Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X India Select Top 10 ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index (the “Underlying Index”).

- The Underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- The number of constituents of the Underlying Index is fixed at 10. The Fund by tracking the Underlying Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- High market volatility and potential settlement difficulties in the equity market in India may result in significant fluctuations in the prices of the securities traded on such market and thereby may adversely affect the value of the Fund. The BSE has the right to suspend trading in any security traded thereon. The Indian government or the regulators in India may also implement policies that may affect the Indian financial markets. There may also be difficulty in obtaining information on Indian companies as disclosure and regulatory standards in India are less stringent than those of developed countries.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

Tap into India’s Bright Future with Global X India Select Top 10 ETF (3184)

India has emerged as one of the fastest-growing major economies in the world, driven by its demographic advantages, growing foreign direct investments, and supportive government policies. Since 2023, India has become the world’s most populous country (Source: UNFPA, April 19, 2023), resulting in a rapidly growing consumer market. Additionally, the Indian government has launched numerous initiatives to attract foreign direct investment and foster a favourable business environment. With its vast growth potential, India stands out as an appealing investment destination for investors seeking long-term opportunities.

The Global X India Select Top 10 ETF (3184), track the performance of the leading companies in various sectors listed on the Bombay Stock Exchange, including information technology, consumer, infrastructure and energy sectors. By investing in this ETF, investors can participate in India’s dynamic and growing equity market.

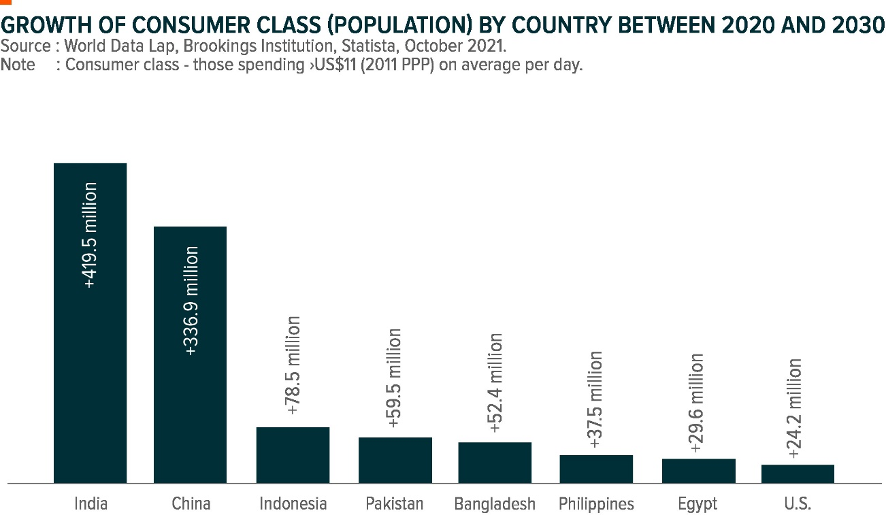

The world’s fastest-growing consumer market of this decade

India’s rising middle class stands as a significant driver of the country’s economic growth. India is projected to experience the most rapid expansion of its consumer class in this decade, surpassing other major markets. The expansion is not limited to urban areas but is also prevalent in rural regions, further broadening the consumer base. Furthermore, as individuals experience an increase in their purchasing power, their consumption habits undergo a significant shift. This shift not only creates a demand for essential goods and services but also drives a desire for higher quality, innovative and lifestyle enhancing products. This trend is expected to fuel the demand for a diverse range of products and services, spanning from automobiles, and electronics to leisure activities. The growth of India’s middle class signifies a transformative force within the economy.

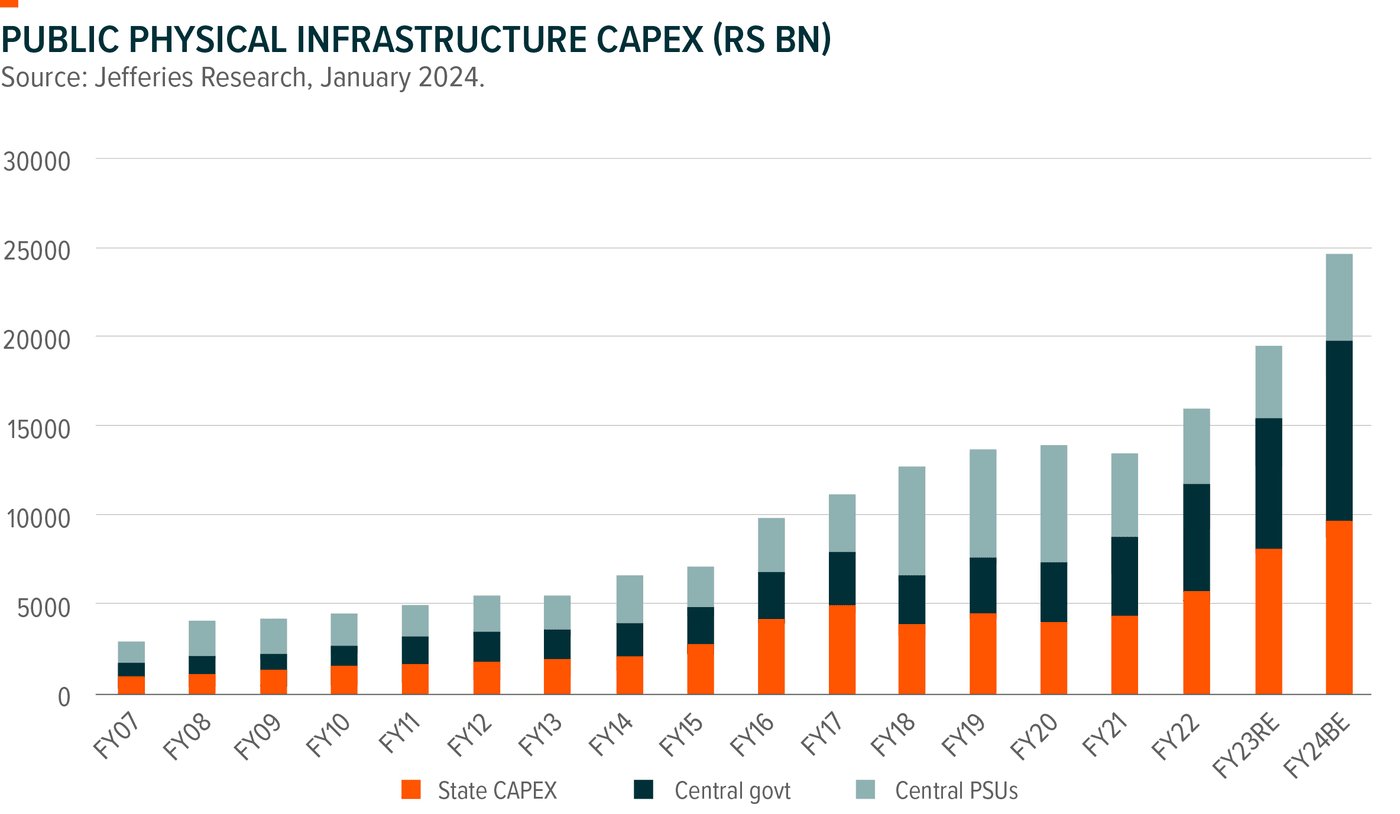

Increased Capital Expenditure to Drive Economic Growth

The Indian government has prioritised infrastructure development as a strategic area, aiming to bridge the existing infrastructure gaps and support sustainable economic development. Following years of comprehensive tax reform, India’s fiscal balance sheet has significantly improved, providing ample resources for substantial investments in infrastructure development. The focus areas encompass transportation, energy, logistics, urban development and digital infrastructure. These investments are not only aimed to improving connectivity but also at creating a conducive environment for businesses to thrive. Concurrently, private companies are leveraging the improved infrastructure to expand operations, establish new manufacturing facilities and enhance distribution networks. India’s multi-year capex cycle, characterized by increased corporate and government capital expenditure, is expected to drive robust GDP growth of 6-7% in this decade.

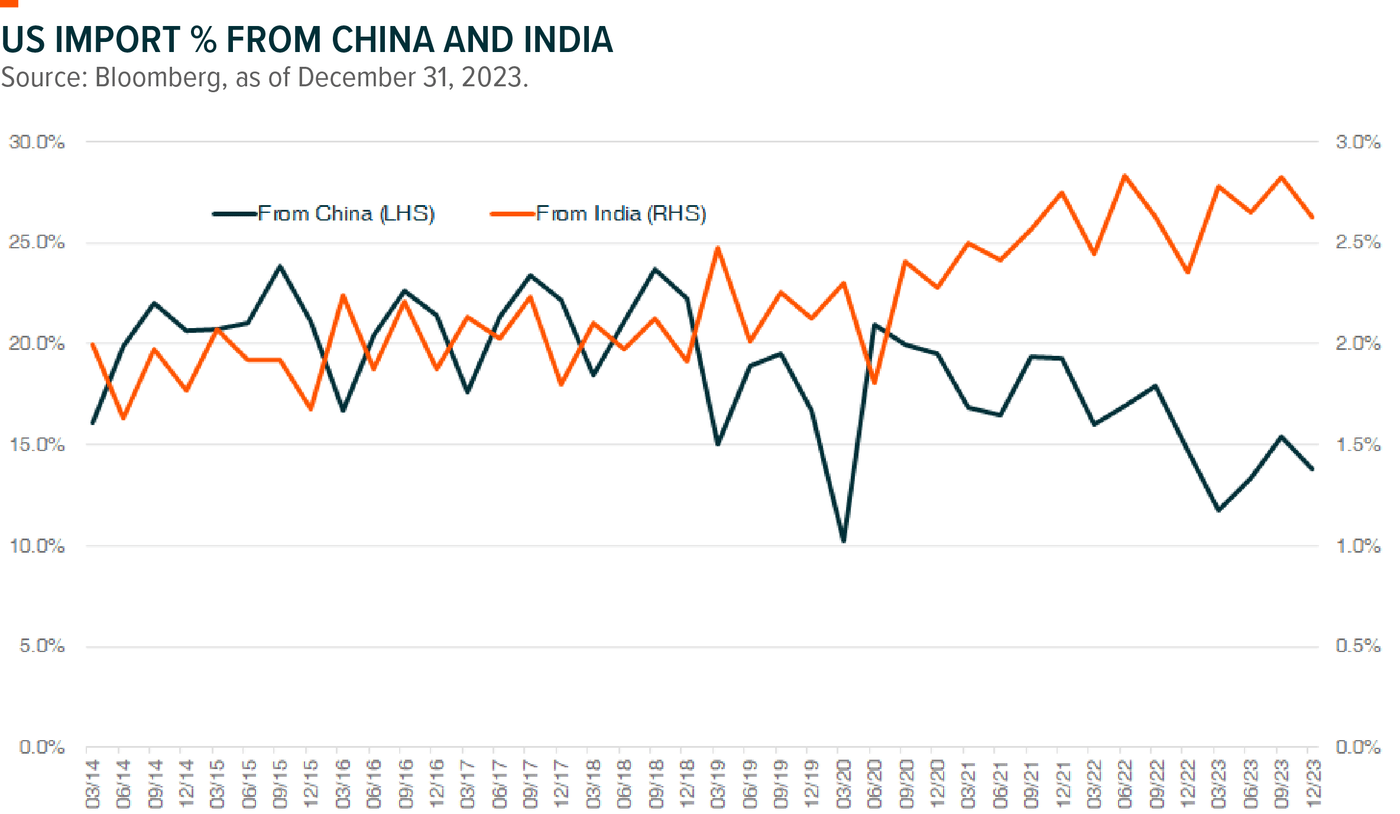

Foreign Direct Investments into India is poised to continue

Due to heightening geopolitical tension, companies are diversifying their production supply chain and reducing excessive reliance on a single market. While China has served as a global manufacturing hub, multi-national companies are now adopting a “China+1” strategy to diversify their operational risk. India, with its large skilled workforce and improving business climate, has emerged as an appealing alternative manufacturing destination.

India’s growing importance to the global capital market has resulted in the recent inclusion of its government bonds into global bond indices. One notable example is India’s inclusion in the JP Morgan Global Emerging Markets Bond Index, which is expected to be effective in June 2024.(Source:Deutsche Bank, 12 October, 2023.) This development enables international investors to gain exposure to India’s debt market, potentially leading to significant capital inflows.

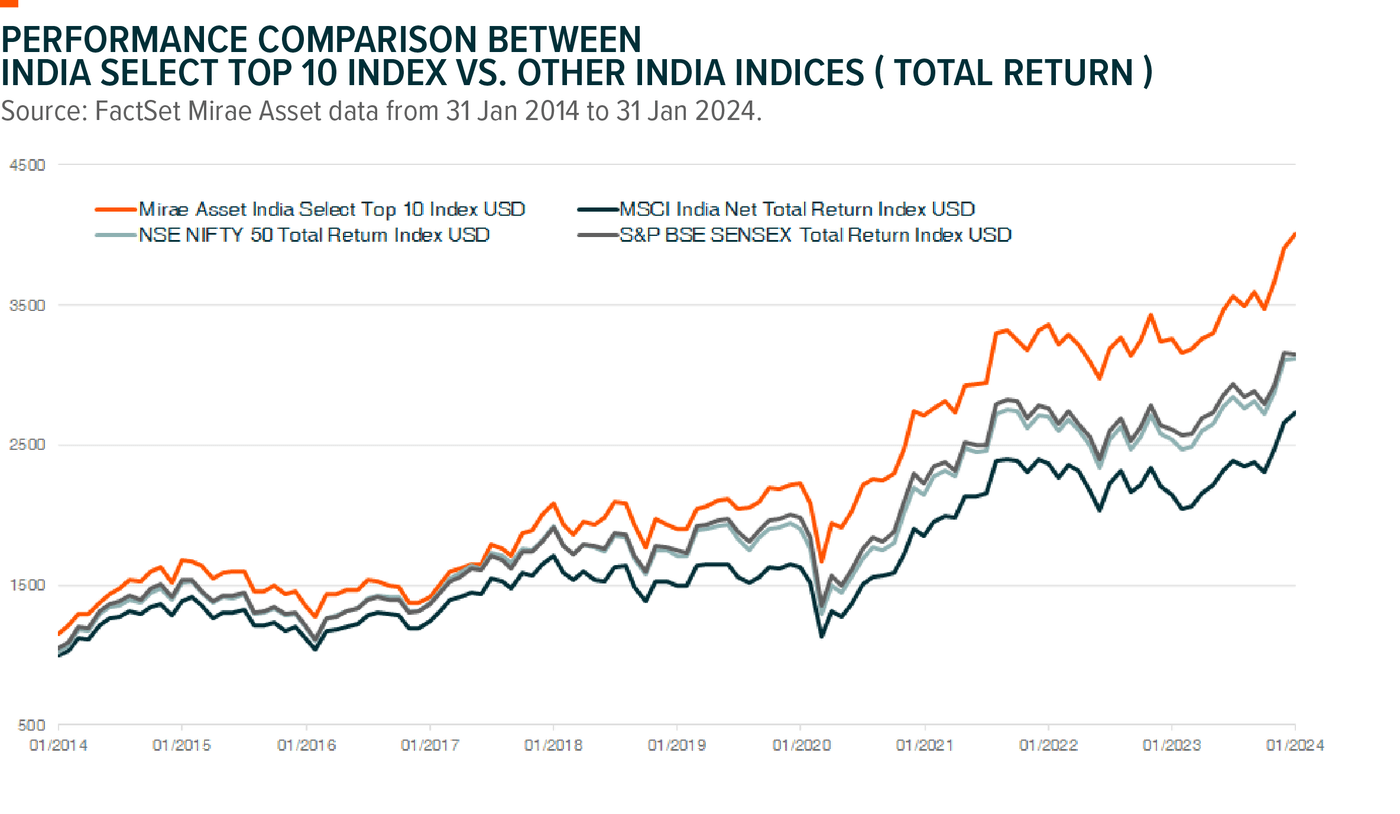

Why invest with Global X India Select Top 10 ETF (3184)?

While India’s growth potential is undeniably attractive for the aforementioned reasons, it is important to note the country’s equity market is trading at a notable premium relative to other emerging countries. Considering the stretched valuations, it becomes even more crucial for investors to exercise prudence during the security selection process. Large-cap companies in sectors, including I.T., consumer, infrastructure, and energy sectors are more resilient due to their economies of scale. Also, Indian businesses have long faced challenges in securing funding for growth, primarily attributed to the high lending costs environment. Sector leaders with a long operational history and stable cash flow tend to enjoy better funding advantage, enabling them to drive long-term growth. Larger companies are better positioned to achieve sustainable growth with an enhanced capital structure.

ETFs offers convenient access to a basket of Indian securities

Exchange-traded funds (ETFs) offer a convenient and diversified way to invest in India. ETFs pool together a basket of securities and trade on stock exchanges like individual stocks. By investing in an ETF, investors gain exposure to a broad range of Indian stocks from various sectors, reducing the risk associated with individual stock selection. ETFs also provide liquidity and transparency, making them an attractive option for both retail and institutional investors.