Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Hong Kong High Dividend Strategy Outperforms Amid Global Market Turbulence

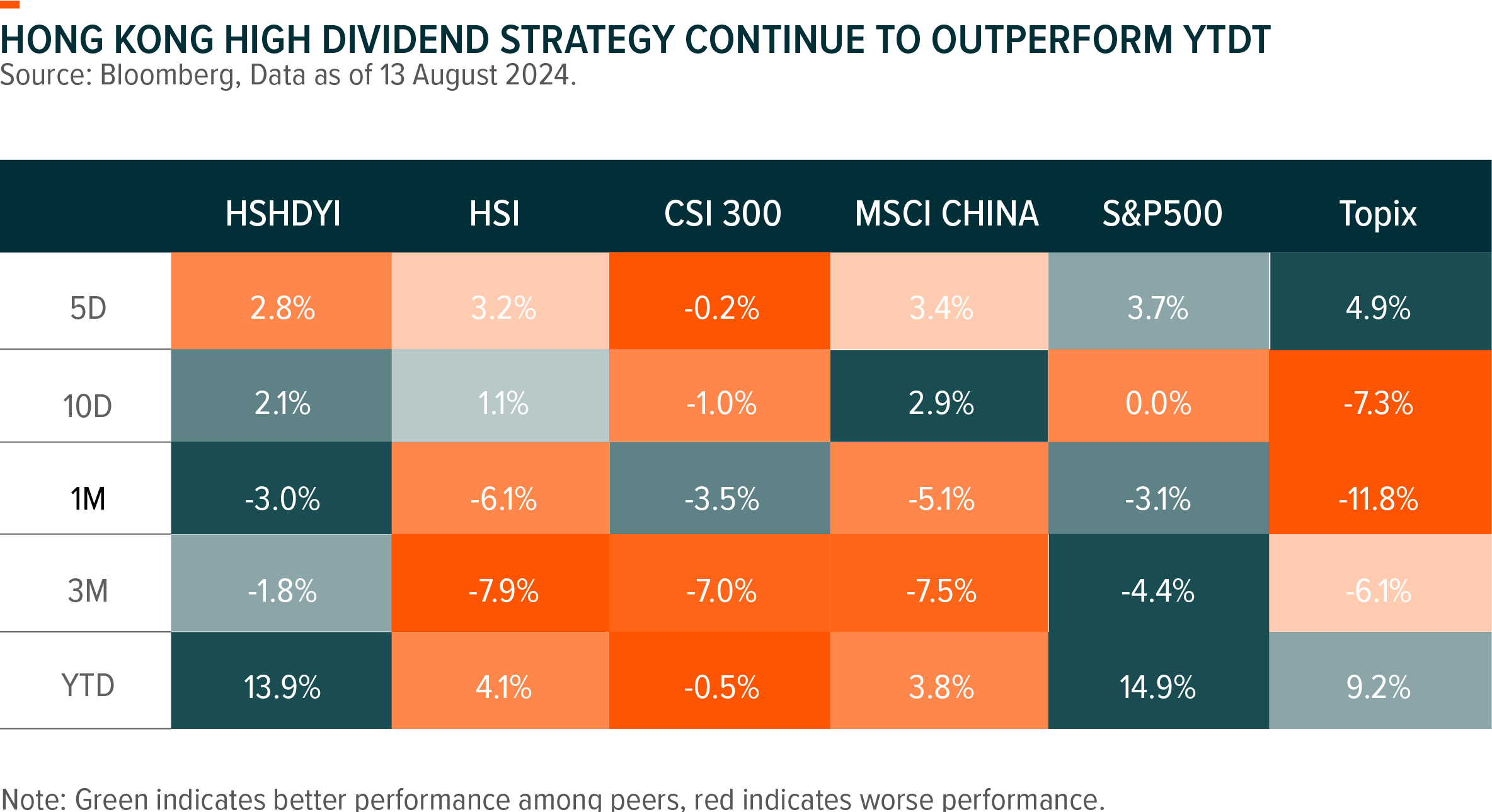

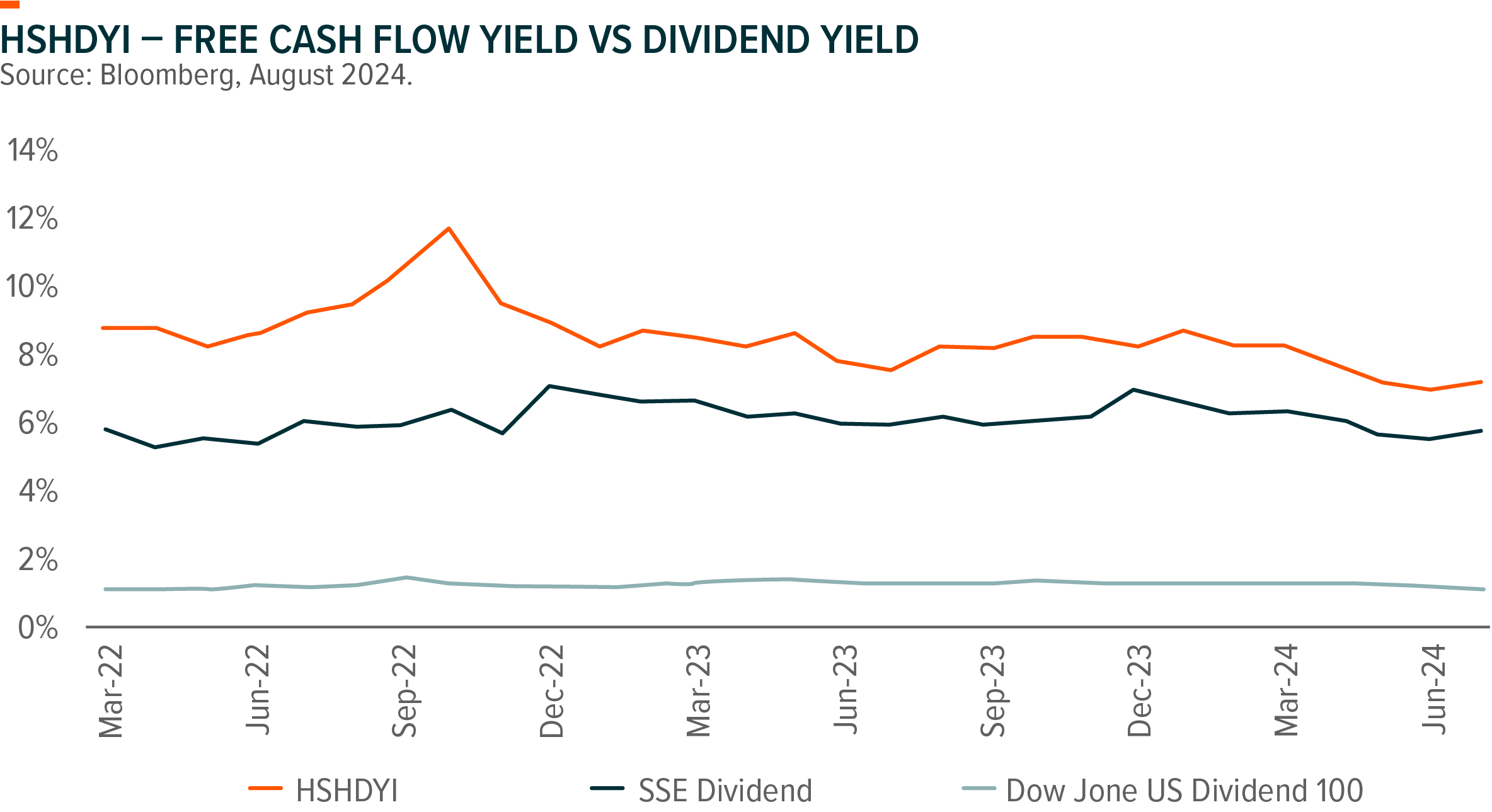

Hong Kong High Dividend Strategy once again demonstrated its resilient and defensive nature amid global market turbulence caused by the coincidental timing of surprising BOJ rate hike, JPY Carry Trade Unwind, soft US macro data, and disappointing earnings of some US Big Tech over the past few weeks. Hang Seng High Dividend Yield Index continued to deliver outperformance compared to other broad-based China A Share/Hong Kong Market Indexes YTD1 thanks to increasing investor interests in defensive and high yield sectors under market volatility and macro uncertainty. With Hong Kong listed names offering additional 1.5ppts dividend yield2. compared to A Share market, and concerns around RMB depreciation (due to US tariff uncertainty) lingers, we should be seeing more southbound inflows that could support Hong Kong Market performance. In addition, dividend yield of over 7% (HSHDYI Index)3. in Hong Kong market should be more appealing to international investors as global central banks enter into rate cut cycle and fears over a potential US recession mount.

Undemanding Valuation Offers Downside Protection

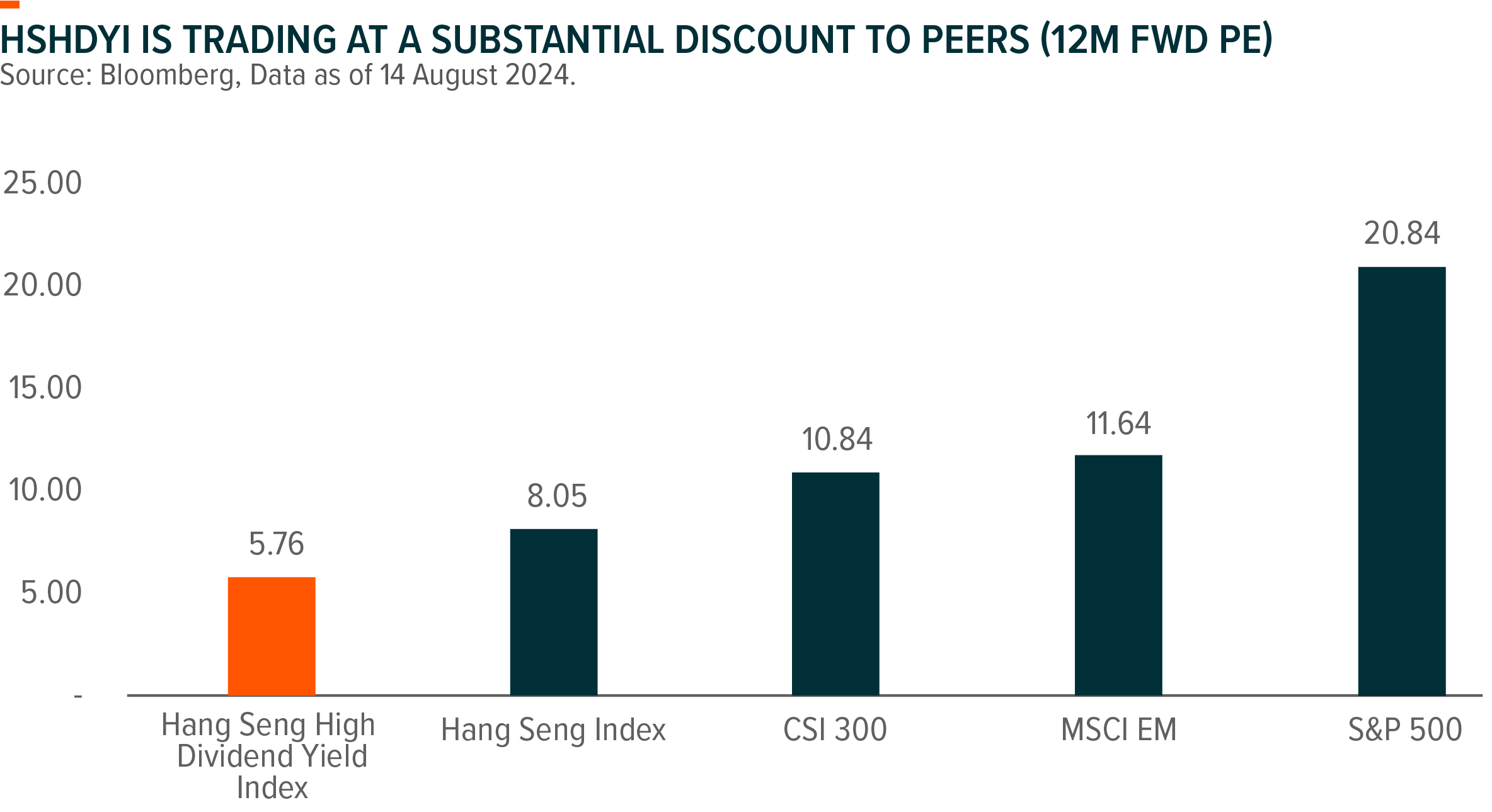

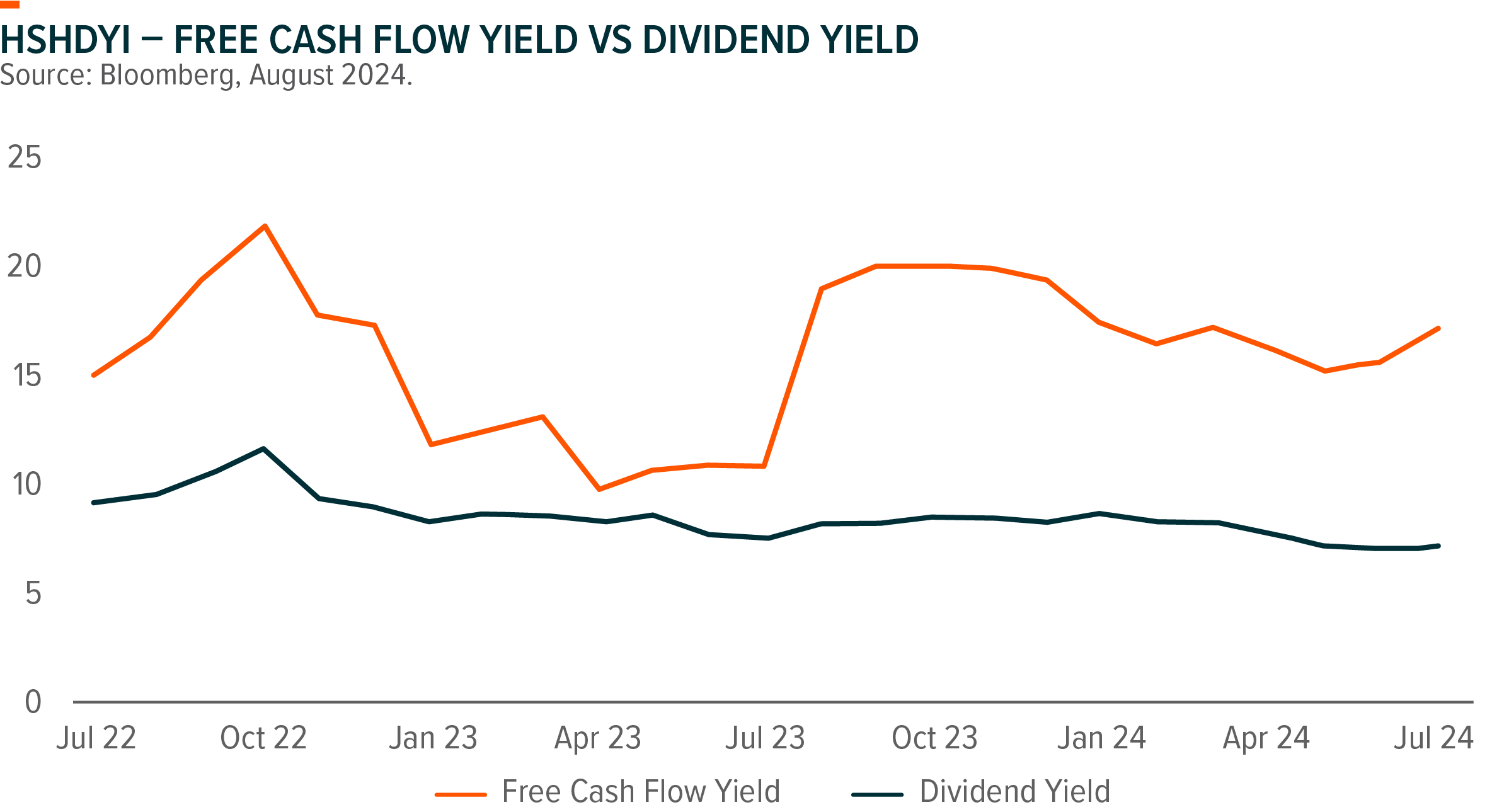

The core to Hong Kong High Dividend Strategy’s defensive nature is low valuation. Hang Seng High Dividend Yield Index Currently Trades at 5.8x 12m Forward PE, substantially lower than overall Hong Kong market (Hang Seng Index at 8.1x), A Share (CSI 300 at 10.8x), and Global EM peers (MSCI EM at 11.6x)4 , offering limited downside risks. In addition, its robust Free Cash Flow yield of 17% and relatively conservative dividend payout ratio should ensure sustainability of dividend yield.

A series of supportive policies also point to a more benign environment for high dividend strategies. “Nine Measures” issued in April 2024 called for higher shareholder returns through dividends and share repurchase, which we believe is arguably the most direct way of uplifting the attractiveness of and reviving investor confidence in China market. In addition, larger portion of high dividend stocks are SOEs, which are set to benefit from “Valuation with Chinese Characteristics” as there have been more focuses on elevating operational efficiency that has historically led to a valuation discount for SOEs. Potential dividend tax exemptions for mainland Individual investors buying Hong Kong Stocks via Stock Connect5 could be a catalyst to stimulate further Southbound Inflow.

Global X Hang Seng High Dividend Yield ETF (3110 HKD) is Hong Kong’s largest and most liquid high dividend ETF delivering over 7% dividend yield with semi-annual dividend payments. 3110 HK offers lower volatility through investing in 50 Hong Kong listed high dividend stocks, subject to annual rebalancing.