Important Information

Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary on Global X China Semiconductor ETF (3191/9191)

Listen

Japan restricts chip-making equipment exports to China: On 23 May, the Japanese government unveiled details of its updated export control on China, under which local companies must have a license to sell 23 types of chip-making equipment to China. The curbs are set to take effect on 23 July. Japanese companies will need licenses to ship a broad range of semiconductor equipment spanning cleaning, deposition, annealing, lithography, etching, and testing. The scope of the ban is largely in-line with US export restrictions published in 4Q 2022. There are concerns about Japan’s restriction on the immersion lithography tool, which could become a reference for the Netherlands to draft its upcoming export control rule.

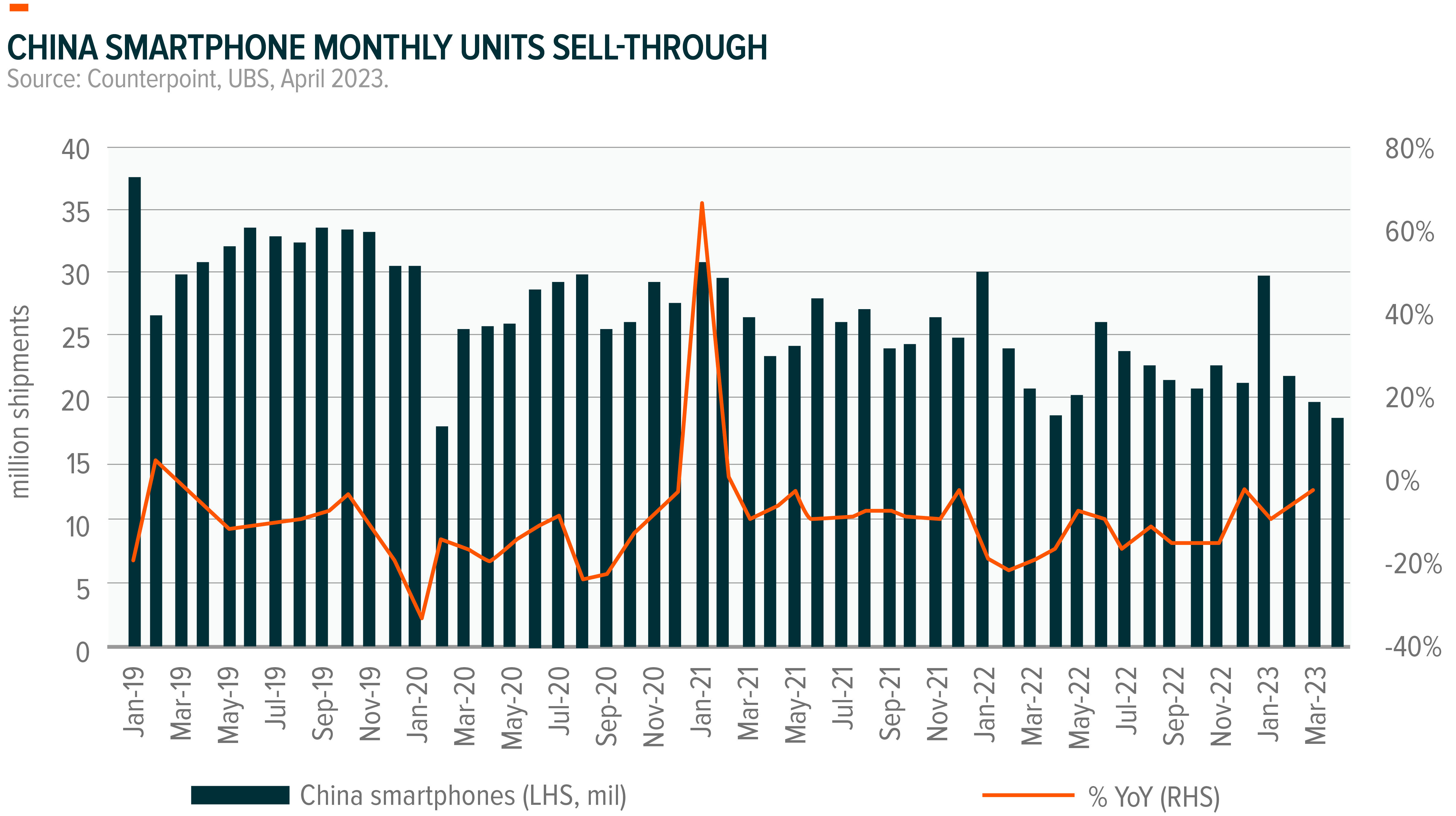

Smartphone shipments see monthly improvement in China: Global smartphone units sell-through for the month of April 2023 came in at 88.7 million units (-10.5% YoY), continuing from last month’s recovery in YoY growth, where February and March sell-through was -14.4% and -13.6% YoY, respectively.1 Similar to last month, the incremental improvement was most notably driven by YoY sell-through in China, improving to -1.9% YoY or 18.1 million units (was -9.9%/-5.7% in February/March). From an original equipment manufacturer (OEM) perspective, the month-on-month (MoM) improvement in YoY smartphone sell-through was primarily led by Android smartphones. Oppo, Vivo, and Xiaomi all showed incremental improvement in YoY sell-through for April to -11.1%/-18.5%/-8.0% YoY (was -17.2%/-29.5%/-14.4% YoY in March). The recovery was, for the large part, centered on both China (Xiaomi and Vivo) and the rest of the world (Oppo and Vivo).