Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X MSCI China ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- The Fund has a portfolio investing in companies whose operations are primarily in the PRC and therefore is subject to emerging market risks such as risks associated with uncertainty concerning PRC laws and regulations and government policies. Generally, investment in emerging markets such as the PRC are subject to greater risks than developed markets due to greater political, economic and taxation uncertainty and risks linked to volatility, market liquidity, foreign exchange, legal and regulatory risks.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region i.e. the PRC. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Global X ETFs in the ETF Connect

ETF Connect in Brief

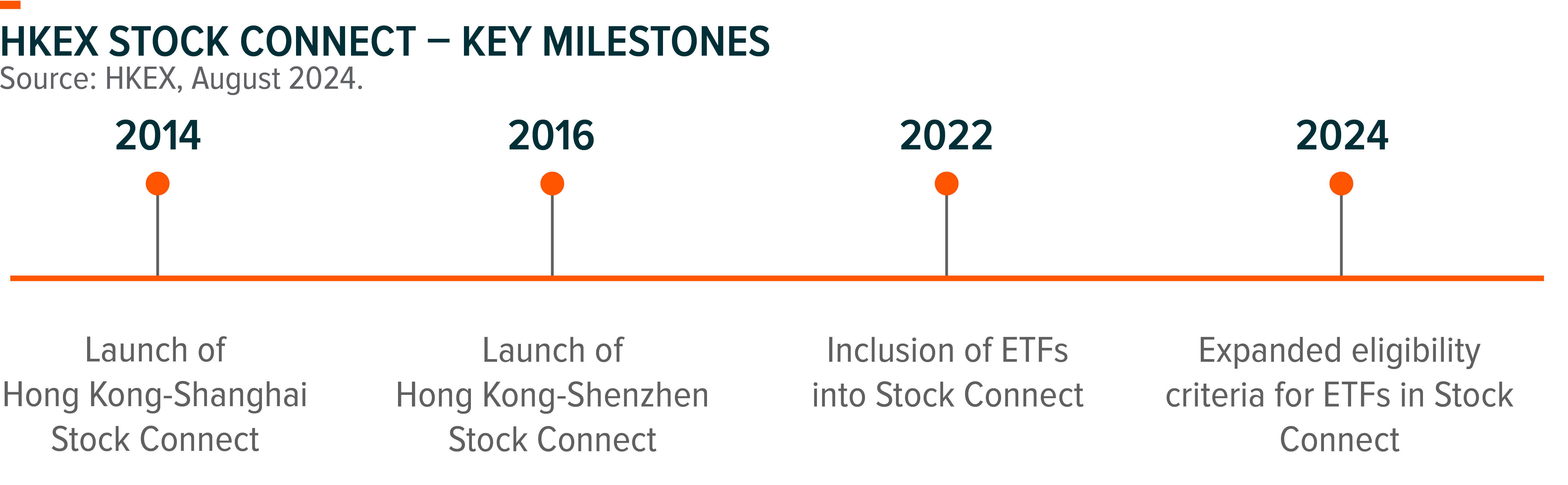

HKEX’s Stock Connect Program was launched in 2014, enabling qualified mainland China investors to access eligible Hong Kong shares (Southbound) and allowing Hong Kong and overseas investors to trade eligible A shares (Northbound) subject to a certain amount of daily quota. ETFs were included into Stock Connect Program in 2022, with a total of 16 ETFs included in Southbound Stock Connect Program as of August 2024.

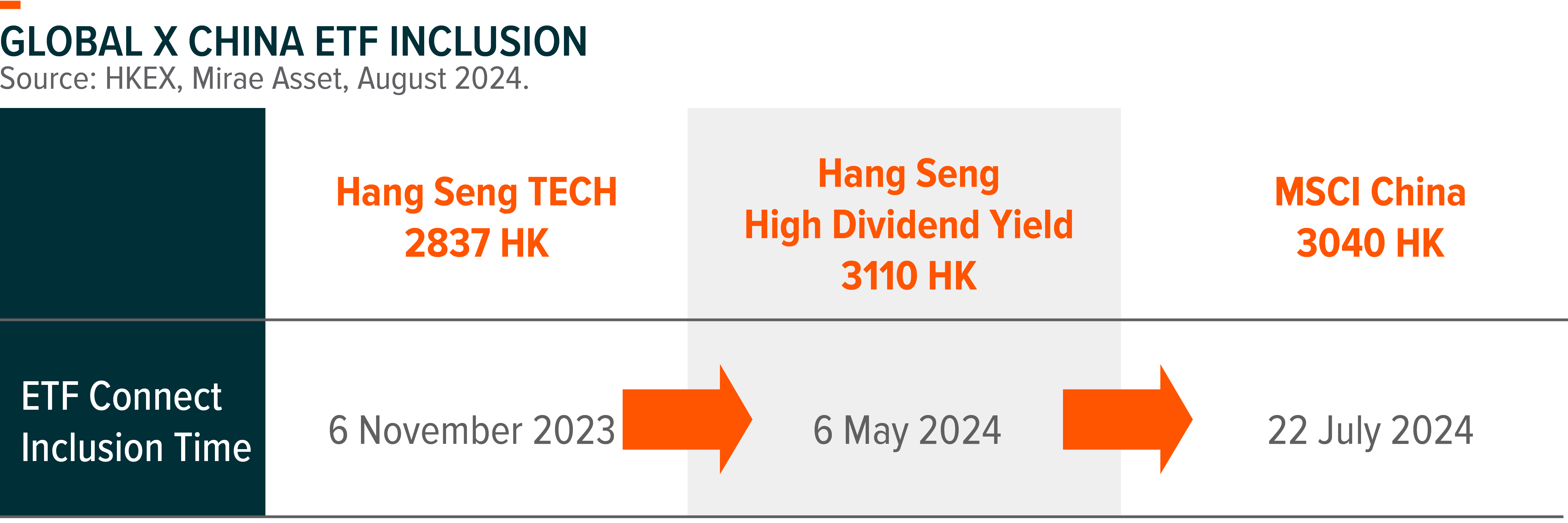

Three Global X China ETFs, namely Hang Seng Tech ETF (2837 HK), Hang Seng High Dividend Yield ETF (3110 HK), and MSCI China ETF (3040 HK), are included in ETF Connect, providing easy access for mainland investors to invest in high quality companies listed in China A, Hong Kong, and US markets.

Global X Hang Seng High Dividend Yield ETF (3110 HK)

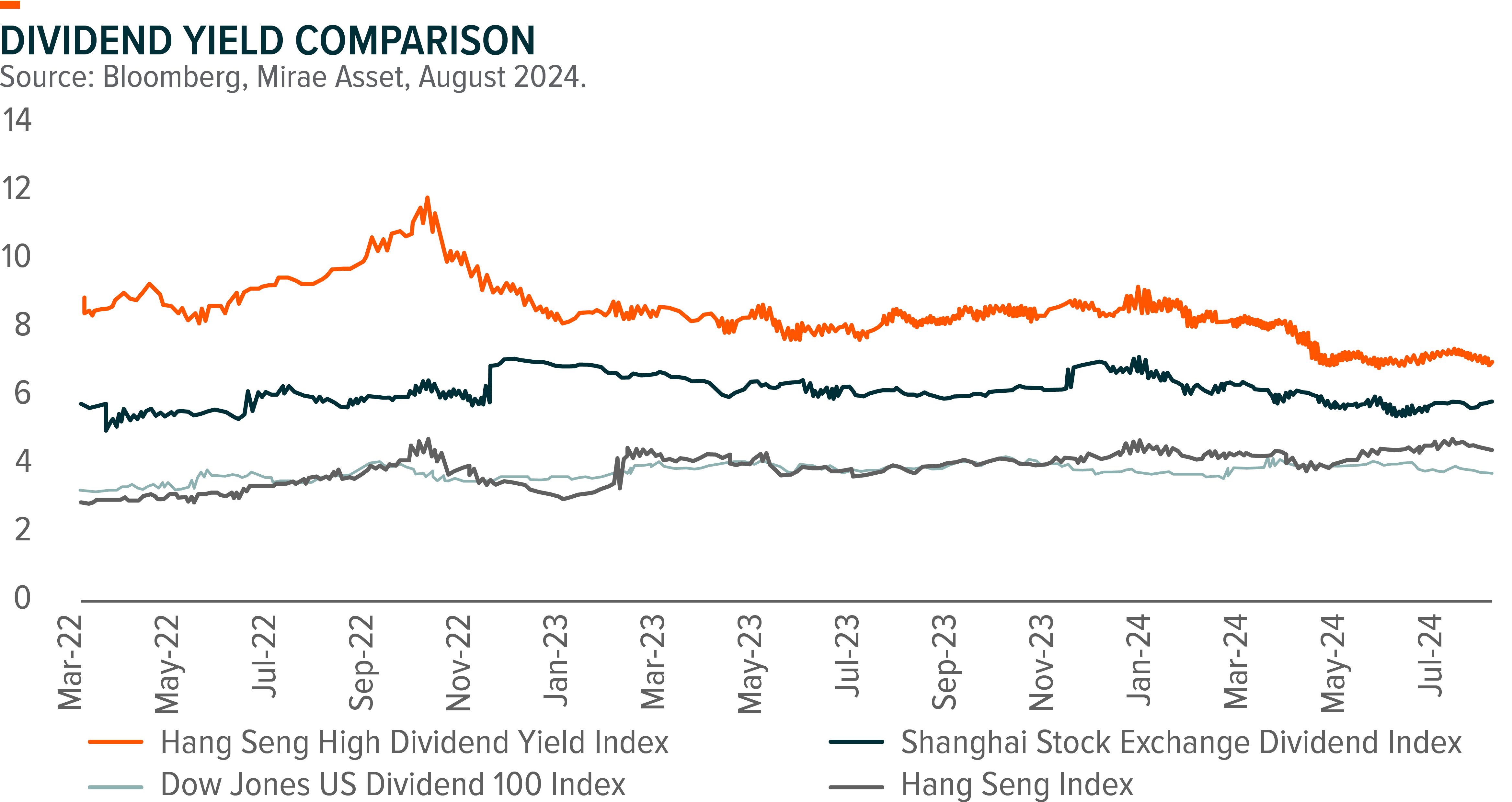

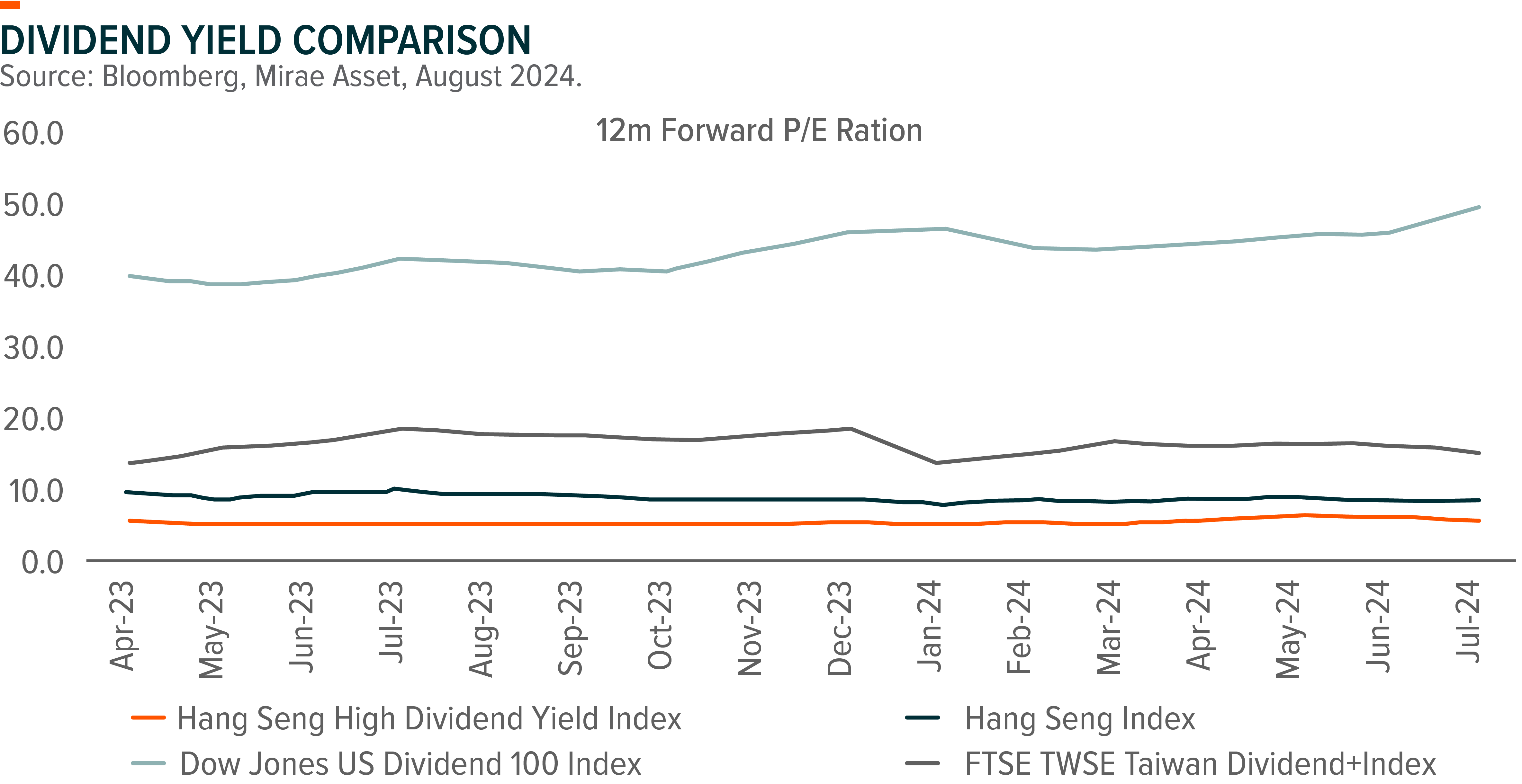

High dividend strategy continues to gain traction amid lingering economic growth concern and rising Fed rate cut expectations. In addition, there are potential incremental fund flows from household savings currently deposited in the bank to seek higher yield, as savings rates are falling. Among major markets, Hong Kong high dividend stocks deliver the most attractive dividend yield thanks to the lowest valuation among peers. Its healthy free cash flow and relatively conservative payout ratio should support more sustainable dividend payment. Compared to A Share listed peers, Hang Seng High Dividend Yield Index offers exposure to Hong Kong Infrastructure, Utilities, and property (REITs) stocks, which provide stable dividends and limited price downside given low valuation.

3110 HK is the largest Hong Kong listed high dividend ETF (HK$5.1bn AUM)1 with over 10 years of operating history. The ETF provides over 8% annualized dividend yield2, and is subject to annual rebalancing to ensure the sustainability of dividend yield. Notably, over 55% of its holdings are SOEs3, positioning the ETF to benefit from the “VCC” and SOE rerating theme.

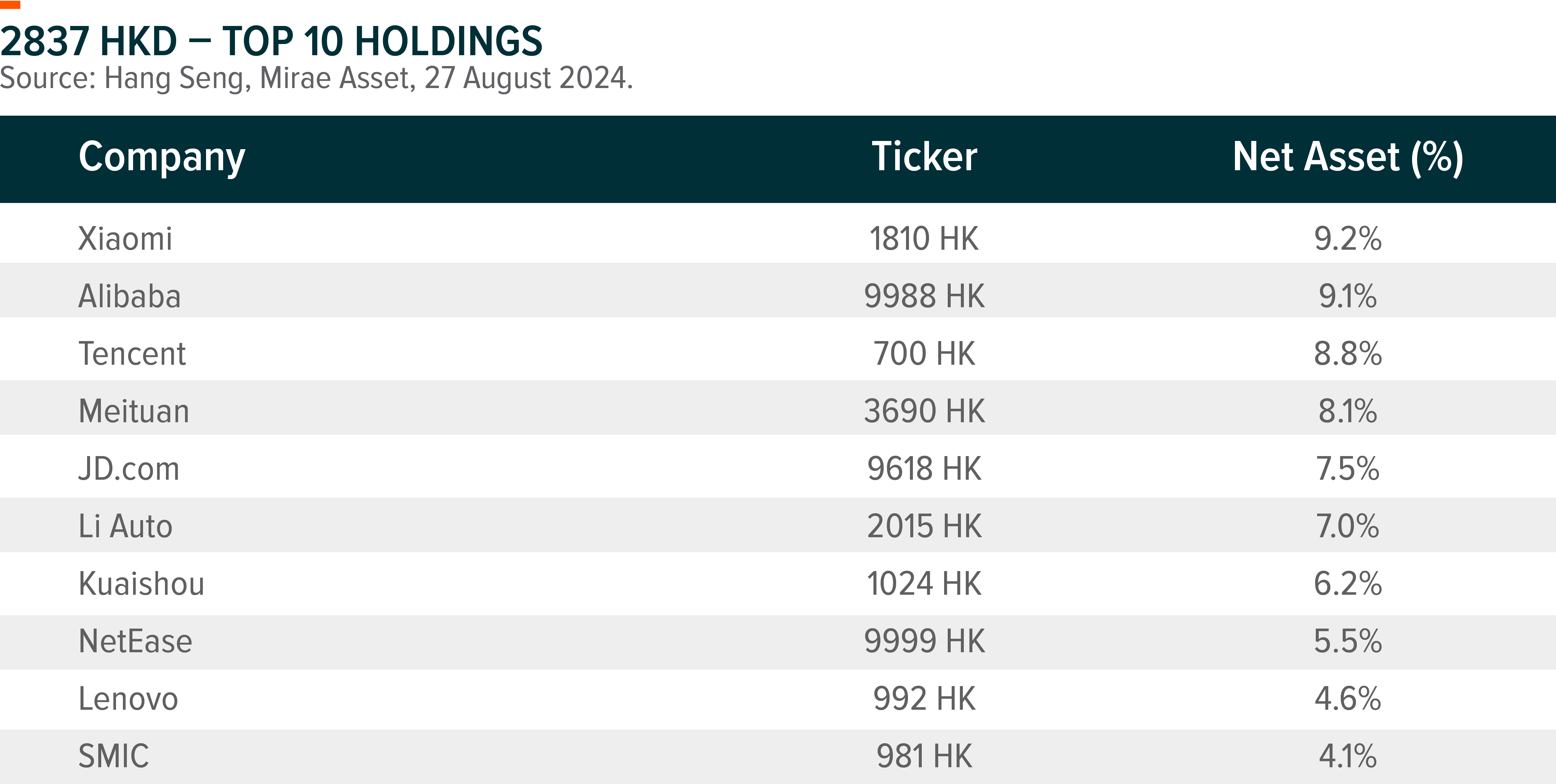

Global X Hang Seng Tech ETF (2837 HK)

Hang Seng Tech ETF invests in high-tech Chinese companies, capturing best quality internet platforms, consumer tech companies (Smartphone, PC), and other high-tech companies (EV, Semiconductor) listed in Hong Kong market. Though macro uncertainty and consumption softness could weigh on corporate earnings growth, we see unique positioning of Hang Seng Tech thanks to its attractive valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV and AI in China.

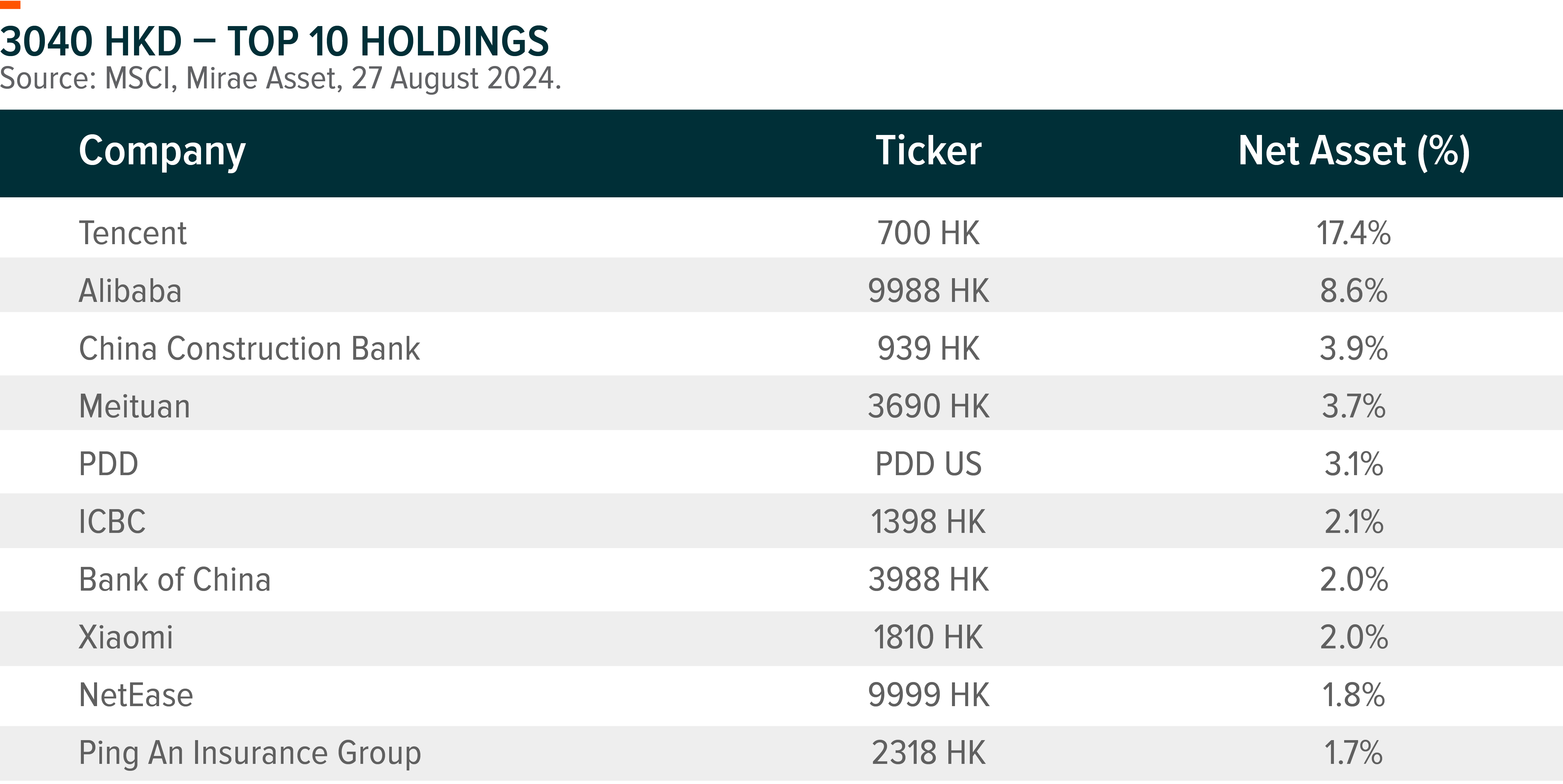

Global X MSCI China ETF (3040 HK)

MSCI China ETF invests in a diversified basket of over 650 companies listed in Hong Kong, China A, and US markets, and offers higher exposure to digital entertainment, online retail, and media sector compared to broad-based China A share index.4 MSCI China currently trades at a discount compared to peer China A share indexes and its own historical valuation, despite its solid growth outlook. This makes it an attractive investment opportunity for investors looking to access the Chinese market. 3040 HK levies the lowest management fees and ongoing charges of its kind5.

Related Global X ETFs’ Product6

| Global X MSCI China ETF (3040 HK) |

Global X Hang Seng TECH ETF (2837 HK) |

Global X Hang Seng High Dividend Yield ETF (3110 HK) |

|

|---|---|---|---|

| Inception Date | 17 June 2013 | 30 March 2023 | 17 June 2013 |

| Reference Index | MSCI China Index | Hang Seng TECH Index | Hang Seng High Dividend Yield Index |

| Primary Exchange | Hong Kong Stock Exchange | Hong Kong Stock Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.18% p.a. | 0.44% p.a. | 0.68% p.a. |

| Product Page | Link | Link | Link |

Ongoing Charges Over A Year: The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. The ongoing charges figure is an annualised figure based on the ongoing expenses of the Fund, expressed as a percentage of the Fund’s average Net Asset Value of the Listed Class of Units of the Fund over the same period. This figure may vary from year to year. The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. The ongoing charges of the Fund is equal to the current rate of the management fee of the Listed Class of Units of the Fund. For the avoidance of doubt, any ongoing expenses of the Fund exceeding the ongoing charges of the Fund (i.e. the management fee) shall be borne by the Manager and shall not be charged to the Fund. Please refer to the Key Facts Statement and the Prospectus for further details.