Important Information

Investors should not base investment decisions solely on this material. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Core TECH ETF (the “Fund”)’s investment objective is to provide investment results that closely correspond to the performance of the Mirae Asset China Tech Top 30 Index (the “Index”).

- The Fund is exposed to concentration risk by tracking a single region or country. It is potentially more volatile than a broad-based fund due to adverse conditions in the region.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are usually of emerging nature with smaller operating scale. In particular, these companies are subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- Distributions paid out of capital, or effectively from capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

Mirae Asset Announces Launch of China Core TECH ETF (3448) to Capture China Innovation Leaders

Single-Share Per Lot Makes China Tech Investing Accessible to All

Hong Kong (July 9, 2025) – Global X ETFs, a leading global provider of ETF (exchange-traded funds), today launched the Global X China Core TECH ETF (Stock Code: 3448) on the Hong Kong Stock Exchange, offering investors unprecedented access to China’s high-tech leaders at just HK$90 per lot of initial issue price.

The ETF tracks the Mirae Asset China Tech Top 30 Index, which is designed to track China and Hong Kong’s leading technology companies by market capitalization across critical next-generation technology sectors. These innovative companies are positioned at the forefront of:

- Digital Transformation (Semiconductors, Software, Hardware, Telecom Equipment)

- Future Mobility (EVs, Battery, Robotics)

- Advanced Solutions (Biotech, Medtech, Industrial Automation, Smart Manufacturing)

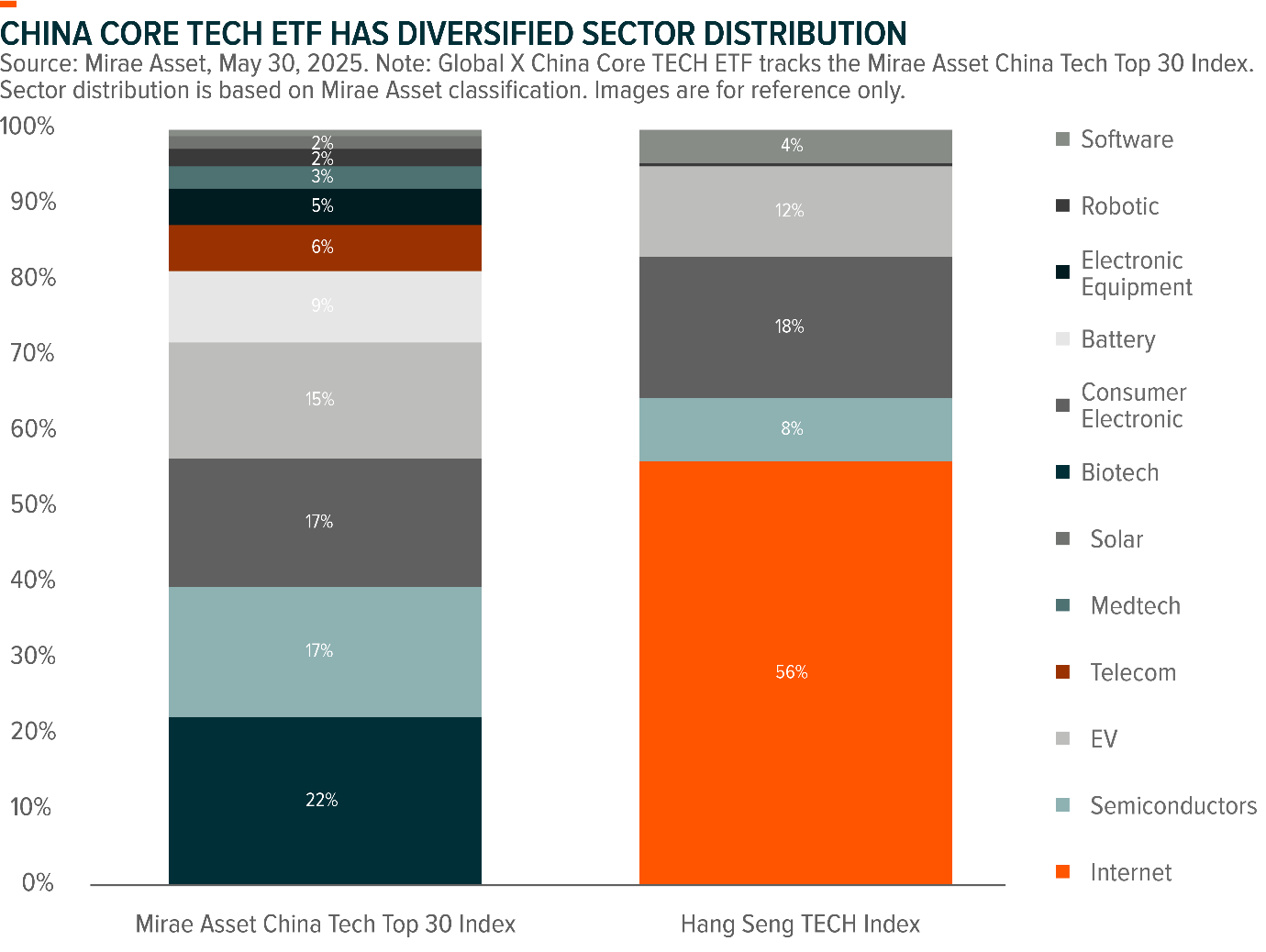

The Index provides exposure to companies that are leading China’s “Technology Self-Reliance” and competing on the global stage. A key feature of this technology-focused ETF is that it has limited exposure to internet companies, which make it different from other technology indices like Hang Seng TECH Index.

“The launch of our China Core TECH ETF comes at a pivotal moment in China’s technological ascent,” Mr. Wanyoun CHO, Chief Executive Officer of Mirae Asset Global Investments (Hong Kong) Limited, said: “Chinese innovators have evolved from cost competitors to global leaders across frontier technologies. Our ETF breaks new ground by making this growth story accessible to all investors through a single-share structure, allowing precise participation in China’s tech revolution.”

The Global X China Core TECH ETF (Stock Code: 3448) is now available for trading through all major brokerage platforms in Hong Kong with single management fee as low as 0.68%*.