Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X Japan Global Leaders ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index.

- The Underlying Index is reconstituted annually. Securities that no longer meet the eligibility criteria may remain in the index until the next scheduled annual reconstitution. The index’s representativeness is not guaranteed to be optimised from time to time.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The investment objective of Global X Innovative Bluechip Top 10 ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index.

- The Underlying Index is an equal weighted index . The Fund may hold larger positions in smaller-cap constituents than a market-cap weighted index, leading to higher risks and potential underperformance.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X India Select Top 10 ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index.

- The number of constituents of the Underlying Index is fixed at 10. The Fund may hold more concentrated investment portfolio, leading to higher risks of volatility.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Fund is a FPI registered with the SEBI. SEBI’s rules and limits on FPI shareholding in some Indian companies can change and may affect the Fund’s performance. SEBI may also cancel the Fund’s FPI registration under certain conditions. If this happens, the Fund may not be able to invest in, hold, or sell Indian securities. The Fund might need to sell all its Indian holdings quickly, possibly at a big loss.

- The base currency of the Fund is USD but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Investment in Emerging Market, such as Indian market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X K-pop and Culture ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive K-pop and Culture Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The base currency of the Fund is KRW but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Monthly Commentary

Global Thematic ETFs – September 2025

Global X Japan Global Leaders ETF (3150)

Industry Update

In August 2025, the FactSet Japan Global Leaders Index recorded 5.6% returns in JPY terms (FactSet, September 2025). Japan equity market held steady amidst weak US employment data and expectations of rate cuts by the Fed. The positive performance of Japanese stocks was attributed to factors like limited concerns about yen appreciation, political stability, and expectations of a US rate-cutting phase. Additionally, the market reacted positively to expectations of a change in administration in Japan and other key factors such as downward pressure on the dollar, wage increases, and corporate earnings impact. Overall, unless there is a significant downturn in the US economic cycle and unexpected yen appreciation, the strong domestic economy and corporate performance suggest that declines in Japanese stocks could present buying opportunities. Corporate governance reform continues to bear fruits and remains a key theme for Japan investments.

Stock Comments

Sony returned 11% in the month, a key contributor to the ETF. The company reported better than expected quarterly results. Game & Network Services segment growth was strong thanks to higher network services sales and better profitability with cost optimization. The company also slightly revised up its FY3/26 full-year guidance thanks to strong G&NS growth and better-than-feared US tariff. (Company data, September 2025)

Mitsubishi recorded 12% return in the month, a key contributor to the ETF. The company reported slightly better than expected quarterly results, driven by solid performance of resource areas and auto operations. In non-resource areas, the decline in auto operations was smaller than expected, with cost savings offsetting consistently weak demand for pickup trucks in Thailand. (Company data, September 2025)

Preview

US-Japan tariff deal and expectation for a change in government after the Upper House election bring higher visibility for Japan equity market investments. While short term outlook remains uncertain given slowing global/US economy and political events uncertainty, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging). (JP Morgan, August 2025)

Global X Asia Semiconductor ETF (3119)

Industry Update

2Q25 DRAM Revenue Jumps 17.1% – TrendForce’s latest investigations demonstrate that global DRAM industry revenue reached US$31.63 billion in the second quarter of 2025, up 17.1% QoQ. This growth was fueled by rising contract prices for conventional DRAM, robust shipments growth, and expanding HBM volumes. Inventory digestion at DRAM suppliers accelerated with stronger procurement momentum from PC OEMs, smartphone makers, and CSPs, driving contract prices for most products back into positive territory. SK Hynix had the highest share in DRAM bit shipment in 2Q followed by Samsung. (TrendForce, September 2025)

TSMC’s 2nm Node Reportedly Set for 60K Monthly Output in 2026, with Prices 50% Above 3nm – According to Liberty Times, TSMC is expected to have four 2nm fabs running at full capacity next year, with a combined monthly output of 60,000 wafers. However, as Wccftech points out, while TSMC is preparing for full-scale 2nm production, the company reportedly has no plans to offer discounts to customers. Liberty Times, citing industry sources, notes that each 2nm wafer could be priced as high as USD 30,000, representing a 50 percent increase over 3nm wafer pricing. (Liberty Times, August 2025)

Samsung Reportedly Plans Exynos 2600 in Galaxy S26 Models, Reducing Qualcomm Reliance – According to South Korea’s Maeil Business Newspaper, sources say Samsung plans to equip the base and slim Galaxy S26 models with the Exynos 2600, while the Ultra version will feature Qualcomm’s Snapdragon 8 Elite Gen 2.

Samsung’s Exynos is reportedly showing a rebound in performance, according to Chosun Daily. Though long criticized for lagging behind Qualcomm’s APs, sources cited by the report said it recently delivered strong benchmark results, coming close to the performance of Qualcomm’s Snapdragon 8 Elite Gen 2, Chosun Daily points out. (Trendforce, September 2025)

Stock Comments

Cambricon +110% – The company reported strong 2Q25 results where revenues sequentially increased by 59% to Rmb1.8bn, net income of Rmb 683m was well ahead of the street. Cambricon remains as the best-alternative to Huawei and profiting from the local-for-local trend. (Company data, August 2025)

SMIC +18% – The company provided upbeat 3Q guidance. SMIC’s 3Q25 revenue guidance is +5-7% Q/Q, driven by increases in both wafer shipment and blended ASP. Management noted that they will still run at a high UTR thanks to robust orders, especially on the power discrete platform. With UTR expected to remain high, the depreciation burden from capacity expansion should ease. Therefore, SMIC guided 3Q25 GM to be 18-20%. (Company data, August 2025)

Quarterly Earnings Review

TSMC – 2Q beat: revenue exceeded high end of guidance +17.8% QoQ to 30.07bn USD. GPM at 58.6% was close to high end of the guided 57-59% range. 100bps impact from ramp up of oversea fab mainly from margin dilution of Arizona fab, 220 bps from fx. EPS of NTD 15.36 was up 10.2% QoQ ~6% ahead of street. (Company data, September 2025)

Samsung – In 2Q25, revenue growth decelerated to flat YoY to W75tr (-6% QoQ) due to FX and HBM business transition. Foundry/LSI showed significant revenue growth (+12% QoQ) off a low base with continued losses due to improving but low utilization at mature nodes. (Company data, July 2025)

SK Hynix – DRAM 2Q25 bit shipments in the mid-20% QoQ increase and more than 70% QoQ increase in NAND, due to tariff-triggered pull-in and strong AI demand growth. (Company data, September 2025)

Cambricon – The company reported strong 2Q25 results where revenues sequentially increased by 59% to Rmb1.8bn, net income of Rmb 683m was well ahead of the street. Cambricon remains as the best-alternative to Huawei and profiting from the local-for-local trend. (Company data, August 2025)

SMIC – The company provided upbeat 3Q guidance. SMIC’s 3Q25 revenue guidance is +5-7% Q/Q, driven by increases in both wafer shipment and blended ASP. Management noted that they will still run at a high UTR thanks to robust orders, especially on the power discrete platform. With UTR expected to remain high, the depreciation burden from capacity expansion should ease. Therefore, SMIC guided 3Q25 GM to be 18-20%. (Company data, August 2025)

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2025. (Mirae Asset, 2025)

Global X Innovative Bluechip Top 10 ETF (3422)

Stock Comments

Apple commit additional $100billion US investment to secure tariff exemption – Cook appeared with Trump to announce Apple’s plans to spend $100 billion on American companies and American parts over the next four years. The company’s plans to buy more American chips pleased Trump, who said Apple would be exempt from future tariffs that could double the price of imported chips. Market turn its focus on iPhone 17 launch in September. (CNBC. August 2025)

TSMC – 2Q beat: revenue exceeded high end of guidance +17.8% QoQ to 30.07bn USD. GPM at 58.6% was close to high end of the guided 57-59% range. 100bps impact from ramp up of oversea fab mainly from margin dilution of Arizona fab, 220 bps from fx. EPS of NTD 15.36 was up 10.2% QoQ ~6% ahead of street. (Company data, Mirae Asset, September 2025)

Alphabet – 2Q slight beat: Top line of $96.4 billion (+13% Y/Y ex-FX) was slightly ahead of street. Search revenue growth of +12% Y/Y and Cloud revenue growth of +32% Y/Y. 2Q Capex beat grew +$5.2 billion Q/Q to $22.4 billion, the company raised FY25 capex spend guide to $85 billion (vs. $75 billion). (Company data, Mirae Asset, September 2025)

Microsoft – Azure growth of 39% came in well ahead of expectations of 36%, and represented a 4% point acceleration QoQ. In the quarter, gross margins beat consensus by ~40 bps. Operating income margin of 44.9% came in above consensus at 43.6%, by 130 bps. As a result, the company was able to deliver $3.65 in earnings per share, which compared to consensus at $3.40. (Company data, Mirae Asset, September 2025)

Nvidia – Nvidia reported revenue of $46.7 bn, slightly above the Street at $46.5 bn. Gross margin of 72.4% was in line. Operating margin of 64.5% was above the Street at 63.5%. EPS of $1.04 was in-line. Data Center revenue of $41.1 bn was below the Street at $41.3 bn. Gaming revenue of $4.3 bn was above he Street at $3.9 bn. Professional Visualization revenue of $601 mn was above the Street at $534 mn. Automotive revenue of $586 mn was in line with the Street at $586 mn. (Company data, Mirae Asset, September 2025)

CATL – CATL delivered solid 1H25 results with revenue up by 7%YoY and net profits up by 33%YoY, in which EV battery accounts for 80% of the total sales and ESS 20%. Utilization is quite full now and production is sequentially improving. (Company data, August 2025)

Global X India Select Top 10 ETF (3184)

Market Update

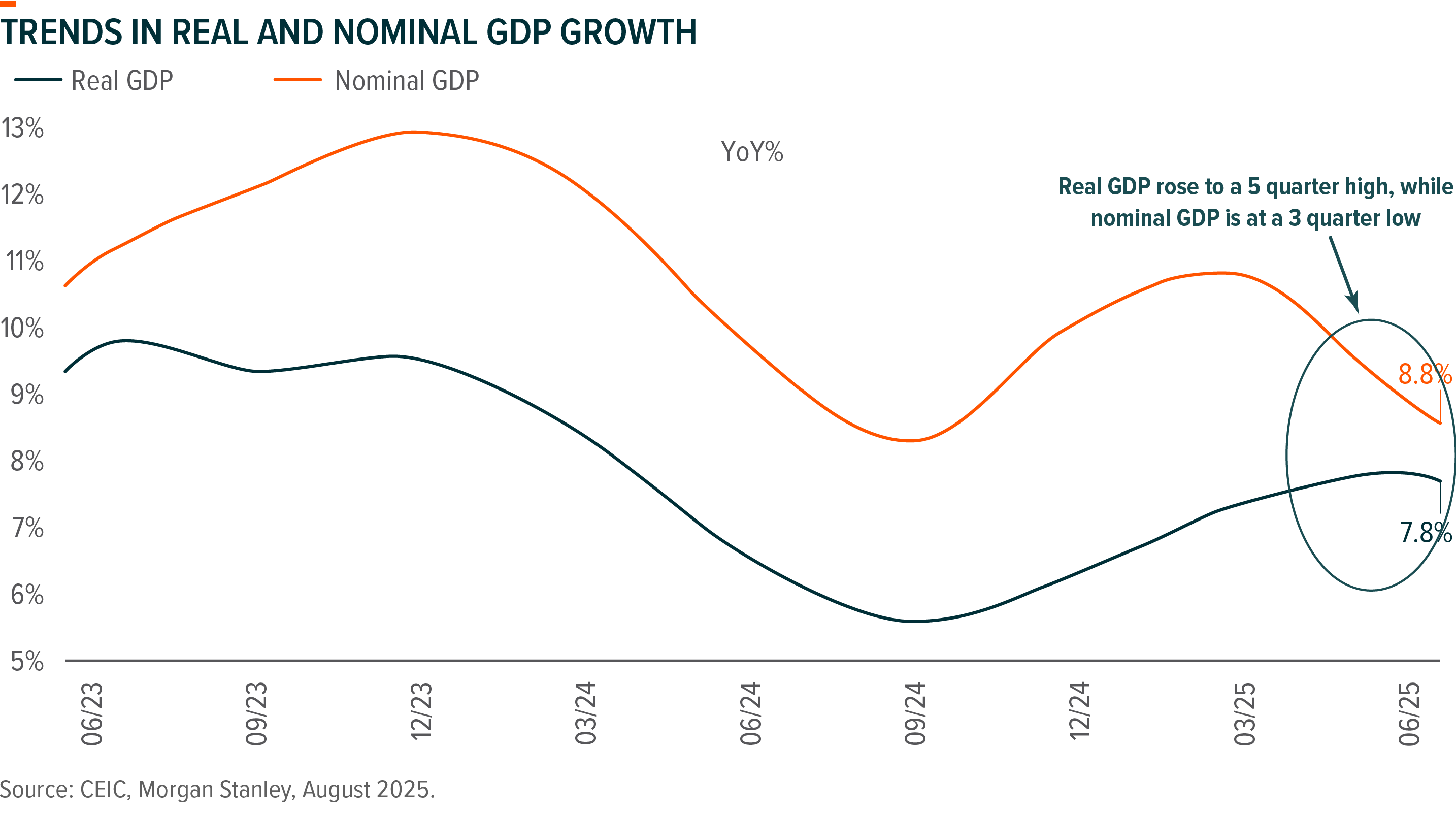

In 1QFY26, India real GDP growth showed a robust growth of 7.8%yoy, surpassing the consensus expectation of 6.7%yoy. Both government and private consumption picked up to 7.5%yoy and 7.0%yoy respectively, while gross fixed capital formation moderated to 7.8%. The ongoing strength in rural demand, bolstered by a favourable monsoon and improved real wages, has boosted consumption levels. In addition, the government has advanced its spending in 1QFY26, which has supported consumption and investment levels. Although external demand risks have increased with higher US tariffs, this can be counterbalanced by stronger domestic demand. (The Time of India, Mirae Asset, August 2025)

Domestic demand-based high-frequency data for August remained a similar trend to the previous month, with a mixed but gradual overall improvement. The Manufacturing PMI further strengthened to 59.3, and the Services PMI reached 62.9, the highest since June 2010, in August. GST collections increased by 6.5%yoy, reaching INR 1.86 trillion in August. Central government capital spending picked up to INR 718 billion in July, with cumulative spending at 31% of the FY26 budgeted target. Credit growth rose to 10.2%yoy in August, up from 10% in July, and power demand also picked up to a 5-month high of 4.3%yoy in August. Vehicle registrations and air passenger traffic both improved on a YoY basis, and consumer sentiment remained resilient. (The New Indian Express, September 2025)

Indian equity flows from foreign institutional investors turned negative this month, with an outflow of USD 3.3 billion in August, after an outflow of USD 2.9 billion in July. Meanwhile, domestic institutional investors continued their buying trend for the 25th consecutive month, net purchasing USD 10.8 billion during the same period, up from USD 7.1 billion in July. (The Times of India, August 2025)

Stock Comments

Maruti Suzuki (MSIL IN) was the major contributor in August as the company is expected to benefit from next generation GST reforms announced during the month. GST for small cars will drop from 29-31% to 18% and Maruti with a 50+% exposure to small cars and high operating leverage, appears likely to be a key beneficiary. (Company data, September 2025)

Sun Pharma (SUNP IN) was the major detractor in August due to overall concerns on exporters while tariffs on pharmaceuticals are yet to be announced. In addition, there was a downgrade on near-term earnings for this name due to slower than expected ramp-up of new launches, which also led to weaker stock prices.

Preview

While global macro uncertainties remain, we expect India’s domestic growth to recover over the coming quarters, supported by easing monetary policy and improved fiscal spending, moderate inflation, and recovery in consumption. This suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market. (Company data, September 2025)

Global X K-pop and Culture ETF (3158)

Market Update

In August, KOSPI was down -1.8% to 3,186, the first retreat in 5 months. This was initially triggered by investor concerns over a proposed tax reform bill, which cast doubt on the new administration’s policy direction and momentum for governance reform. However, sentiment stabilized later in the month as the government showed a willingness to revise its proposals and advanced a second amendment to the Commercial Code, which included shareholder-friendly provisions like mandatory cumulative voting.

In this mixed market, the K-pop sector was a relative outperformer. The Solactive K-Pop & Culture Index gained 2%, outperforming the broader KOSPI. We view the sector’s strong Q2 earnings as a validation of our thesis on its fundamental mid-term recovery. The breakout success of K-Pop Demon Hunters (KDH), which could become one of Netflix’s most-watched content items, underscores K-content phenomenon in global market. We believe this cultural boom is a key catalyst driving increased international consumption of Korean cosmetics and food products, such as noodles. Furthermore, we continue to see K-pop as a direct beneficiary of thawing Korea-China relations under the new government.

Stock Comments

YG Entertainment (122870 KS): YG recorded 19% return in August. YG’s 2Q25 Revenue of W100bn missed consensus by 5%, while OP of W8bn substantially above consensus, thanks to cost control during a relatively quiet period with no major artist activities. YG’s earnings momentum is poised to accelerate entering 2H25 with Blackpink’s comeback. BP’s world tour is scheduled with 15 stadium concerts in 3Q25 across Korea, US and EU, along with 11 more for 4Q25 mainly in Asia. (Company data, Mirae Asset, August 2025)

Amorepacific Corp (090430 KS): Amorepacific experienced 11% loss in August. In 2Q25, Amorepacific’s sales grew 11.1% YoY to W1tn thanks to strong top-line growth for most regions. Thanks to sales growth and a low base from big losses in China in 2Q24, the company’s 2Q25 OP surged 16.7x YoY to W74bn, and beat consensus by 8.5%. AP brands continued to build robust track records in overseas expansion and profitability upgrade. However, COSRX’s growth was weak again, down 33% YoY, and its operating margin declined to mid-20% due to restructuring, but falling sales trend could moderate into 2H25 with transition nearly completed. (Company data, Mirae Asset, August 2025)

Preview

We maintain positive on the rise of K-Pop and cultural phenomenon in global market. Amid Trump tariff risk, we believe K-pop industry is less vulnerable thanks to its unique cultural and fandom characteristics, as well as the potential for price increases to mitigate the effects. Meanwhile, following Lee Jae-Myung’s victory in presidential election, we see K-pop sector as a key beneficiary of improving Korea-China relations under the new government, benefiting from the potential resumption of commercial activities and fan engagement in China. Top artists comebacks, such as Blackpink and BTS, further support the fundamental improvement. We expect this cultural wave to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food.