Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X EV and Humanoid Robot Active ETF (the “Fund”) is to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses (the “EV/Battery Business”), humanoid robots and robot-related automation businesses (the “Humanoid Robotic Business”).

- The Fund does not seek to track any index or benchmark, it may fail to meet its objective as a result of the Manager’s selection of investment, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Fund’s ability to invest in A-Shares or access the PRC markets through the programme will be adversely affected.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Global X EV and Humanoid Robot Active ETF (3139) Updates

Why EV and Humanoid Robot?

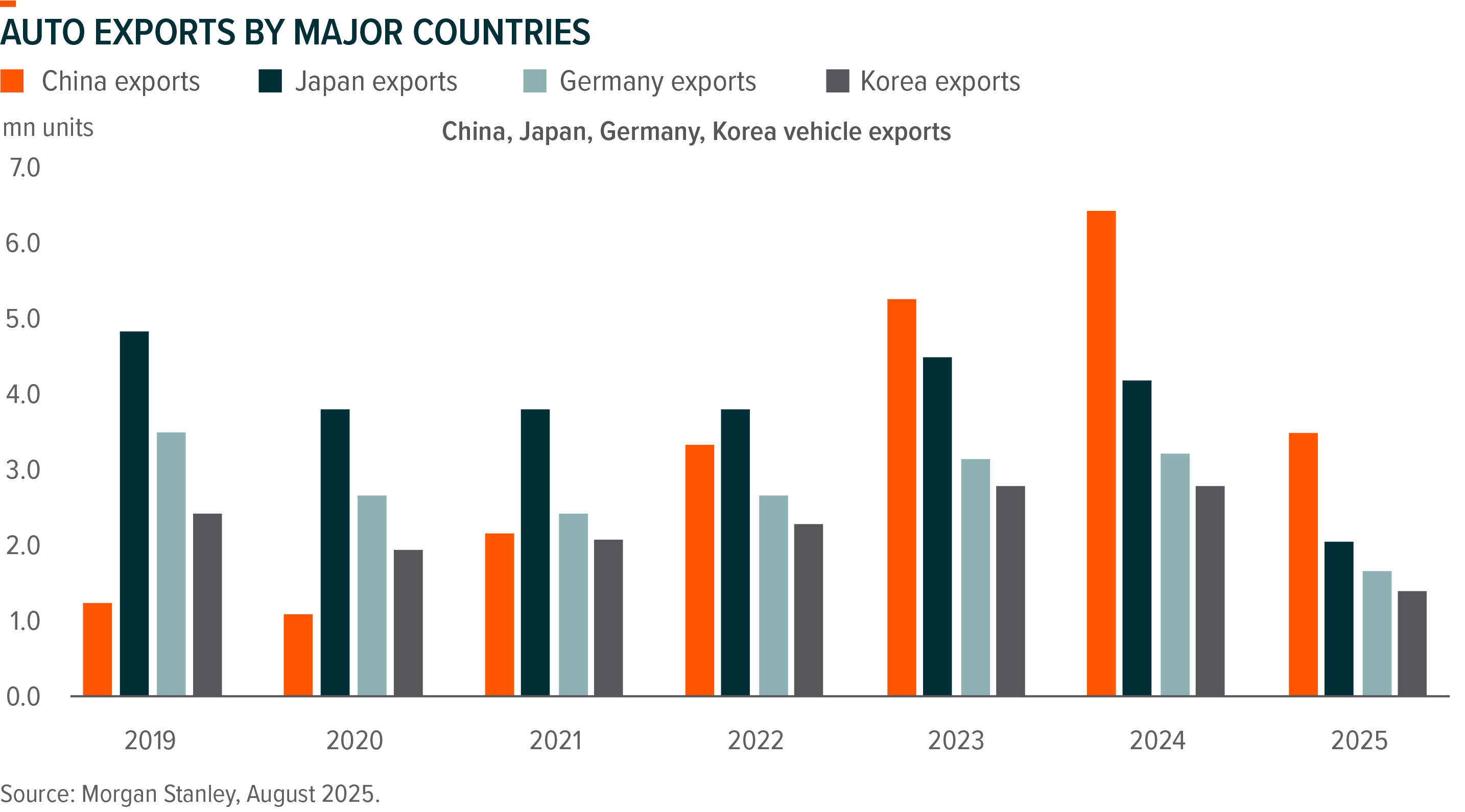

There is no doubt that electric vehicle and humanoid robot are the two fastest-growing manufacturing businesses in the world, and the most promising sectors with huge room to grow in the coming decade, catering to global energy transition and aging population issues. Global xEV sales reached 10.2mn units as of August 2025, +23.5%YoY, in which China accounted for 7.5mn units, +25.7%YoY, Europe 1.5mn units, +26.2%YoY and the US 1.1mn units, +7.8%YoY, despite the policy/tariff headwinds in the first half of the year. The global penetration remains in the early stage compared to the 80~90mn units sales auto market every year. As one of the key beneficiaries, global battery also witnessed much stronger sales year-to-date than people’s initial expectation. According to SNE and CABIA research, global battery shipment recorded a new high level of 907GWh as of July 2025, +47%YoY, in which EV battery accounted for 697GWh, +37%YoY and ESS battery 210GWh, +93%YoY. LFP batteries are widely accepted by automakers with an installation rate of nearly two-thirds of the total xEV sales. (Macquarie, September 2025)

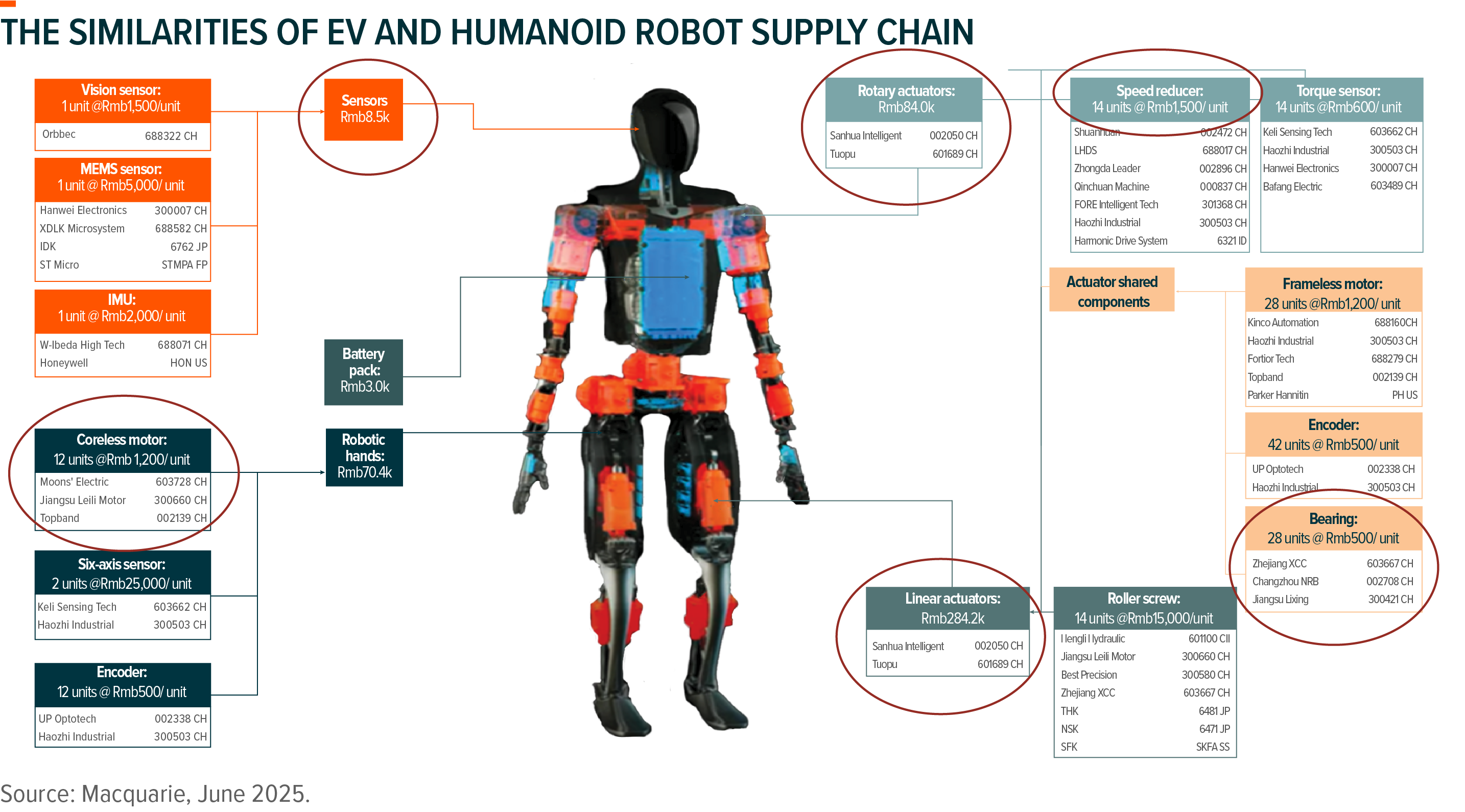

2025 is seen as humanoid robotics’ breakout year with a major breakthrough in practical and affordable robot products and visible mass production. People have been dreaming about intelligent humanoid robots since the introduction of the first humanoid robot in the early 1960s. However, like many new technology applications, it takes an entire ecosystem to evolve to enable the realistic cost-effective mass-production. In the past 60 years, we have seen the technology innovation in mechanicals, electric motors, sensor, semiconductor, computing power, battery, and more importantly, meaningful cost cutting in all these industries, to make robot manufacturing practical in the real business. EV and humanoid robot share many similarities along the supply chain, especially in mechanical and electric components. As shown in the chart below, for example, the producers of actuators in the humanoid robot are also the key auto component integrators for the major EV makers, while the manufacturers of the speed reducer used in the actuator are expanding their products and business from auto gears. Basically, the two manufacturing sectors are very similar as a technology-driven assembly business, especially when automobiles are becoming “smarter” with powerful intelligent features by using more sensors, lidars and chips. Indeed, the autonomous driving electric vehicle can be seen as a specific type of robot on the road. This is one of the key motivations that we would like to combine the two themes together to leverage our expertise in EV supply chain research and capture more growth opportunities in a wider scope.

Additionally, humanoid robot represents an exciting technological opportunity to help address the manual labor shortage issues in many developed economies caused by aging population, declining birth rates and hazardous working environments. According to Morgan Stanley data, the accumulative humanoid population in the US will be 8 million units by 2040, equivalent to $357billion wage impact. Tesla CEO Elon Musk expressed his confidence in the recent AGM that humanoids will eventually outnumber humans by “at least two-to-one”, which means “the order of 10 billion humanoid robots or more” in the long run. The promising growth potential is another crucial factor that attract us to increase our investment exposure to the value chain. (Morgan Stanley, April 2025)

We insist on a bottom-up investment strategy and take the deep dive into EV and humanoid robot supply chain from a global perspective, reading across different countries and subsectors to generate a global EV and humanoid robot industry map in-house independently and have profound understanding of the industry dynamics. We will make a balance between different subsectors over time to ride the cycle along the value chain. We are selective on stock-picking based on the long-term competitiveness of each company, but stay flexible to respond to the inflection point of the cycle in the medium term.

The Latest Key Trend

-

China exports of EV and battery

China xEV exports are rapidly growing with 7M25 number ending at 1.42mn units, +41%YoY, in which PHEV and HEV sales are catching up, especially new products of plug-in hybrid electric pickup that are well adopted in ASEAN and Latin America markets. The top destination countries of China EV are Belgium, Brazil, Mexico, Philippines, UK, Australia, Thailand, Turkey, UAE, India etc. The leading Chinese brands, for example BYD, Geely and SAIC-MG, are aggressively gaining market share in the emerging markets from ICEs brands by increasing their local production capacities, setting up JV with local partners, expanding sales networks and adding more car vessels.

During the same reporting period, China battery exports reached 150.5GWh, +53.1%YoY, in which EV battery exports were 96.4GWh, +29.4%YoY, accounting for 64% of the total exports. The exporting business, including local production outside China, has become another growth driver for Chinese battery makers despite the tariff headwinds. According to SNE research, the leading Chinese battery makers, not limited to CATL, BYD, Gotion, EVE energy and Svolt, have been continuously expanding their footprint outside China in the last two years. CATL remained top1 in the global battery usage ranking with a worldwide customer list both in EV and ESS applications. Compared to Korean and Japanese peers, BYD and EVE Energy are rapidly catching up in volume growth in non-China markets.

-

Humanoid robot industry development

Elon Musk’s bullish guidance of humanoid robot shipment in early 2025 brought Chinese robots components supply chain in the spotlight, coupled with Unitree robots dance show in Spring Festival Gala. Increasing Chinese robot makers are accelerating their R&D and supply chain coordination activities. In the meanwhile, component producers also attached more significance to robots-related component business, shifting their focus from traditional business such as auto components, automation, home appliances, general industrials, etc. Even though Tesla suspended the component procurement for Optimus in June due to design changes, it didn’t stop Chinese peers’ enthusiasm in humanoid robot investment. There were 150+ humanoid robots on show in Shanghai World Artificial Intelligence Conference (WAIC) 2025 this year, a historical high level, suggesting rapidly growing opportunities along the supply chain. We saw a number of new players, many of whom are start-ups, competing on actuator assembly, dexterous hands and limb structure, etc. We also witnessed more targeted and active exploration of application scenarios, spreading across manufacturing, warehouse and logistics, consumer and retail, family and elderly care, etc.

Based on the talks with companies in the humanoid supply chain, the Chinese humanoid robot companies are currently focusing on commercialization at the existing phase of development, as China’s sophisticated manufacturing supply chain offers a rich landscape for manufacturing user-case scenarios, and data quality for robot training. The industry is moving towards developing lightweight, flexible and easily deployable robots that can enhance operational efficiency and reduce costs. Competition in some key components including reducer, motor, screw, sensor sounded intensified, which implies cost cutting could be faster than expected and monetization more visible, especially in industrial and residential scenarios. We may see some meaningful breakthrough in the coming two years as the leading companies are speeding up the new product launch.