Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

CATL 3Q24 Results Beat With Robust Outlook Ahead

CATL reported solid 3Q24 results on 18 Oct after market. Net profit of Rmb13bn was +26% YoY. Excluding the one-off asset impairment of Rmb4.7bn, CATL’s 3Q24 core earnings implied c.30% beat vs consensus. 3Q24 revenue of Rmb92bn declined by 12% YoY mainly due to the c.30% YoY decrease in battery prices. EV Battery Unit GP of c.Rmb200/kWh was higher than consensus estimates, driven by product mix premiumization and cost savings from manufacturing advantages. ESS battery sales volume grew by 63% YoY driven by solid US demand, and accounts for c.25% of total battery sales volume for CATL.

Outlook – Solid Demand and Profitability Ahead

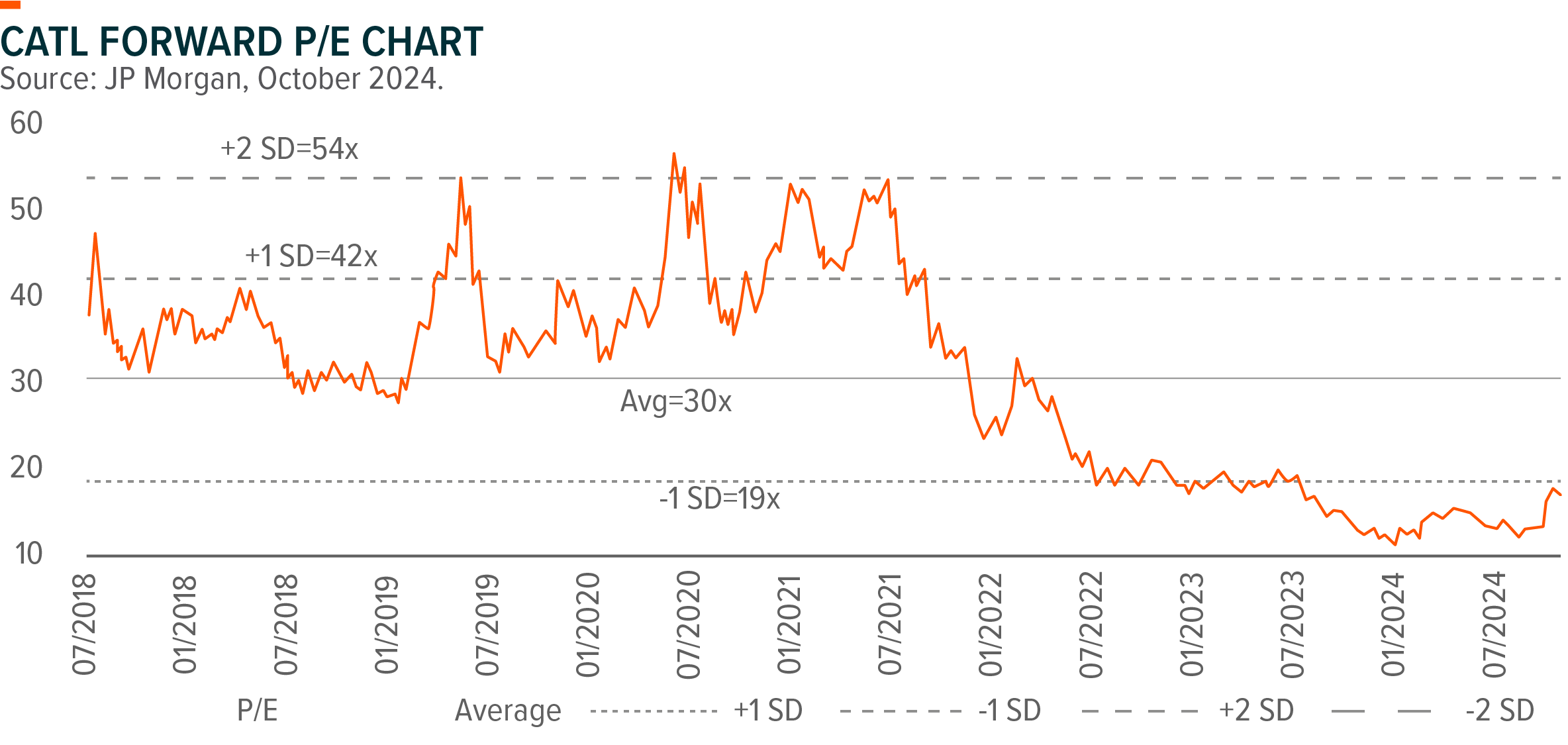

Robust demand in 3Q drove capacity utilization recovery, and CATL is operating at nearly full capacity currently. Management is seeing even better 4Q order momentum as compared to 3Q, which should support CATL to regain revenue growth in 4Q on the back of stabilizing battery prices. EU OEMs are on track to launch new EV models as the auto industry stick to 2025 carbon emission targets, which should support volume growth for CATL. Product mix upgrades bode well more stable profitability. Management expects Shenxing and Qilin battery (with higher unit profit) to account for ~70-80% EV battery shipments in FY25, from current 30-40%. CATL continues to adopt a prudent capacity expansion plan, and the marginal CAPEX pick up in 3Q is to accommodate solid demand growth. On the back of solid growth outlook, CATL is only trading at 16.6x 2025E PE, 1S.D. below its historical average.

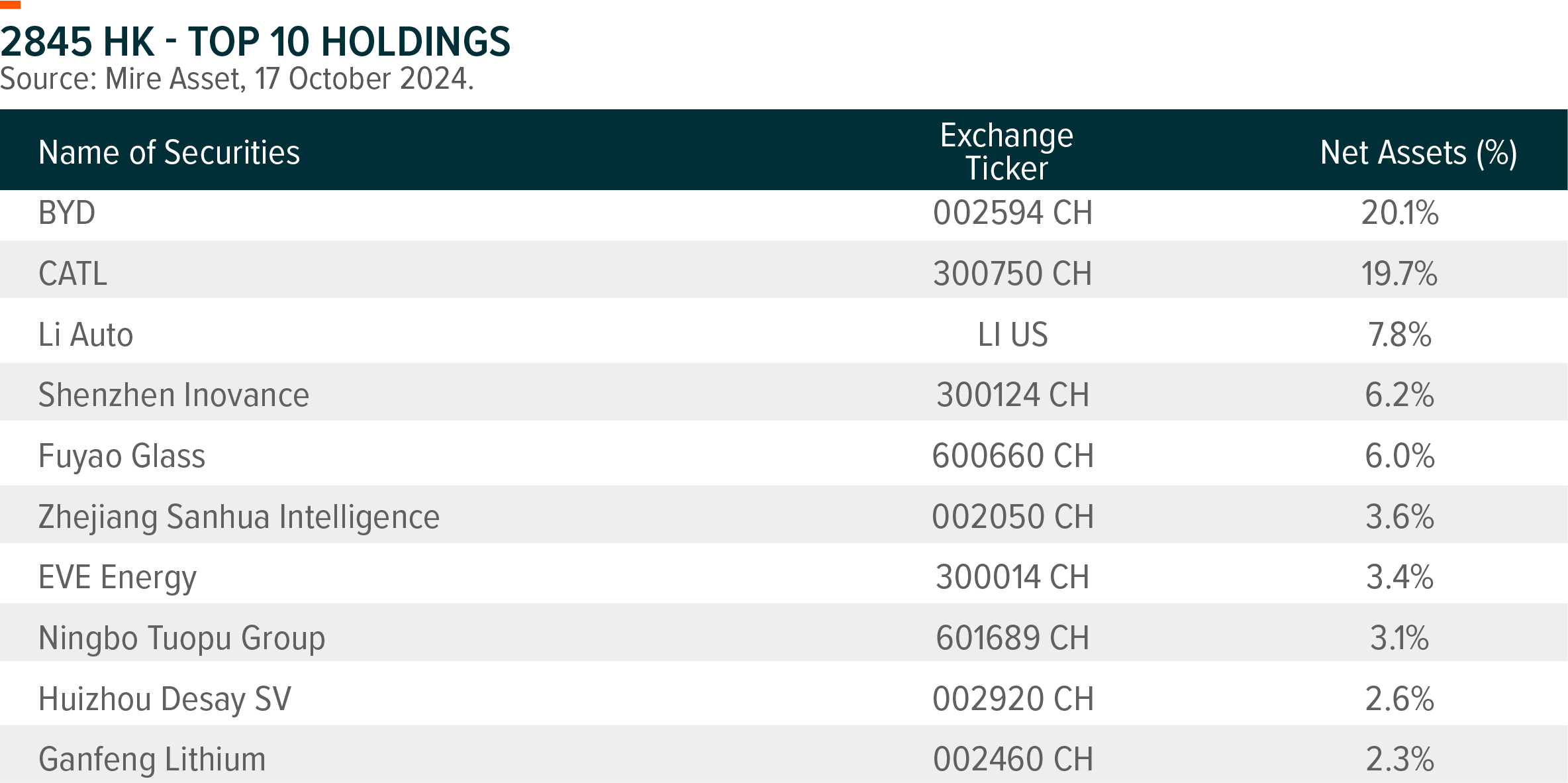

Global X China EV and Battery ETF (2845 HK) invests in leading companies across China EV and Battery value chains. Our positive outlook for China EV sector is bolstered by strong EV demand, supportive trade-in policy, improved competitive landscape, and lowered financing costs in a rate cut cycle. Battery sector is also nearing an inflection point with improving supply-demand dynamics as battery makers react to overcapacity issues through more rationalized Capex. In addition, the continue decrease in lithium prices should also lower the costs for battery and automakers and thus support better profitability outlook across the value chain.

Related Global X ETF

| Global X Electric Vehicle and Battery ETF (2845 HK) |

|

|---|---|

| SEHK Listing Date | 17 Jan 2020 |

| Reference Index | Solactive China Electric Vehicle and Battery Index NTR |

| Primary Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.68%p.a. |

| Product page | Link |

Source: Mirae Asset, 21 Oct 2024. The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. The ongoing charges figure is an annualised figure based on the ongoing expenses of the Fund, expressed as a percentage of the Fund’s average net asset value over the same period. The figure may vary from year to year. The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. The single management fee does not include the fees related to FDIs (including swaps) entered into by the Fund. The ongoing charges of the Fund are fixed at 0.68% of the Fund’s net asset value, which is equal to the current rate of the management fee of the Fund. For the avoidance of doubt, any ongoing expenses of the Fund exceeding the ongoing charges of the Fund (i.e. the management fee) shall be borne by the Manager and shall not be charged to the Fund. Please refer to the Key Facts Statement and the Prospectus for further details.