Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X Japan Global Leaders ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index.

- The Underlying Index is reconstituted annually. Securities that no longer meet the eligibility criteria may remain in the index until the next scheduled annual reconstitution. The index’s representativeness is not guaranteed to be optimised from time to time.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The investment objective of Global X India Select Top 10 ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index.

- The number of constituents of the Underlying Index is fixed at 10. The Fund may hold more concentrated investment portfolio, leading to higher risks of volatility.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Fund is a FPI registered with the SEBI. SEBI’s rules and limits on FPI shareholding in some Indian companies can change and may affect the Fund’s performance. SEBI may also cancel the Fund’s FPI registration under certain conditions. If this happens, the Fund may not be able to invest in, hold, or sell Indian securities. The Fund might need to sell all its Indian holdings quickly, possibly at a big loss.

- The base currency of the Fund is USD but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Investment in Emerging Market, such as Indian market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X K-pop and Culture ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive K-pop and Culture Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The base currency of the Fund is KRW but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X India Select Top 10 ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index.

- The number of constituents of the Underlying Index is fixed at 10. The Fund may hold more concentrated investment portfolio, leading to higher risks of volatility.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Fund is a FPI registered with the SEBI. SEBI’s rules and limits on FPI shareholding in some Indian companies can change and may affect the Fund’s performance. SEBI may also cancel the Fund’s FPI registration under certain conditions. If this happens, the Fund may not be able to invest in, hold, or sell Indian securities. The Fund might need to sell all its Indian holdings quickly, possibly at a big loss.

- The base currency of the Fund is USD but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Investment in Emerging Market, such as Indian market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Monthly Commentary

Global Thematic ETFs – August 2025

Global X Japan Global Leaders ETF (3150)

Industry Update

In July 2025, the FactSet Japan Global Leaders Index recorded 0.6% returns in JPY terms(FactSet, January 2025). Japan market reacted positively to the US-Japan tariff deals. On July 22, US government revealed new tariff agreements with Japan, notably reducing tariffs on Japanese exports, including the automotive sector, from 25% to 15%. The tariff deal also includes US$550bn Japanese investment package in the US. Better-than-expected tariff deals have positive implications on Japan companies, especially exporters. Improved corporate earnings could also contribute to wage hikes in Japan, sustaining the reflationary trend in Japan. Additionally, the US$550bn Japan investments in the US as part of the tariff deal could lead to further JPY depreciation, which will support corporate earnings and benefit Japan exporters. Corporate governance reform continues to bear fruits and remains a key theme for Japan investments. After the FOMC and BoJ meetings July 30-31, the yen weakened further to finish the month at ¥150/$ after having depreciated in July.

Stock Comments

Auto stocks, including Toyota (+8%) and Honda (+13%), performed well during the month. US-Japan tariff deal came in as a positive surprise to the market, especially considering the reported challenges in negotiating reductions in automobile tariffs. US had previously imposed a 25% tariff on Japan’s automobile, which accounts for over 25% of Japan’s total export to the US. As a result, Japan’s auto export to the US fell by 25% YoY in May, and further accelerated to 27% YoY in June. EPS growth consensus for Japan Autos and Transportation Equipment Sector has been revised down by over 29% in the past 4 months to reflect tariff impact, leaving potential for upside revision after the tariff deal. Auto supply chain companies could also benefit.

Preview

US-Japan tariff deal and expectation for a change in government after the Upper House election bring higher visibility for Japan equity market investments. While short term outlook remains uncertain given slowing global/US economy and political events uncertainty, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging). (JP Morgan, August 2024)

Global X Asia Semiconductor ETF (3119)

Industry Update

Samsung inks $16.5 billion Tesla AI chip deal

Samsung announced it had inked a $16.5 billion foundry deal with an unnamed partner, confirmed to be Tesla by Elon Musk, who says the company will produce its next-generation A16 chip. The deal represents a major win for Samsung Foundry, which has been lagging behind TSMC for a while. In addition, the deal is big news for Samsung’s fab in Taylor, Texas, where the system-on-chips (SoCs) will be produced. (Toms hardware, July 2025)

TSMC raised full year revenue guidance

2Q beat: revenue exceeded high end of guidance +17.8% QoQ to 30.07bn USD. GPM at 58.6% was close to high end of the guided 57-59% range. 100bps impact from ramp up of oversea fab mainly from margin dilution of Arizona fab, 220 bps from fx. EPS of NTD 15.36 was up 10.2% QoQ ~6% ahead of street. (Mirae Asset, August 2025)

3Q guide beat lifted full year guide: revenue guided to grow 8% QoQ at the mid point, ahead of street at LSD QoQ. GPM 55.55-57.5% vs Street at 57.2%. Company revised up full-year revenue guidance from mid 20% to 30% YoY growth in USD. No change in CAPEX guidance (38-42bn). (Mirae Asset, August 2025)

Samsung to produce image sensors for Apple’s iPhone in Texas

Samsung Electronics will produce digital image sensors for Apple in the latest sign that South Korean technology companies are starting to reap the benefits of a series of US investments and President Donald Trump’s aggressive tariff policies. (Financial Times, August 2025)

The iPhone maker said it would work with Samsung’s semiconductor facility in Austin, Texas, “to launch an innovative new technology for making chips, which has never been used before anywhere in the world”. (Financial Times, August 2025)

Stock Comments

Samsung +16.96%: Samsung announced it had inked a $16.5 billion foundry deal with an unnamed partner, confirmed to be Tesla by Elon Musk, who says the company will produce its next-generation A16 chip. Apple will also work with Samsung to produce chips in the Austin fab. (Reuters, July 2025)

TSMC +7.81%: The company delivered a strong set of 2Q result and 3Q guidance. Management revised up full-year revenue guidance from mid 20% to 30% YoY growth in USD. (Company data, July 2025)

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2025. (Mirae Asset, August 2025)

Global X Innovative Bluechip Top 10 ETF (3422)

Stock Comments

Microsoft Azure revenue rose 39%, beating expectations

Microsoft forecast a record $30 billion in capital spending for the current fiscal first quarter, after booming sales in its Azure cloud computing business showcased the growing returns on its massive bets on artificial intelligence. (Reuters, July 2025)

Microsoft said Azure revenue jumped 39% in the June quarter, more than the average analyst estimate of 34.75%, according to Visible Alpha. The company said it expects growth of 37% for the current quarter, beating analyst estimates of 33.5%, according to Visible Alpha data. (Reuters, July 2025)

Apple roars back with stronger-than-expected iPhone sales and record $94 billion third-quarter revenue

The company reported better-than-expected iPhone sales, which were up 13% year over year. Apple delivered record third-quarter revenue of $94 billion compared to Wall Street’s estimates of $89.3 billion. (Business insider, July 2025)

BYD: The company’s sales were slowing down in July thanks to seasonality, competition and unclear subsidy policies pan-China in the middle of the year, despite strong exporting numbers. BYD also guided down their whole-year shipment from 5.5mn units to 5.2mn units. (Company data, August 2025)

Global X K-pop and Culture ETF (3158)

Market Update

In July, KOSPI increased 5.7% MoM to 3,245. This upward trend was initially driven by the smooth passage of the Commercial Code Amendment earlier in the month, which continued the market’s positive rerating. However, investor focus later shifted to the tax reform package, which, when announced on August 1st, disappointed market participants. Further progress in reform implementation, stronger corporate earnings, or significant repatriation flows will likely be necessary to sustain the market’s rerating momentum. Trade negotiations with the US concluded within the month, resulting in Korean tariffs stabilizing at 15% by the August 1st deadline, aligning with the rate applied to Japan.

K-pop sector corrected and underperformed the broader KOSPI in July, with Solactive K-pop and Culture Index -5% due to profit taking and sector rotation. On Aug 6, Korea announced to offer visa-free entry to Chinese tourists from late September, another positive signals for Korean and China relations. We see K-pop sector as a key beneficiary of the thaw in Korea-China relations under the new government. The potential market reopen could facilitate the resumption of fan engagements and businesses in China.

Stock Comments

Key Contributors:

APR Corp (278470 KS): APR recorded 13% return in July. APR is a leading beauty company in Korea and specializes in cosmetics and beauty devices, which it develops and manufactures in-house. APR reported strong 2Q25 results, with sales surging 111% YoY. This is mainly driven by Medicube’s explosive increase in overseas cosmetics sales. OPM hit record high at 26% in 2Q25, thanks to greater contribution from high-margin B2B business and disciplined cost management. Looking forward, growth outlook remains strong, supported by ongoing global expansion and sustained momentum in device sales.

HYBE (352820 KS): HYBE experienced 16% loss in July. 2Q25 revenue and OP were in-line with consensus. The company faced ongoing challenges in recorded music, down 8% YoY (marking a fourth consecutive quarterly drop). However, this is offset by near-record concert sales, up 31% YoY, driven by global tours from J-Hope, SEVENTEEN, and TXT. Merchandise sales also surged 40% YoY along with the concert lineups. Fan club revenue increased 46% YoY, boosted by BTS’s military decommissioning, which drove Weverse MAU to a new peak of 11 million. Despite this, margin pressure are expected to persist through 2025, due to pre-debut investments for new artists.

Preview

We maintain positive on the rise of K-Pop and cultural phenomenon in global market. Amid Trump tariff risk, we believe K-pop industry is less vulnerable thanks to its unique cultural and fandom characteristics, as well as the potential for price increases to mitigate the effects. Meanwhile, following Lee Jae-Myung’s victory in the presidential election, we see K-pop sector as a key beneficiary of improving Korea-China relations under the new government, benefiting from the potential resumption of commercial activities and fan engagement in China. Top artists comebacks, such as Blackpink and BTS, further support the fundamental improvement. We expect this cultural wave to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food.

Global X India Select Top 10 ETF (3184)

Market Update

The MSCI India Index declined by 5.2% (in USD terms) in July, driven by a somewhat mixed earnings season, tariff uncertainties throughout the month, a ‘25% tariff plus penalty’ announcement on 30th July, negative foreign institutional investor flows, depreciation of the Indian Rupee, and a spike in oil prices.

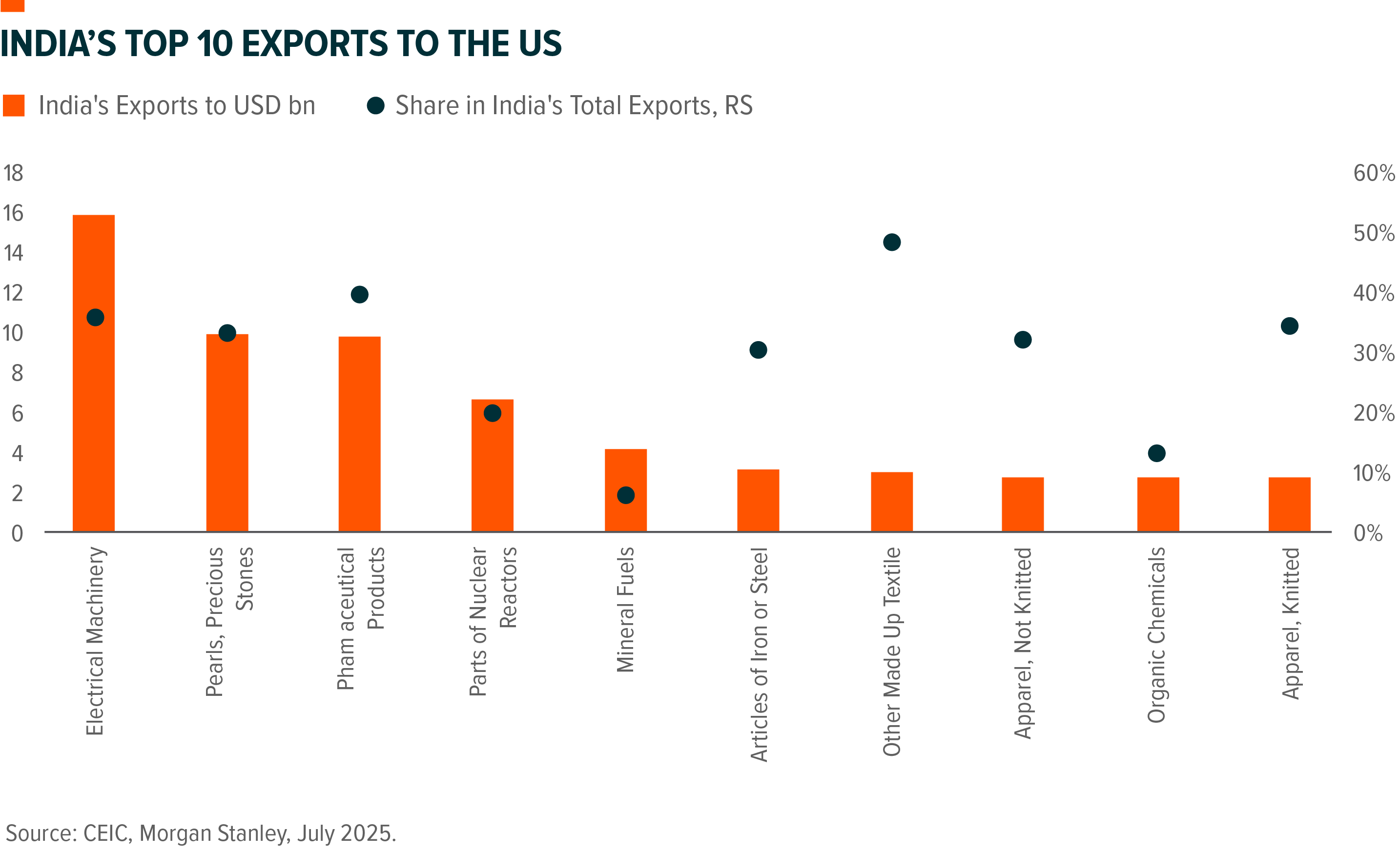

On 30th July, the US imposed a 25% of tariff on India’s goods exports after the two countries failed to reach a trade agreement by the extended deadline for pausing reciprocal tariffs. In early August, the US announced an additional 25% ad valorem duty on India’s exports as a penalty for continued oil imports from Russia. This brings total tariffs on India’s exports to 50%, a rate higher than that faced by other key competing economies. However, India’s exports to the US amounted to US$87 billion or 2.2% of GDP in FY25, and there are sector-level exceptions for many US-exporting sectors. Therefore, the direct impact from tariffs on GDP growth, corporate revenue, and earnings could be limited.

Domestic demand-based high-frequency data for July maintained a similar trend to the previous month, with a mixed but gradual overall improvement. The Manufacturing PMI further strengthened to 59.1, and the Services PMI reached an 11-month high of 60.5 in July. GST collections increased by 7.5%yoy, reaching INR 1.95 trillion in July. Central government capital spending softened to INR 528 billion in June, with cumulative spending at 24.5% of the FY26 budgeted target. Credit growth rose to 9.8%yoy in July, up from 9.5% in June, and power demand also picked up by 2.1%yoy in July. However, vehicle registrations and air passenger traffic both declined on a YoY basis, while consumer sentiment remained resilient.

July CPI came in at an eight-year low of 1.6%yoy, down from 2.1%yoy in June. This drop was primarily driven by food prices, especially vegetables. Food CPI declined by 1.8%yoy, and the Core CPI (excluding food and fuel) eased to 4.2% in July. Based on high-frequency data, overall Food CPI may show slight positive growth and the favourable base effect is expected to dissipate, leading to a modest increase in headline CPI in August.

Indian equity flows from foreign institutional investors turned negative this month, with an outflow of USD 2.8 billion in July, compared to an inflow of USD 2.4 billion in June. Meanwhile, domestic institutional investors continued their buying trend for the 24th consecutive month, net purchasing USD 7.1 billion during the same period, down from USD 8.5 billion in June.

Stock Comments

Hindustan Unilever (HUVR IN) was the major contributor in July as some of the street analysts upgraded their ratings after 1QFY26 results. The company’s standalone revenue and EBITDA grew by 4%yoy and 3%yoy respectively, which came in line with expectation. Yet, the street expects gradual improvement in 2HFY26 combined with high expectations on new CEO, led to upgrades on the name.

Tata Consultancy Services (TCS IN) was the major detractor in July due to its weaker than expected 1QFY26 results. Revenue decline of 3.4%qoq was the key negative surprise while normalized profits were inline. Overall IT services sector underperformed this month due to continued pressures on discretionary IT spends, delays in decision-making, and overall challenged environment outlook.

Preview

While global macro uncertainties remain, we expect India’s domestic growth to recover over the coming quarters, supported by easing monetary policy and improved fiscal spending, moderate inflation, and recovery in consumption. This suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.