Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The investment objective of Global X AI & Innovative Technology Active ETF (the “Fund”) is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence and innovative technologies as detailed below.

- The Fund does not seek to track any index or benchmark, it may fail to meet its objective as a result of the Manager’s selection of investment, and/or the implementation of processes which may cause the Sub-Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Asia Semiconductor Companies are the Backbone of AI Supply Chain

The semiconductor supply chain in Asia forms the backbone of global AI chip production, underpinning the success of companies like Nvidia, AMD, and other ASIC developers. At the heart of this supply chain are advanced logic fabrication and high-bandwidth memory, both of which are supported by Asia semiconductor companies such as TSMC, SK Hynix and Samsung.

AI accelerators, such as Nvidia’s Blackwell GPUs, demand cutting-edge process nodes and advanced packaging technologies to deliver the performance and energy efficiency required for training and deploying large-scale models. TSMC, as the world’s largest foundry, manufactures these chips using its advanced nodes, while also providing CoWoS (Chip-on-Wafer-on-Substrate) packaging to integrate multiple dies and memory stacks. Without this capability, the performance gains driving generative AI adoption would not be possible.

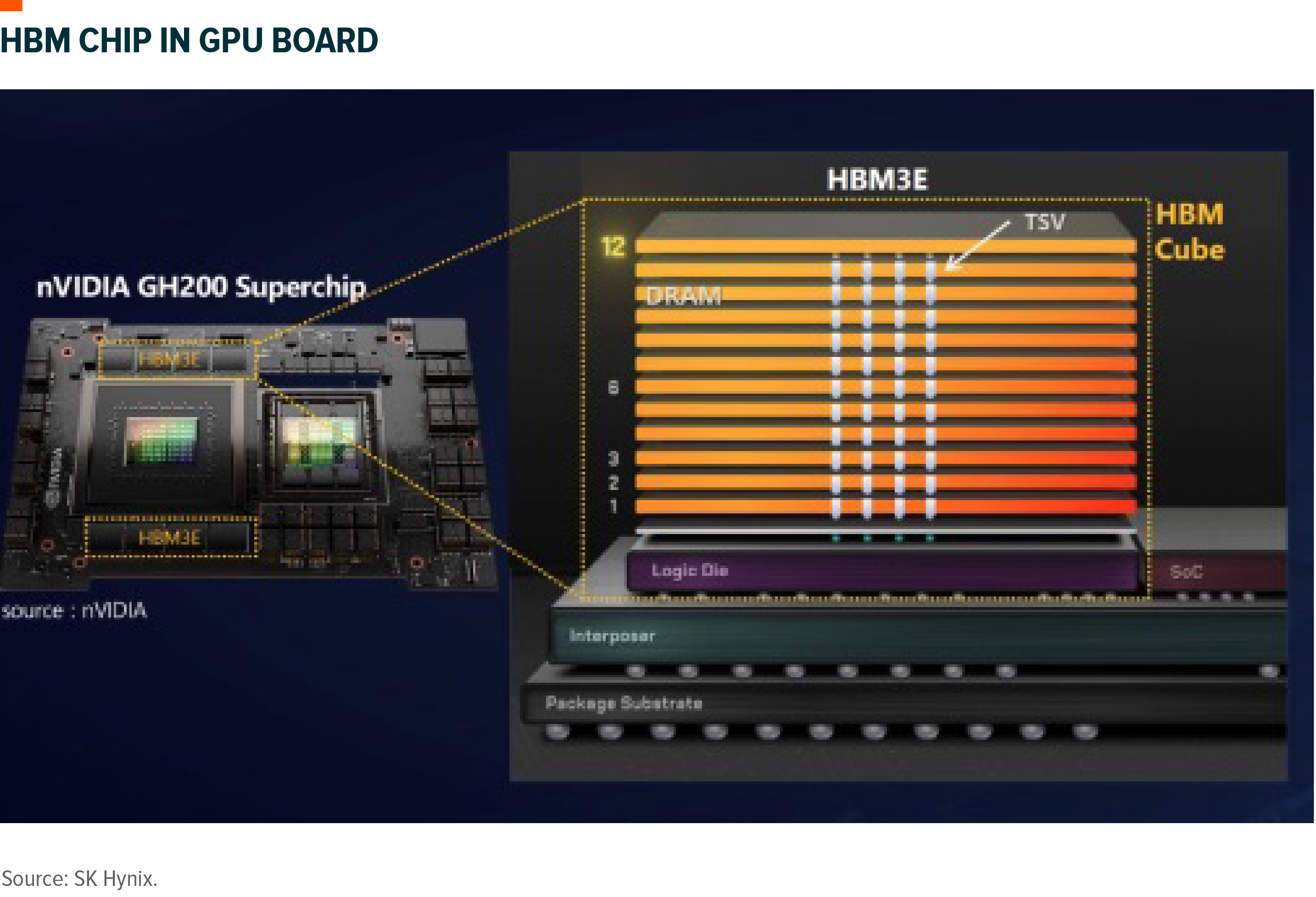

Equally critical is the memory component. AI workloads are bandwidth-intensive, and high-bandwidth memory (HBM) has become a key differentiator in performance. Suppliers in Asia play a key role this segment, providing HBM3 and moving toward HBM4 to meet the escalating requirements of next-generation AI chips.

Global X Asia semiconductor ETF (3119) Key Holdings Review

TSMC – The company is the leading semiconductor foundry globally. It has a significant technology gap with the 2nd best semiconductor manufacturer, with over 90% market share in leading-edge semiconductor manufacturing. (Mirae 2025) TSMC is well-positioned to benefit from the AI capex cycle and structural growth in semiconductor content, underpinning its 5-year 20% revenue CAGR guidance. (TSMC 2025)

SK Hynix – SK Hynix has the largest market share in the global HBM market, it has been the key supplier of HBM3 and HBM3e for Nvidia. The company shipped HBM4 samples to customers in 1Q25 and started mass production in 2H 2025. (Hynix 2025)

Sony – Sony raised its FY3/26 full-year operating profit guidance for continuing operations on a pre-tariffs basis from ¥1.38trn to ¥1.4trn, and on a post-tariffs basis from ¥1.28trn to ¥1.33trn. PlayStation monthly active users (MAU) in June was 123mn accounts (+6% YoY), marking an 11th straight quarter of YoY growth. (Sony 2025)

Naura Technology – Naura is China’s leading semiconductor equipment maker. Naura is expanding its portfolio of wafer fabrication equipment and positioning itself as a key enabler of China’s semiconductor self-sufficiency strategy. The company is well positioned to benefit from the localisation trend of semiconductor equipment in China. (Naura 2025)

SMIC – SMIC posted Q2 2025 revenue of $2.21B, up 16% YoY or down 1.7% QoQ, with gross margin at 20.4%. Management continues to see high utilisation across its production line, while wafer ASP is expected to improve sequentially in 3Q25. SMIC plans to maintain its capital expenditure at roughly $7 billion in 2025, similar to 2024 levels ($7.3 billion). (SMIC 2025)