China Government Initiatives in Biotechnology

What the Chinese Government did to enhance the competitiveness of its biotech industry

In this piece, we discuss key government initiatives over the last decade to support the budding Biotechnology sector as well as favorable external factors in private capital investments as well as a talent pool.

In 2010, China’s State Council launched the Strategic Emerging Industries (SEI) Initiative, which identifies seven SEIs that the Chinese government feels are crucial to China’s economic competitiveness: energy efficient and environmental technologies, next-generation IT, biotechnology, high-end equipment manufacturing, new energy, new materials, and new-energy vehicles. The development of these sectors is prioritized, and specific milestones have been declared.

As seen in the 13th FYP, it lays out the vision of China’s development over the years 2016-2020 and continues a theme of innovation as key to China’s growth. In it, goals for the development of the biotechnology industry— an SEI— are provided, including the wide application of genomics; large-scale development of personalized medicine and new drugs; and the creation of gene and cell banks. As part of the 13th FYP, the Ministry of Science and Technology released a Biotechnology Development Plan which provides several goals and milestones to achieve with respect to China’s biotechnology industry by 2020 –

- Enhance the originality of biotechnology. The plan directs the Chinese biotechnology industry to focus on developing new technologies and products. The mandate includes goals of developing 20-30 leading new technologies, 30-50 major strategic new products, and 5-80 key application-critical technologies.

- Create a biotechnology innovation platform. To accelerate the industrialization of biotechnology, the plan promotes the construction of biotechnology innovation centers focusing on green bio-manufacturing, innovative drug R&D, and biomedical engineering.

- Strengthen the industrialization of biotechnology. It instructs to accelerate the construction of biotechnology specialized high-tech parks, including building 10-20 biopharmaceutical specialty parks and 5-10 biomanufacturing specialty parks, each with an output value of over RMB10 billion.

The plan states that the scale of China’s biological industry should reach 8 to 10 trillion yuan ($1.2 to $1.6 trillion) by 2020.

Made in China 2025

Made in China 2025 is an overarching government strategy document that outlines China’s plan to become a powerhouse in high-tech and high-value industries, such as robotics, advanced IT, aviation, and new energy vehicles, plus biopharmaceuticals and other medical technologies. Specifically for biotechnology, the roadmap includes specific goals for licensing of 3-5 new biotech drugs and their companion diagnostic reagents in advanced economies by 2020 plus commercialization of 30-35 innovative drugs (of all types) by 2025 as well as a broader goal of achieving world-class innovation capacity, production volume, and international competitiveness in pharmaceuticals by 2025.

Biotechnology Parks

A major strategy to advance its biotechnology industry is building biotechnology parks. These large campuses are designed to collocate high-tech companies and are built around a common theme, such as biopharmaceuticals or nanotechnology. In addition to nationally created parks, nearly every province has a number of local bio-industry parks. Over 100 national-level high-tech and economic industrial parks involving biotechnology and more than 400 provincial-level biotech industrial parks exist across China so far. These parks provide infrastructure, talent pools, and business support for multiple collocated companies. For example, Suzhou Biobay in the Yangtze River Delta provides nanotechnology service platforms for 51 companies, as well as offering support with regulatory filings and financing.

Bumping up the regulatory backbone

The National Medical Products Administration (NMPA) is the key regulator of drug approval and post-marketing supervision in China. The drug approval function is jointly overseen by three key entities under the NMPA:

- The Center for Drug Evaluation (CDE), which takes the lead in assessing the efficacy and safety of new therapies. The technical review of clinical trial data is conducted at the CDE.

- The National Institutes for Food and Drug Control (NIFDC) is responsible for the registration test for an investigational drug’s samples, and the testing reports are sent to the CDE to facilitate the technical review.

- The Center for Food and Drug Inspection (CFDI) conducts onsite inspection of clinical trials and manufacturing facilities (i.e., GMP inspection) before the final approval of an investigational drug.

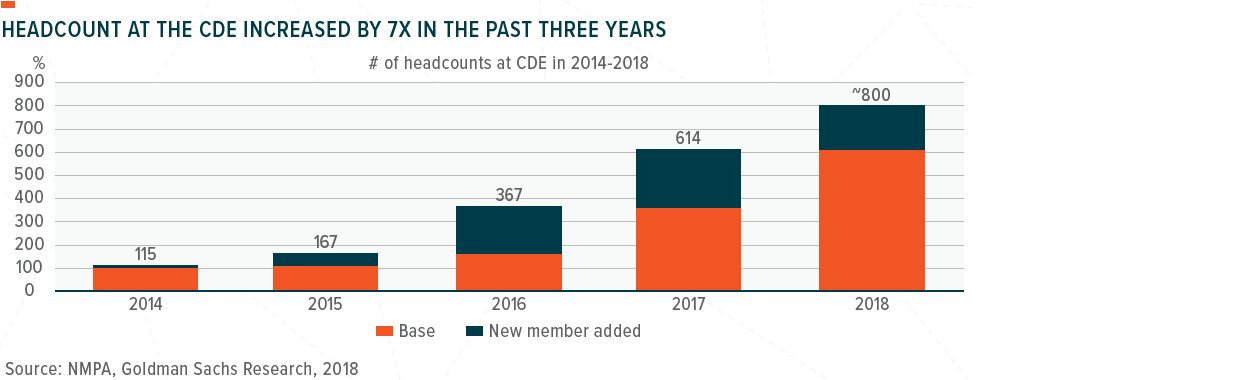

One of the key bottlenecks that has contributed to the slower drug approval process in China as been significant capacity constraints at the CDE, which had a staff of only about 100-120 people before 2015, vs. over 5,000 at the US Food and Drug Administration (FDA). One of the key reforms at the NMPA starting from 2015 has been the acceleration of talent recruitment, which we believe is the foundation for driving a more efficient drug approval system in China. In 2014-2018, the CDE’s headcount increased by about 7X and reached 800 in 2018, according to the Commissioner of the NMPA.

Click here to download the full report.

Related ETFs