Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Index is reconstituted annually. Eligible securities are added into the Index as constituents during the next scheduled annual reconstitution. Similarly, securities that no longer meet the eligibility criteria of the Index may continue to remain in the Index until the next scheduled annual reconstitution, at which point they may be removed. There is no guarantee that the representativeness of the Index is optimised from time to time.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index Calculation Agent calculates and maintains the Index. If the Index Calculation Agent ceases to act as index calculation agent in respect of the Index, the Index Provider may not be able to immediately find a successor index calculation agent with the requisite expertise or resources and any new appointment may not be on equivalent terms or of similar quality. There is a risk that the operations of the Index may be disrupted which may adversely affect the operations and performance of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the Stock Exchange of Hong Kong is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future.

- Global X Innovative Bluechip Top 10 ETF (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Index is an equal weighted index whereby the Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Index.

- The Fund’s investments are concentrated in companies with a technology theme. Many of the companies with a high business exposure to a technology theme have a relatively short operating history. Technology companies are often characterised by relatively higher volatility in price performance when compared to other economic sectors. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. Rapid changes could render obsolete the products and services offered by these companies. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in companies in the technology sector. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The number of constituents of the Index is fixed at 10. The Fund by tracking the Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- Global X India Select Top 10 ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index (the “Underlying Index”).

- The Underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- The number of constituents of the Underlying Index is fixed at 10. The Fund by tracking the Underlying Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- High market volatility and potential settlement difficulties in the equity market in India may result in significant fluctuations in the prices of the securities traded on such market and thereby may adversely affect the value of the Fund. The BSE has the right to suspend trading in any security traded thereon. The Indian government or the regulators in India may also implement policies that may affect the Indian financial markets. There may also be difficulty in obtaining information on Indian companies as disclosure and regulatory standards in India are less stringent than those of developed countries.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The investment objective of Global X K-pop and Culture ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive K-pop and Culture Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is KRW but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary on Global Thematic ETFs – Aug 2024

Global X Japan Global Leaders ETF (3150 HK)

Industry Update

In July 2024, the FactSet Japan Global Leaders Index experienced a loss of 3.5% in JPY terms1, followed by a substantial volatility in early August. On 31 July, BOJ decided to raise policy rate from 0-0.1% to 0.25%, the highest level since 2008. In addition, BOJ governor’s hawkish comments point to risk of the next hike to be brought earlier, depending on upcoming data.2 USDJPY rose rapidly to over 1453 on BOJ’s rate hike and the upcoming fed rate cut, leading to the unwind of ‘Carry Trade’ that resulted in a global risk asset sell-off in early August.4

Stock Comments

- Canon recorded return of 8.9% in July, a key contributor to index performance. The company recorded better-than-expected operating profit in quarterly results on reduced costs and growth in new businesses. Full-year OP target lifted to above consensus on sales growth and currency weakness. Possible catalysts ahead include increased profit benchmarks and disclosure of restructuring details ahead of F12/25.5

- Toyota recorded negative return of -10.4% in July, a key detractor to index performance. Toyota reported in-line quarterly results, with revenue boosted by upward price revisions, while normalized industry conditions, including rising inventory and incentives, remain a risk.6 Toyota’s share price correction is attributable to concerns about yen appreciation and worsening sales climate, yet its unique positioning and competitive edge should remain solid in the industry.

Preview

Japan stock market is undergoing massive volatility under concern for JPY appreciation and US economy recession. While short term outlook remains uncertain given potential for further Carry Trade unwinding and slowing global economy, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. Stock price and valuation returned to an attractive level after the share price correction, providing support for potential stock market rebound when near term obstacles fade away.

Global X Innovative Bluechip Top 10 ETF (3422 HK)

Industry Update

Microsoft delivered in-line results, continue to invest in AI

Microsoft reported June quarter results. Azure June quarter +30% YoY vs guide 30-31%, street 31%+. Management expect Azure growth to accelerate as capital investments create an increase in available AI capacity to serve more of the growing demand.

The company reported June quarter total CAPEX was 19bn, well ahead of street expectation. Management guided FY25 (June) CAPEX to be higher vs FY24. In FY24 Microsoft CAPEX was + 58% YoY at 44.48bn USD (74bn USD FCF+25% YoY).7

Meta result beat

Total revenue of $39.1 billion (+23.3% Y/Y ex-FX) came in just above the high-end of guidance led by advertising revenue growth of +22.9% Y/Y ex-FX as impressions and pricing each rose +10% Y/Y and 3Q revenue guidance came in ~2% above consensus at the mid-point. EPS of $5.16 came in better than consensus of $4.72, with Family of Apps reaching ~50% OI Margins. Meta maintained its ’24 Opex guidance range and raised the low-end of its’24 Capex guide to $37-40 billion.8

Global X India Select Top 10 ETF (3184 HK)

Industry Update

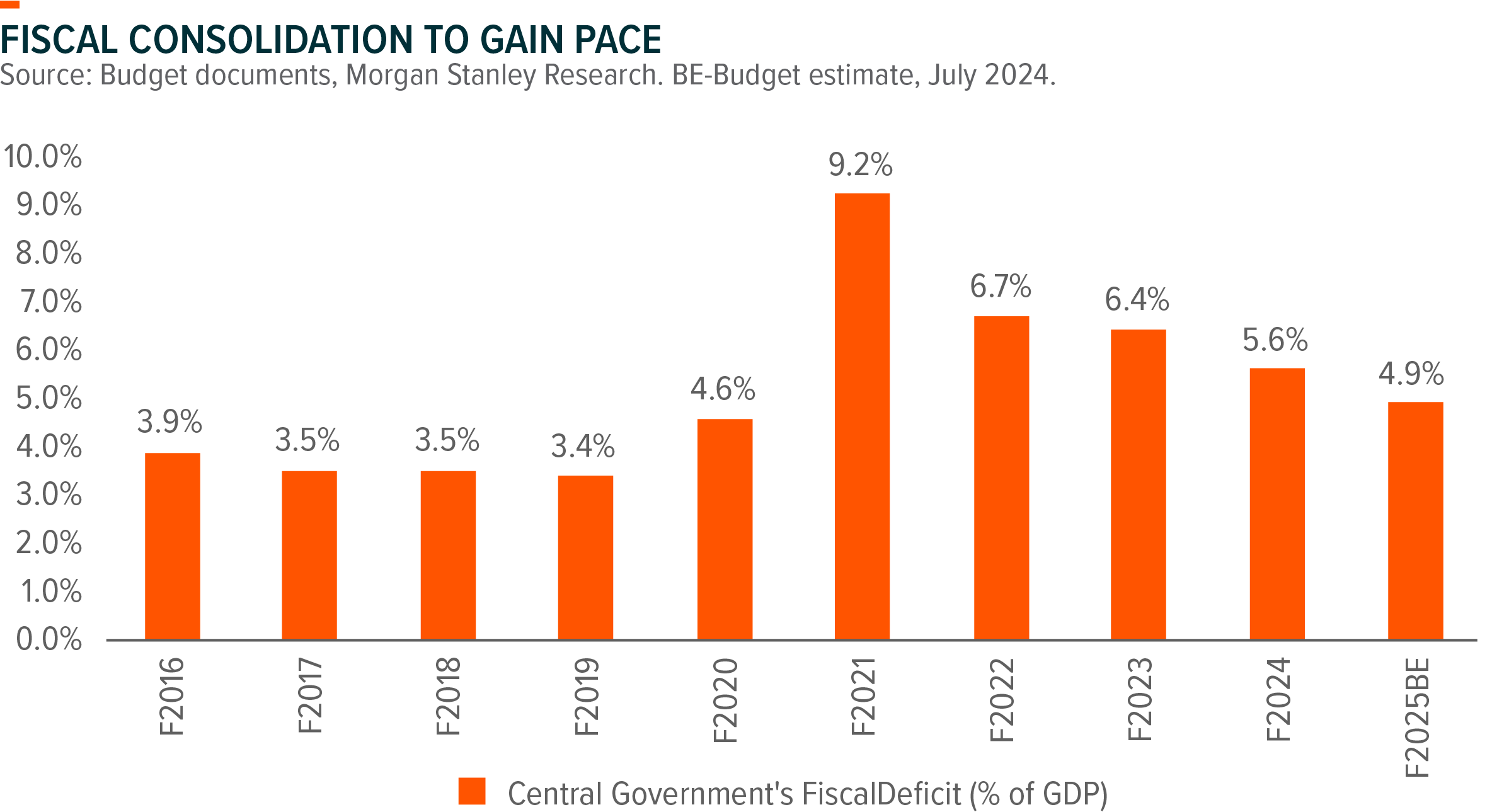

FY2025 budget focused on fiscal consolidation while keeping momentum on capex investments and focusing on enhancing skills and job creation for sustainable growth. The government targeting fiscal deficit of 4.9% of GDP for FY25 came in as a surprise to market as this was lower than 5.1% of GDP shared during interim budget earlier this year. Overall capex for FY25 came in line with the expectation as well as interim budget which is Rs 11.1tn or 17.1%yoy growth. CAPEX is expected to increase to 3.4% of GDP in FY25E from 3.2% of GDP in FY24. Meanwhile, there was no major surprise on rural spending, in fact, overall social sector spending is expected to moderate driven by lower core subsidy in FY25. That said, the government laid particular focus on employment and skill enhancement which is more important and structurally positive for India’s mid to long term growth outlook.Monsoon has been strong so far this year and consumption growth is expected to be broad based with improving trend in rural demand. For instance, FMCG sales have shown rural outpacing urban in 4QFY24 as well as 2 wheelers sales outpacing 4 wheelers in recent months. Consumer sentiment in India also have surpassed pre-pandemic levels. While food CPI remains sticky, core CPI continues to trend down further leading to overall headline CPI to stay at 5.08% in June.

Stock Comments

- Infosys was the major contributor in July after the company handsomely beat its 1QFY25 results. The company reported revenue growth of 3.6%qoq, 2.5%yoy compared to consensus estimate of 2.3%qoq. EBIT margin expanded 100bp qoq reaching 21.1%. The company raised the FY25 revenue guidance band to 3-4%yoy from 1-3%yoy earlier. The management shared that they are seeing early signs of improvement in the US financial services while the broader environment for discretionary spends remains unchanged. Overall IT services sector have performed well this month as the market believes the worst is behind for the sector after the company’s results.

- HDFC Bank was the major detractor in July due to its disappointing 1QFY25 results. Overall loan growth was muted as the bank aiming to bring LDR down to pre-merger levels of ~85% from 104% in 1QFY25. The street now expects weaker loan growth as the bank is slowing down balance sheet faster than expected, hence this has led to earnings cut for FY25 after the results and also underperformance of the stock during the month.

Preview

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.

Global X K-pop and Culture ETF (3158 HKD)

Industry Update

As per the Bank of Korea’s survey, consumer confidence continued to strengthen in July, increasing by 2.7 points to reach 103.6, following a 2.5-point rebound in June. This marks the highest level recorded since April 2022. Sectors such as Healthcare, Financials, Consumer Staples, Industrials, Internet, and Utilities performed well, while Energy, Technology, Materials, and Consumer Discretionary sectors showed weaker performance.

Share performance of entertainment companies was under pressure in July. The aggregate album sales of the big four companies have declined by more than 40% for the first six months of 2024. Additionally, a shift towards live performances has negatively impacted overall margins. The prolonged conflict between HYPE and Ador has also raised apprehensions.

Stock Comments

- Netmarble (251270 KS) has demonstrated robust sales momentum thanks to the successful launch of new games such as Solo Leveling, and Raven 2 in May 2024. We remain positive on Netmarble in 2H24 on the continuous expansion of its gaming portfolio with consistent releases, a varied user base and genre selection, and persistent cost control measures, notably in enhancing the effectiveness of marketing strategies compared to prior approaches.

- Amorepacific (090430 KS): The Prime Day event in July stands as Amazon’s second-largest shopping event. Within the beauty and personal care category, Amorepacific’s flagship brand, COSRX, clinched the top spot, with Laneige’s two products securing the third and fourth positions. This success underscores the widespread appeal of its major brands in the US market and highlights the substantial growth prospects for Korean cosmetics on a global scale. Despite this, market concerns have aroused regarding Amorepacific’s exposure to China market, as the company has revised down its guidance on Chinese business due to sluggish cosmetics consumption trends in the region.

- HYPE (352820 KS): HYPE’s stock has experienced fluctuations since announcing in April 2024 that it had commenced an internal audit of their 80% owned subsidiary Ador. In the short term, investor sentiment may be challenged due to concerns regarding the potential repercussions on the brand equity of artists and artist retention amid a prolonged internal management dispute.

Preview

Despite short-term volatility, we maintain positive on the K-Pop and cultural phenomenon surge in the international market and expect it to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food. Beyond that, price competitiveness and compelling value propositions stand out as key factors driving the strong export of Korean consumer goods in the global market, especially under current economic uncertainties and consumer downtrading trend. Yet, we remain cautious on the impact from China market especially for some companies with meaningful China exposure.

Global X Asia Semiconductor ETF (3119 HK)

Industry Update

TSMC reported strong result and guidance

TSMC raised its full year revenue guidance to “slightly above mid-20%s” YoY (from low to mid 20%s previously vs street 23% YoY USD, 30% YoY NTD) For 3Q24, management guided revenue to be in the range of US$22.4-23.2bn (+9.5% QoQ at midpoint; based on FX of 32.5), GM in the range of 53.5-55.5%, and OpM in the range of 42.5-44.5%. GPM guide ahead of street implies HSD upside to Street’s 3Q24 EPS of 11.3 NTD before the call. (Company data, Mirae Asset)

Samsung HBM3e to ramp in 2H24

The company will increase HBM3E sales portion and capacity expansion. 3e8H mass production in 3Q, 3e12H ramp in 2H24. HBM3e’s share in HBM sales to exceed mid-teen in 3Q and high-60% by 4Q. HBM bit shipment to increase by 4x in 2024, 2x in 2025. Management expect memory ASP recovery to continue with modest demand growth in 3Q. (Company data)

Stock Comments

- Naura Technology, China domestic CAPEX on track to see solid growth as domestic memory and logic production are expected to ramp over the next few years. Naura is well positioned as one of the domestic leader in semiconductor equipment.

- SMIC, Domestic foundry utilization continues to recover on restocking orders. Regional mature foundries like UMC also reported better than feared margins provide support to the foundry segment sentiment.

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. Currently we are still in the process of cycle recovery as both stocks and earnings are below previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024.9