The Next Frontier for Solar-grade Wafer

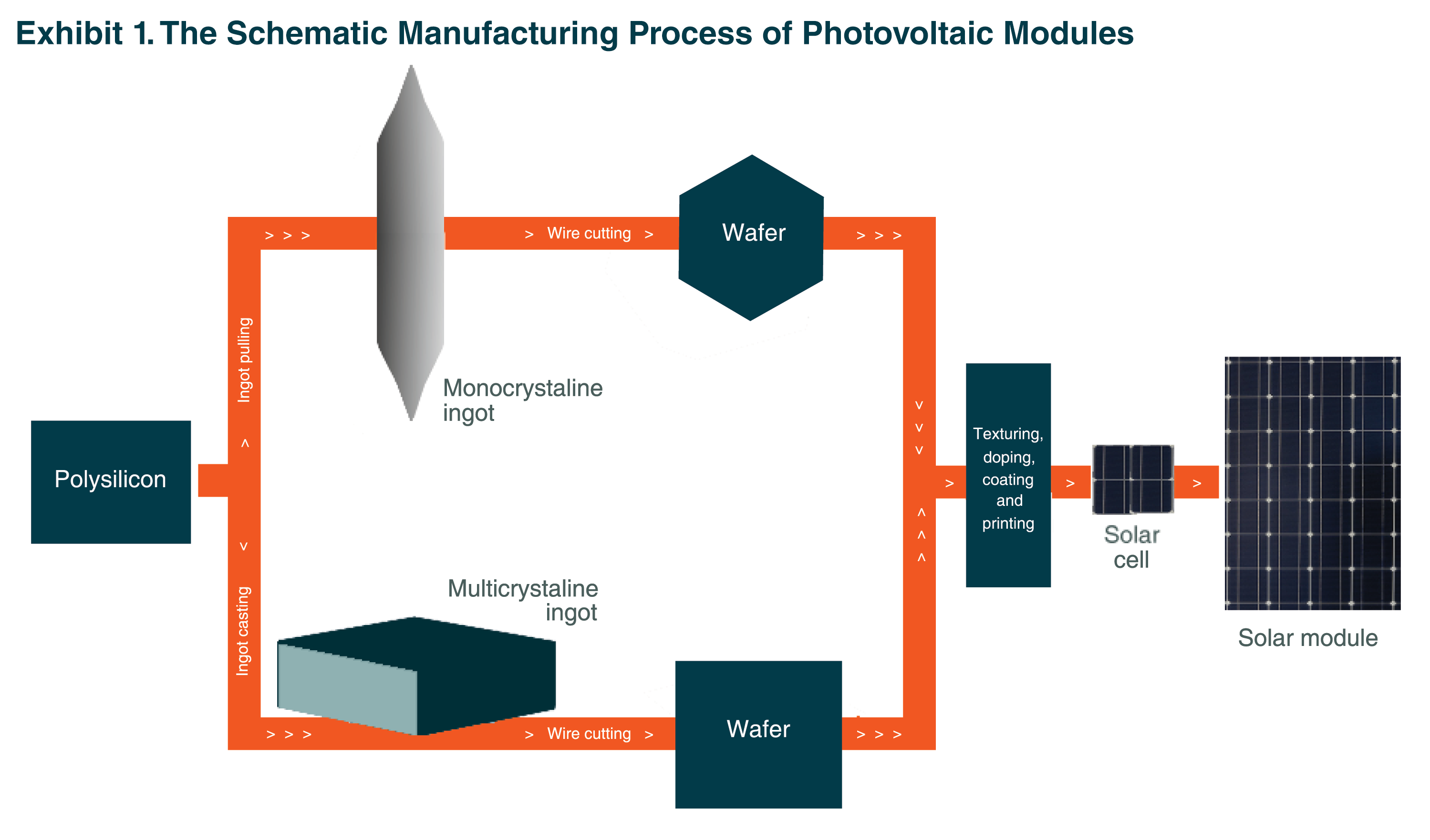

The renewable energy across the globe enters into a new phase of growth by customer demand, competitive cost, and innovation, being the primary growth driver for the solar-grade wafer market in the coming few years. In this chapter, we elaborate on the evolution of solar-grade wafer, newcomer’s roadblock, and its opportunity and future.

Evolution of Solar-grade Wafer Industry

Solar-grade wafer originates from the semiconductor-grade wafer. Most of the players who are currently producing solar-grade wafers such as Longi and Zhonghuan (China), Sumco (Japan), and SunEdison (formerly MEMC Electronic Material, USA), started their business with semiconductors before 2010. As the photovoltaic market was small before 2010, Chinese cell and module producers integrated the supply chain by extending to wafer with small capacity.

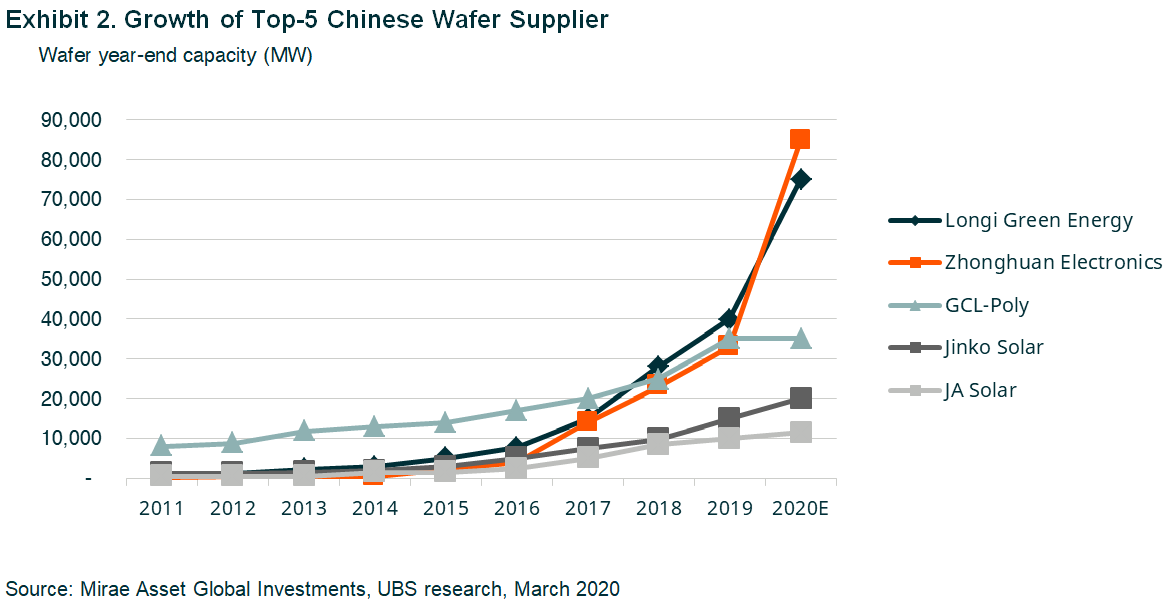

As China’s solar market grew up, GCL-Poly Energy (“GCL”), the biggest polysilicon maker in China, extended to multi-wafer business. Their production dominated the market for a period until Longi, the afterward largest mono-wafer maker, brought in mono module products in 2015, showing the market mono-product was able to achieve higher conversion efficiency with the same level of unit cost. Then the downstream cell and module makers began to switch to the mono technology route.

Roadblock for Foreign Newcomers

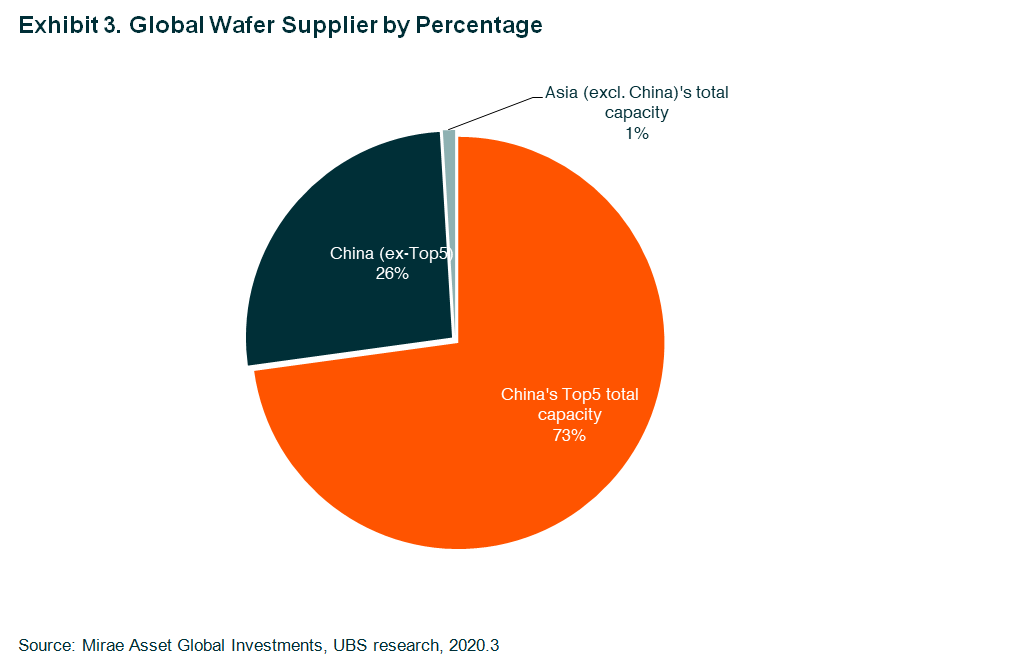

Different from polysilicon, where non-Chinese companies were forced to exit in the long-term competition, Chinese wafer players took the growing part of the pie from the beginning of the solar industry booming. Solar supply chain in China, from silicon to end solar farms, provides local players with competitive advantages in cost, supply chain coordination, and collaboration, which left no room for overseas entrants.

Similar to the semiconductor-grade wafer, solar-grade wafer production is a fine manufacturing business with four key inputs: solar-grade polysilicon, equipment, and auxiliary materials (ingot furnace, cutting machine and diamond cutting lines), energy and labor. As we mentioned in the previous article (The Innovation Race: How China’s Polysilicon Industry Has Upped Its Game), China is the largest supplier of polysilicon and enjoys the lowest retail power cost and labor cost. Similar to the polysilicon industry, after domestic substitute of key equipment and auxiliary materials, Chinese players take all the competitive advantages in massive production. Being the biggest supplier of wafers, China enjoys the lowest cost with cheap logistics and less trading frictions, such as tariff and supply chain stability. It results in no overseas players being able to enter into this business.

Technological Drivers

Same as polysilicon, adequate liquidity, cash cost, and sale price are essential for players to determine to grow in the down cycle. Additionally, technology is another critical factor in determining success in the long run. Similar to semiconductor wafer business, downstream demand, equipment, and innovative production processes drive the development of wafer. Semiconductor wafer is different from the chemical business (polysilicon) in which technology is relatively stable. Technology innovations in cell and module propose new requirements on wafer size, thickness, and components, and so on, which further results in equipment adjustment and adaptation.

On the contrary, the innovations in equipment help with higher efficient products as well as cutting costs of wafer, cell, and module. Those who are not well prepared for new technologies will suffer ultimately. Once innovation goes to the end, the lower margin the industry has, the fewer new entrants there are. It is easy to figure out the consolidation landscape following each player’s capacity expansion plan. As the photovoltaic industry is still new, we shall keep an eye on technology changes at the moment.

The Roads of Tomorrow

Top five Chinese wafer producers take a total market share of over 70% in terms of capacity by the end of 20191. The top two wafer makers, Longi and Zhonghuan, have been working on aggressive capacity expansion since 2017. Until now, the soft demand is expected to result in oversupply, may stop other players’ new capacity plans, and consolidate the leading position of the first two players.

In the long term, manufacturing business offers a relatively stable margin. Leading players either focus on wafer business and grow up with the solar market or look for the second growth line, for example, integration into a cell, module, or even energy storage business. Before reaching a stable state, there are still some ways to cut production cost by:

- enhancing the efficiency of wafers and accordingly equipment innovation to reduce unit production cost;

- achieving economy of scale to lower fixed cost amortization; and

- bringing revolutionary changes to a silicon-based solar cell.

Leaping into the Future

In the next few years, it is believed the downstream demand for solar-grade wafer will keep increasing at high speed, driving the boom of the industry in the foreseeable future.

The Global X China Clean Energy ETF is designed to offer investors efficient access to growth potential through companies critical to further advances and increased adoption of clean energy in China.

Other Key Features:

- Unconstrained Approach: The fund’s composition transcends the classic sector and industry classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the clean energy theme in China.

Please click here for more information on the Global X China Clean Energy ETF.