How Much Can the Rmb 150trn Household Deposits be Reallocated to Equity Market?

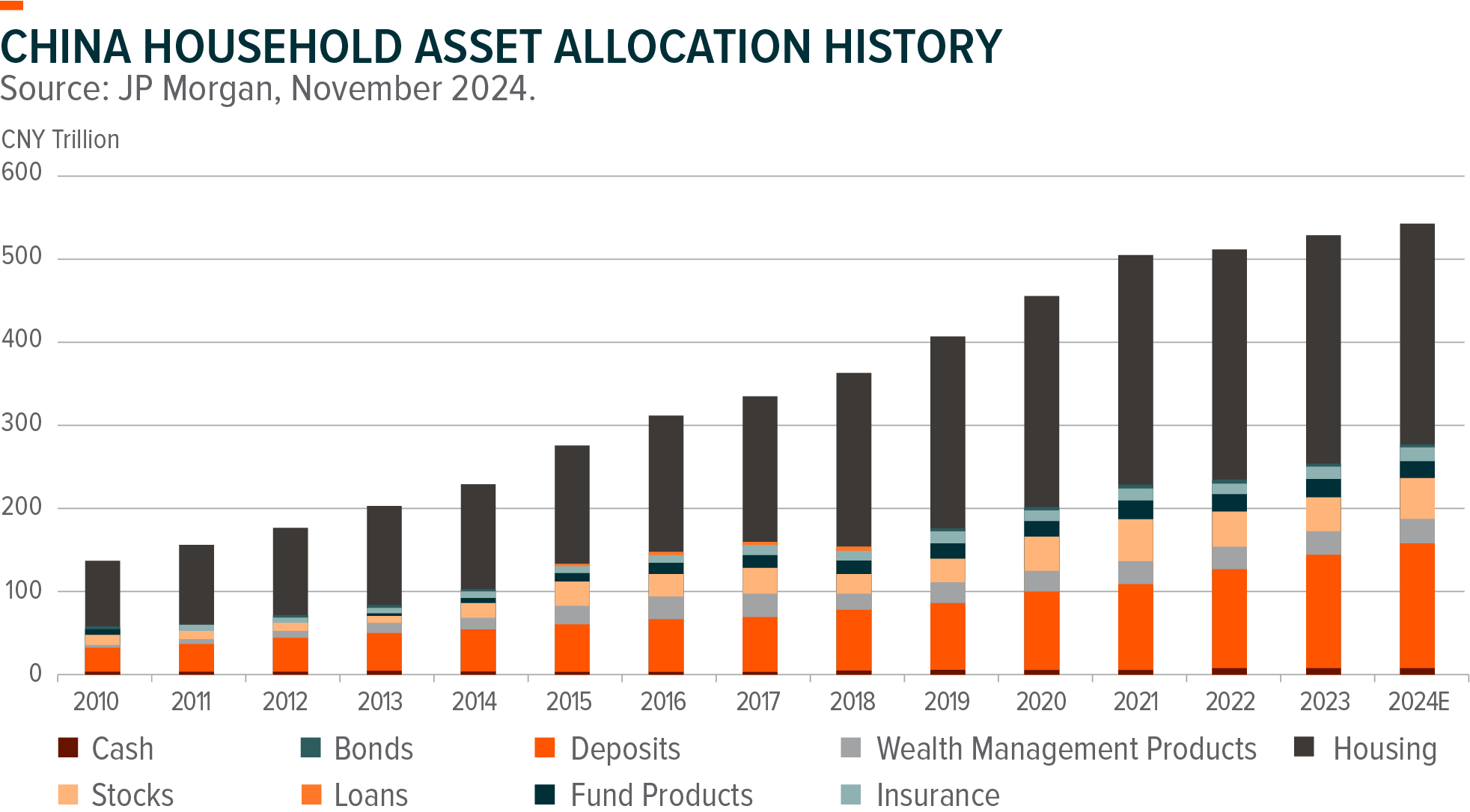

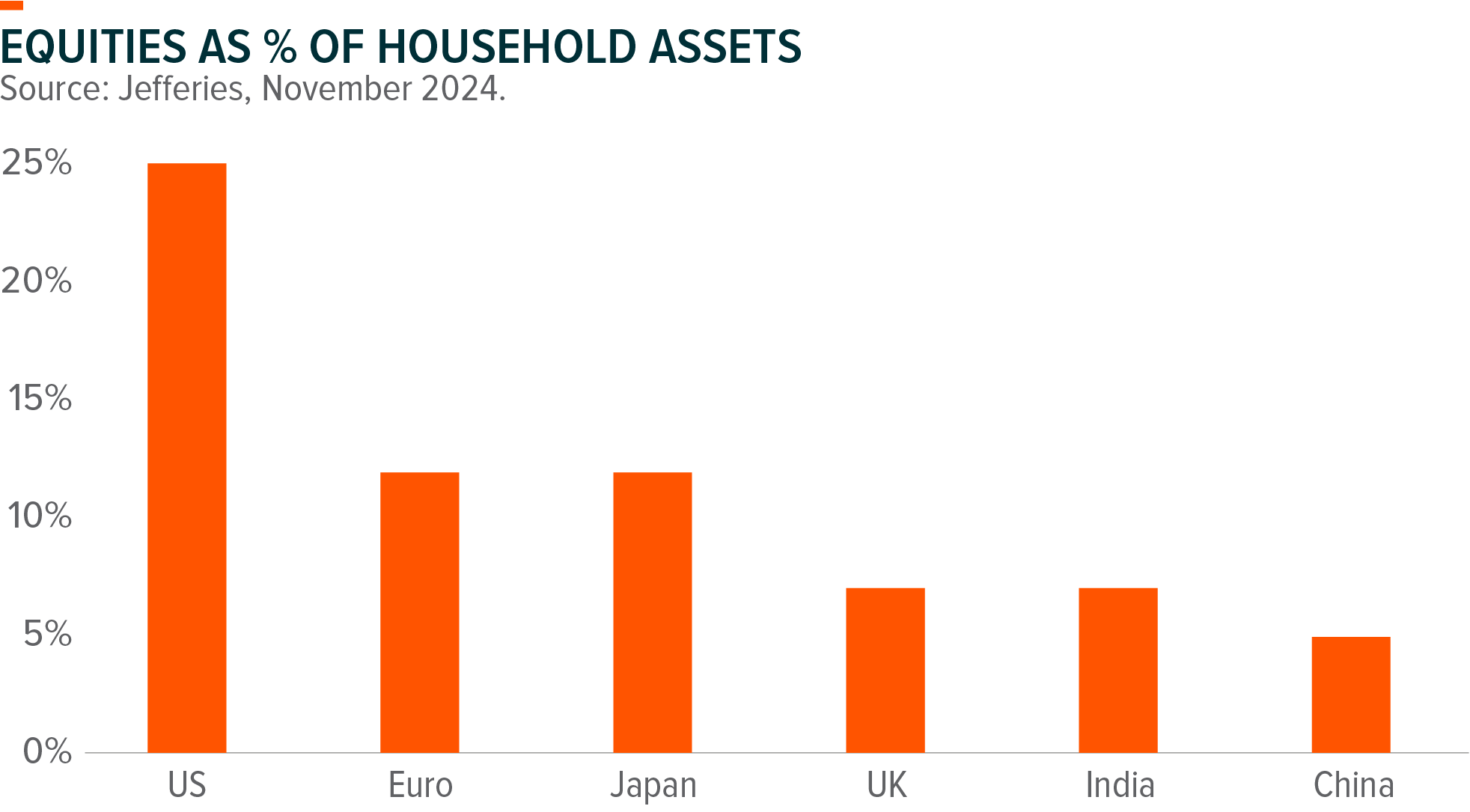

In China, property (c.60%) and cash & deposit (c.25%) command the lion’s share of household asset, while equity market only accounts for 5%, a much lower number compared to US (25%), Europe (12%), and India (7%). Amid a prolonged property downturn over the past years, real estate has become a less attractive investment option, and the decreasing deposit rate has also disincentivize household from savings. Under China’s new economic landscape, equity market could take on a more important role as household wealth reservoir, and a better performing stock market will also create wealth effect and support consumption. The household asset rebalancing towards equity market could be a long-term driver for stock market performance in China.

However, we note that household allocations to stocks are typically contingent on stock market performance, as historically onshore household allocation to stocks reached 10% or even higher during major market peaks in 2007, 2015, and 2020 (JP Morgan estimates). In addition, the enhancement of listed co. quality and minority shareholder protection is also essential to restore retail investor confidence and increase household adoption. We are seeing strong regulatory push to establish ‘high quality capital market’ that are in line with national strategy. Notably, the launch of ‘Nine Measures’ in April 2024 aims to enhance capital market supervision, improve operational efficiency, and increase shareholder returns. PBOC also launched two innovative monetary tools – Rmb500bn swap facilities and Rmb300bn relending program – in September 2024, which should provide better resilience for China market.

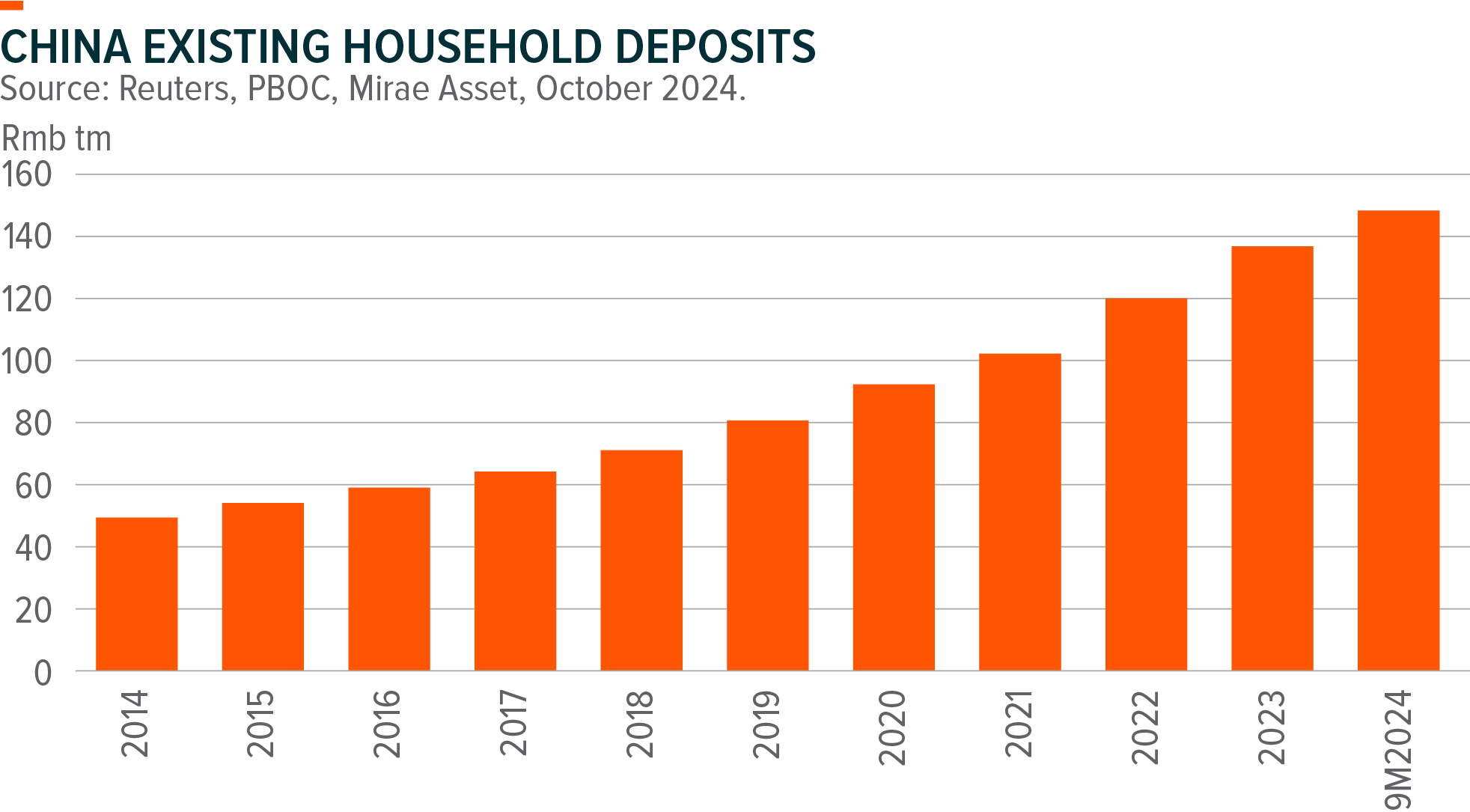

Tapping into the Rmb 150trn Household Deposits

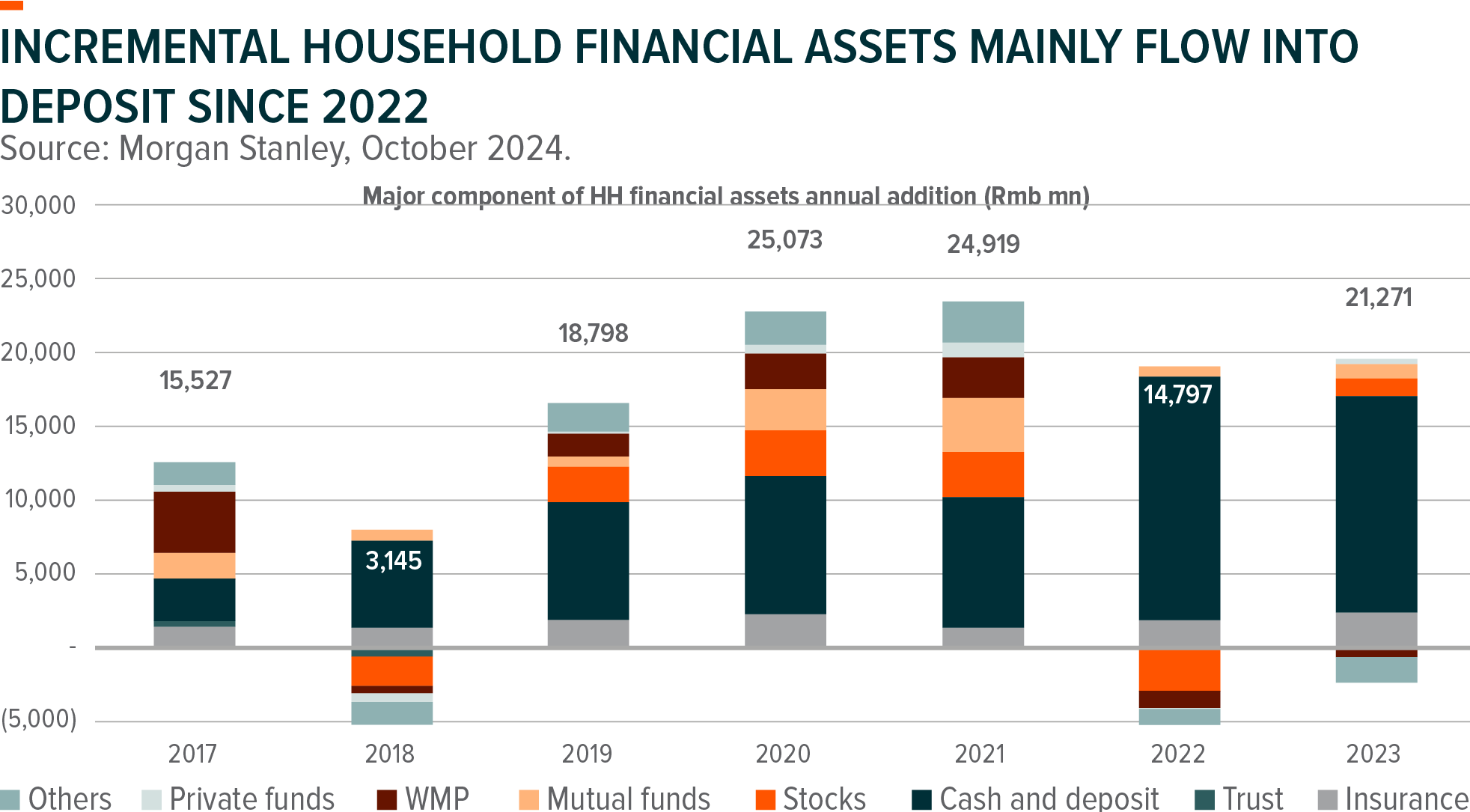

In 2022-2023, china household financial assets increased by c.18trn per year, mostly flew into deposits with a notable shift from equity and mutual funds allocations due to unsatisfactory returns. Total household deposit reached c.Rmb 150trn in September 2024 and recorded accelerated inflow in 2022-2023. As comparison, the total deposit amount is larger than China’s GDP (Rmb126trn in 2023) and China A-Share total market cap (c.Rmb98trn as of Nov 2024). We note that run rate for monthly incremental household deposit slow down marginally to Rmb 1.3trn in 9M24, from Rmb 1.5trn in 2022. Multiple rounds of deposit rate cuts since 2023 should make deposit a less appealing allocation option for households, while the sharp stock market rally at end-September on the back of strong stimulus attracts massive retail attention and potentially drive reallocation into equity market. If allocation could return to 2020-21 levels, retail investors would bring Rmb 2-3trn potential inflows to the stock market. To put into context, the estimated inflow would be similar to the average annual inflow to equities and equity funds during 2020 and 2021.

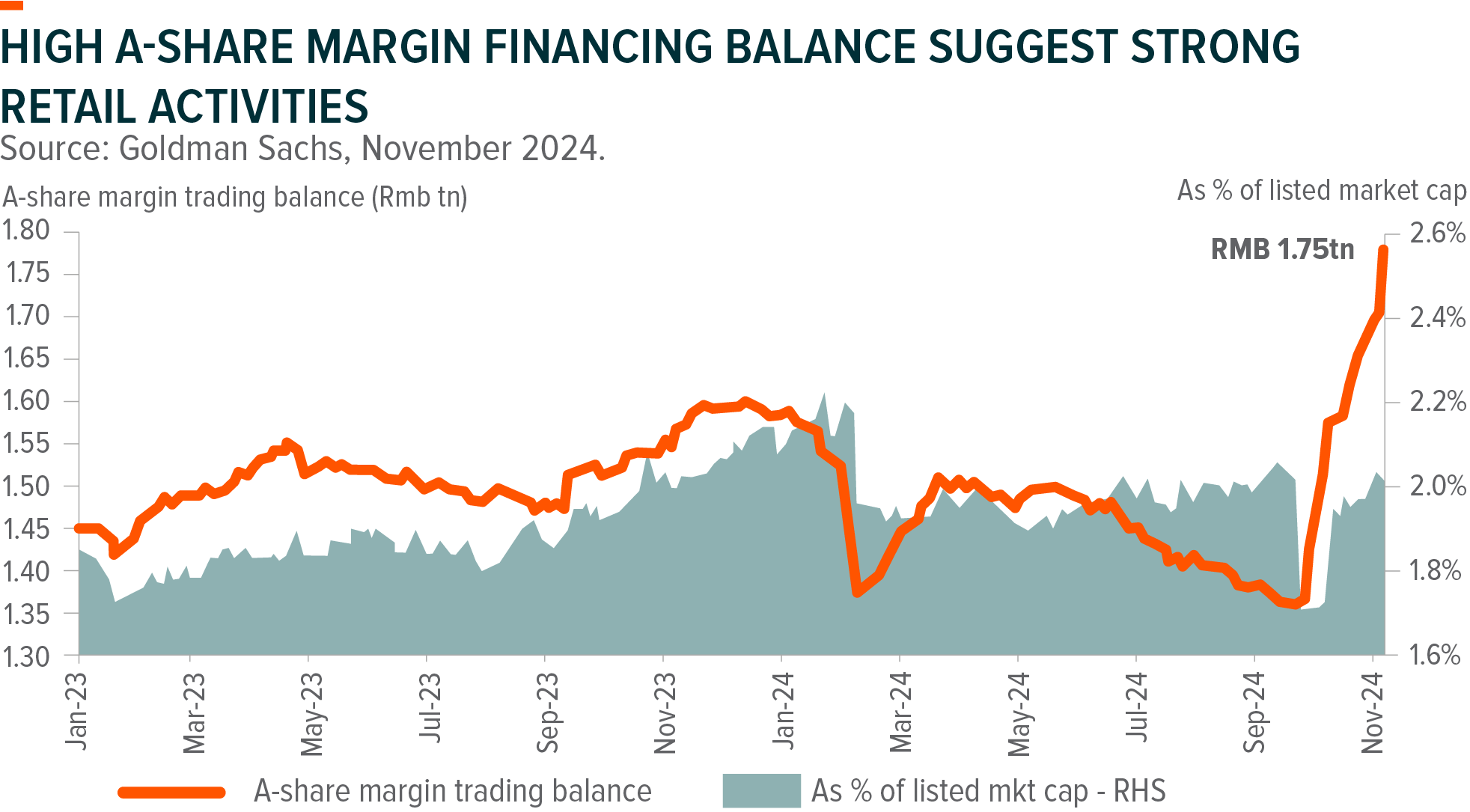

Retail Sentiment Upticks On The Back Of Market Rally And Policy Supports

China market recorded sharp rally at end-September as bolstered by supportive policies, driving a rapid uptick in retail investor sentiments. A Share turnover reached record-high Rmb3.5trn on the first trading day after national holiday (October 8), and the trading volume remain elevated after the initial rally and subsequent market correction. A share margin trading balance, an indicator for retail investor sentiment, approached Rmb1.75trn, the highest since late 2023, suggesting strong retail activity. New market participants, including retail investors with newly opened accounts and institutional investors that seek to enter China market, should provide support for China market especially during correction. After the sentiment driven market rally, a more sustainable share market rebound would hinge on economic and corporate earnings recovery, which we now have better visibility on given the supportive stance from central government and the gradual rollout of fiscal and monetary policies.