Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X China Core TECH ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset China Tech Top 30 Index.

- The Fund is exposed to concentration risk by tracking a single region or country. It is potentially more volatile than a broad-based fund due to adverse conditions in the region.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit (the “Unit”) on the SEHK is driven by secondary market trading factors. The Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Global Leaders ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Global Leaders Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

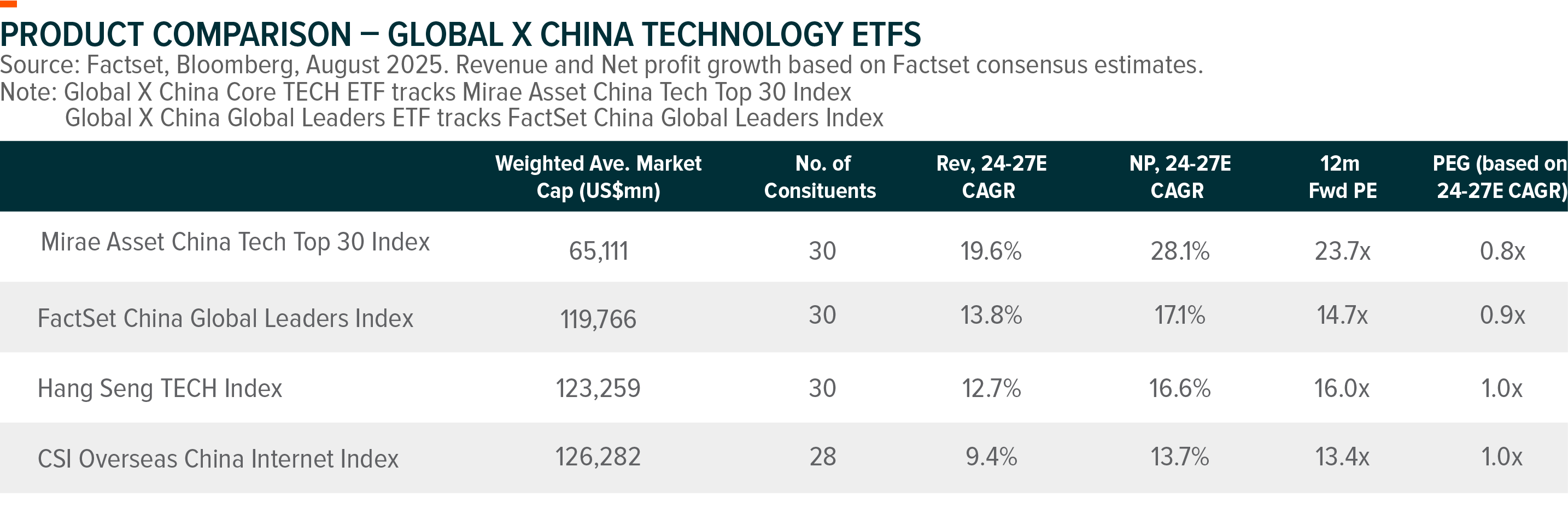

Product Comparison – Global X China Technology ETFs

Continued breakthrough in China AI and Biotech sectors highlighted the innovative capabilities of Chinese technology companies and reignited investor interests. We remain positive on the development and investment value of China technology companies as supported by large talent pools, supportive policies, sophisticated supply chains, solid industrial foundations, and improving global recognition.

Global X provides a suites of technology ETFs that help investors capitalize on China technology developments. With thematic-focused approach, we highlight Global X China Core TECH ETF (3448), and Global X China Global Leader ETF (3050) as complementary options to the existing mainstream Hang Seng Tech/KWEB ETFs in order to effectively capture the growth potential of the Chinese technology sector.

Global X China Core TECH ETF (3448)

A Diversified Technology Portfolio Across Different Cycles: Each technology industry has different business cycles. By covering more than seven technology sectors, this portfolio can help to reduce some of the high volatility that comes with investing in technology stocks. Global X China Core TECH ETF (3448) represents a comprehensive portfolio that encompasses companies across major high-end technology categories where China is expected to become competitive globally. Within relevant sectors, top 30 companies ranked in market cap are included in the index, with weighted average market cap of US$65bn. Top 5 sectors include Semiconductors (18%), Biotech (17%), EV (16%), Consumer Electronic (15%), and Battery (11%) (Mirae Asset, as of 30 June 2025). Furthermore, through more diversified allocation among high-tech themes, investors can have a more balanced portfolio to navigate different business cycles of technology development.

Global X China Global Leader ETF (3050)

From Domestic To Global Leaders: As China’s economy shifts into a slow-growth phase, many industries are becoming oligopolistic, allowing leading companies to enjoy better profitability profile. Furthermore, China’s manufacturing excellence not only enables leading Chinese companies to solidify their domestic leaderships but also facilitates their expansion into overseas markets, empowering them to emerge as global leaders with products that are internationally competitive. By employing a leader-focused index methodology, Global X China Global Leader ETF (3050) helps investors in seizing investment opportunities presented by potential Chinese global leaders. First, we select companies that have top revenue ranking within sectors to include sector leaders. Second, we choose companies that derive over 25% of their revenue from international markets or have more than US$1 billion in overseas revenue, thereby identifying firms with a significant global presence. Finally, we focus on the top 30 companies ranked by market cap.

Portfolio Analysis

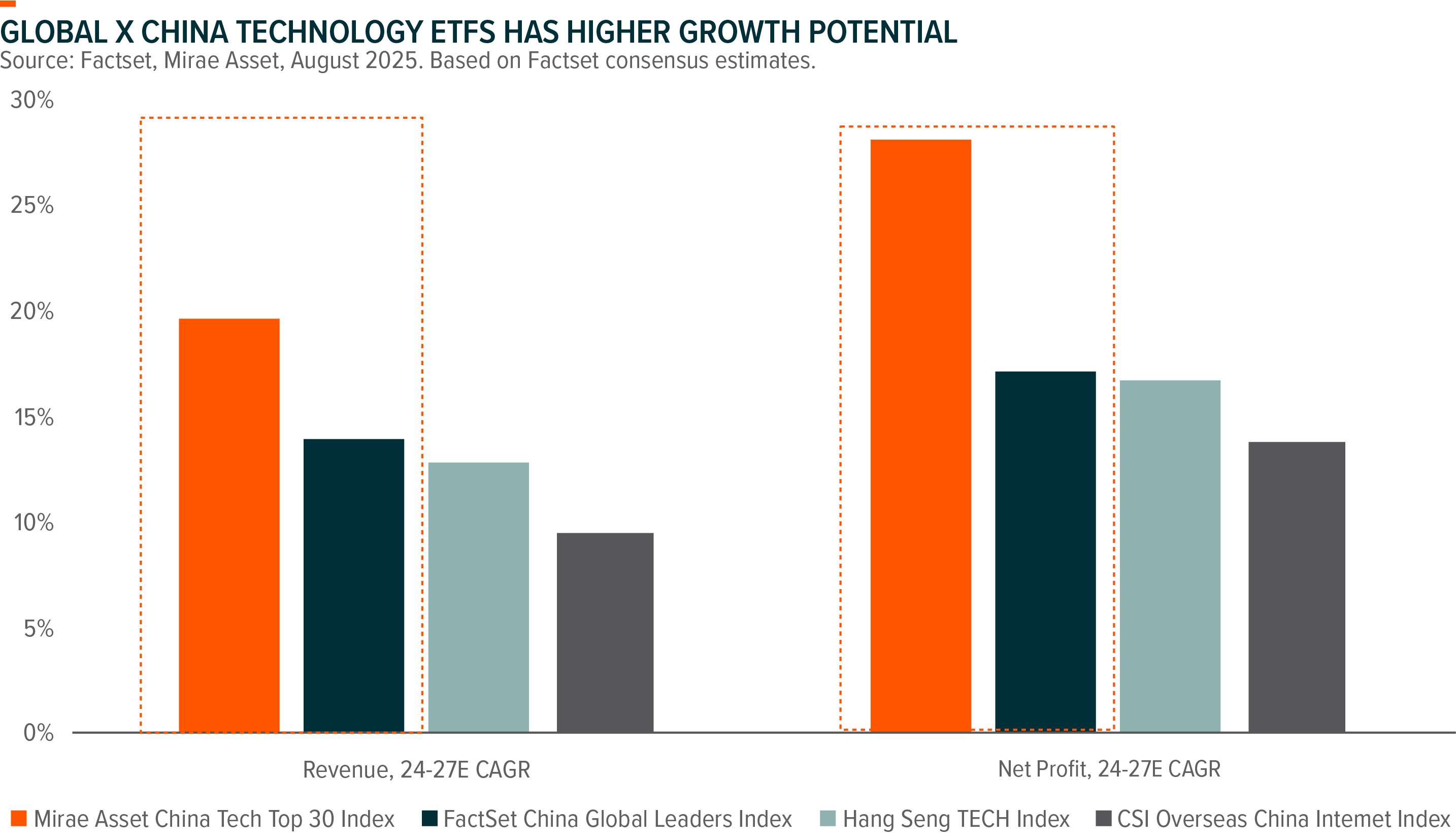

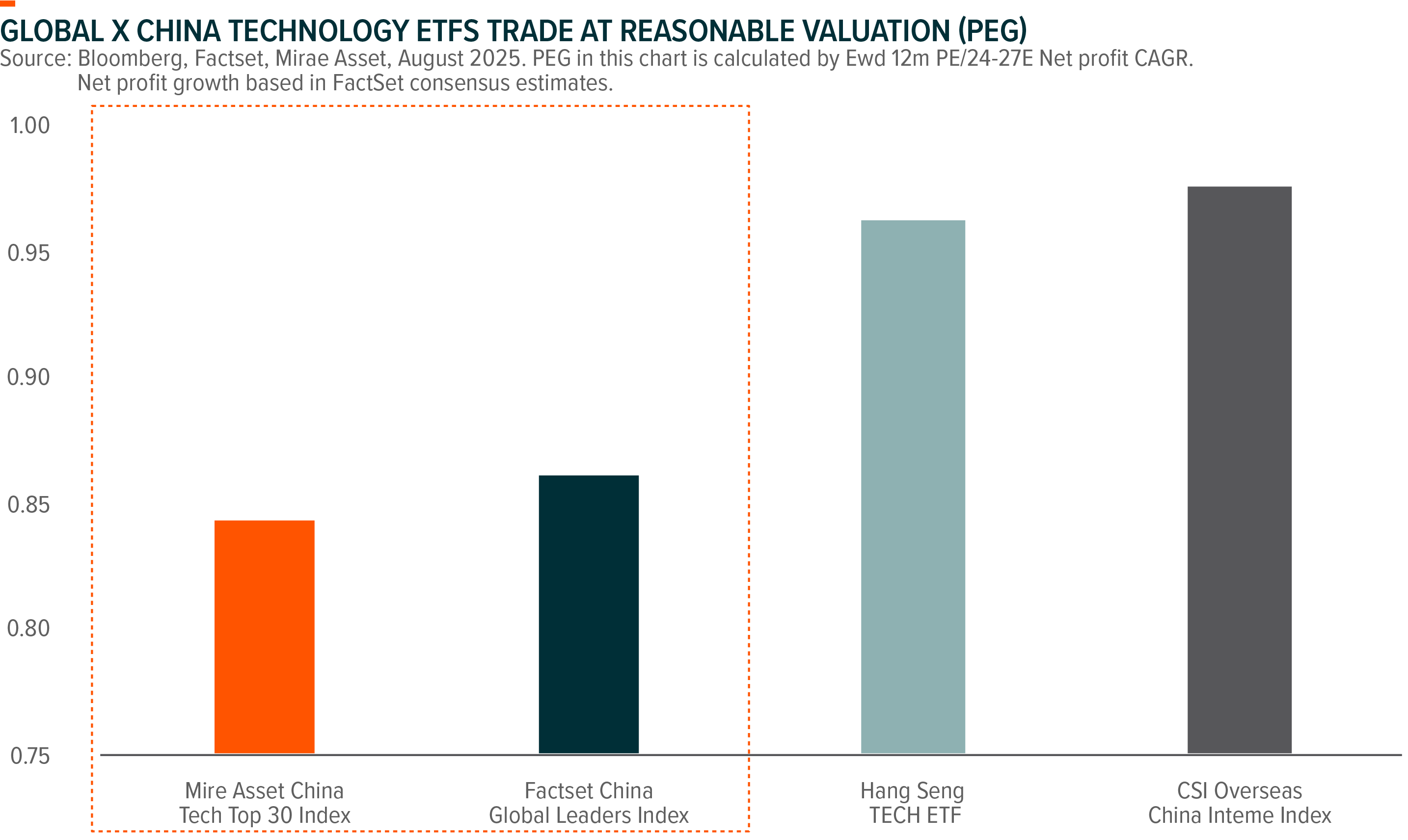

Higher growth prospects with reasonable valuation: Our thematic investment approach in China technology space leads to higher growth potential. By both Revenue and Net Profit, China Core TECH ETF and China Global Leaders ETF have higher growth prospects (based on Factset Consensus estimates) compared to internet-centric Hang Seng Tech ETF and KWEB ETF. Valuation is relatively higher, but this is justified by higher future growth. Valuation for China Core Tech and China Global Leaders portfolio look compelling from PEG perspective.

Quality portfolio with high overseas exposure: Though investing in technology sector leaders/niche market leaders in China, Global X China Technology ETFs demonstrated generally on-par or higher ROE and profitability compared to major China Technology ETFs. China Core TECH ETF also has higher R&D intensity. Furthermore, Global X China Technology ETFs have substantially higher overseas revenue contributions, indicating more established overseas business and potential to penetrate globally. Global X ETFs also have higher exposure to onshore listed stocks, and are positioned to benefit if A-Share catches up with the H-Share rally YTD.