Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Index is reconstituted annually. Eligible securities are added into the Index as constituents during the next scheduled annual reconstitution. Similarly, securities that no longer meet the eligibility criteria of the Index may continue to remain in the Index until the next scheduled annual reconstitution, at which point they may be removed. There is no guarantee that the representativeness of the Index is optimised from time to time.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index Calculation Agent calculates and maintains the Index. If the Index Calculation Agent ceases to act as index calculation agent in respect of the Index, the Index Provider may not be able to immediately find a successor index calculation agent with the requisite expertise or resources and any new appointment may not be on equivalent terms or of similar quality. There is a risk that the operations of the Index may be disrupted which may adversely affect the operations and performance of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the Stock Exchange of Hong Kong is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

Market Insight

US-Japan Tariff Deal Benefits Japan Exporters

Japan stock market surged in response to favorable news regarding US-Japan tariff deals. On July 22, US government revealed new tariff agreements with Japan, notably reducing tariffs on Japanese exports, including the automotive sector, from 25% to 15%. This came in as a positive surprise to the market, especially considering the reported challenges in negotiating reductions in automobile tariffs. The tariff deal also includes US$550bn Japanese investment package in the US.

Implications

The tariff deal came in better than expectation, especially on Automobile sector. US had previously imposed a 25% tariff on Japan’s automobile, which accounts for over 25% of Japan’s total export to the US. As a result, Japan’s auto export to the US fell by 25% YoY in May, and further accelerated to 27% YoY in June. EPS growth consensus for Japan Autos and Transportation Equipment Sector has been revised down by over 29% in the past 4 months to reflect tariff impact, leaving potential for upside revision after the tariff deal. Auto supply chain companies could also benefit. Improved corporate earnings could also contribute to wage hikes in Japan, sustaining the reflationary trend in Japan. Additionally, the US$550bn Japan investments in the US as part of the tariff deal could lead to further JPY depreciation, which will support corporate earnings and benefit Japan exporters.

On another note, Japan’s ruling coalition suffered a defeat in the Upper House elections on July 20, resulting in minority rule in the Upper House as well. Japanese Prime Minister Ishiba denied the news that he will resign and reiterated intention to stay in office. Visibility is still low at current stage as the situation evolves, but the election impact on stock market could be limited.

With the settlement of US tariff uncertainty, Japan equity market is in a relative positive setup with room for EPS upward revision. Corporate governance reform continues to bear fruits as it enhances listed company qualities and improve shareholder friendliness. Japan market (TOPIX Index) is currently trading at an undemanding 15.7x forward PE, with potential opportunities for valuation rerating as bolstered by EPS upward revision and improved market sentiments.

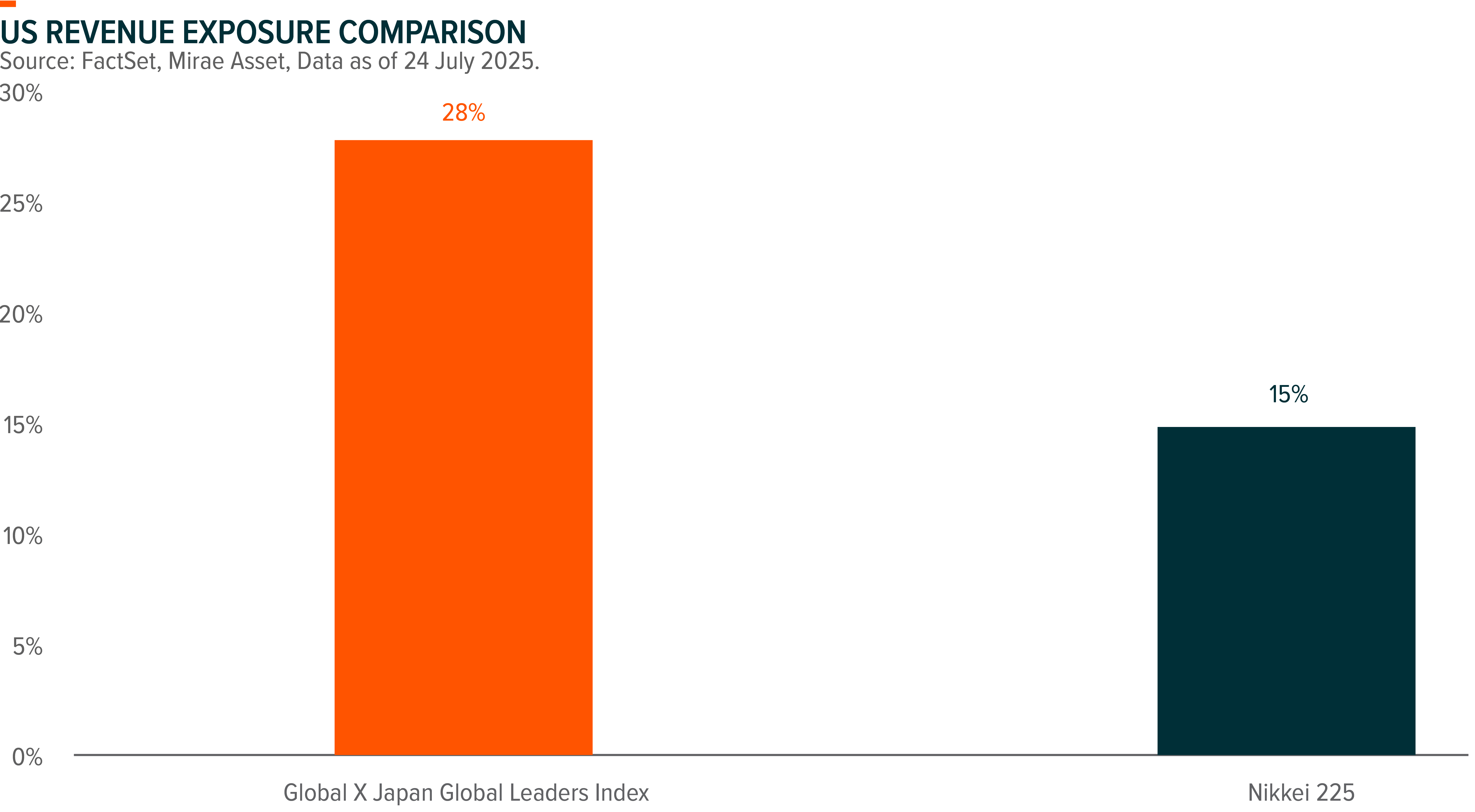

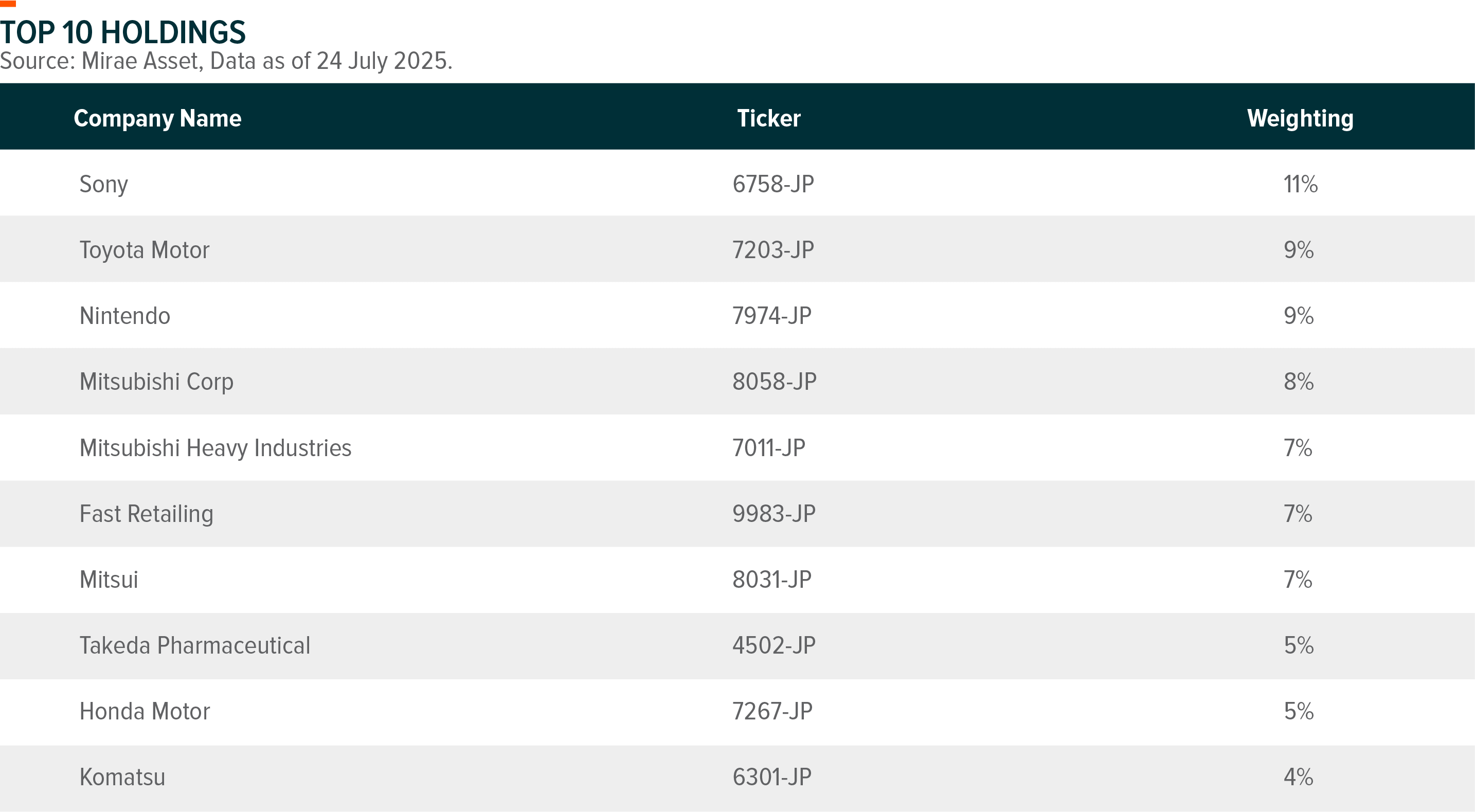

Global X Japan Global Leaders ETF (3150) invests in 20 Japanese companies featuring global leaderships. The ETF has higher revenue exposure to the US and thus could potentially benefit from a more favourable US-Japan tariff deal. Top categories for the ETF include Trading Houses, Auto manufacturers, and Consumer Electronics.

| Global X Japan Global Leaders ETF (3150) |

|

|---|---|

| Listing Date | 24 Nov 2023 |

| Reference Index | FactSet Japan Global Leaders Index |

| Primary Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.68% |

| Product Page | Link |

Source: Mirae Asset; Data as of July 2025. The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. As the Fund is newly set up, this figure is an estimate only and represents the sum of the estimated ongoing charges over a 12-month period, expressed as a percentage of the estimated average Net Asset Value of the Listed Class of Units of the Fund over the same period. It may be different upon actual operation of the Fund and may vary from year to year. As the Fund adopts a single management fee structure, the estimated ongoing charges of the Fund will be equal to the amount of the single management fee, which is capped at 0.68% of the average Net Asset Value of the Listed Class of Units of the Fund. Any ongoing expenses exceeding 0.68% of the average Net Asset Value of the Listed Class of Units of the Fund will be borne by the Manager and will not be charged to the Fund. Please refer to the Product Key Facts and the Prospectus for further details.