School’s Out, e-Learning Shines

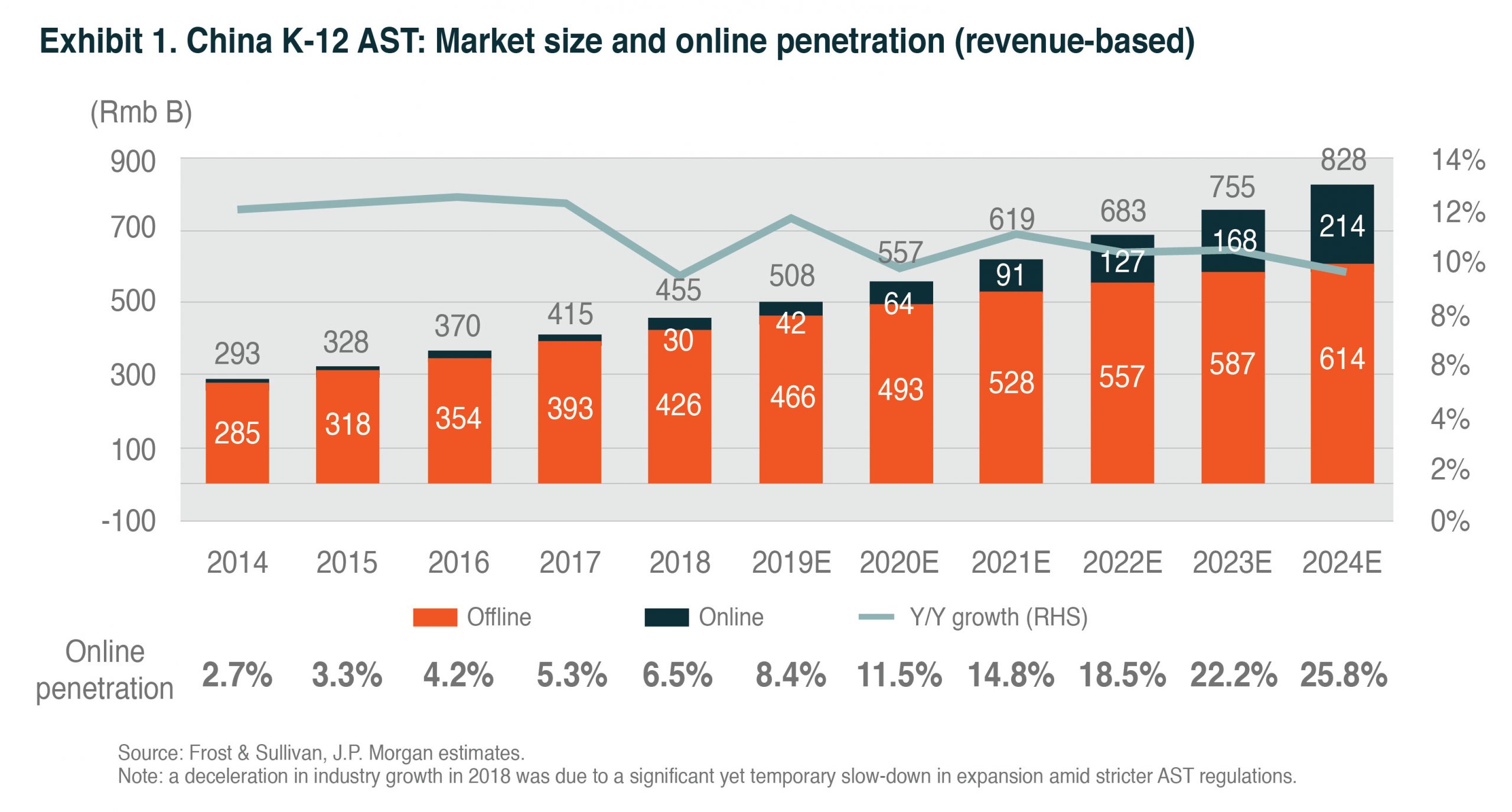

Online education will be the key growth driver in the After-school Tutoring (AST) industry in China, and we believe the COVID-19 pandemic could be a trigger point for the growth acceleration of the online education sector.

Schools in China had been closed since the Chinese New Year until May, and most students had to stay home and took various online courses instead. Leading online AST players have been actively providing free online courses, leveraging this opportunity and engaging with students to expand their user base and increase market penetration. Thus, we believe online education can meaningfully take off in China after the COVID-19 pandemic.

Online Learning Sees a Surge in Demand

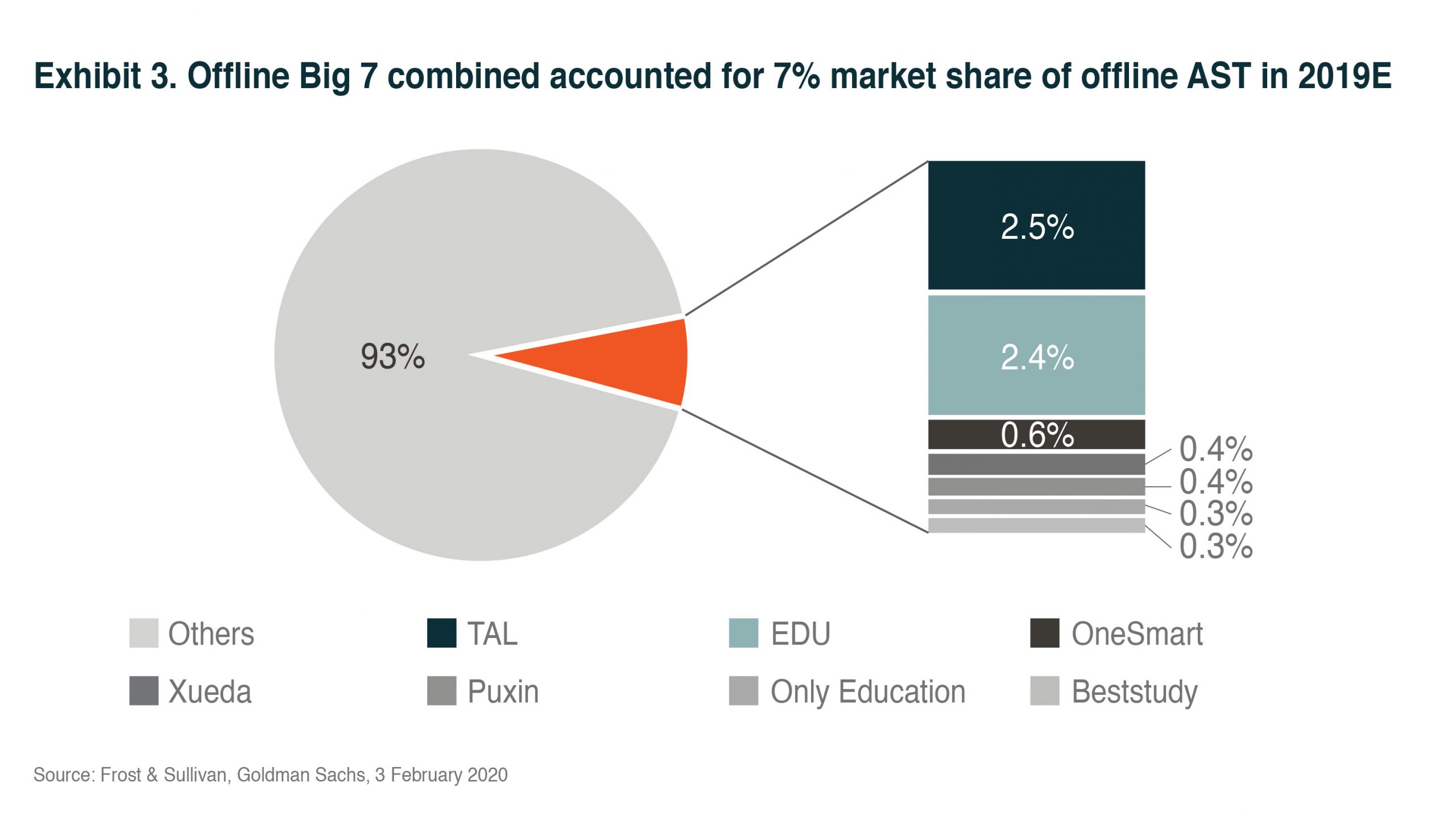

Online education is the most effective and efficient way to penetrate low-tier cities in China, where 70% of the K-12 population resides.1 AST industry is vast and fragmented by the nature of the business. Albeit leading players like TAL and EDU have been aggressively opening offline new learning centres in the past several years, they only have less than mid-single-digit market shares combined in the total offline AST market. However, online education has no physical constraint that will be a scalable business, through enhancing its content quality and services.

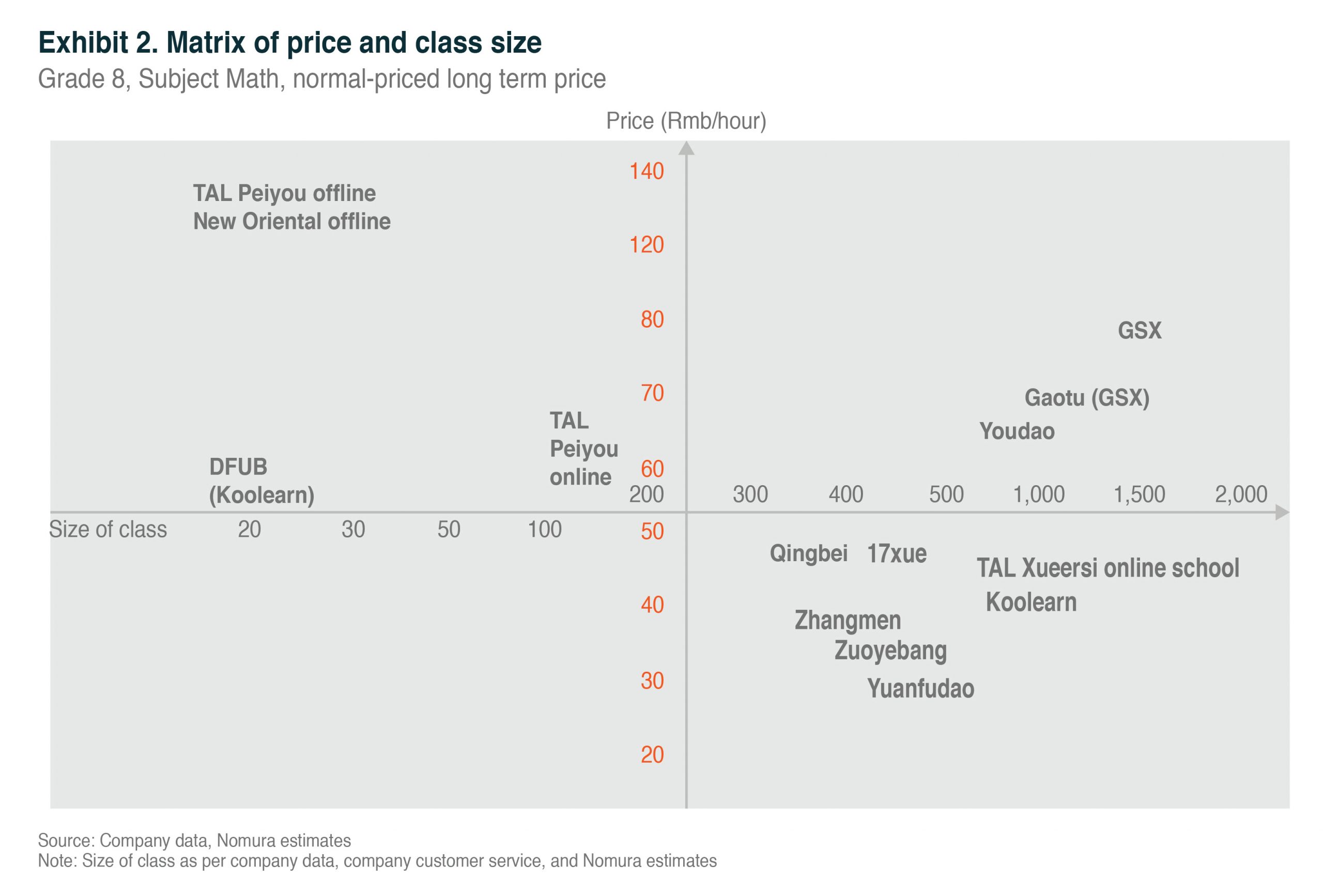

Additionally, parents find online education learning easily affordable because it costs only around 40% of offline courses. This preferential price opens the door to students in both low and top-tier cities that online education providers expand the addressable market through low entry price points.

According to TAL, offline courses are priced at around RMB 3,000-4,000 per subject each semester, which translates into roughly RMB 10,000 per subject every year. In Beijing, the average salaries for single and double-income families are RMB 8,000 and RMB 16,000 per month (before tax). Even though there are many affluent families in top-tier cities in China, there is a large portion of low, and middle-income households in top tier cities that can’t afford those AST classes.

Moreover, students today are tech-savvy and inclined to use digital formats, comparing to their parent generation. Most K-12 students are born after the invention of smartphones that they find convenient and straightforward to take courses at homes without spending hours in traffic.

Ed-tech Tools for Online Learning

There has been a significant number of investments going into online education from technology and R&D to sales and marketing. GSX may be one of the very few companies which currently is profitable from online education business, while most of the rest are loss-making as they are still in investment mode. As a result, technology on education has been developing fast, and this will continuously enhance the quality of content and, more importantly, services to compete with offline services aggressively.

Education companies have been actively investing in artificial intelligence (AI) in recent years. For instance, there are AI-based courses for kids aged below ten years old such as Monkey English by TAL and Zebra Thinking by Yuanfudao. Kids learn through their play, which could hold a more extended period of their attention. Also, the companies have been developing facial and voice recognition systems to capture students’ performance in different subjects, providing feedback to both teachers and students after the classes to enhance productivity and efficiency of learning.

Teachers’ Quality Matters

There is an enthralling trend related to teachers’ quality and content. For instance, GSX tech has a star teacher model, and its top instructors make several times more money than that of average offline teachers.

Many instructors in China are young, passionate, and willing to take challenges. Thus, they keen to be online teachers to have better pay and build franchises that could enhance their confidence and pride in their jobs. Teachers in GSX typically spend only 4-5 hours a week delivering lessons to students. The rest of their time will focus on developing and improving their content, that many teachers find it more interesting than re-using the same material several times.

Offline teachers usually use the same curriculum from time to time, which is not the case for teachers in massive open online courses with thousands of students. As a result, more passionate teachers with better content quality will increasingly shift to massive open online lectures, supporting faster online education growth.

Will E-Learning Go Viral?

The online education market is more consolidate and easy to control and regulate. According to the Ministry of Education, there are 718 registered online AST institutions in China compared to 401K reported offline AST institutions under the Ministry of Education investigation in 2018-19.

The top four players account for 20-25% of the total online AST market, and we expect they will grow at a rigorous pace by its nature of business. Online education currently accounts for 7% of the total AST market (USD 7bn), and is expected to take up 22-23% of the AST market by 2025E (USD 50bn).2

There are three types of online courses, namely 1) 1-on-1, 2) small class with less than 100 students per class, and 3) big online lectures with more than 100 students per class. The small class can further divide into pure online and online-merge-offline (OMO). In terms of gross billings breakdown, scalable class accounted for 52%, followed by 1-on-1 at 36% and small class at 13% in 2019E, according to Frost & Sullivan.

Companies have various views and strategies on online businesses, but all agree that online will be an essential part of the education industry. Most of the offline players, i.e., TAL and EDU, are pursuing OMO strategies for their existing offline courses. For instance, they teach two hours face-to-face in offline learning centres and incrementally add 0.5-hour online classes at home. OMO format is an extension of existing courses and thus does not require as much marketing and promotion as a purely online course.

The real competition is happening in the online course segment. TAL and other pure online players mainly focus on large classes, investing a significant number of resources to gain market shares. TAL is a leading player in both online and offline. It takes 11% shares online compared to 3% in the overall AST industry as of 2019E.3

Online AST industry is still at an early stage with 15% penetration and 7% shares in total AST market as of ’19E. Different types of AST formats exist in the current education system, which brings fierce competition in the market. We believe online will offer a large room of the growth potential in the AST market. That said, it is true that leading companies like TAL, GSX, Yuanfudao, Zuoyebang, 17 Edteach, etc. are ahead of the others and in a better position to ride on the online education growth.

Seize the Moment

The COVID-19 pandemic has become a trigger point of online education growth in China, and it will be an exciting area to watch out its growth path in the next few years. Our Global X Consumer Brand ETF (Ticker: 2806 HKD / 9806 USD) seeks to invest in high growth potential through companies that are positioned to benefit from consumption premiumization in China, is your gateway to seizing the tailwinds of online education.

THIS ARTICLE IS FOR EDUCATIONAL PURPOSES. NOT FOR SOLICITATION, OFFER OR RECOMMENDATION TO TRADE ANY SECURITIES.