Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X Japan Global Leaders ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index.

- The Underlying Index is reconstituted annually. Securities that no longer meet the eligibility criteria may remain in the index until the next scheduled annual reconstitution. The index’s representativeness is not guaranteed to be optimised from time to time.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Global X Japan Global Leaders ETF (3150) Updates

Japan equities hit record highs as bolstered by several positive tailwinds including US-Japan tariff agreements, passage of US tax cut regulations, better-than-feared Apr-Jun earnings, and expectations surrounding domestic political developments. Furthermore, the revival of Japan’s economy and ongoing corporate reforms continue to serve as the structural drivers for Japan’s stock markets.

Apr-Jun earnings for TSE Prime companies were -17% YoY in Net Profit and roughly flat YoY in Revenue, as affected by US tariff and Yen appreciation. The YoY decline has been expected by the market, and majority of companies still beat consensus estimates in the quarter. The current EPS expectation has adequately priced in tariff impacts, with upside potential for companies to lower their impact estimates as they take into consideration the lowered tariff (esp. for auto sector) and the mitigation impact from their countermeasures (such as price pass through). Some companies have also revised their outlooks upward, thanks to milder-than-expected tariff impacts. Current valuation for Japan market (12m Fwd PE for TOPIX = 15.7x) is slightly higher than historical average of 15x, but still at a higher-than-historical discount as compared to the US market, implying room for further valuation rerating on the back of potential upward earnings revisions. (Mirae Asset, August 2025)

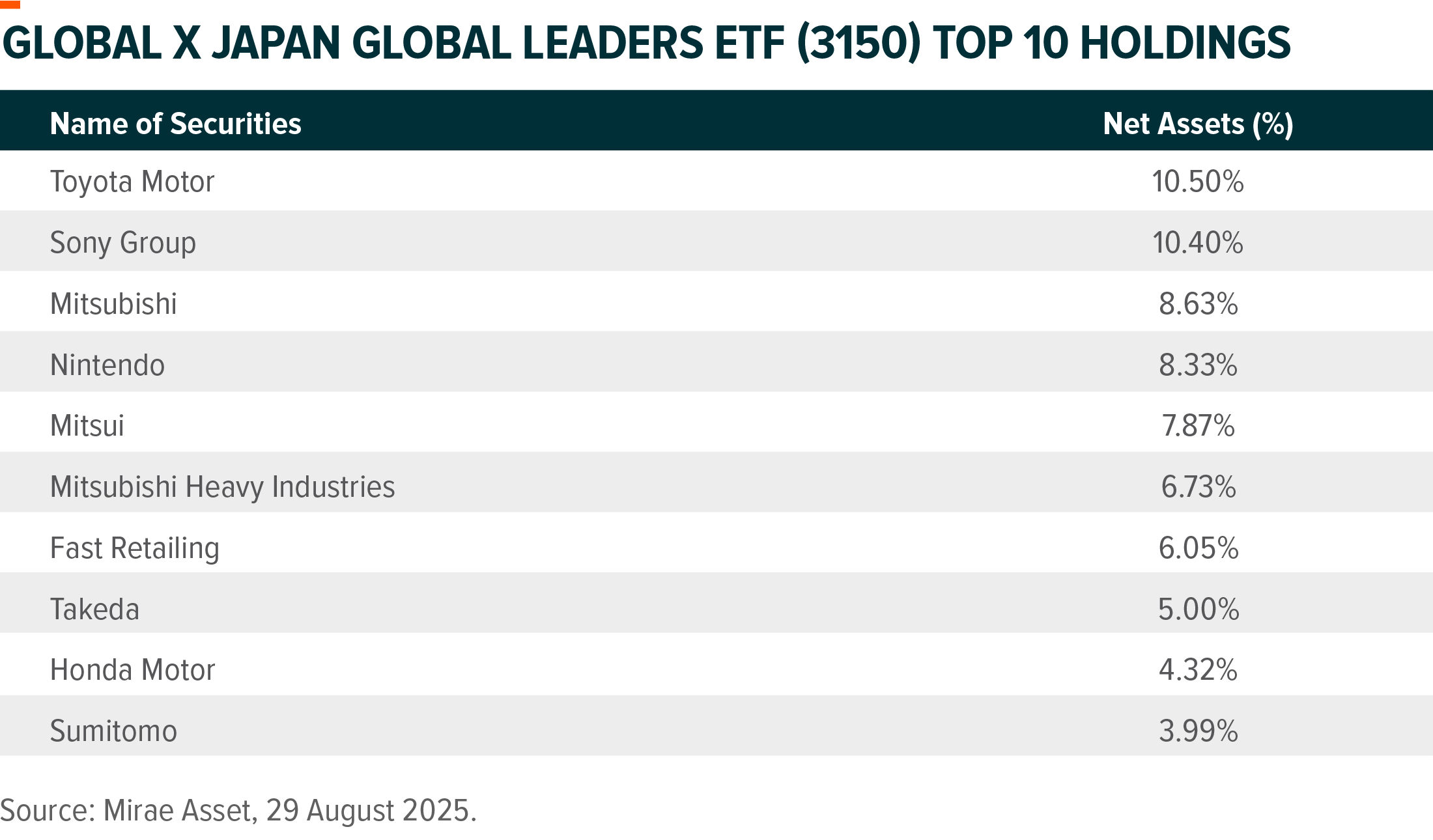

Notably, Global X Japan Global Leaders ETF (3150) outperforms broad-based Japan Market by large margin thanks to the solid performance of exporters on the back of better-than-expected US-Japan tariff deal. Industrial is the best performing sector and contributed most to the outperformance. Among major ETF constituents, Mitsubishi Heavy Industries (7011 JP) is the best performing stock YTD with ~70% return, as its earnings continue to expand on growth for energy due to increasing electric power demand as well as for aircraft, defense & aerospace from expansion of Japan’s defense budget. Nintendo (7974 JP) gained over 50% mainly driven by the successful launch of Switch 2. Sony (6758 JP) also returned over 30% on the back of better-than-expected Game performance. Major auto companies such as Toyota (7203 JP) and Honda Motor (7267 JP) also rebounded substantially after US-Japan tariff agreement, contributing to the ETF performance since late July. (Mirae Asset, August 2025)

| Global X Japan Global Leaders ETF (3150) |

|

|---|---|

| Listing Date | 24 Nov 2023 |

| Reference Index | FactSet Japan Global Leaders Index |

| Primary Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.68% |

| Product Page | Link |

Source: Mirae Asset; Data as of August 2025. The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. As the Fund is newly set up, this figure is an estimate only and represents the sum of the estimated ongoing charges over a 12-month period, expressed as a percentage of the estimated average Net Asset Value of the Listed Class of Units of the Fund over the same period. It may be different upon actual operation of the Fund and may vary from year to year. As the Fund adopts a single management fee structure, the estimated ongoing charges of the Fund will be equal to the amount of the single management fee, which is capped at 0.68% of the average Net Asset Value of the Listed Class of Units of the Fund. Any ongoing expenses exceeding 0.68% of the average Net Asset Value of the Listed Class of Units of the Fund will be borne by the Manager and will not be charged to the Fund. Please refer to the Product Key Facts and the Prospectus for further details.