Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X China Robotics and AI ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Robotics and Artificial Intelligence Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Global X China Robotic and AI ETF (2807) Updates

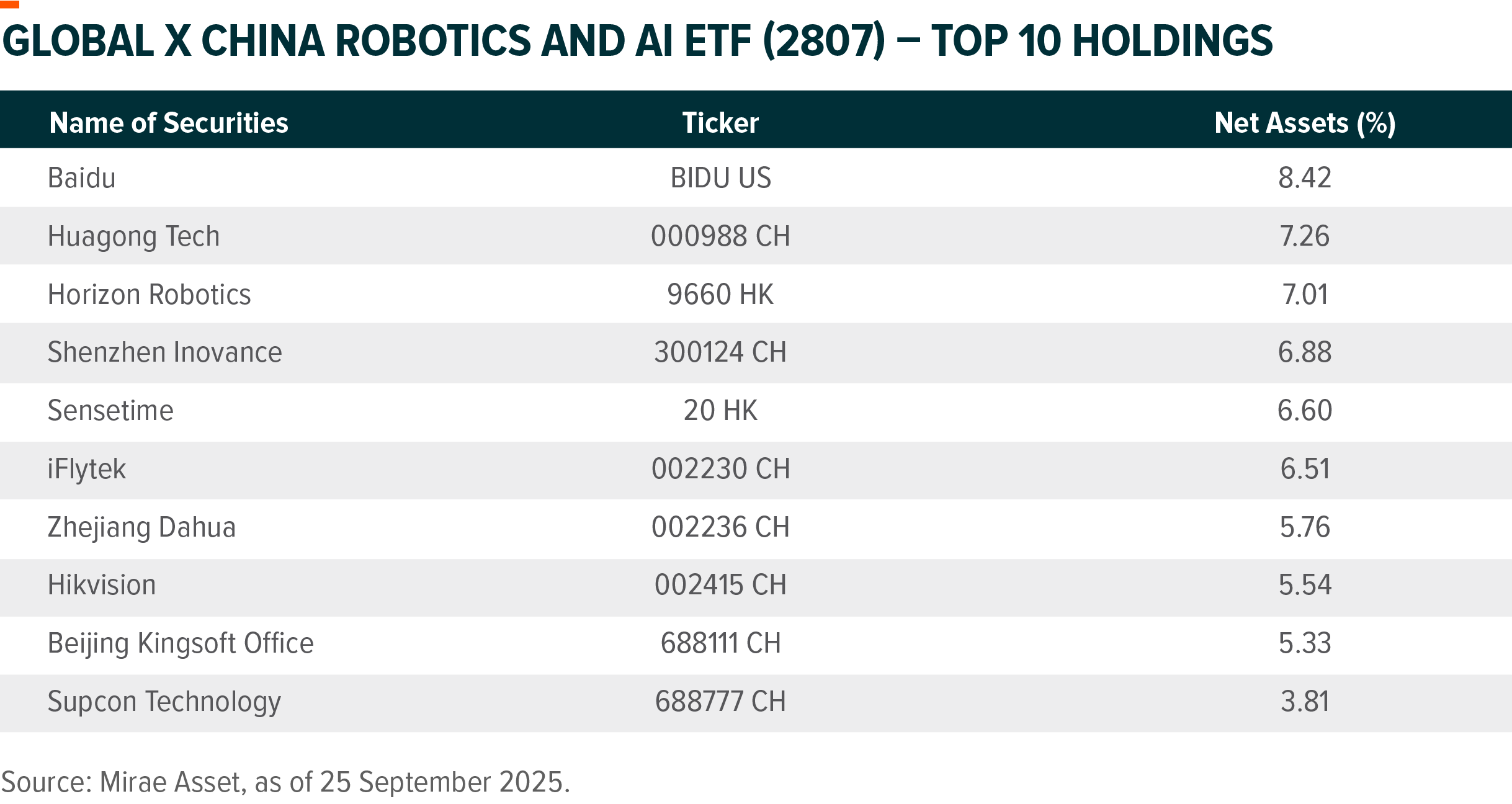

Global X China Robotic and AI ETF (2807) invests in leading Chinese Robotic and AI companies. In addition to the traditional Robotic & Automation sector, the ETF also has exposure to Humanoid Robot and Autonomous Driving sectors – two of the most prominent Physical AI applications. In this note, we provide updates on the three key themes, along with the ETF’s key constituents.

Humanoid Robot: Accelerating Adoption

Major Chinese integrators, including Agibot, Unitree, and Ubtech, have announced millions dollar of orders over past 3 months, indicating accelerating adoption across commercial service and industrial use cases. Ubtech made headlines in September by securing order worth Rmb250 million, marking the largest order worldwide to date. Most integrators are targeting hundreds to thousands of units of delivery this year. In the US, Tesla expressed its confidence in Optimus Gen 3 architecture and may push for scaled production next year. CEO Elon Musk reiterated his target of 1mn unit annual production within 5 years. (Business Insider, September 2025)

We are also seeing sufficient fundings for humanoid robot development. Unitree completed series C funding in June with Rmb12bn (US$1.7bn) valuation, and has reportedly started its IPO process. Unitree claimed its annual Revenue exceeded Rmb1bn and has been profitable since 2020. Both major listed companies (UBTECH through share placement) and private companies (Agibot through strategic investments) have completed latest round of financing in the past few months. Furthermore, large cap tech companies such as Alibaba and JD are also participating in humanoid robot development through investments. (Company data, September 2025)

Data remains a key constrain for further humanoid robot development. There are still debates over whether only real world data can help to achieve scaling law as in the case of intelligent driving, or simulation data can also do. If the former were true, Chinese players could have advantages thanks to larger data volume and lower costs.

Policy support is another key driver for China’s humanoid robot development. On central government level, humanoid/embodied intelligence is a strategic industry, and was mentioned by Premier Li in government working report in March 2025. MIIT guided to create industrial pilot zone for emerging sectors such as humanoid robots, brain-computer interfaces, and quantum information in the “fifteenth-five’ period. On local government level, Beijing and Zhejiang stated their targets of deploying 10-20k units of humanoids by 2027, and some local governments are providing subsidies for humanoid robot adoption at up to 30% of the robot price.

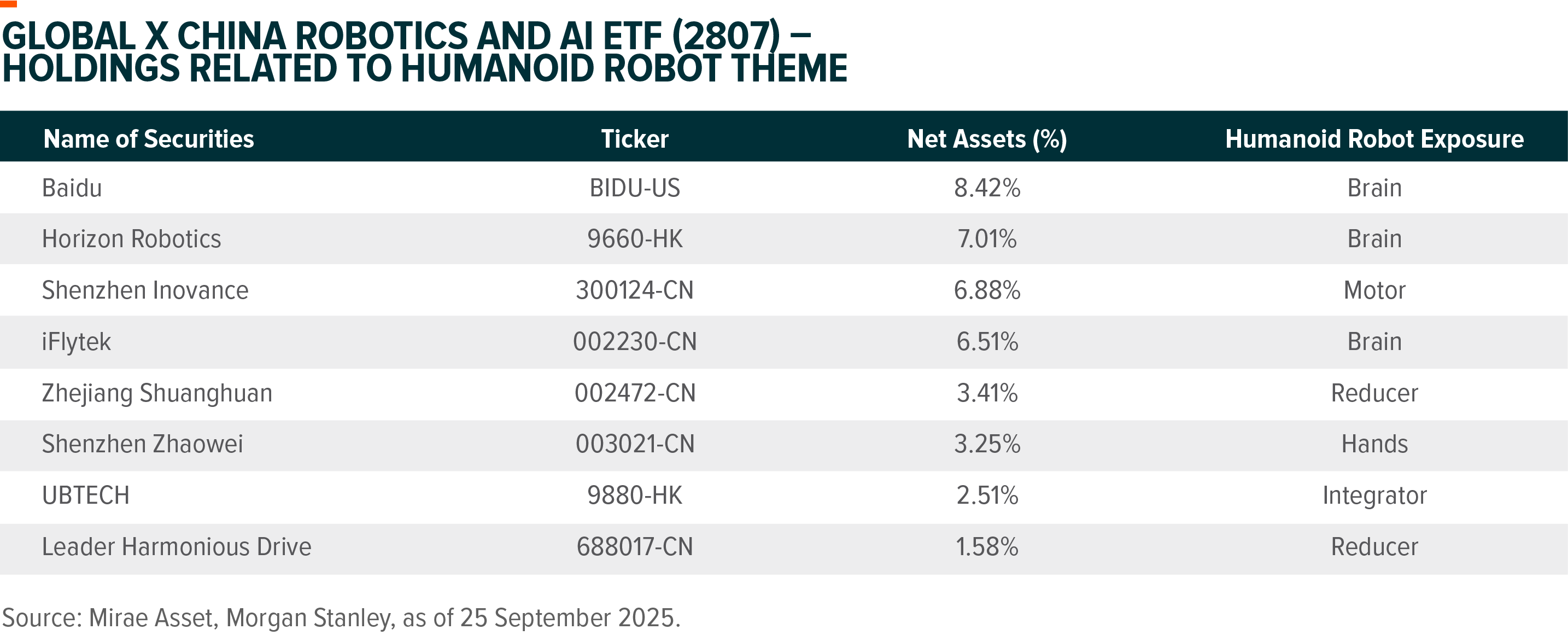

Global X China Robotic and AI ETF (2807) invests in leading robotic and AI companies in China. As of 25 Septemeber 2025, the ETF has 40% exposure to humanoid robot supply chain, spanning across Brain (Baidu, iFlytek), Robot parts (Inovance, Shuanghuan, Zhaowei), and integrator (Ubtech).

Robotaxi: Ramping Up Commercialization

China’s prominence as a global leader in autonomous driving development is underscored by its position as the world’s largest electric vehicle (EV) market, supported by significant investments from leading companies in the field. There are two major business models: Advanced Driver Assistance Systems (ADAS, mostly L2/L2+) offered by EV OEMs, and Robotaxi (L4) that operates as driverless taxi. Robotaxi generates revenue by charging fares from passengers. (HSBC, April 2025)

In the past year, we are seeing rapid progress of Robotaxi adoption in China, with leading players such as Baidu ApolloGo and Pony AI expanding fully driverless services in several major cities (or certain districts within cities) including Beijing, Shanghai, Shenzhen, Wuhan, Chongqing etc. China is also a global leaders in Robotaxi with combined fleet size of over 2000 (c.1000 for Apollo Go, c.500 for Weride, c.270 for Pony AI, as of May 2025). In the US, Waymo is a major player with c.1500 fleet size operated in several major cities.Tesla also began small-scale road testing since June 2025, and planning to expand to 1000 vehicles in few months. (Company data, Mirae Asset, September 2025)

Robotaxi is a viable way of commercialization for autonomous driving with improving unit economics, which is supported by technology advancement and regulatory support. Unit economic improvement can be achieved by the improvement in both revenue and cost side. 1) On revenue side: a) Orders per day could increase meaningfully. Compared to traditional taxi, Robotaxi can take more orders given longer operation hours. b) ASP can also increase driven by larger operating area and longer trips per order. 2) On cost side: With technology evolvement, spending on remote assistant could decrease due to less demand for monitoring and intervention. Per vehicle hardware costs could also decrease as fleet size expands. Improving unit economics should accelerates Robotaxi commercialization and adoption in China. (Mirae Asset, September 2025)

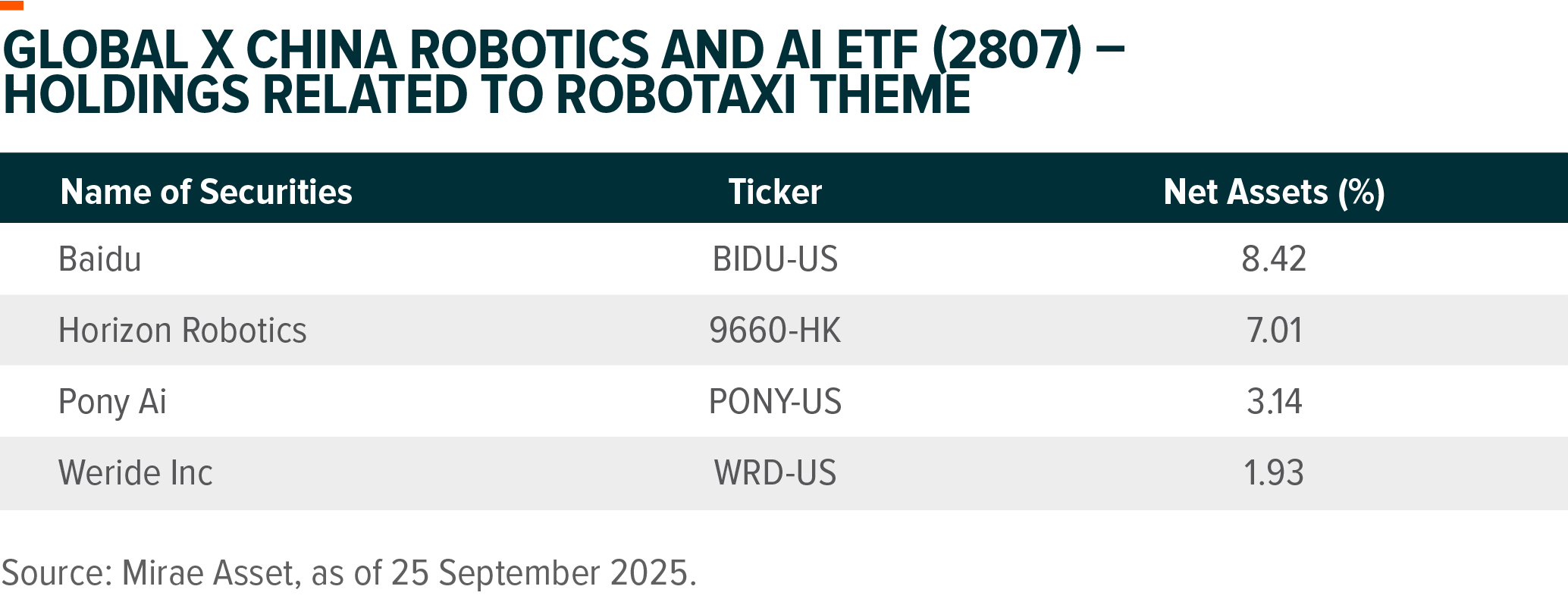

Global X China Robotic and AI ETF (2807) also has exposure to Robotaxi theme through investing in Baidu, Horizon Robotics, Pony AI, and Weride.

Robotic and Automation: Bottoming Out For Some Sectors

The China State Council has announced an artificial intelligence plus action plan recently that promotes the application of artificial intelligence technologies, targeting a 90% application rate by 2030. (China Daily, August 2025) We will see more policy details to follow in terms of specific measures and targets. On the manufacturing side, the plan is aimed at speeding up the commercialization of AI technologies such as humanoid robots and autonomous logistics, which are restricted by high production and R&D cost, legislation and many other factors now. (Mirae Asset, September 2025)

The general China factory automation demand is bottom out from OEM segments including lithium battery, electronics, auto and industrial robotics, while process automation such as petrochemical and chemicals industry remained sluggish. The sector’s outlook has shifted decisively upward, with some leading companies delivering strong sales and earnings results in 1H25, much better than feared at the early of the year. Chinese leading companies, such as Inovance, Leader Drive, Shuanghuan, keep gaining market share thanks to growth in lithium battery and logistics industries.

ETF Constituents Updates

Baidu: Its core advertising business remain under pressure though, as Baidu undergoes AI search transformation. However, Baidu’s share rallied by over 40% in Sep, as market tends to value the stock with SOTP valuation framework and attribute more value to its AI-related cloud and Robotaxi business. Baidu is one of the leading AI Cloud providers in China, offering full-stack AI architecture. Its AI Cloud revenue recorded substantial growth acceleration in past quarters thanks to strong AI demand. Baidu also has its proprietary Kunlun chips that are used for internal inferencing demand, and increasingly for external uses. It won deals with China Merchants Bank and China Mobile in Mar-25 and Aug-25, respectively. Furthermore, Baidu is also one of the largest Robotaxi providers in China and even globally. The number of fully driverless rides provided by Apollo Go increased by 148% YoY to over 2.2m in 2Q25. The cumulative rides provided to the public exceeded 14m as of Aug-25. Apollo Go covers 16 cities globally, and is in talk with multiple regions across Middle East, SE Asia, and Europe for potential overseas expansion. With its solid R&D capability, strong AI commitments, and ongoing AI integration with core business, Baidu is well positioned to benefit from the AI development in China. (Company data, September 2025)

Horizon Robotics: The company’s shipment and margins are expected to improve in 2H25, thanks to more sales from key customers and increasing penetration to new automakers. The 1H25 results ended at 68%YoY revenue growth and the net loss Rmb5.2bn due to high R&D cost, but management shared they would improve the profitability with fast volume growth to reduce the R&D D&A cost going forward. (Company data, September 2025)

Huagong Tech: The company is one of the key beneficiaries from 800G optical module domestic production and semiconductor imports substitution. The company also delivered solid 1H25 results with revenue up by 45%YoY and net profits up by 45%YoY driven by strong order growth in all segments. (Company data, September 2025)

Shenzhen Inovance Technology: The company’s order intake was reaccelerating in July and August with double digits growth. Demand from logistics and heavy machines, lithium battery and autos, F&B and some traditional industries are quite strong, which are not impacted by the tariff headwinds. The company also delivered much better than expected 1H25 results with top line up by 27%YoY and bottom line up by 40%YoY. (Company data, September 2025)

WeRide: The company delivered 33%YoY revenue growth in 1H25 and the net loss was narrowing down. WeRide is partnering with Uber to offer robotaxi services beyond China and the United States. (Company data, September 2025)