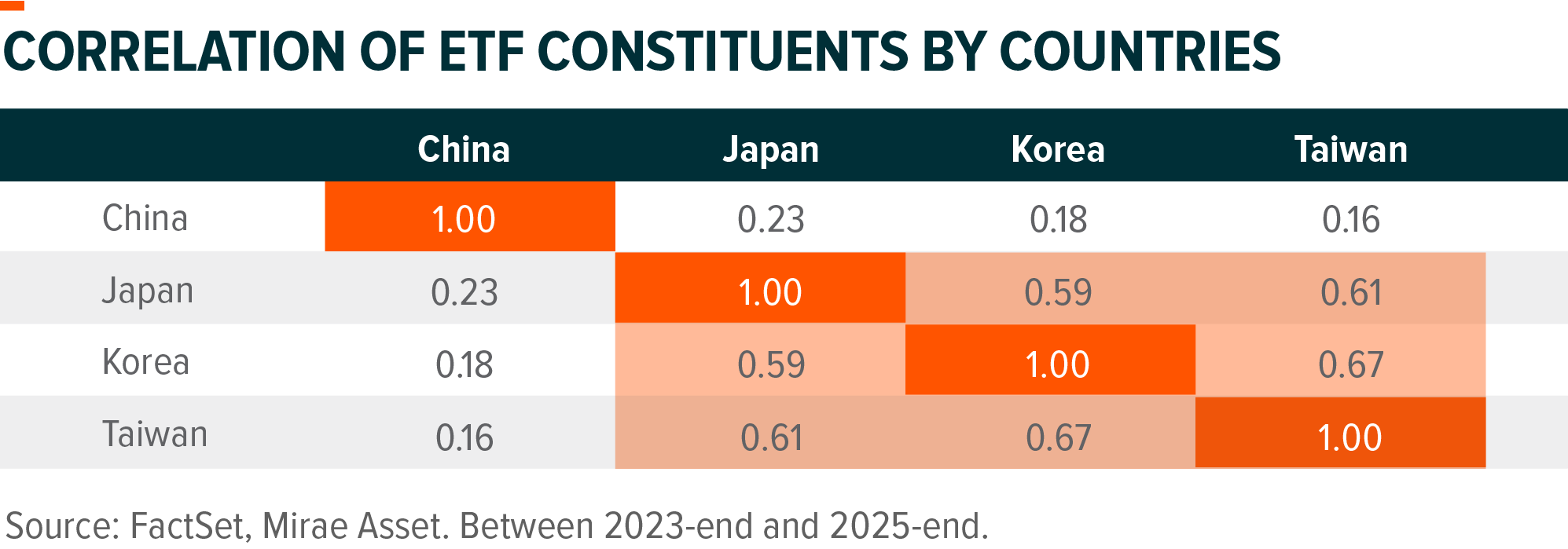

In fact, the correlation between stocks in different regions has been quite low over the past two years.