Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund. Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins. They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary

China Thematic ETFs – July 2025

Global X China Electric Vehicle and Battery ETF (2845)

Industry Update

Solid June EV Sales: According to CPCA estimates, June NEV wholesale sales volume was 1.26mn, +29% YoY. By individual brand, BYD reported June NEV PV sales of 383k units, +33% YoY and flat MoM. Overseas sales remain the bright spot with record high 90k units (+1% MoM), with YTD overseas sales more than double YoY and tracking ahead of its annual overseas sales target. Xpeng recorded YoY sales growth of +224% YoY with MONA Max debut. Upcoming models include G7 official launches and new P7 Launch. Li Auto sold 36.3k units in the month, -24% YoY. Xiaomi delivered over 25k units in June, and launched YU7 SUV in end-June. (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF).

Price competition update: BYD’s price cut announced on 23 May sparked market fear on intensified competition, the time-limited incentives ended by 30 June. BYD June production also lower than sales volume, showing potential production refrain. From industry regulation perspective, People’s daily published article asking the industry to get out from “involution” competition and follow rational economic principles. Xinhua News Agency also reported on 1 July that President Xi spoke at the central finance committee meeting, appealing to change the practice of low-price disorderly competition. These new developments can bode well for EV OEM profitability.

Xiaomi YU7 was launched on 26 June, receiving 240k orders within 18 hours of launch, beating market expectation by a large margin and substantially outperformed Xiaomi SU7.

Battery material costs remained low: Battery grade lithium carbonate price was Rmb61.4k/ton, +2.8% wow, -43%/-24%/-20%/-19% vs. average of 2Q24/3Q24/4Q24/1Q25. ( Goldman Sachs, July 2025). Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers

Stock Comments

- Gotion High-tech gained 33% in the month, a key contributor to the ETF. Stock rallied on positive development of its solid state battery. In May, the company launched the second generation of Jinshi Solid State Battery, along with new technologies and products featuring high safety and high energy density. Currently, the Jinshi Solid State Battery is in the pilot production stage, boosting market sentiment. However, the company noted that solid state battery is still at early stage with limited commercial contribution.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program (which has been extended in 2025), together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. BYD’s launch of God’s Eye ADAS in mass market model should accelerate smart driving adoption in China. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands

Global X Hang Seng TECH ETF (2837)

Industry Update

Global X Hang Seng TECH ETF (2837 HK) recorded positive return in June. The intensified competition in food delivery/instant shopping sector between eCommerce players (Alibaba, JD) and local service leaders (Meituan) led to the share price decrease of these companies. Alibaba announced to invest Rmb50bn in on-demand retail to support users/merchants on July 2. GMV growth for 618 shopping festival was healthy at 10-11% YoY, driven by national subsidies on electronics/appliance and normalized competition (with similar growth rates across platforms). With a clear change in policymaker stance, the gradual rollout of stimulus policies could support a revived consumer sentiment that will benefit sectors including ecommerce, advertising, EV, and 3C electronics. Online gaming sector remains less macro-dependent and continued to record solid revenue supported by high quality games.

Stock Comments

- Xiaomi recorded 18% return in the month, a key contributor to the ETF. Xiaomi’s launch of YU7, its first SUV EV model, was a great success, with over 200k orders within first 3 mins of launch. Xiaomi also recorded solid sales in 618 shopping festival, aggregating gross payment of Rmb35.5bn, up by over 30% YoY.

- Meituan recorded loss of 9% in the month, a key detractor to the ETF. Meituan continue to suffer from intensified competition in the instant delivery sector as other major ecommerce platforms like JD and Alibaba continue investing into this space. This cause concern around Metuan’s CLC profitability.

Preview

Hang Seng Technology Index constituents are well positioned to benefit from the policy stimulus by central government. We see unique positioning of Hang Seng Tech thanks to its attractive valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV, Semiconductor and AI in China.

Global X China Clean Energy ETF (2809)

Industry Update

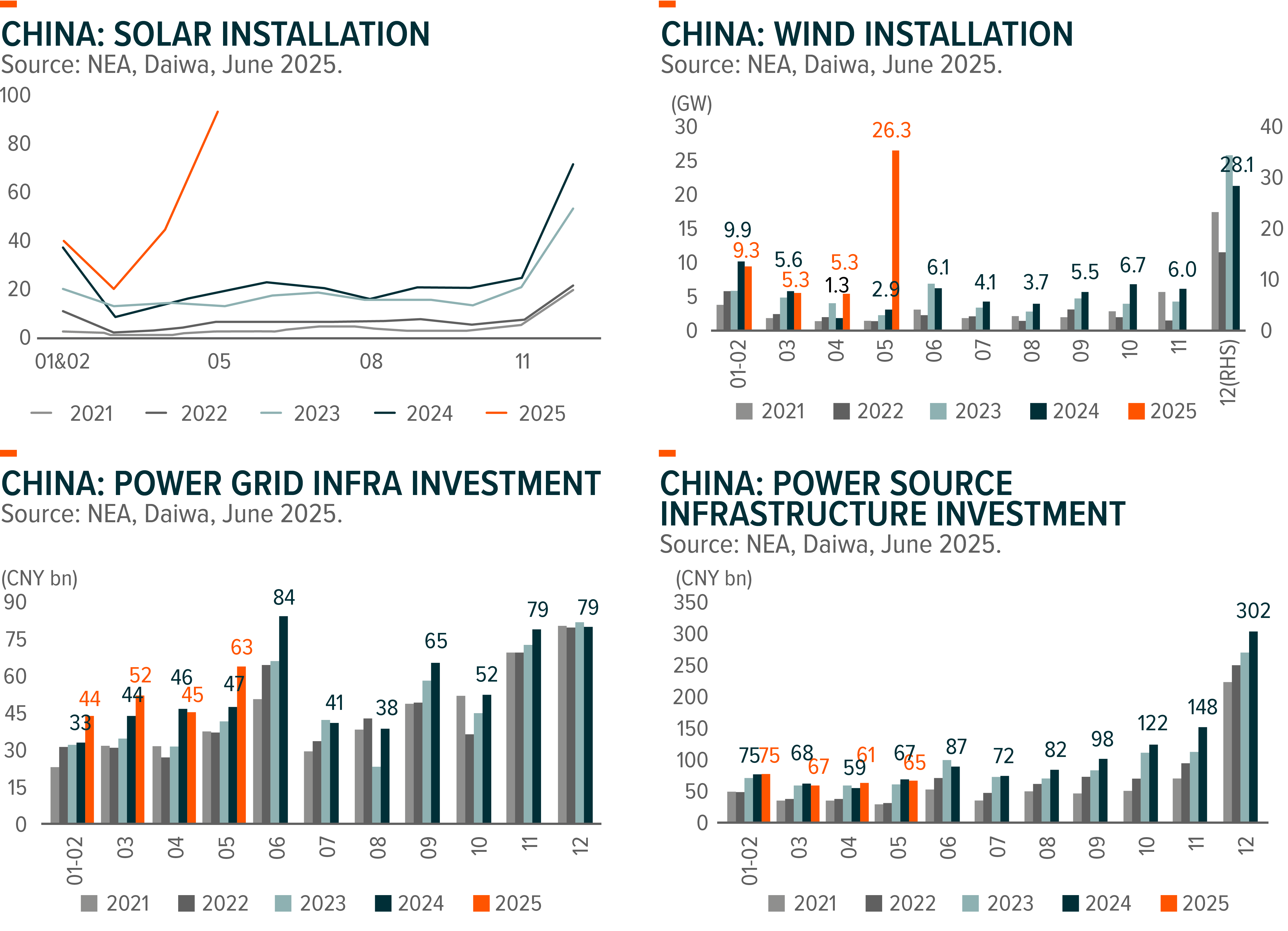

China solar installation ended at a historical high level of 92.9GW in May due to the front-loading, sending 5M25 installations to 197.9GW, +150%YoY. Wind installation amounted to 26.3GW, sending 5M25 installations to 46.3GW, +134%YoY. According to China Custom, solar cell and module export reached $2.4bn in May, -15%YoY but +7%MoM, implying shipment volume of 25GW, +6%YoY and +15%MoM. Investment in power generation capacity was Rmb65bn in May, -3%YoY but +6%MoM, sending 5M25 investment amounted to Rmb258bn, +0.4%YoY. Investment in power grid was sequentially improving to Rmb63bn in May, +33%YoY and +40%MoM, sending 5M25 investment to Rmb204bn, +20%YoY.

Stock Comments

- Sungrow Power Supply Co., Ltd. Class A: The company’s share price was soft YTD due to the concerns on exports to the US despite strong front-loading ESS shipment. Management shared the 2025 ESS sales to the US was not impacted much by the tariff indeed.

- NAURA Technology Group Co Ltd Class A: Sector rotation to play defensive amid the uncertainties of US tariff.

- Ningbo Deye Technology Co., Ltd. Class A: The company is losing market share in some European countries and South Africa due to intensified competition versus other Chinese makers

Preview

China has added a record-high solar installation in May, which may suggest the demand slowdown meaningfully in the coming six months or even longer, given the overall power generation size is huge across the country. People are again calling for the ending of “involution” competition and urging stronger industry self-discipline and governmental intervention. Wind installation is a beat YTD. People are expecting more upside from offshore demand and exports. We remain constructive on power grid investment in the coming two years to better utilize the newly installed renewables.

Global X China Consumer Brand ETF (2806)

Industry Update

Retail sales increased by 6.4% YoY, beat market expectation and accelerating from 5.1/5.9% YoY in April/March. This is mainly driven by the robust spending during the May holiday season, an early promotion of 618 online shopping festival, and increased spending by in-bound tourists under the visa-free policy.

During 618 shopping festival, total online GMV grew by 15% YoY to c.Rmb856bn, according to Syntun. Brand sales demonstrated resilience, with 453 brands exceeding Rmb100mn in GMV. The campaign also achieved record participation, with buyer base expanding at a double-digit rate YoY.

The month also saw a revival in the “Trade-In Subsidy” investment theme. Concerns about the potential fade-out of these subsidies had led to a gradual unwind in related stocks since mid-May. However, recent NDRC meeting announced a third round of trade-in subsidy will be released in July. Policymakers emphasized their commitment to maintaining consistent and effective incentives, albeit with a more targeted approach. For “New Consumption” names, we have seen some corrections during the month. Fundamentally, street expectations for Pop Mart remain bullish that the company will meet its full-year earnings guidance of Rmb10bn, and channel checks suggest potential earnings beat in 2Q.

Stock Comments

- Pop Mart (9992 HK): Pop Mart recorded 20% return in June. Recently, the secondary market price correction, criticism of blind boxes by Chinese official media and broader weakness within the “new consumption” sector have weighed on the company’s share price. However, we see the secondary price correction is mainly due to the company’s proactive supply chain management and active restocking to reduce counterfeit risks and improve consumer accessibility. Comparing to other “New Consumption” names, Pop Mart differentiates itself from its strong sales growth momentum driven by overseas expansion.

- New Oriental Edu (EDU US): New Oriental achieved 13% return in June. Entering FY26, we see the risk-return profile for the stock becoming more attractive following the consensus reset and improving shareholder return. Its valuation is also fair at 13x FWD PE vs 15-20% EPS Cagr. Management reaffirmed its core revenue growth guidance of +13% YoY in USD terms (+15% YoY in RMB) and maintained its core OPM target of at least 1ppt YoY increase, benefiting from a low base effect and ongoing cost control. EDU has accelerated its share buyback execution in recent quarters to complete its $700mn program by May 2025 and its upcoming new shareholder return plan could serve as a near-term catalyst.

- Trip.com (TCOM US): Trip.com experienced 7% loss in June, pressured by heightened domestic competition. Despite this short-term headwind, we are still confident in TCOM’s long-term industry position and see significant growth potential for its overseas platform. Management reinforced its outlook and mentioned that they have limited concerns on domestic competition given TCOM’s competitive advantages in high-end hotel supply chain, customer service capabilities and comprehensive one-stop products offerings. Management has no intention to alter its take rate in the short term and applies ROI requirements on marketing expense across different markets

Preview

We believe policy stimulus remains key to enhancing consumer sentiment and bolstering stock performance for China consumer in 2025. During the Two Sessions, consumption was reaffirmed as a primary policy focus, and the introduction of the Special Action Plan to boost consumption underscores this commitment. Amid escalating trade tensions, China government may accelerate the pace and scale of these policies. We expect that macroeconomic recovery, supported by policies and the stabilization of the property market, presents the largest upside potential for China consumer sector in 2025. Among subsector, we favour those that are directly targeted by stimulus policies, such as home appliance and EV under extended consumer goods trade-in programs, as well as sectors sensitive to macroeconomic changes, such as Baijiu, catering and beverage.

Global X China Robotics and AI ETF (2807)

Industry Update

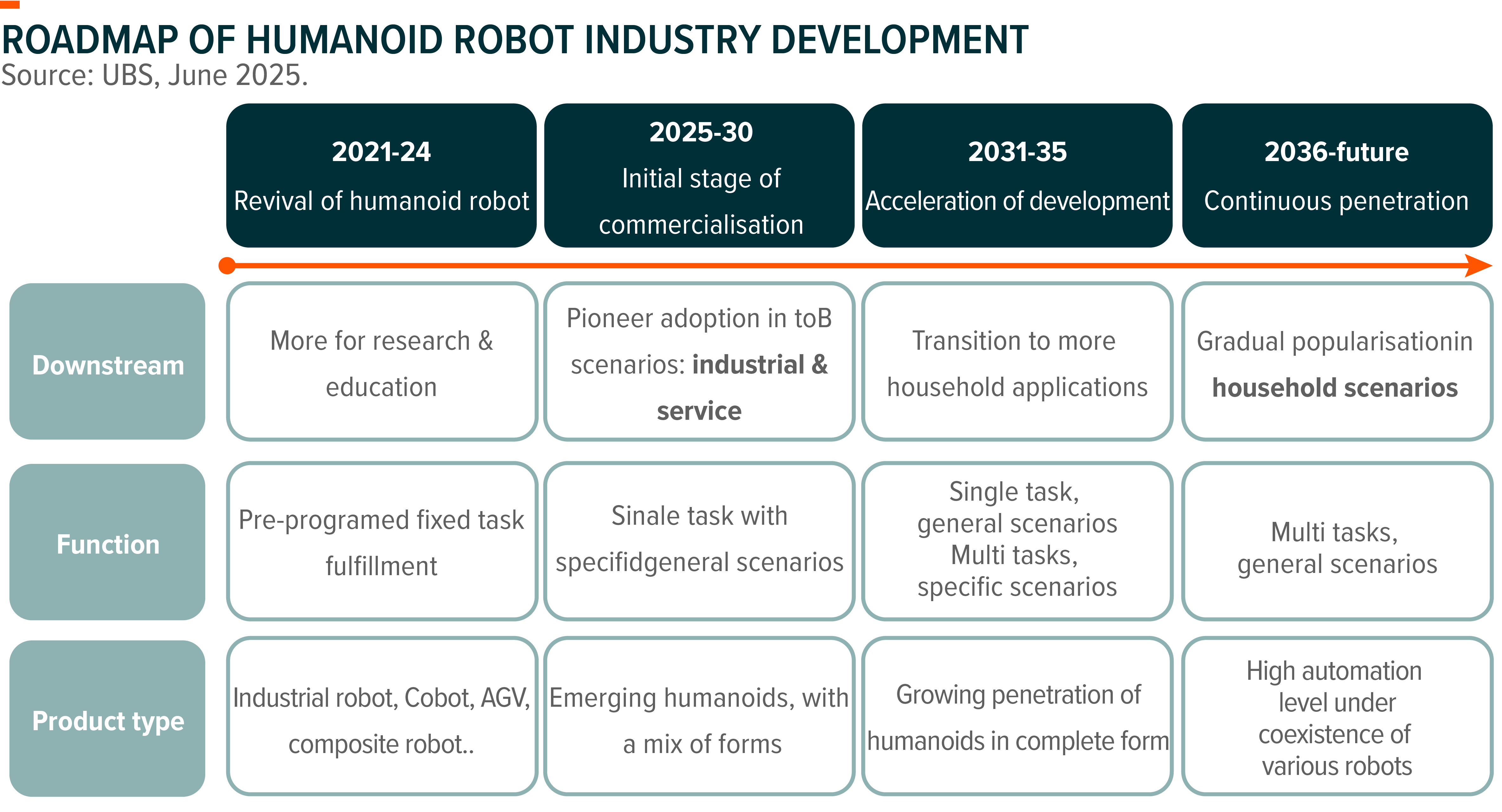

China industrial robot production sustained robust growth at 36%YoY in May, further accelerating sequentially. However, other industrial data points showed a slowing trend, with machine tool production up by 6%YoY in May (vs 13%YoY for 5M25) and the growth of Japan machine tool orders to China also slowing down. Lithium battery and consumer electronics capex demand remained strong, while textile, solar and metallurgy sectors are muted.

It is reportedly Tesla will suspend the component procurement of their humanoid robot Optimus due to design changes, and revise down the 2025 robot shipment target from 5-10k units to roughly 1,200 units as of May. On the other side, we are seeing the Chinese robot makers are accelerating the R&D and supply chain coordination activities. The commercialization may start with some simplified structuralized household and special industrial scenarios, as they are calling for cost cutting with visible demand.

Stock Comments

- Huagong Tech Co., Ltd. Class A: The company announced their 1H25 preliminary result of bottom-line growth by 42~52%YoY, driven by strong demand from AIDC and electric vehicles.

- Baidu, Inc. Sponsored ADR Class A: The company launched MuseSteamer AI video tool recently. They also partner with CAR Inc to start the driverless rental car services.

- Pony AI Inc. Sponsored ADR: Investors take profits before seeing meaningful robotaxi orders in the near term.

Preview

China’s FAI in advanced manufacturing and technology have been strong despite the overall economy slowdown. Robotics, AI and automation are one of the key beneficiaries from both the government’s stimulus measures in the near term and the economy transition goal in the long run. We are waiting to see some meaningful delivery from the current robotics companies in the coming twelve months.

Preview

China’s FAI in advanced manufacturing and technology have been strong despite the overall economy slowdown. Robotics, AI and automation are one of the key beneficiaries from both the government’s stimulus measures in the near term and the economy transition goal in the long run. We are waiting to see some meaningful delivery from the current robotics companies in the coming twelve months.

Global X China Little Giant ETF (2815)

Market Update

Global X China Little Giant ETF gained positive return in June. China market was supported as US-China 2-day trade talks in London agreed to implement the truce reached in Geneva. Market volatility kicked in after the outbreak of Israel-Iran military actions, which was followed by a fast de-escalation. We expect the continued US-China trade tension uncertainty might strengthen policy support to enhancing supply chain upgrades and achieving self-sufficiency. We still expect promoting emerging industries to climb up technology tree and supporting domestic substitution remain policies priorities in 2025. Therefore, these specialized and sophisticated SMEs play a crucial role in China’s transition to high quality development.

As a high-quality, small-cap fund, Global X China Little Giant ETF is likely to benefit from government’s supportive policies on tech innovation and may outperform large-cap funds if the economy turns to strong recovery in 2025.

Stock Comments

TFC Optical‘s management reported stable delivery of 1.6T products, with expectations of increased shipments in 2Q25 and further sequential growth in 3Q25, aligning with the broader ramp-up in rack shipments. While demand for 800G products is expected to persist into the second half of 2025, volumes will likely remain limited. Management is optimistic about demand for transceivers and passive optics in 2026, with contributions from new optical engine customers anticipated to begin in that year.

Management highlighted a tight supply for FAU and MT Ferrule products, supported by strong order trends. TFC Optical has avoided price competition with tier-2 competitors in the low-end market, maintaining high utilization rates that bode well for the 2026 demand outlook. The average selling price (ASP) for FAU and MT solutions in transceivers is expected to range between RMB 50 and 200, depending on the model, with higher costs for silicon photonics (SiPh) due to lower yields. These solutions are projected to contribute roughly in the teens to overall revenue.

In terms of infrastructure, TFC Optical’s Thailand plants span approximately 40,000 square meters, with an employee-to-area ratio of about 1,000 workers per 10,000 square meters, lower for active optics. Management expects robust year-on-year capital expenditure growth in FY25/26, primarily driven by high-precision machinery sourced from Japanese suppliers. Efforts to advance automation are ongoing, with some processes still in development and further updates expected in six months. These automation initiatives are anticipated to improve gross margins, helping to offset the impact of annual ASP declines. The co-packaged optics (CPO) business, including chip-on-chip (CoC) packaging, is expected to have minimal revenue contribution this year.

Global X China Cloud Computing ETF (2826/9826)

Market Update

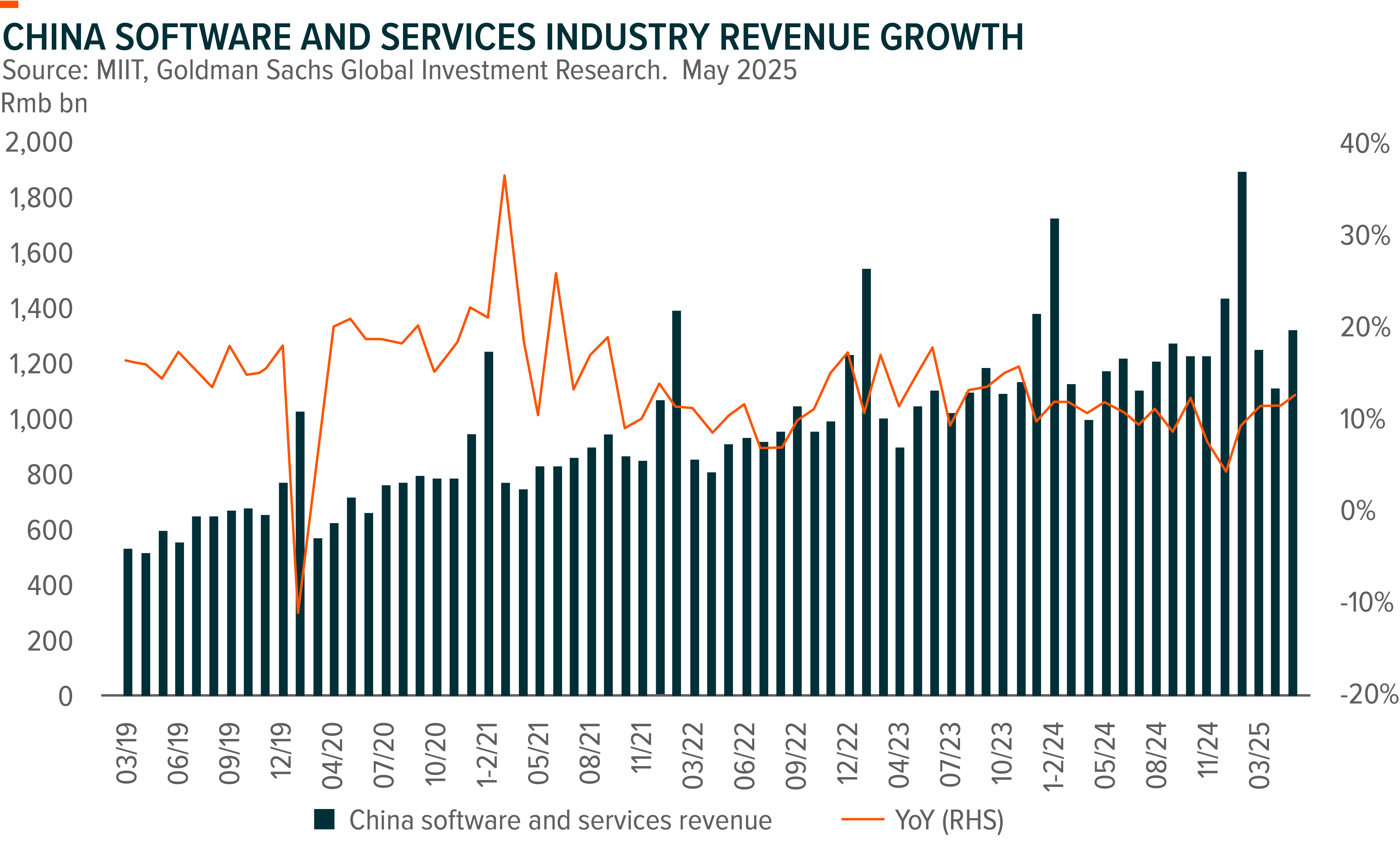

China software industry growth in May was up 12.6% YoY (vs. Mar/ Apr 2025 at +11.5%/ 11.5% YoY), increasing from the past two months, leading aggregate 5M25 revenues to +11.2% YoY (vs. 5M24 at 11.7% YoY). In May, the aggregate net income of software companies registered in China was Rmb165bn (US$23bn), or net margin of 12.5% (vs. 12.1% in Apr 2025), resulting in 5M25 net margin of 12.0%, higher than 4M25 net margin of 11.9%, per MIIT.

Software bidding in recent months and are positive on the accelerated momentum of new projects, mainly focusing on ERP cloud platform, DeepSeek LLM deployment/customized AI apps, and smart operation services.

The three telecom operators continued to commit investments in AI. Tight OPEX control will remain a key driver for earnings growth for telecom players, given rev growth will likely remain moderate, and cloud/AI-related revenue would likely have lower margin than that of traditional telecom services.

Stock Comments

- NetEase Inc Sponsored ADR: NetEase’s share price reacted positively to its 1Q25 results with net profit beating consensus expectation attributable to lower than expected marketing expenses, which leads to EPS upward revision and market continues to expect margin upsides into 2Q25. Besides margin, topline growth was solid, driven by solid performance of the new games including Marvel Rival and Where Winds Meet, and legacy games including FWJ and Identity V’s grossing were strong in 1H25.

- Hundsun Technologies Inc. Class A: Market is expecting potentially solid growth in non-core income, but also because brokers may increase software outsourcing services after entering the profit cycle.

- Shanghai Baosight Software Co., Ltd. Class A: parent company’s organic demand has been weakened by deflationary macro and geopolitics which will negatively impact core business growth, and can’t be entirely offset by a strong IDC revenue growth in the next few years.

- Beijing Kingsoft Office Software. Inc. Class A: AI monetization is further delayed amid overheated competition in available functions, while KSO’s unique offerings are not yet sufficiently developed.

Preview

China is developing cutting-edge AI capabilities with significantly less hardware, redefining expectations of computing power requirements. We see potential for AI agents to become the new user interface for enterprises and individual knowledge workers and unlock productivity, supported by capabilities of responding and being proactive to environmental changes. Manus launched general AI agents in Mar then starting monetization, and software vendors released AI agents with specific features to plan the work flow and complete independently.

Into second half of the year, we expect CSP (cloud services providers) to continuously invest in computing resources, and software companies to deploy more capital and human resources for industry specific AI tools that will integrate with existing software products.