Important Information

Investors should not base investment decisions solely on this material. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Core TECH ETF (the “Fund”)’s investment objective is to provide investment results that closely correspond to the performance of the Mirae Asset China Tech Top 30 Index (the “Index”).

- The Fund is exposed to concentration risk by tracking a single region or country. It is potentially more volatile than a broad-based fund due to adverse conditions in the region.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are usually of emerging nature with smaller operating scale. In particular, these companies are subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- Distributions paid out of capital, or effectively from capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

Long Report – Global X China Core TECH (3448)

Investment Points

- The Rise of China’s High-End Technology: As the global competitiveness of China’s tech companies continues to rise, these companies could deliver attractive stock returns in the mid-long term.

- Asset allocation in the G2 Tech era: The era of G2 technology has arrived, where technology companies from both countries are leading the world and competing directly. This ETF provides a diversification tool to investors with high exposure to US tech stocks.

- Diversification Effect: Each technology industry has different business cycles. By covering more than seven technology sectors, this ETF can help to reduce some of the high volatility that comes with investing in technology stocks.

A Portfolio Featuring China’s High-tech Leaders. With this note, we introduce Global X China Core TECH ETF (3448 HK). We define core tech sectors as 1) Sectors that are crucial for China to achieve Sci-Tech self-reliance; and 2) Sectors that leading Chinese companies have the potential to become global leaders. This includes Biotech, Semiconductor, EV, Battery, Medtech, Robotic, Consumer Electronic, Solar, and Software sectors. In these traditionally foreign-dominated high-tech sectors, we are witnessing a notable emergence of Chinese companies as significant market share gainers in domestic market, with the prospect to become global leaders. Through investing in 30 domestic leaders, the ETF embodies a robust investment strategy characterized by elevated growth prospects and high R&D intensity, while maintaining an attractive valuation proposition.

High-end Technology Is The New China Growth Driver. China has made remarkable achievements in industrialization over the past decades, successfully manoeuvring through different industrial cycles and currently commanding the world’s largest manufacturing share of over 30% (Gov.cn, 2025). Notably, China’s upgrade to high-tech manufacturing has also made solid progress, outperforming the overall manufacturing growth with policymaker’s effort to move up the global value chain. China surpasses the US in the Nature Index 2024 (Nature Index, 2025), indicating strong competitiveness in science and technology field. With central governments’ efforts to prioritize technology innovation and position high-tech manufacturing as a key growth engine, we believe high-tech companies will play a crucial role to support China’s transition 0020 to technology innovation driven economy.

China Has Established Solid Foundations For Technology Innovation And Industrial Upgrade. China is the only country with every industrial category classified by the United Nations, and has established sophisticated and complete supply chain that supports the manufacturing of globally competitive products. Furthermore, a number of leading Chinese universities have nurtured a substantial pool of science graduates and researchers, facilitating the swift advancements and significant breakthroughs in scientific research and technological innovation. These factors, coupled with the improving digitalization and smart manufacturing foundations, are poised to underpin the sustained success and exceptional performance of China’s technology leaders.

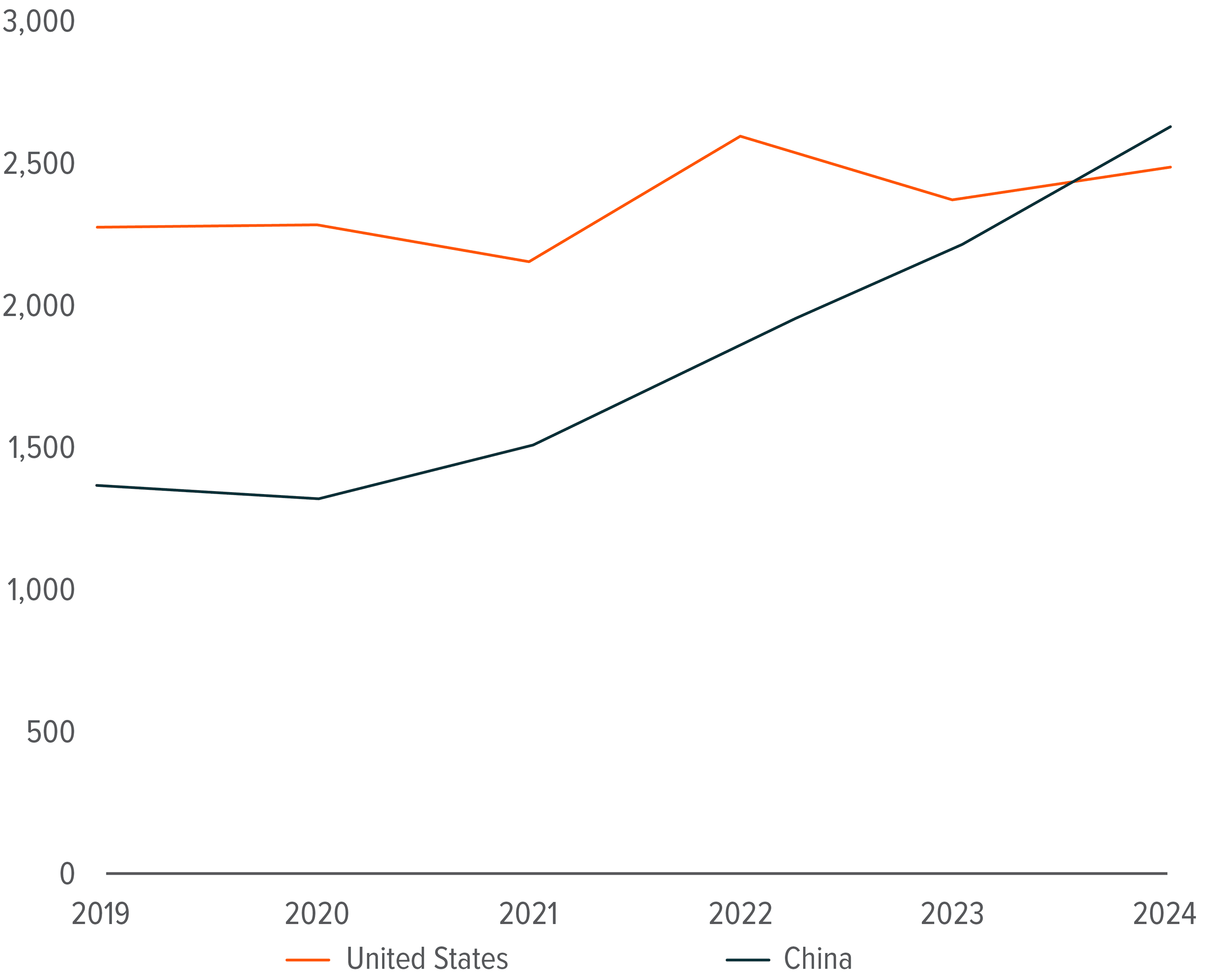

Decades Of Investment Is Starting To Bear Fruits. The emergence of Deepseek is a good example of Chinese companies’ innovative capabilities, but it is just tip of the iceberg. In 2024, China’s total R&D expenditure surged to Rmb3.6 trillion, securing the second position globally and marking an impressive 8.3% YoY growth (Gov.cn, 2025). As a result of continued investments, in various of high-tech sectors such as AI, EV, battery, and Robotics, we are seeing a number of leading Chinese companies not only capturing domestic market share, but also expanding into overseas markets with globally competitive products. Furthermore, the recent major out-licensing deals to leading global pharma companies showcased global recognition of the innovation capabilities of Chinese biotech companies, which were historically considered as laggards in new drug development. From a more holistic perspective, China’s exports have been growing strong with policymakers’ manufacturing push, with increasing contribution from mid-to-high tech sectors. The entry into global markets brings higher TAM and generally better profitability for Chinese technology companies, further solidifying their investment value.

Portfolio Analysis

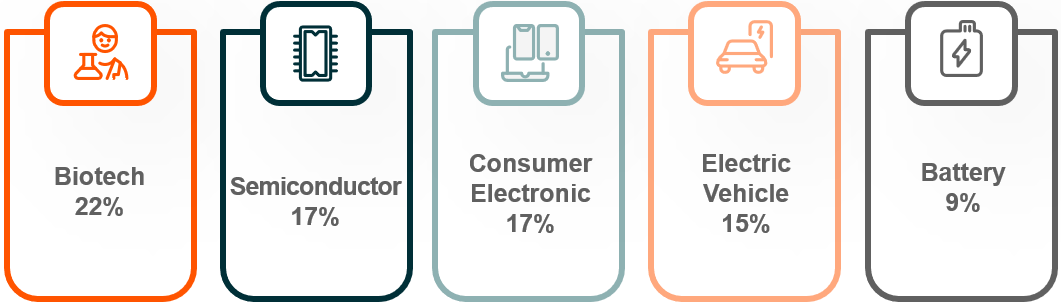

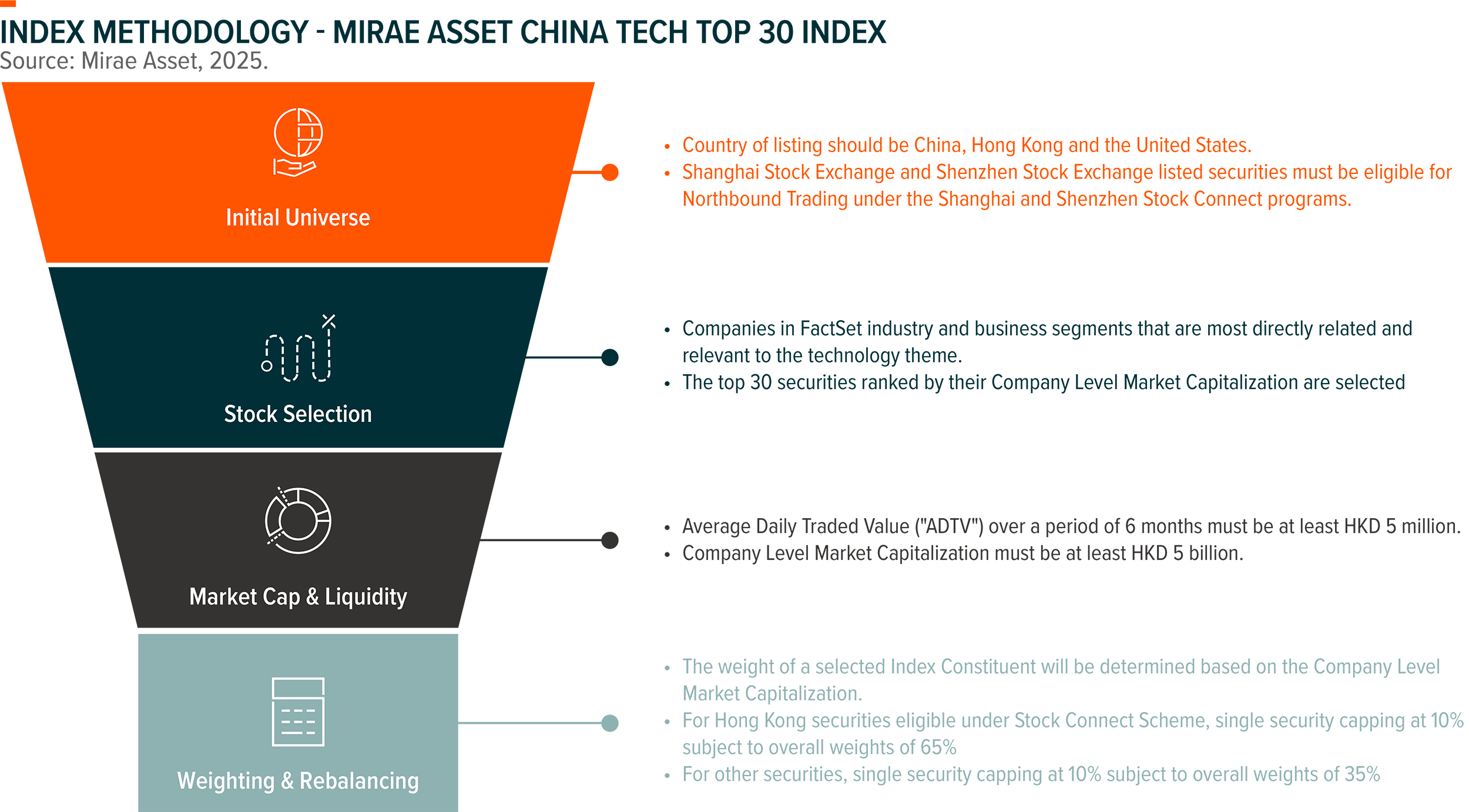

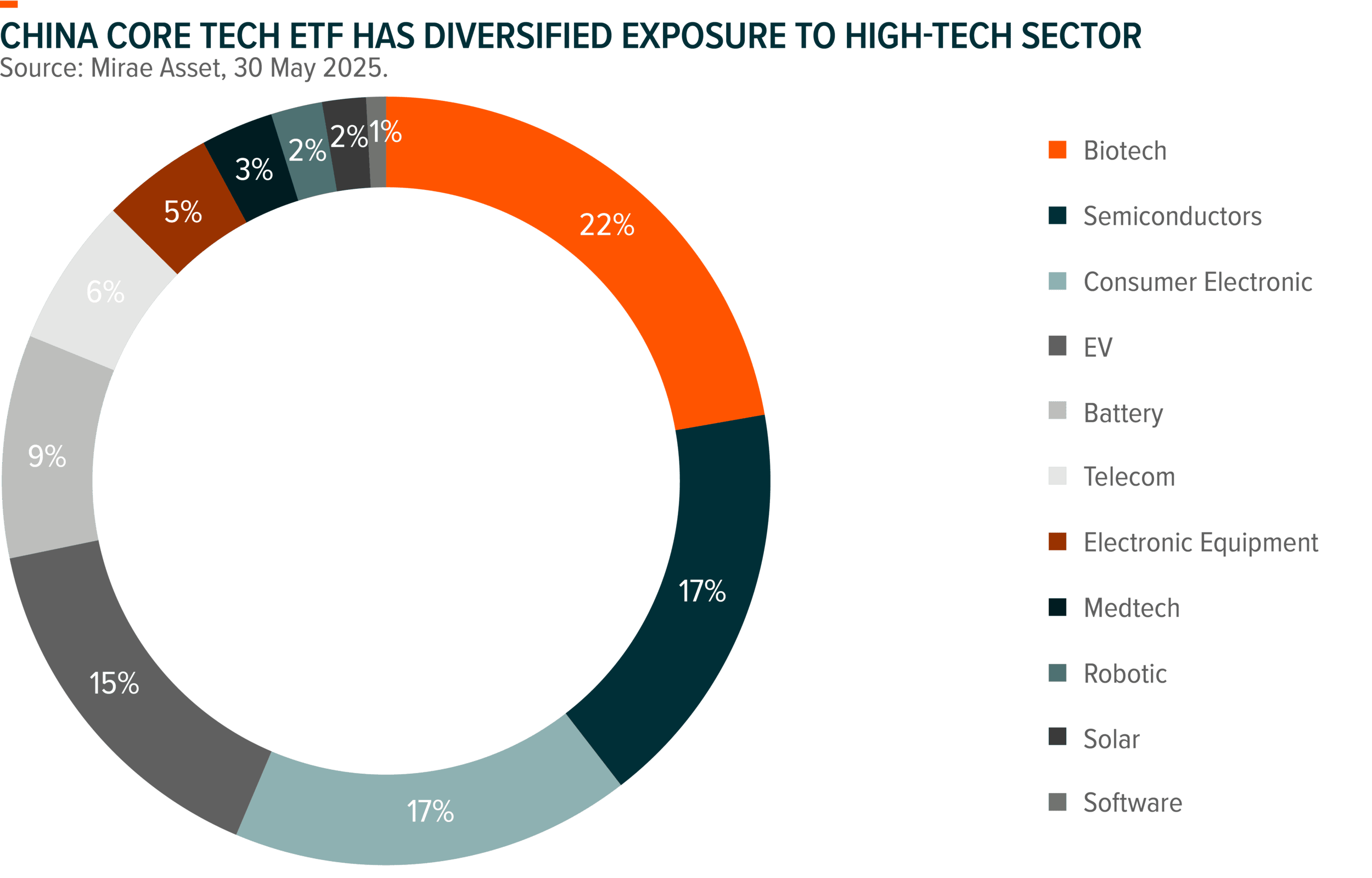

Global X China Core Tech ETF tracks Mirae Asset China Tech Top 30 Index. The Index represents a comprehensive portfolio that encompasses companies across major high-end technology categories where China is expected to become competitive globally. Within relevant sectors, top 30 companies ranked in market cap are included in the index, with weighted average market cap of US$65bn. Top 5 sectors include Biotech (22%), Semiconductors (17%), Consumer Electronic (17%), EV (15%) and Battery (9%). Furthermore, through more diversified allocation among high-tech themes, investors can have a more balanced portfolio to navigate different business cycles of technology development.

Top 5 Sector Allocation

Source: Mirae Asset, July 2025

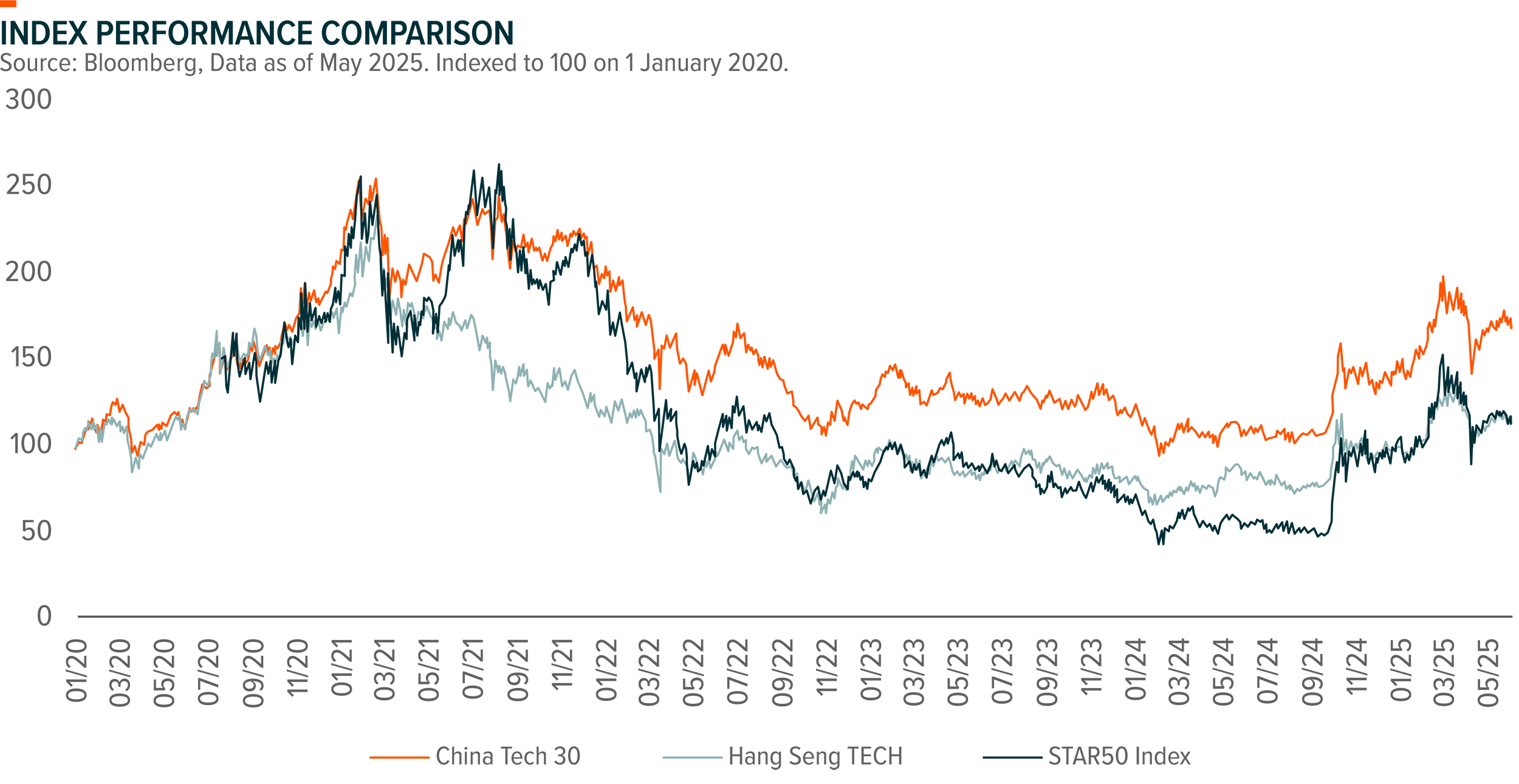

Risk Adjusted Return: Riding on the positive momentum of China technology, underlying index (Mirae Asset China Tech Top30 Index) recorded over 60% return in the past 1 year, significantly outperforming other major China/US technology indices. Industries including Biotech and Semiconductors are capitalizing on significant trends such as international expansions and domestic substitutions. We anticipate these trends will persist as China advances towards high-end manufacturing and scientific and technological self-reliance, aligning with its national strategy. Domestic leaders in these high-tech industries are poised to benefit.

Diversification Effect: The index does not include some of the largest companies in China internet sector, as 1) We seek to provide a portfolio of companies with potential to become global leaders, and Chinese internet companies are more focused on domestic market operations; 2) These internet names are already well-owned by investors, we aim to provide an option for investor to diversify their portfolio. The index has low duplicate ratio (23% by constituents weighting) with Hang Seng Tech.

Index Characteristic: We summarize key index characteristics as follow:

- Comprehensiveness: Invest in high-tech industries across different business cycles. The portfolio has more diversified sector distribution and listing location distribution (35% listed in A-Share); (FactSet, Mirae Asset, 30 May 2025)

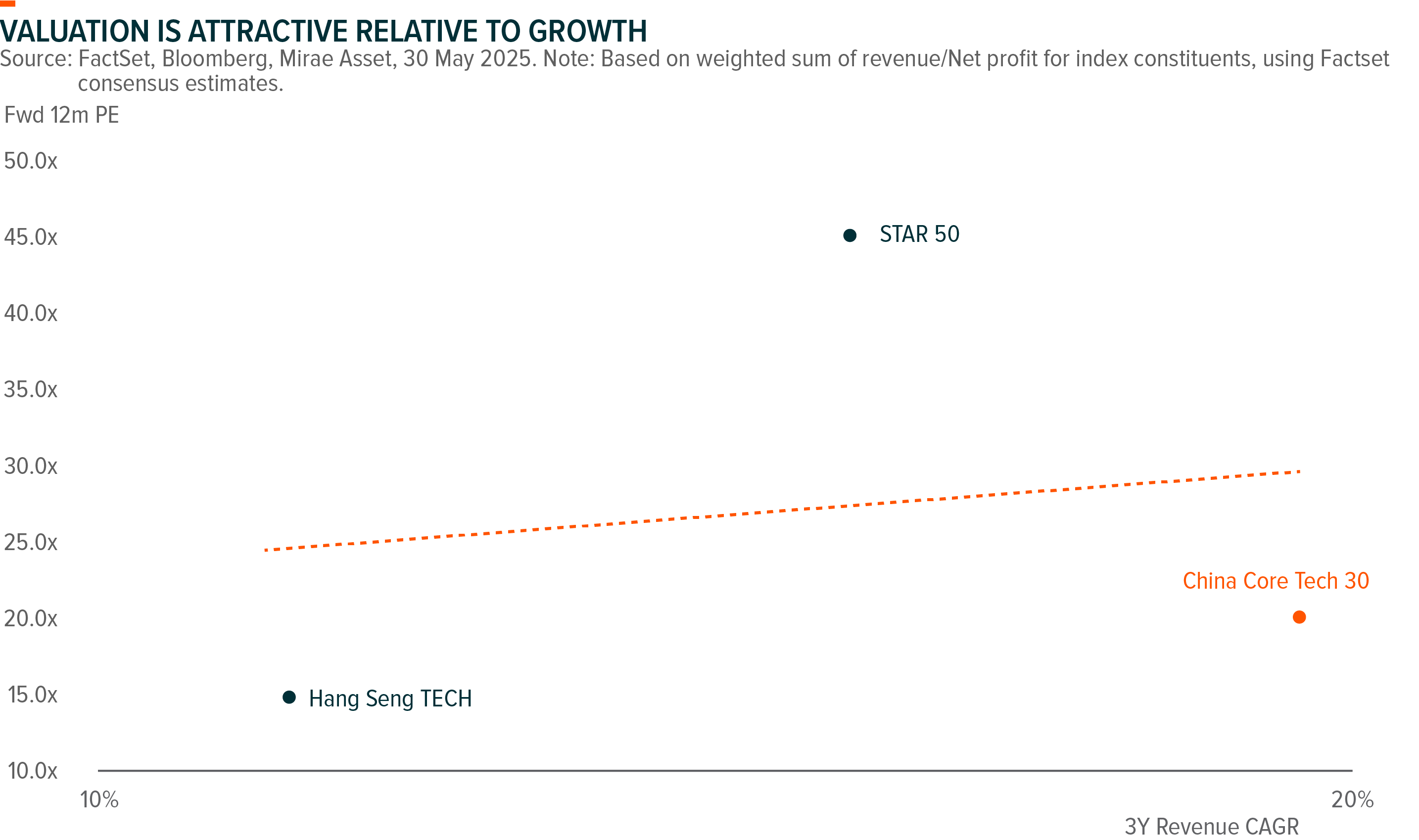

- High growth potential: Many of the high-tech sectors are at fast development stage with domestic leaders rapidly gaining share and expanding overseas. As a result, the portfolio has high growth potential in both Revenue and Net Profit terms, with both figures leading peer indices such as Hang Seng Tech and Nasdaq;

- Reasonable Valuation: Despite higher growth potential, index valuation is undemanding at 20x 12m forward PE, more attractive than other peer indices;

- Dedicated R&D: The index exhibits a higher R&D expense ratio in comparison to peer indices, reflecting a strong commitment to investment in technology research and product innovations;

- Global Footprint: We aim to capture potential global leader in technology sector. The index has higher overseas revenue contribution ratio (41%, vs 15% for Hang Seng Tech). (FactSet, Mirae Asset, 30 May 2025)

Sector Analysis – Electric Vehicle

Strong NEV Sales Momentum

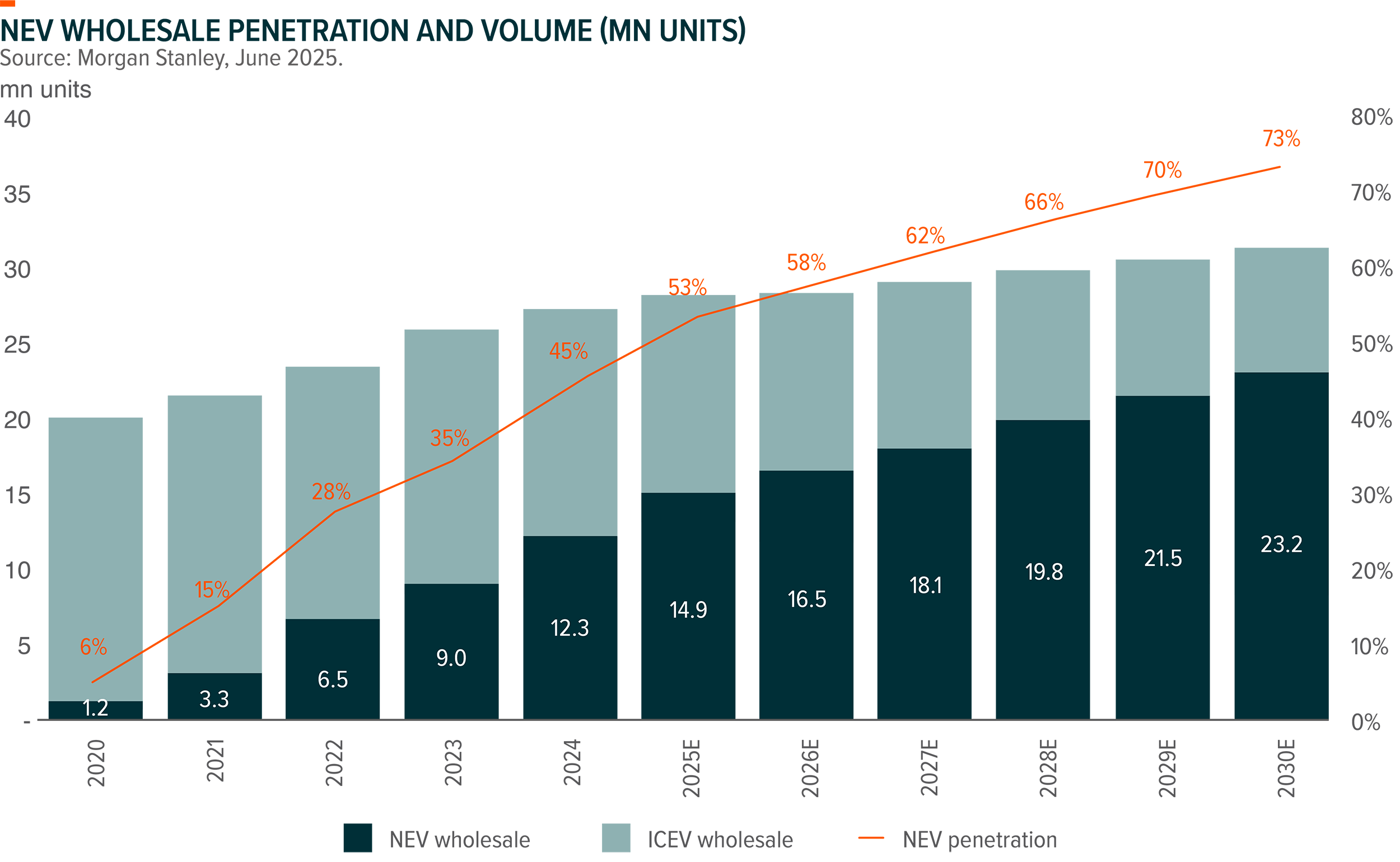

In 2024, China led the global market by selling over 12 million NEVs, reaching a NEV wholesale penetration rate of 45%, a substantial lead among global peers. 5M25 NEV wholesale volume reached 5.2mn, +40% YoY, with penetration rate reaching 48%. NEVs sales could further grow to 15mn in 2025E with penetration exceeding 50%. We see a number of drivers for the solid growth, including extended auto trade-in policy throughout the year, launch of new models, technology innovation by auto OEMs and battery makers, further application of intelligent functions, and competitive pricing.

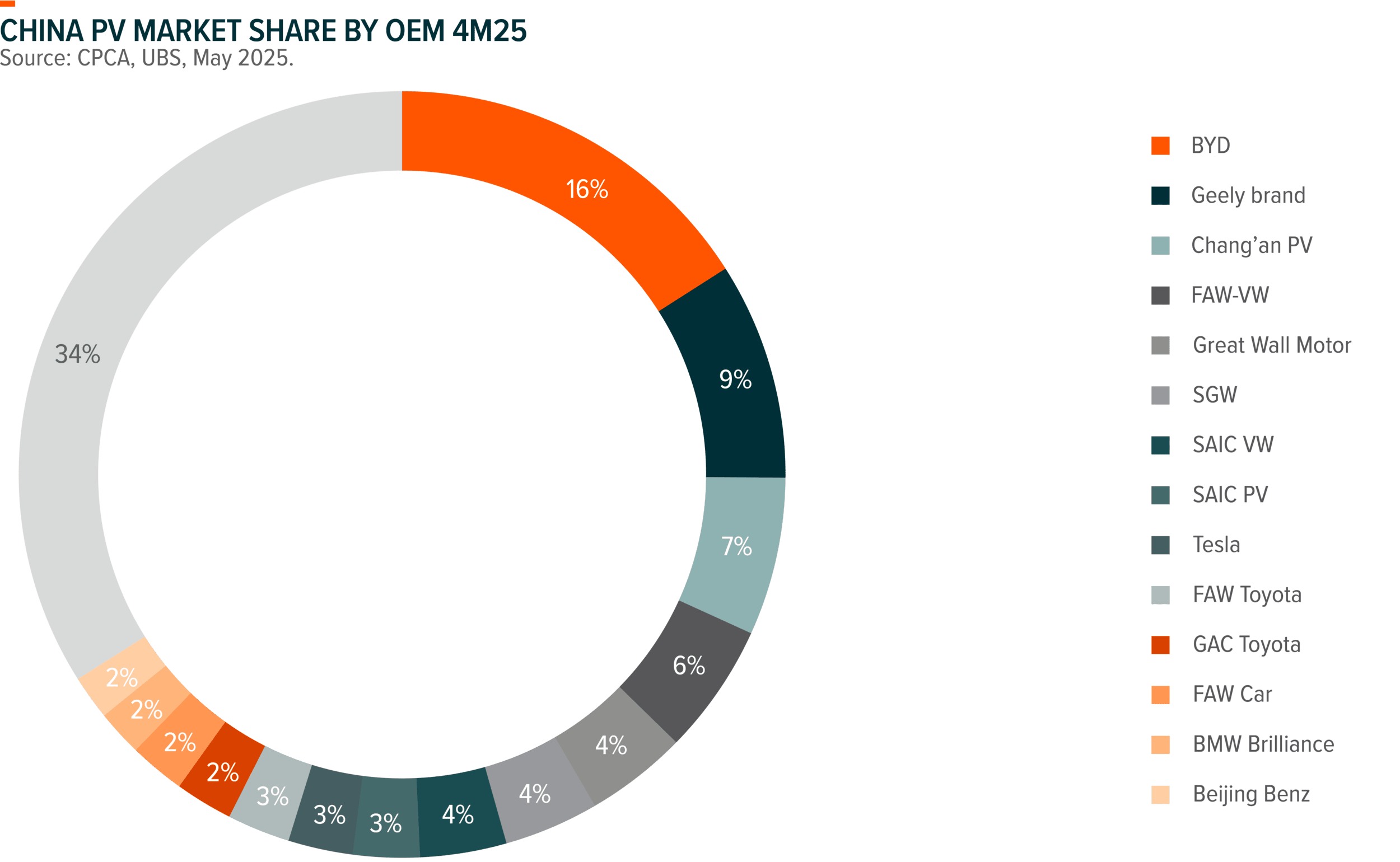

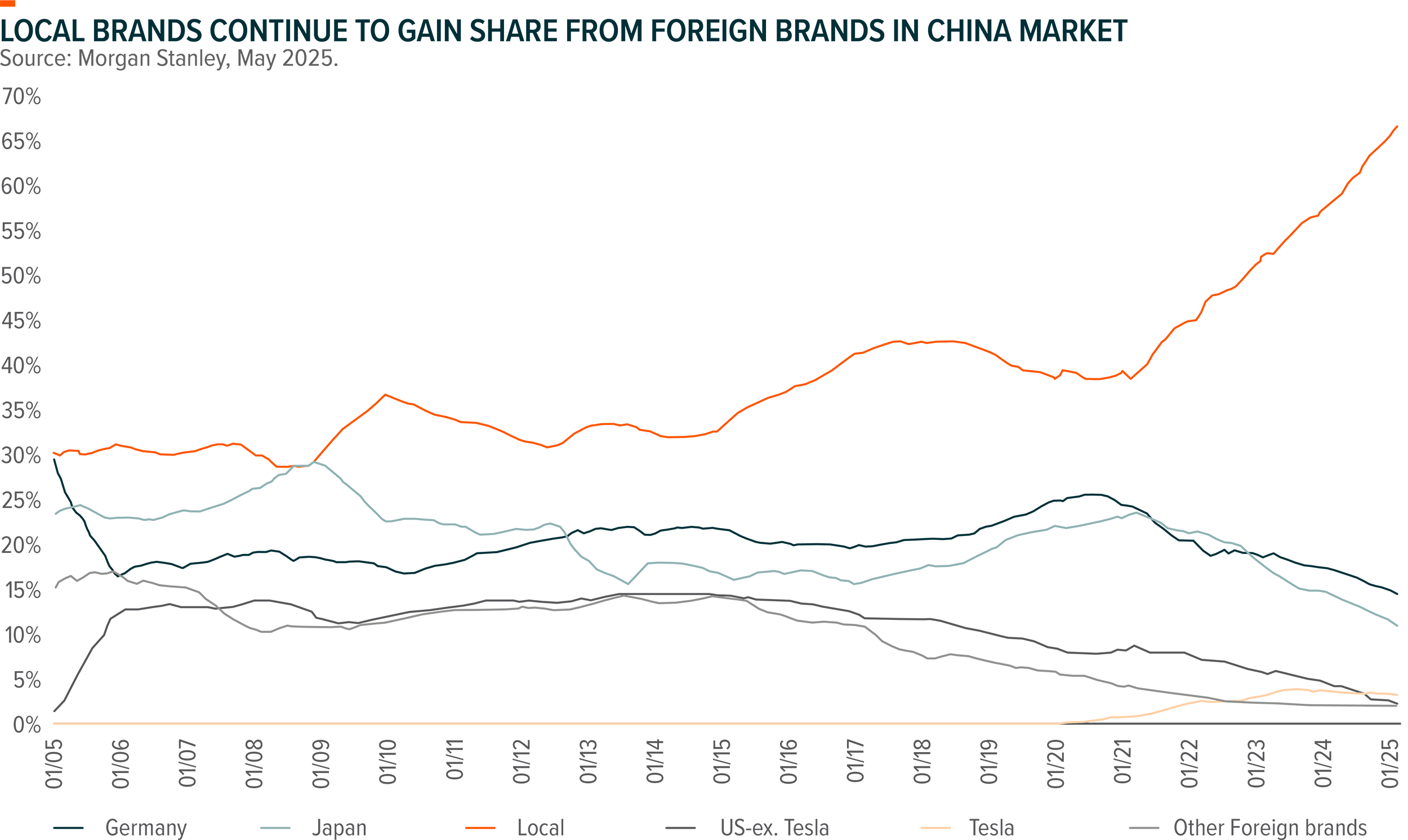

Market Is Competitive, But Domestic Leaders Are Consolidating

Price competition remains a key concern for domestic market. Recent price cut announcement by BYD in May caused share price decline for the company and the sector as it brought back market concern over prolonged price war that affects EV OEM profitability. Up to Rmb53k discounts are offered to 22 BYD models, and some competitors such as Geely also followed suits and offered discount. Though price competition is likely to persist due to reasons such as diminishing marginal costs and industry fragmentation, the discounts might not be as high as the headline had suggested. Company management points to no more than Rmb5k incremental discounts this round, with the discrepancy between headline and real effective discounts coming from pre-existing discounts and government trade-in subsidies. The impact on BYD’s margins should be manageable, thanks to continuous cost optimization through supply chains, technological innovations, economies of scale, and increasing overseas revenue contribution. Competition should remain fierce, but we see potential for leading OEMs like BYD to gradually consolidate the still-fragmented China auto market through with their superior cost basis and continuous share gain from foreign brands. On the flip side, a more competitive domestic market also propelled faster product & technology innovations and higher production efficiency, allowing leading OEMs to product better models to compete in the global market.

At the Forefront of Technology Innovation

Chinese brands are spearheading global innovation in EV technology, driven by intense domestic market competition and bolstered by a robust industry ecosystem, a vast talent pool, and agile responses to technological trends. Their technological prowess is are almost every aspects, from powertrain engineering, battery technology, and electronic architecture integration to smart driving. Additionally, the high level of vertical integration, economics of scales of leading OEMs and China’s sophisticated auto supply chain enable Chinese brands to manufacture models at highly competitive prices, positioning them for expansion into global markets.

At the Forefront of Technology Innovation (cont’d)

Chinese brands are spearheading global innovation in EV technology, driven by intense domestic market competition and bolstered by a robust industry ecosystem, a vast talent pool, and agile responses to technological trends. Their technological prowess is are almost every aspects, from powertrain engineering, battery technology, and electronic architecture integration to smart driving. Additionally, the high level of vertical integration, economics of scales of leading OEMs and China’s sophisticated auto supply chain enable Chinese brands to manufacture models at highly competitive prices, positioning them for expansion into global markets.

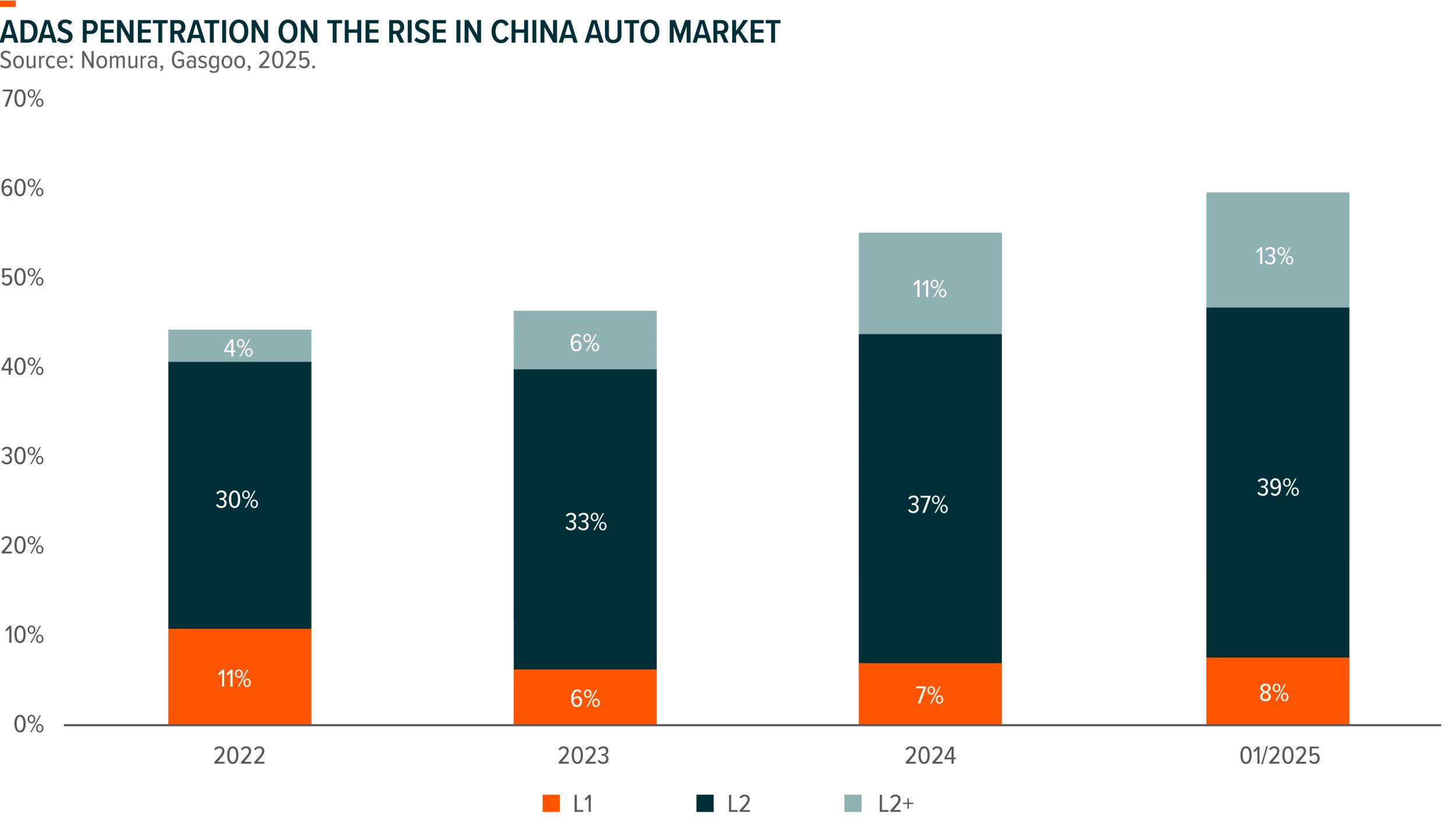

Chinese firms are also leading in autonomous driving development for the following reasons:

- China is the global leader in auto electrification, selling over 12mn NEVs with NEV penetration of c.45%, surpassing its global counterparts significantly in both metrics;

- The vast EV market provides a broad application platform for autonomous driving. To survive the highly competitive EV market, automakers are deploying advanced technology as a key selling price at competitive prices, which includes AI, intelligent cockpits, and autonomous driving;

- BYD is accelerating the democratization of autonomous driving technology in China, as the company brings its ADAS system to mass market models. Previously only mid-end to premium models are equipped with ADAS systems. The increase in penetration would allow leading OEMs to collect more data, therefore further enhance their autonomous driving technology;

- Chinese regulators offer supportive regulatory framework;

- China has built up comprehensive supply chain for autonomous driving, with leading companies across Lidar, autonomous chip, OEM, and Robotaxi sector;

- China is also a leader in Robotaxi. Chinese companies like Baidu, Pony AI and WeRide operate c.2000 Robotaxi in major cities in China, vs less than 1000 for Waymo in the US.

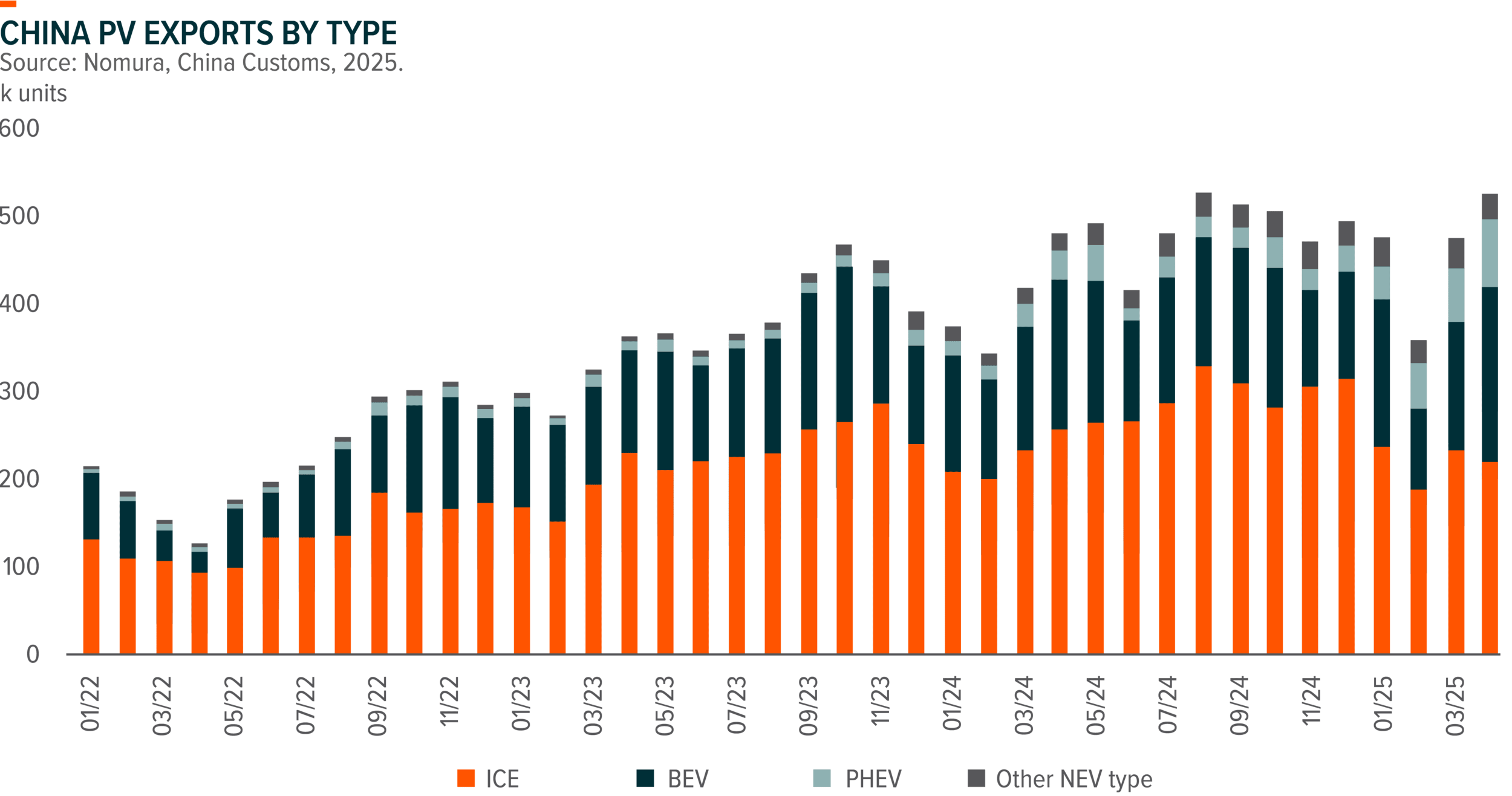

Overseas Expansion Tracking Strong

Despite global trade tariffs uncertainties, China auto exports have been holding up resilient with 5M25 NEV export penetration exceeding 40%. Chinese OEMs’ global competitiveness is built on attractive value proposition, rapid model iteration, and intelligent product offerings. Major export destinations include Southeast Asia, EU, and Latin America. US represents an insignificant portion of China’s EV export.

Despite the c.25-45% tariff on China BEV exports, EU remains a top export destination for China NEV exports. Notably, BYD outsells Tesla in Europe for the first time in April 2025, indicating the aggressive expansion for Chinese brand in the European market. Reshoring remains a key strategy for China EV brands to bypass current tariff landscape, with leading OEMs such as BYD actively investing in overseas factories across countries such as Hungary, Brazil, and Thailand.

Sector Analysis – Battery

China Is Leading Global Battery Sector

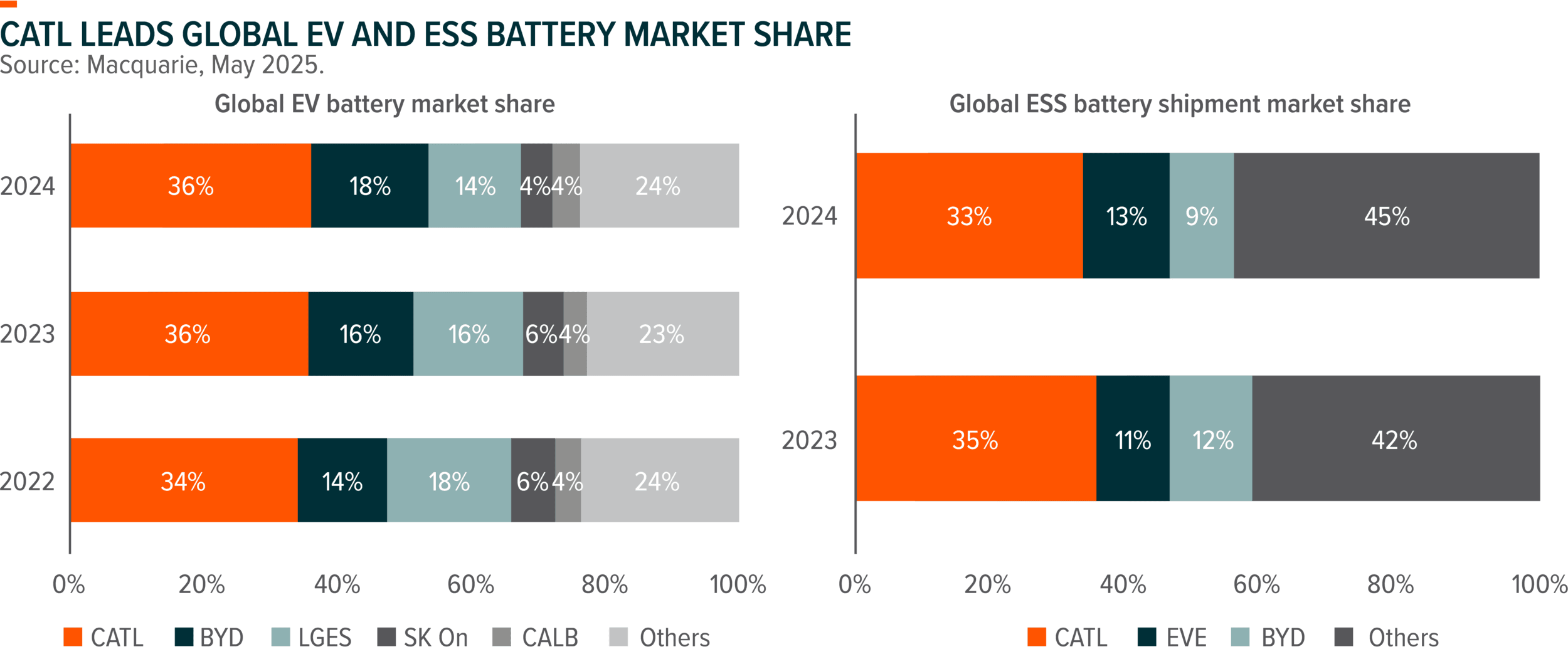

Global battery sector includes EV batteries (c.72%), Energy Storage System (ESS) batteries (c.22%), and Consumer electronics batteries (c.6%). EV battery demand has been experiencing substantial growth along with the rise of global EV penetration, with increasing adoption of LFP batteries over traditionally dominated NCM batteries, thanks to the advancements in LFP technology that are closing the performance gap with NCM batteries at lower costs. Chinese battery makers are leading in LFP space and therefore benefiting from the trend, while Korean battery makers remain strong in NCM batteries. On global stage, CATL leads the EV battery market with close to 40% of global share, with strong presence in both LFP and NCM batteries. BYD batteries, which are predominately installed in BYD models, rank second globally with c.18% market share.

ESS battery is mainly used in utility scale energy storage, and has been growing rapidly in past years with the accelerated adoption of wind and solar energy. ESS battery is also used in residential sector, and more recently commercial applications where energy demand is driven by AI data center. LFP batteries are dominating in the ESS use case due to better cost-efficiency and lower demand for performance and energy density. This segment is again dominated by Chinese players with CATL commanding c.33% of global market share, followed by EVE and BYD.

Improving Supply-demand Dynamics

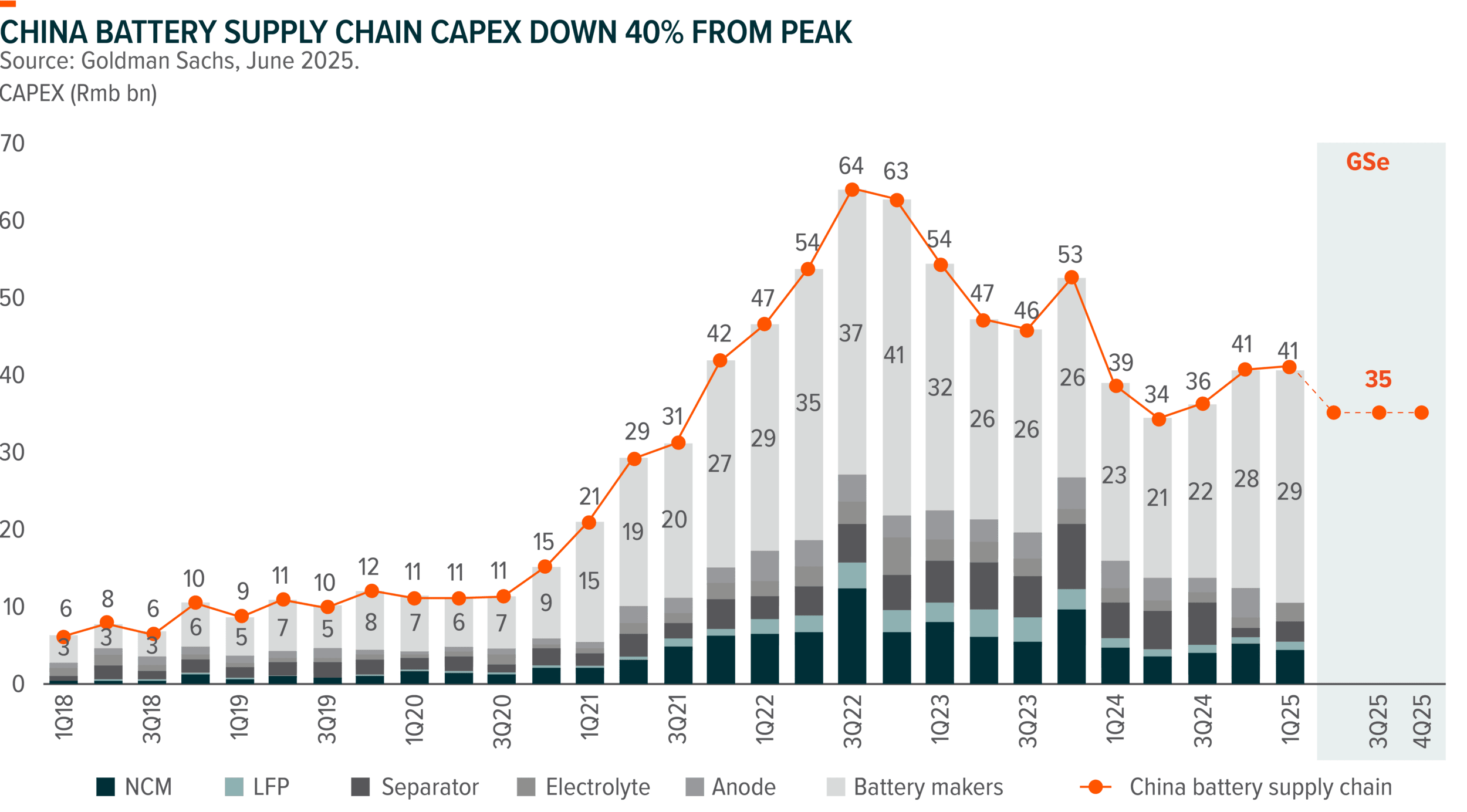

The fast expansion of EV market attracted lots of investments in battery sector during 2022-2023, which eventually led to overcapacity and low utilization rate. Many small size battery makers were operating at a loss, leading to their eventual closure and capacity shutdown. We see more rationalized CAPEX by battery makers since 2024, and now CAPEX is down c.40% from peak level, with larger portion coming from leading battery makers. More rationalized CAPEX plan, coupled with solid demand, should drive a better supply-demand dynamics within the sector. Furthermore, upstream lithium price remains at low level due to abundant supply, which contribute to more stable margin for battery makers.

At the Forefront of Technology Innovation

Chinese companies are also leading in battery technology innovation. As mentioned above, Chinese companies’ technology leadership in LFP battery (higher energy density, faster charging speed, and higher battery life) help them to capture the largest market share in EV battery and ESS battery sector. Superfast charging is one important area of innovation and competition as it is key to address customer’s range anxiety which remain one of the key obstacles to further BEV adoption. For CATL, following the launch of Shenxing Battery (4C superfast charging, 700km range, the first superfast charging LFP battery) in August 2023 and its upgraded version Shenxing PLUS (4C+ superfast charging, 1000km range) in April 2024, CATL unveiled second-generation Shenxing Battery in April 2025, featuring both an 800km range and a 12C peak charging rate. This translate to 2.5kms of range per second of charging, with a peak charging power of 1.3MW. Similarly, In March 2025, BYD launched “Super E-Platform” with 1000v architecture and “10C” flash charging efficiency. Flash charging speed at 400km per 5mins charges is top among peers and generally on par with ICEs. BYD plans to build 4k+ 1MW flash charging piles to make the technology available nationwide. BYD also unveiled 2 BEV models, Tang L and Han L priced at Rmb 270k and Rmb 280k, featuring Super e-Platform. This marks substantial progress for BYD in charging speed, which will enhance the product competitiveness for BYD and provide another marketing push for future BEV models.

Sector Analysis – Biotech

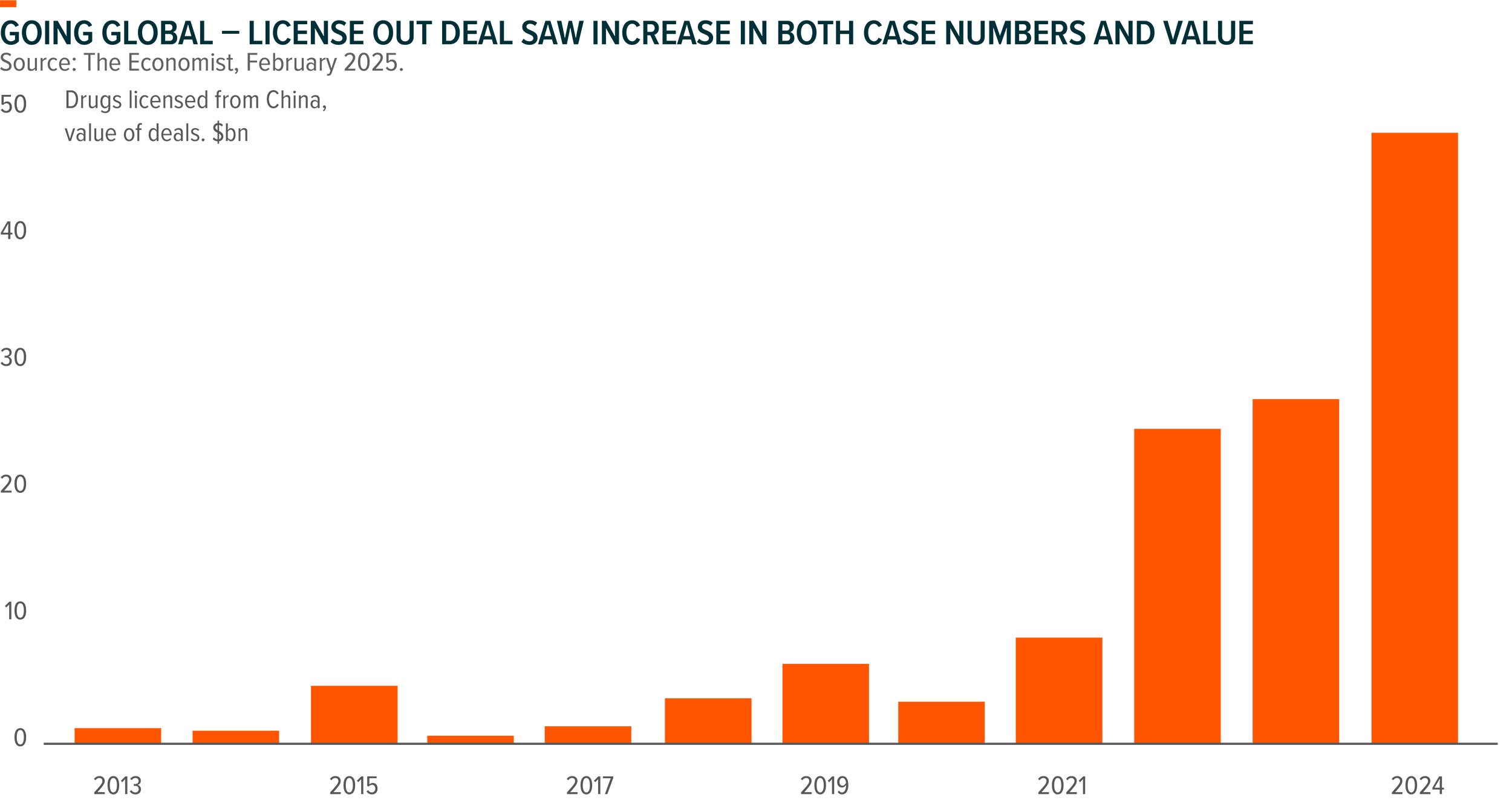

After four consecutive years of subdued performance, the China biotech sector has experienced a significant rebound, achieving a year-to-date return of +50% and emerging as the best-performing sector. We are seeing a number of positive catalysts kicking in, including strong momentum in out-licensing deals from Chinese biotechs to global pharma, positive newsflows related to innovative drugs, improving corporate earnings, and policy supports. The surge in out-licensing deals validates the asset quality and innovation capability for Chinese biotech companies, and the ongoing global BD should support a more sustainable rerating of China biotech sector.

Going Global Through Out-licensing

The surge in out-licensing deals is the key driver for this round of re-rating. In May, HK-listed Chinese biotech company 3SBio announced the US$6bn out-licensing deal (including US$1.25bn upfront and up to US$4.8bn downstream fees if the drug hits all milestones) with US Pharma giant Pitzer on 20 May. This is the largest out-licensing deal by Chinese biotech companies so far. Other examples of Chinese biotech companies entering global markets through global clinical trials or out-licensing include Beigene (direct entry), Akeso (bispecific antibody), Hansoh (GLP1 oral), Eccogene (GLP1 oral), and LaNova (bispecific antibody). Furthermore, Biopharma executives are expecting more out-licensing (BD) activities, with multiple companies such as RemeGen and Sino Biopharm expressing their willingness for BD. We recognize an accelerating trend of increase in out-licensing deals volume and upfront payment over the past 2 years, with novel modalities accounting for an increasing share of out-licensing deals.

Recent development indicates global recognition of China’s innovative capability, suggesting that China-originated assets entering US/global market is becoming a new norm in biotech sector. Implication for Chinese companies: drug prices are typically higher in overseas market than in China market, due to government VBP, lower per capita income, and single payer structure. Penetration into overseas market allow Chinese biotech companies to have better profitability. Additionally, we believe such IP licensing is not goods or services export and should be less affected by US tariffs, and the 3SBio-Pitzer deal could further relieve investors’ concerns.

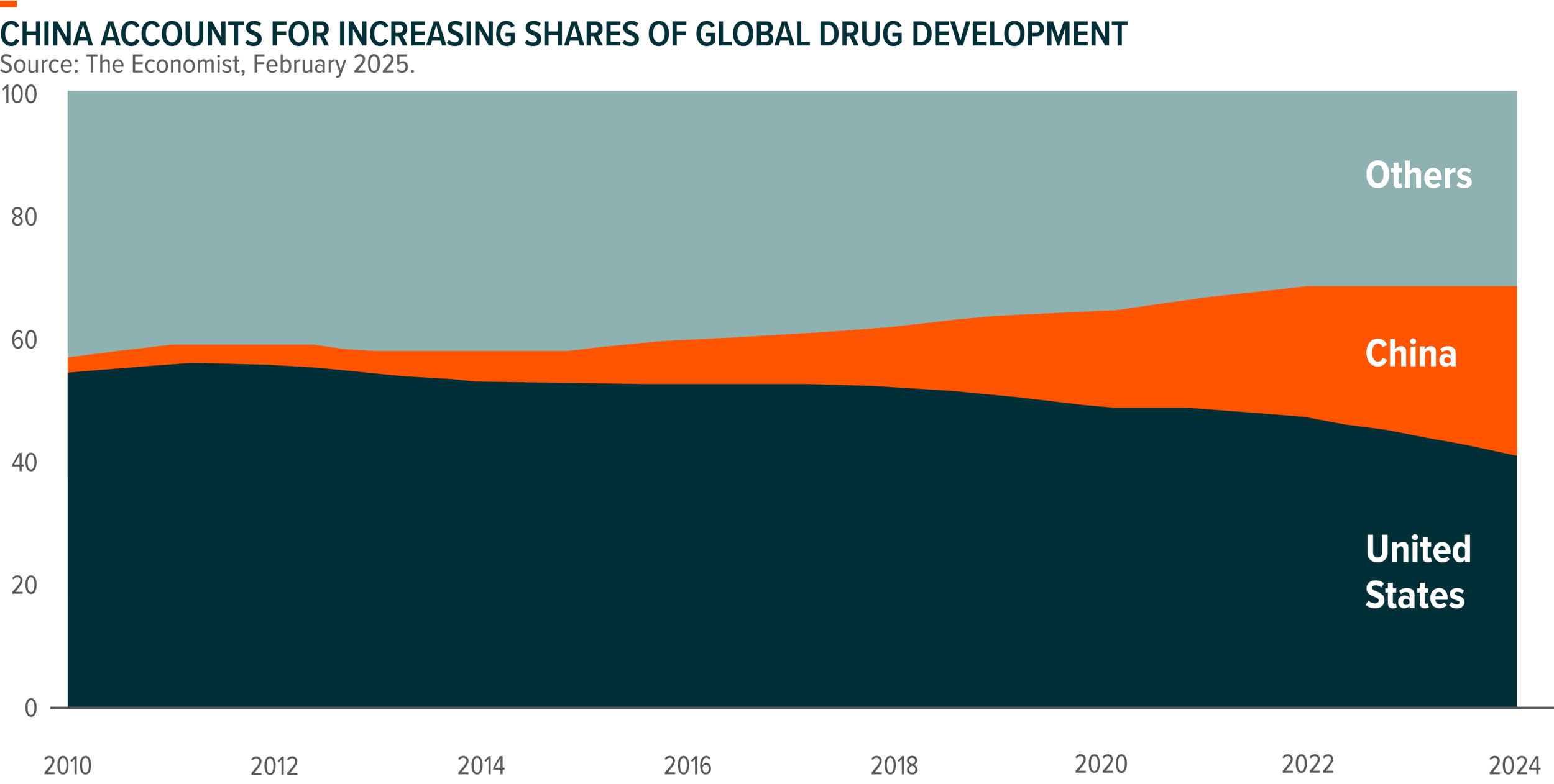

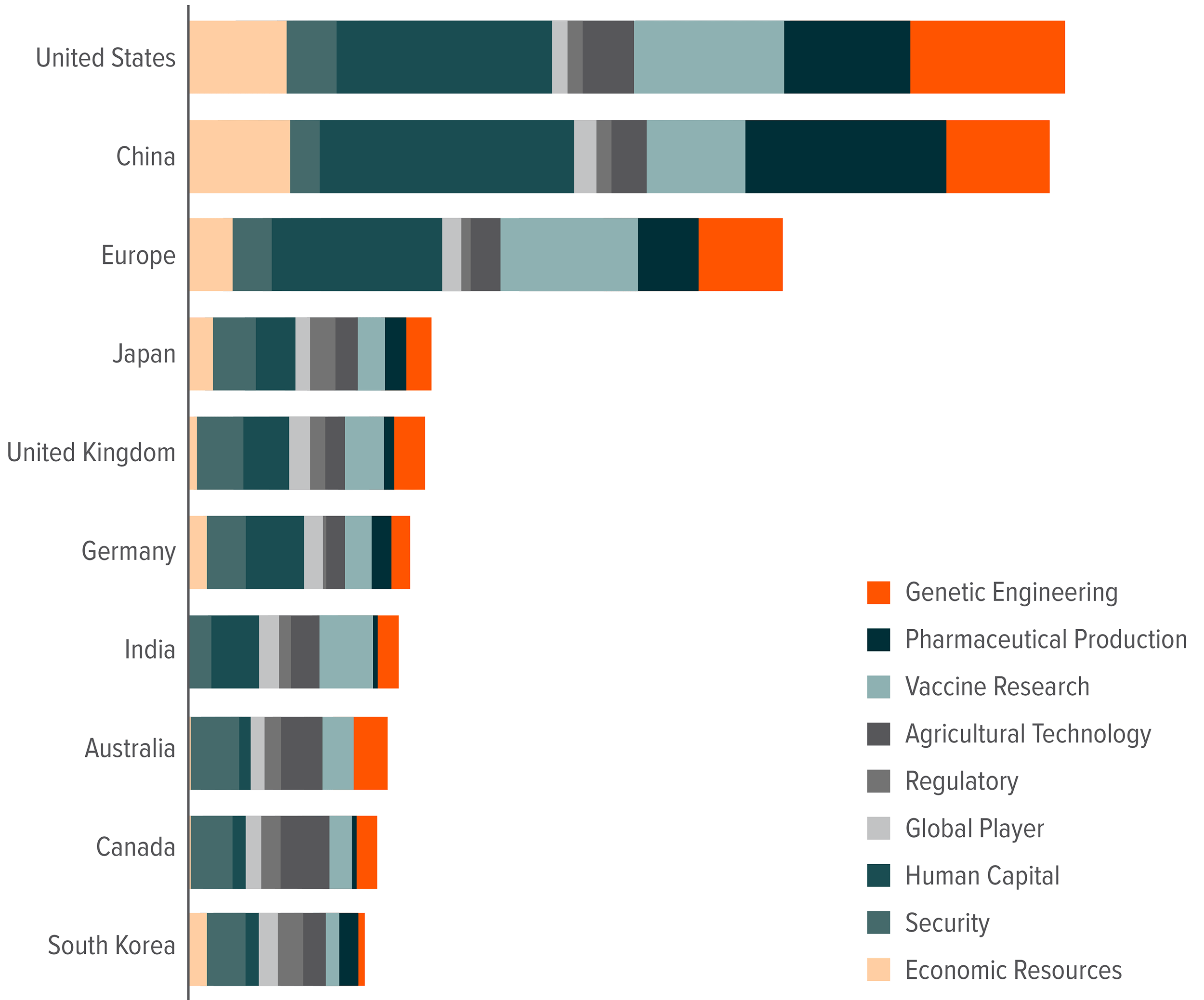

Improving Innovation Capability

As bolstered by China’s large talent pool, supportive policy, and technological advancement (such as AI), China has made solid progress in innovative drug development and now ranks No.2 globally in terms of number of new drugs under development. From Scientific Research perspective, China overtook US in the cancer research output in the Nature Index for the first time in 2024. Furthermore, China is catching up and is now generally on par with the US in 2025 Harvard Critical and Emerging Technologies Index (Biotechnology Sector). Both indices demonstrate the robust biotech academic research capabilities of China.

From regulatory perspective, number of innovative drugs approved in China market in 5M25 is closed to full year level in 2024. Furthermore, over 70 researches from China were presented in the oral abstract session in ASCO 2025, up 40% YoY, indicating solid progress for China biotech research. The solid progress in innovative drug research and monetization is also leading to improved corporate earnings, with several leading innovative drug companies on track to achieve breakeven this year, which should further sustain the momentum

|

|

Policy Supports

Positive newsflows around regulatory supports across innovative drug developments, commercial insurance systems, and VBP optimization are also the key drivers for Biotech sector rebound.

Support for innovative drug development: We are witnessing favorable policies from both central and local governments aimed at bolstering innovative drug development, with a focus on expediting approval processes, enhancing payment systems, refining pricing mechanisms, and enhancing the funding environment.

Commercial insurance development: China’s single payer medical system constrain the drug prices and therefore profitability for biotech companies. The rising medical costs and the increasing pressure on basic medical insurance drive the rising demand for commercial medical insurance. We also see government push such as the Healthy China 2030 initiative and reforms to basic medical insurance schemes as a key driver.

Potential VBP optimization: A draft regulation regarding VBP (volume-based procurement) optimization is being circulating over months. The document includes optimizing access standards, bidding rules, and implementations, and could largely mitigate the current unreasonable low bidding prices and improve the cash flow for biotech companies, if the draft is sustained. This also echo to 2025 Government Work Report (GWR) released in early March which mentioned the optimization and quality enhancement of VBP. Additionally, we are seeing a series of supportive policies including encouraging M&A by SOEs in biotech sectors and the supports for innovative drug developments that can propel long-term growth within the sector.

Sector Analysis – Medtech

China medtech sector has been facing multiple headwinds including the implementation of value based procurement (VBP) that pressured product selling prices, government anti-corruption campaigns, and slower than expected stimulus implementations, which resulted in share price weakness for the sector. In past months, Hospital capex is showing signs of stabilization, with 2H25 hospital CAPEX revenue in China potentially return to growth, and could turn to full recovery in 2026. Equipment tendering remained robust YTD. Furthermore, recent signs are pointing to some easing of Anti-Corruption Campaign and more constructive policy framework to support roll out of stimulus measures, with domestic leaders poised to benefit.

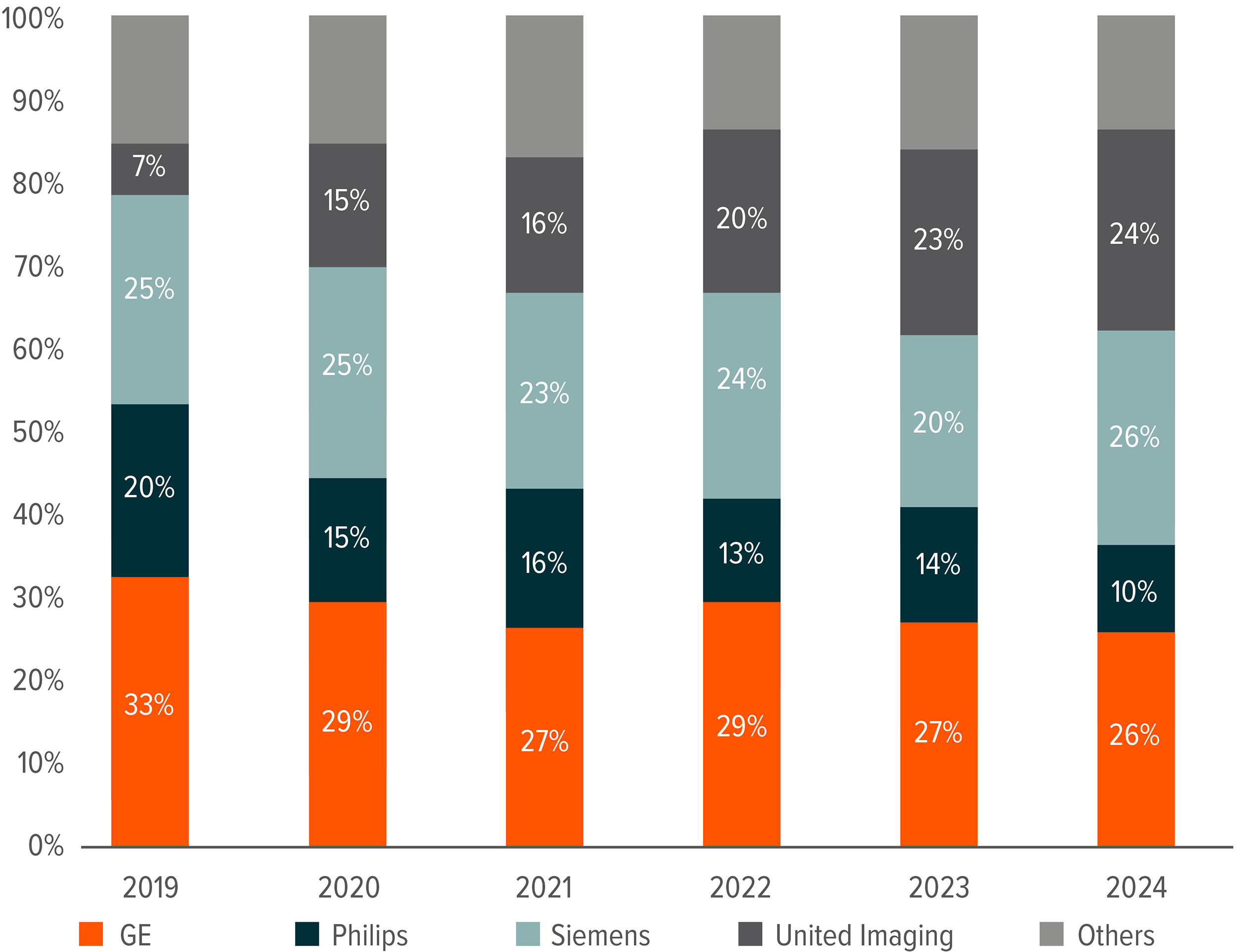

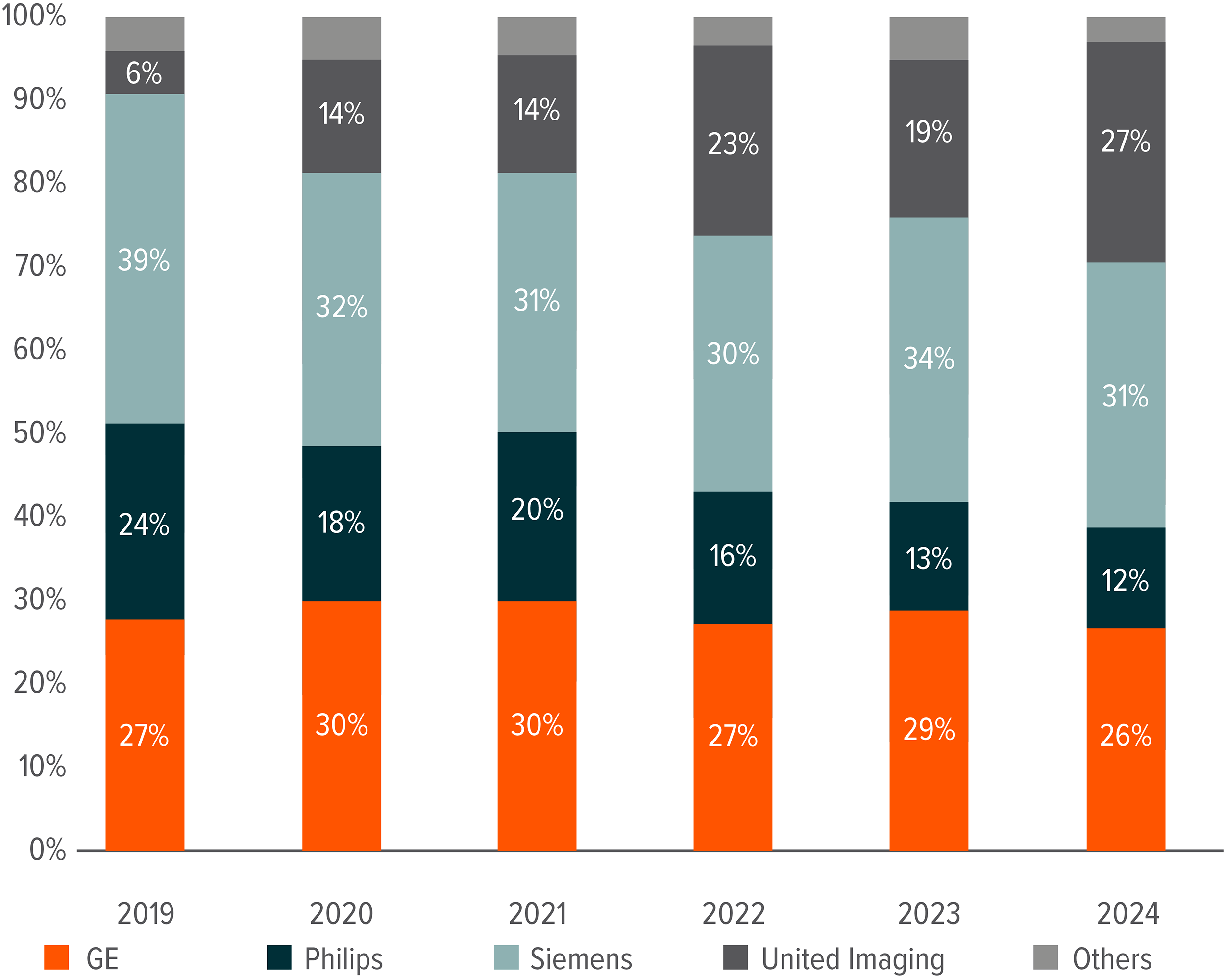

Domestic Leaders Gaining Share

Import substitution is a secular trend we are seeing in China medtech sector. This is accelerated by government policy, as central government departments such as Ministry of Finance have been promoting the purchase of domestic medical equipment. Geopolitical uncertainty is also supporting the import substitution trend. Furthermore, the VBP in medical equipment field will also drive out some lower-tier foreign brands esp. in mid-to-low end market. In addition to policy supports, Chinese leaders are becoming more competitive in technology and products. Domestic leaders, notably United Imaging and Mindray, are continuously gaining share in hospital CAPEX across key modalities including CT, MRI, and Ultrasound. This trend should continue in coming years as local players offer cost effective and technologically competitive products.

|

|

Trade-in stimulus implementation in 2024 is slower-than-expectation. Major medical equipment companies have already observed implementation of trade-in program in certain provinces using 2024 budget, and are optimistic about the scale and pace of new round of trade-in program in 2025 and expect smoother implementation program. The rebound in bidding data observed in 4Q24 may start to be reflected in company revenue in 2Q25 onwards due to longer revenue recognition cycle.

Domestic Leaders Gaining Share (cont’d)

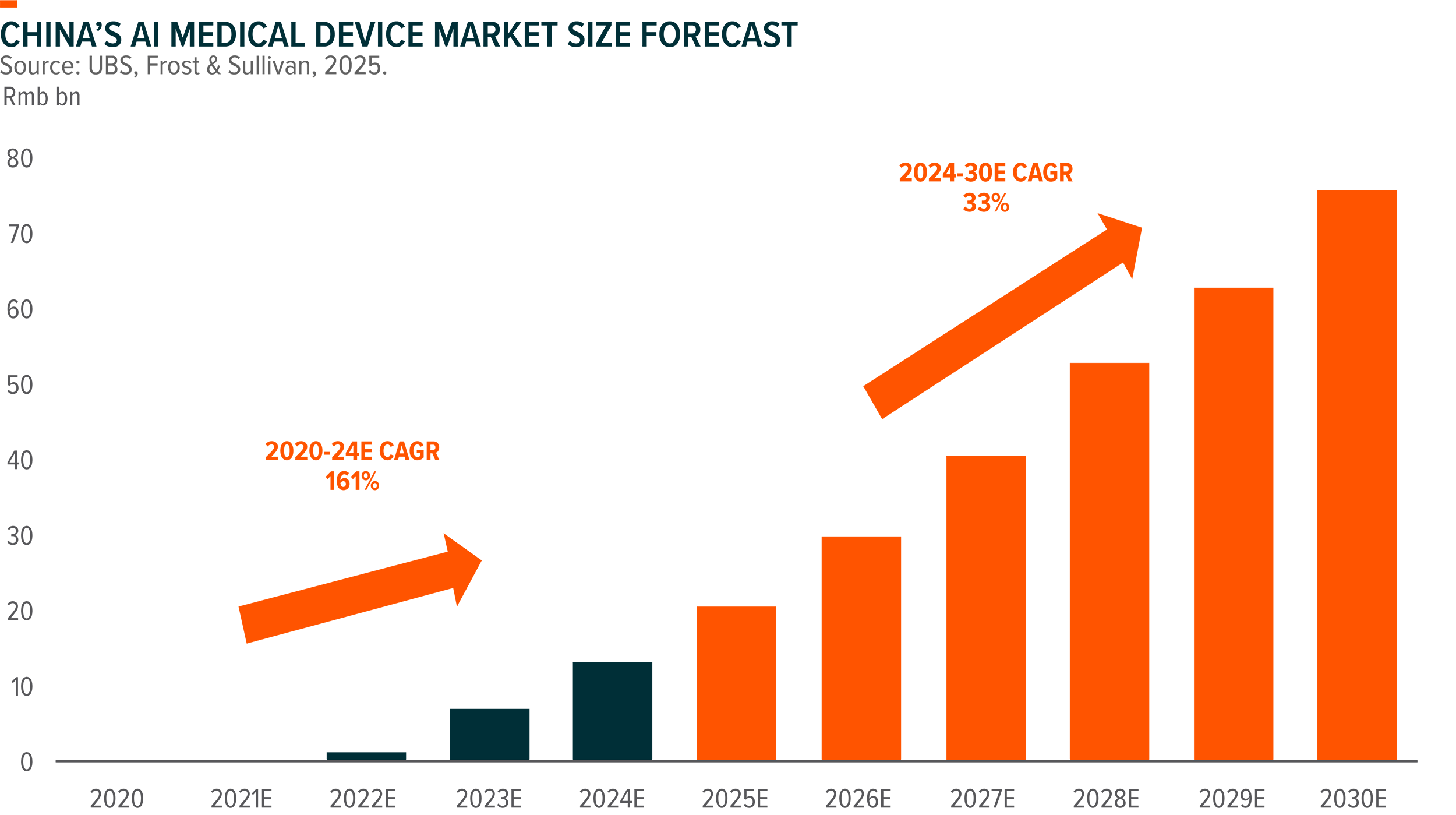

AI brings optionality for Chinese medtech leaders, potentially contributed to both revenue and net profit growth. AI monetization can be in the form of hardware premiumization and software/LLM sales. By tender value, AI-enabled products contribution in United Imaging’s China product portfolio has increased to 16% in 2024, from 4% in 2019. Mindray also see similar trend with AI-enabled product contribution growing from 0.4% to 14%. Global AI medical device market size is expected to expand to US$114bn in 2030E with 24-30E CAGR of 52%, according to Frost & Sullivan.

Sector Analysis – Semiconductor

China semiconductor companies have significant potentials for rapid growth with market share gains. While China brands accounts for 35% of global semis demand, local firms only account for 7% of global semis capacity supply. This disparity highlights a relatively low localization rate in China at around 20% in 2023, particularly for specific semiconductor devices. Growing geopolitical uncertainties are prompting efforts within the Chinese semiconductor supply chain to accelerate product and technology development in pursuit of self-sufficiency. This environment creates substantial opportunities for domestic substitution within the semiconductor market. In the meantime, China’s increasing preference to domestically produced semiconductors – driven by cost advantages, service speed and the desire for supply chain self-dependence – has offered opportunities for local suppliers to penetrate into local customer base. As a result, the upward trend in China Semiconductor’s self-sufficiency ratio is poised to persist in the years ahead.

AI Semiconductor

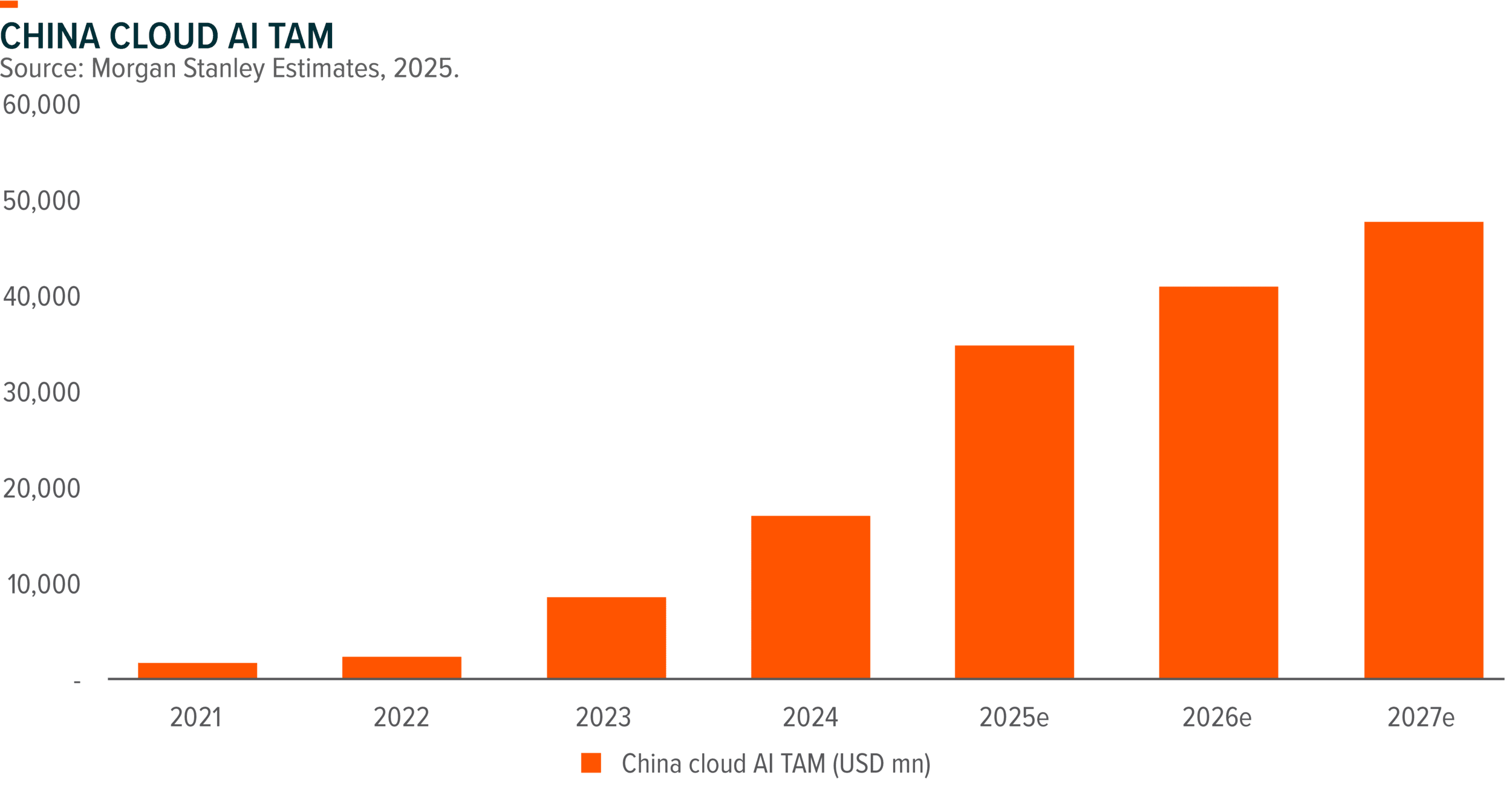

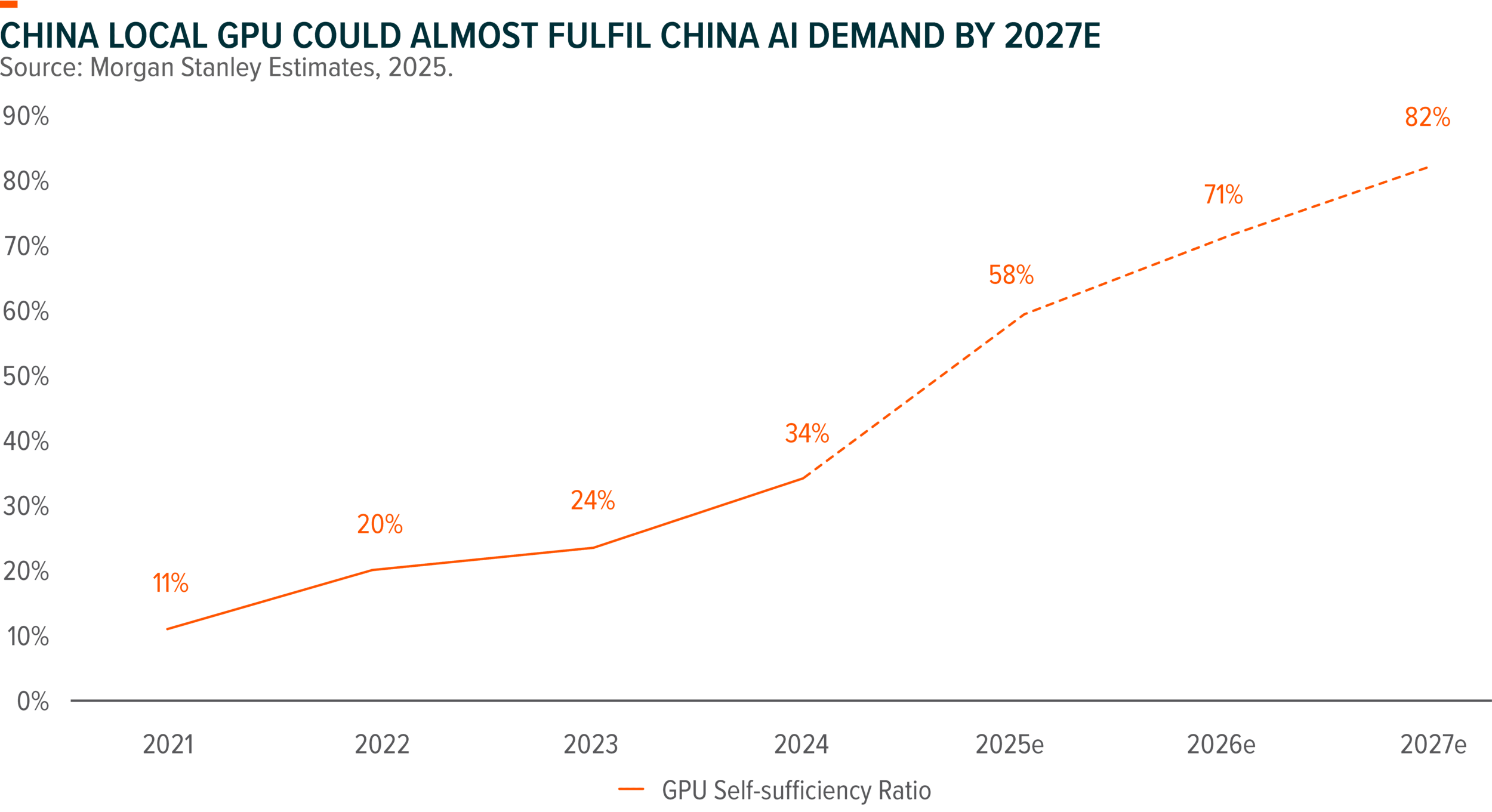

The emergence of DeepSeek accelerate the demand of inference compute in China, driving an accelerated Cloud CAPEX by large technology companies. Major local GPU provider in China includes Huawei and Cambricon, whose chips are fabricated mostly by domestic foundry leader SMIC. China’s GPU self-sufficiency ratio is expected to increase in the upcoming years due to several factors: 1) US continue to restrict high-end chip shipment to China; 2) AI model inferencing requires less advanced chips than AI model training; and 3) inference demand will be the key driver for China cloud CAPEX going forward.

Auto Semiconductor

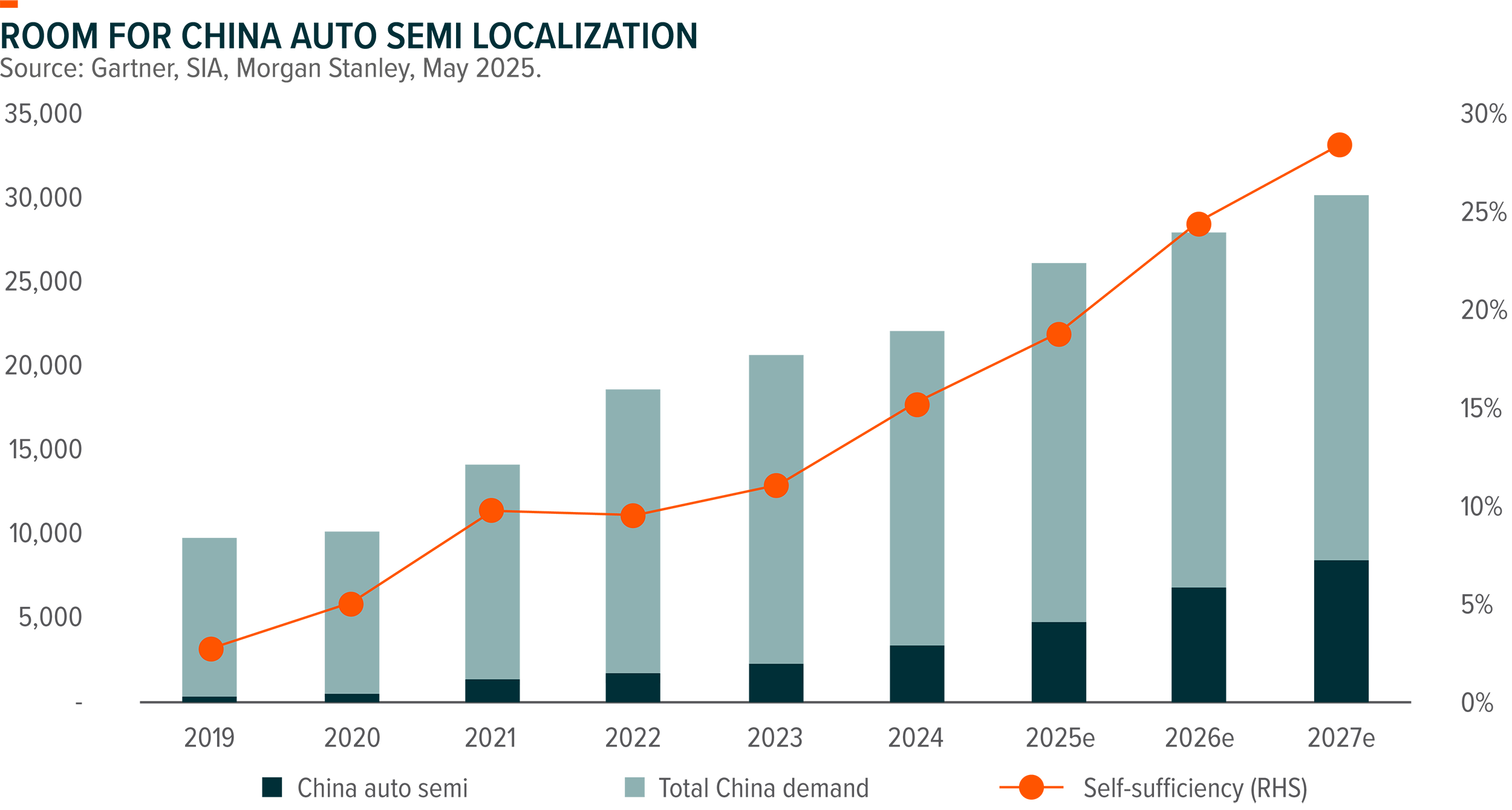

China has the largest EV market in the world, commanding over 50% of global EV production with substantially higher EV penetration than other major auto markets. Furthermore, Chinese EV OEMs are rapidly launching new models, with increasing penetration for autonomous driving systems. On the contrary, global auto semi market is still dominated by European, Japanese, and US players, with Chinese companies only representing less than 5% of global market share. On the back of the fast growing EV market and government advocacy for semiconductor localization, current self-sufficiency ratio for China’s auto semi is still low at 15%, presenting a structural growth opportunity for Chinese companies.