Eyeing China’s Solar Cells and Modules

The Evolution of China’s Solar Cell and Module Industry

The manufacturing of solar cells is an intricate and fine business where the evolution of its equipment with technological improvement has been pivotal in product development. In contrast to a solar-grade wafer, cell manufacturing involves much more automation. The ingot is a piece of relatively pure material, typically metal, that is molded into a shape suitable for further processing. The ingot process in the manufacturing wafer needs to be controlled by a skilled technician due to the slight variation in the quality of polysilicon. Generally, the majority of solar cell work is able to be completed by machines as they are part of a standard manufacturing process. As a result, the advancement of equipment or production lines becomes an area of focus. Similar to that of solar-grade wafer producers, many cell equipment manufacturers come from semiconductor backgrounds. For example, Meyer Burger (Switzerland), Tempress Systems (Netherlands), Shenzhen S.C New Energy (China), and NAURA Technology (China) were semiconductor producers who later expanded into cell equipment manufacturing.

The technological improvement in the manufacturing process is directed at advancing the conversion rate. Currently, PERC is the second generation in solar cells. This generation has an improved conversion rate of about 22.5%1 under mass production based on traditional silicon solar cells. It has almost reached the potential limit of the silicon-based solar cell.

Therefore, the next generation of solar cells is working on heterostructures using other materials, as cost-cutting is the key answer for both cell and cell equipment makers. Module manufacturing is more of a replication business, using similar equipment, providing a homogenous product. In the past, equipment providers produced outputs that had been resembling production lines for other industries; therefore, it is a fairly mature business. It has been long known that China has been the leader in the business of replication for many years thanks to comparative advantage in cheap labor and land abundance.

The Drivers of the Industry Dynamics

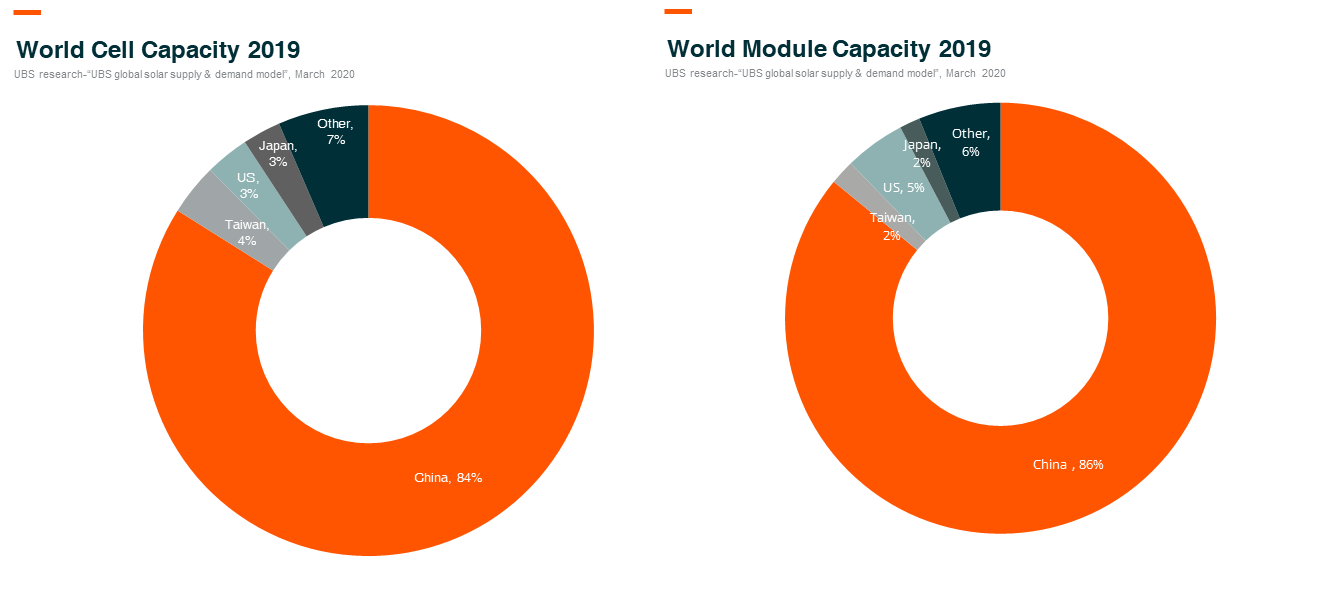

There are four inputs in the production of solar cells: wafer, auxiliary materials (silver/aluminum), equipment, and labor. Citing the solar cell leader Tongwei’s cost structure in 20192, wafer and auxiliary materials accounted for 84.1% of the total production cost, followed by equipment D&A and others totaling to 11.1% and labor at 4.7%. Similarly, the key inputs for a module are cell, labor, equipment, and energy, which make up 94.8%, 2.8%, and 1.5%, and 0.9%3 , respectively, according to Risen Energy’s report. China leads the solar materials supply chain, which also benefits cell and module production from a cost perspective. There are a few cell and module capacities outside of China that focus on different technology routes. However, in the long-term, the expectation and trend will be for Chinese players to continually consolidate the market.

For the cell business, cash cost and sale price determine whether a business will suspend capacity in the short-term, as adequate liquidity is important for players to survive during a down cycle. However, similarly to the wafer business, besides cost, technology is another key factor that determines success or failure in the long-run. Downstream demand, equipment, and production process innovations drive solar cell developments accordingly. Businesses that are not well prepared for technological changes will ultimately fall behind the curveball and be driven out of the market. Once innovation reaches its potential, the lower the margin an industry has, the fewer new entrants there will be. It is relatively simple to decipher the consolidation landscape if we look at each player’s capacity expansion plan. For module business, the consolidation may be driven by channel, especially to C business. Players that emphasize significance in building up their channels today are likely to succeed in the future.

Forward-Looking

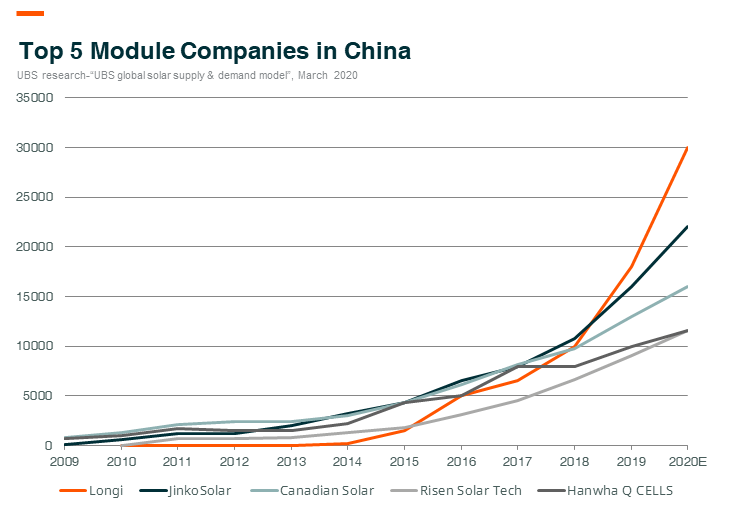

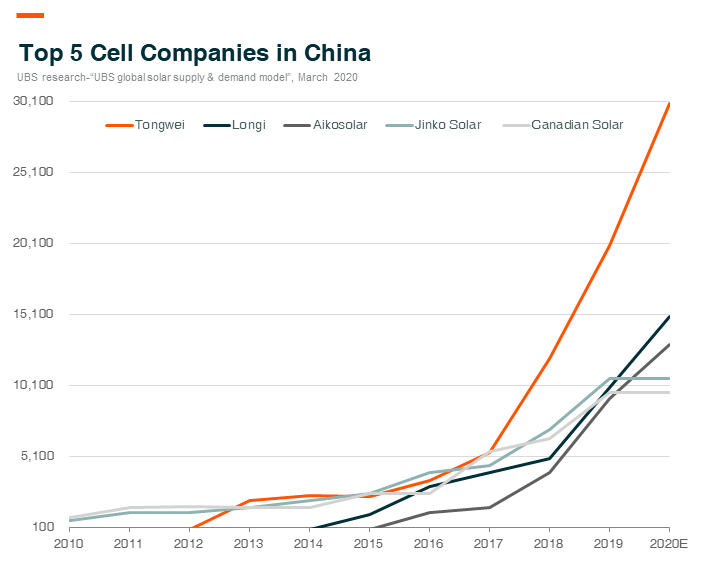

By the end of 20194, the top 5 Chinese solar cell producers comprised of a total market share of 33% in terms of capacity, while the top 5 module makers’ total market share was 35%5 vs. polysilicon (56%) and wafer (70%). We can see from Exhibit 1 that both cells and modules are oversupplied. However, as technology is improving at exponential rates, the expectation is for costs to be lowered and efficiency to heighten. This will ultimately encourage end-demand and partially offset the oversupply. The current soft demand is likely to stop or delay small/new cell and module players’ new capacity plans and benefit existing leaders, at least from a medium-term perspective.

In the long-term, the manufacturing business offers a relatively stable margin. If there is no special knowhow involved, then the cell and module margin will not be very high as it is with most of the manufacturing subsectors. We are likely to see module consolidation trends earlier than a cell. The reason behind this is that the module manufacturing process is already mature. As the current low margin environment continues, the industry is not attractive to new entrants. Existing leaders are able to build up their capacity and enjoy a large market share with low prices thanks to economies of scale. However, cell technology is on track to fast advancements. Capital could be a moat to stop small private enterprises, but the call for traditional energy SOEs is rising as they have decent access to funding and incentives to change, although, in our opinion, SOEs still have a long way to go. We cannot be assured that solar cell leaders today will be able to survive and consolidate the market in the future as there are still new entrants, and with new technological advancements, it will be a difficult task to predict the outlook of these businesses.

Global X China Clean Energy ETF (2809 HKD / 9809 USD) is designed to enable investors to access high growth potential through companies critical to further advances and increased adoption of clean energy in China.

Other Key Features:

- Unconstrained Approach: The fund’s composition transcends the classic sector and industry classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the clean energy theme in China.

Please click here for more information on the Global X China Clean Energy ETF.