China E-commerce and Logistics: H1 2022 Review

E-commerce: Focusing on Quality Growth

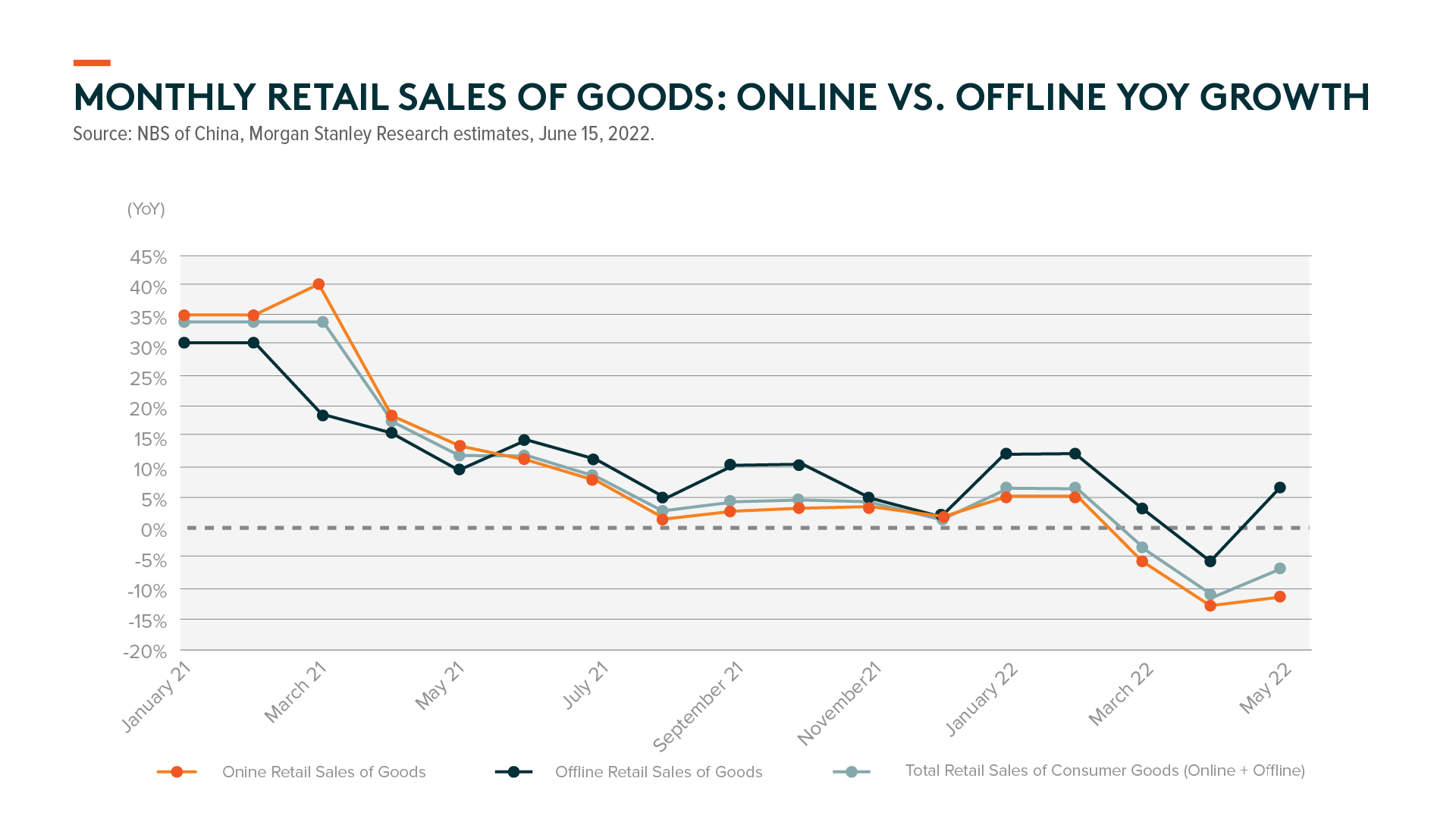

China’s e-commerce sales showed recovery in the first two months of the year until the resurgence of Omicron in March. Retail sales slowed down sharply in April with lockdowns in key cities, particularly in Shanghai, causing supply chain and logistics disruptions and impacting online retail sales. The situation improved sequentially in May and June, along with earlier than expected reopening in early June. Total online physical retail sales grew +7% year-on-year (yoy) in May compared to -5% yoy decline in April, according to the National Bureau of Statistics (NBS) of China.1 Sales during the 618 shopping festival were also stronger than market expectations. While the dynamic zero-covid policy is to stay for a while, it is unlikely that there’ll be another citywide lockdown as in Shanghai earlier this year. We expect to see gradual consumption recovery going forward.

In terms of categories, consumer staples like fast-moving consumer goods have been performing better than discretionary such as apparel and home appliances as many consumers had to stay home during the lockdowns. That said, premiumization seems to be still the major trend rather than trade down. For example, JD’s overall sales grew 10% during the 618 festival, but the company saw high-end appliance sales surging nearly five folds compared to a year ago.2 While many e-commerce companies have not provided Q2 2022 guidance due to uncertainties from Covid, VIP Shop provided revenue guidance of 20-25% yoy decline in Q2 20223. However, performance in June seemed better than expected as supply chain and logistics had returned to near-normal levels. The company expects a gradual recovery in H2 2022, compared to the sharp recovery seen in H2 2020, as consumer demand is weaker now than two years ago.

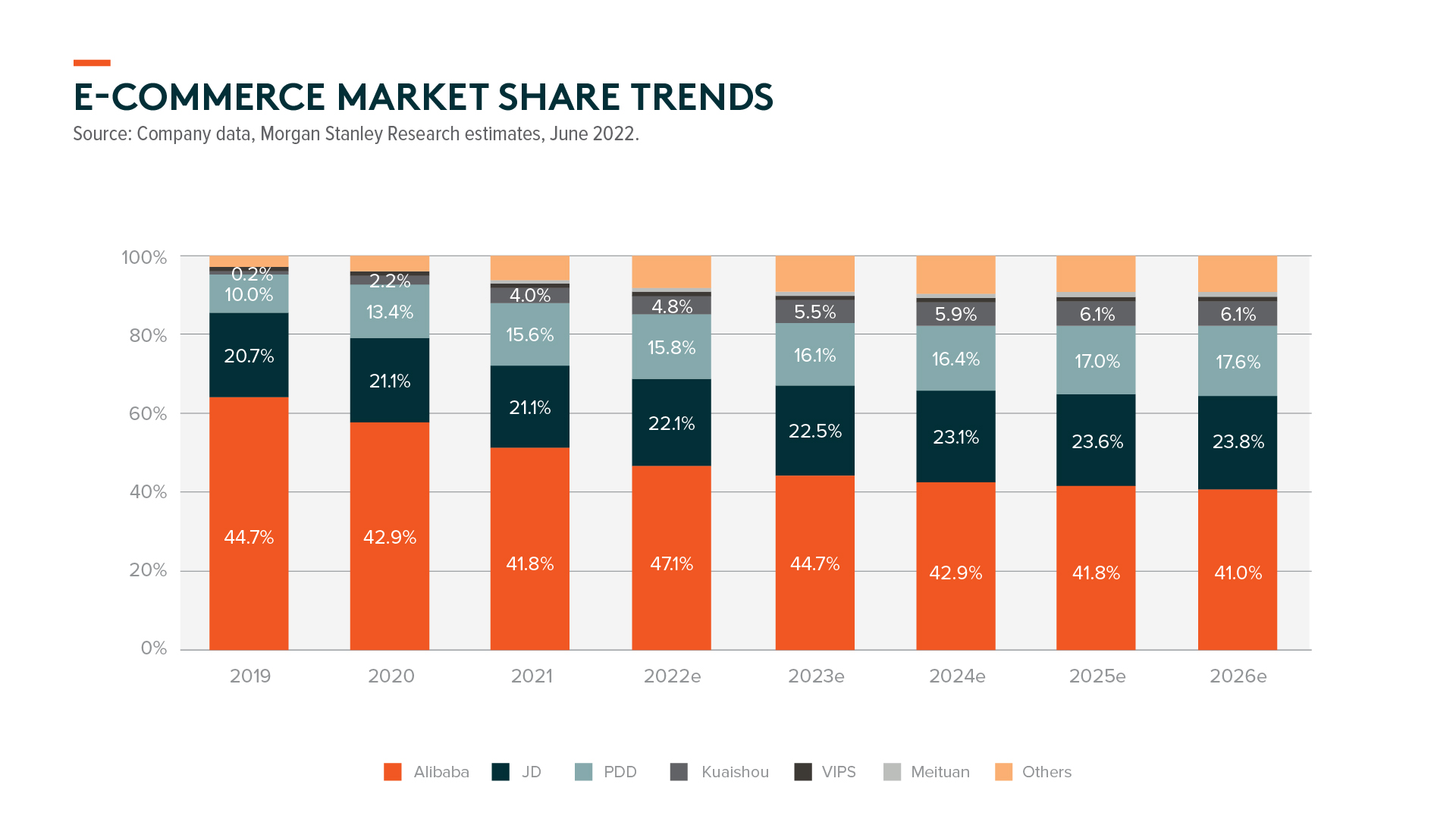

Despite the weak consumption environment amid the resurgence of Omicron, major platform companies have reported better than expected Q1 2022 results thanks to their focus on profitability this year. E-commerce companies were in an investment mode in 2021, but turned to focusing on profitability and aiming for quality growth in 2022. E-commerce penetration reached 35% of total retail sales in China4 and the industry is becoming more mature with a much larger base. Alibaba shared that they would have to tackle different categories differently by looking at subcategories, assortments, increasing direct sales, and focusing more on quality growth going forward.

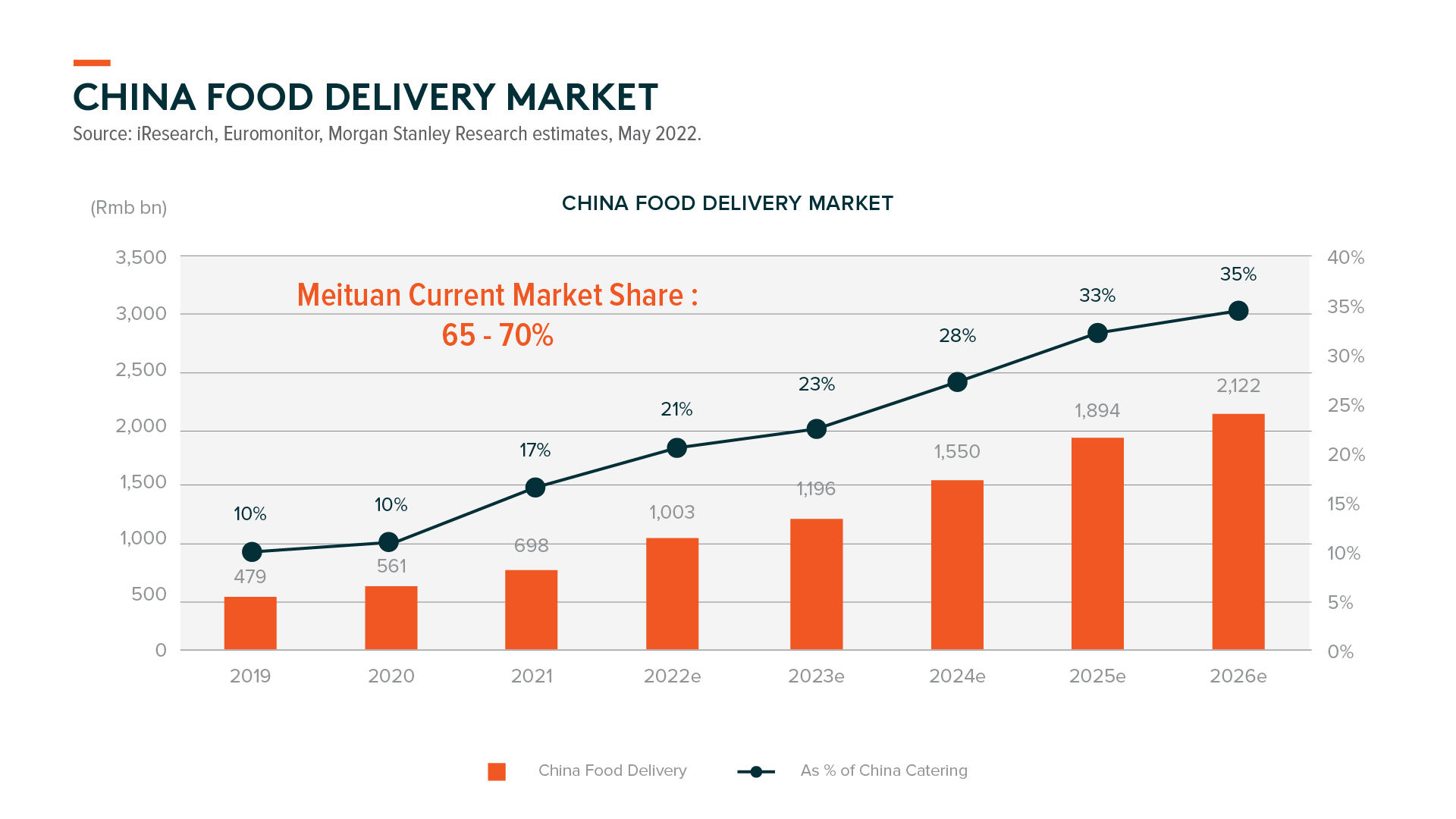

Local services such as food delivery still have a robust growth outlook with lower penetration than that of physical goods e-commerce. For example, Meituan’s total revenue grew +25% yoy with food delivery revenue growth of +17% yoy in Q1 20225 amid the resurgence of Omicron in March. According to Morgan Stanley estimates, penetration of the food delivery market will grow from 21% in 2021 to 35% in 2025 out of China’s total catering industry, while Meituan’s food delivery revenue is forecast to grow 26% CAGR over the same period.6 Moreover, we see an improving competitive landscape leading to better unit economics for food delivery businesses, albeit slower order volume growth in Q1 2022.

The Chinese government has emphasized several times this year that the regulation of the platform economy is largely done, and it has created a better playing field for all industry players to focus on quality and sustainable growth. The e-commerce industry is expected to show gradual recovery under a benign competitive landscape with government support to boost domestic consumption in the latter half of this year.

Logistics: Focusing on Margin Recovery

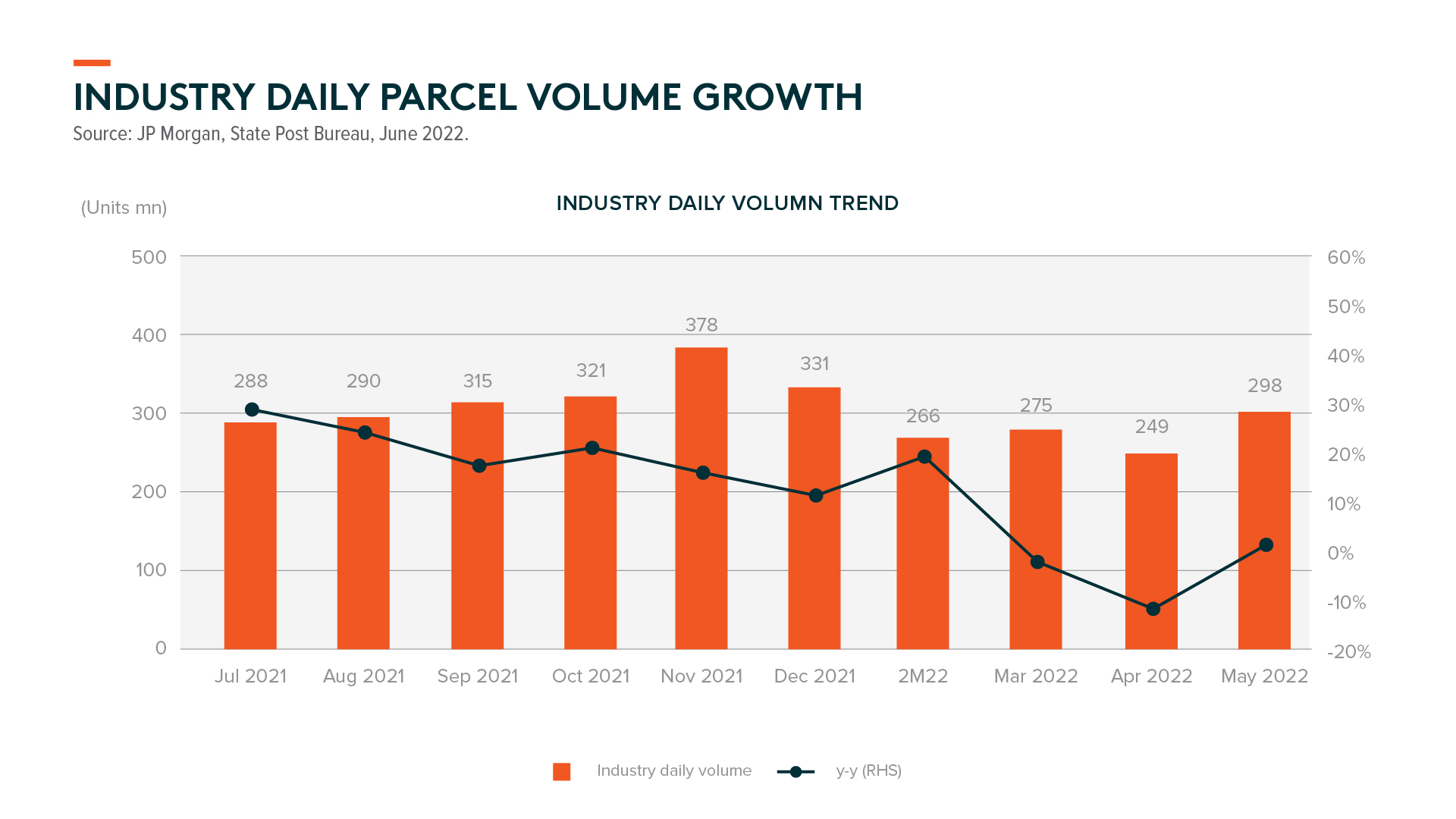

Since the beginning of 2022, there have been concerns around parcel volume growth for the year as it is uncertain whether the property market slowdown and overall economic weakness would lead to marginally slower consumption. Parcel volumes were hit heavily by lockdowns, and volume concerns still hold true after gradual reopening, but the market focus is shifting towards volume recovery and corporate margin improvement. According to recent company results conference calls, logistics companies have cut their full-year volume guidance and industry outlook to factor in the lockdown impact.

There was a decent recovery in parcel volume growth, with May data +0.2% yoy vs. -12% yoy in April, according to the State Post Bureau.7 By cities, yoy trend of parcel volume in Shanghai, Beijing, Hangzhou, and Shenzhen improved to -74%/-22%/-15%/-10% yoy respectively in May, from -90%/-23%/-20%/-15% in April. Daily nationwide parcel volumes were up by mid-to-high single digit for the first 18 days of June vs. +24% yoy last year.8

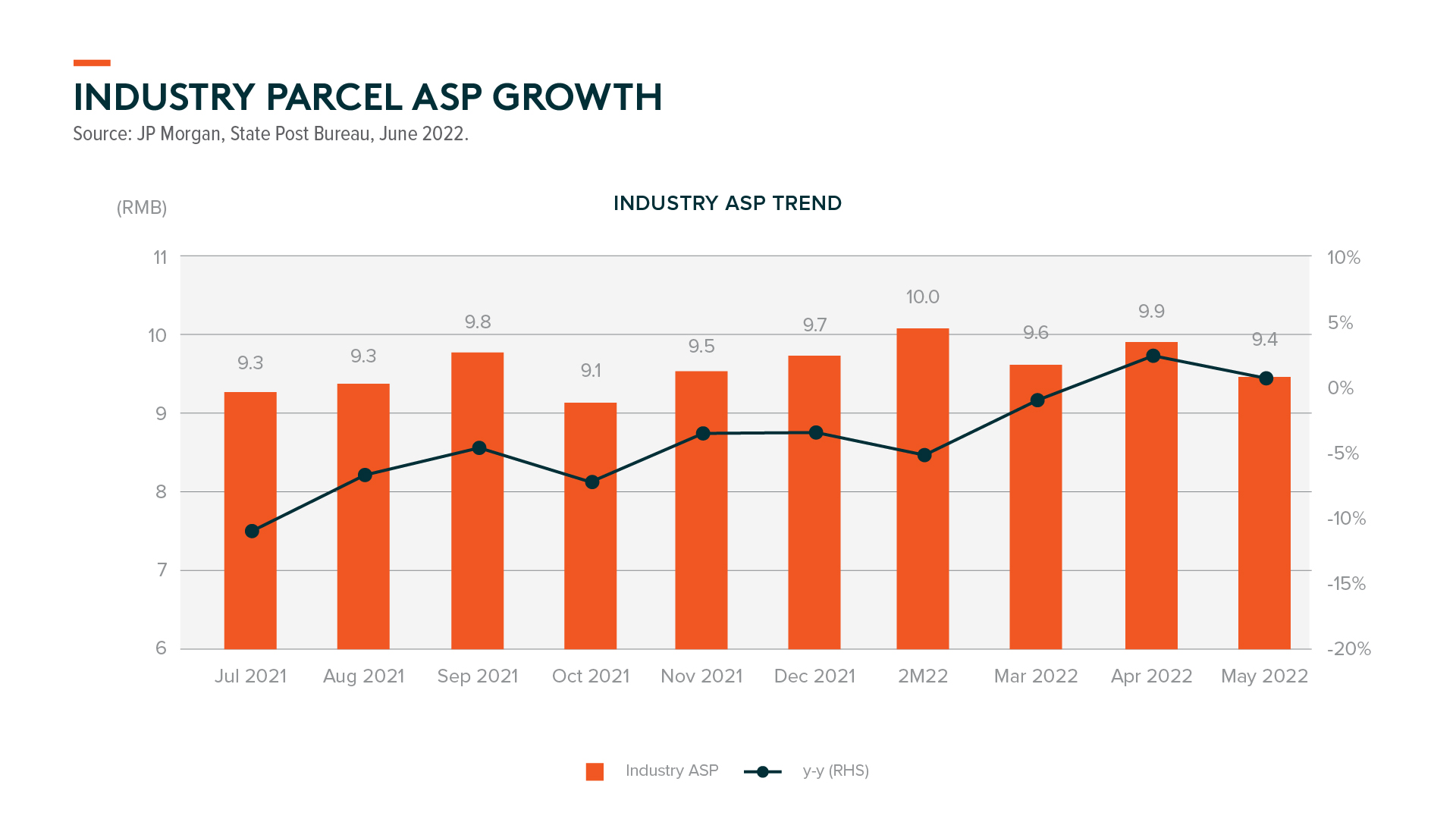

As we highlighted in our last review, we believe we are seeing an inflection point in logistics parcel pricing and competition. Throughout 1H22, top logistics companies are prioritizing quality and profitability over quantity. This is particularly obvious during an economic downturn after lockdown to ensure profitability, cash flow, and employment. The average parcel price grew by 8% yoy in 1Q22, according to data from the State Post Bureau.9 We expect the trend to persist this year despite some regional pricing adjustments. There is also generally tight regulatory oversight on healthy logistics industry competition. Corporate CAPEX is modest post lockdown. Companies are enjoying reasonable market share gains this year, part of which comes from the share loss after the merger between J&T and Best. With that market share gain in mind, top logistics companies can be less aggressive in price competition this year.

We believe top logistics companies are focusing more on non-price competition. The benefits of economies of scale will gradually fade when the industry further consolidates and top players have built a certain business scale. We expect future competition to rely on services categorization and companies’ ability to charge premium prices for premium services. Logistics services have become the major battleground in the fierce competition to improve customer satisfaction and GMV for e-commerce platforms.