Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

China Consumer

Domestic Consumption as Key Focus amid Tariff Turmoil

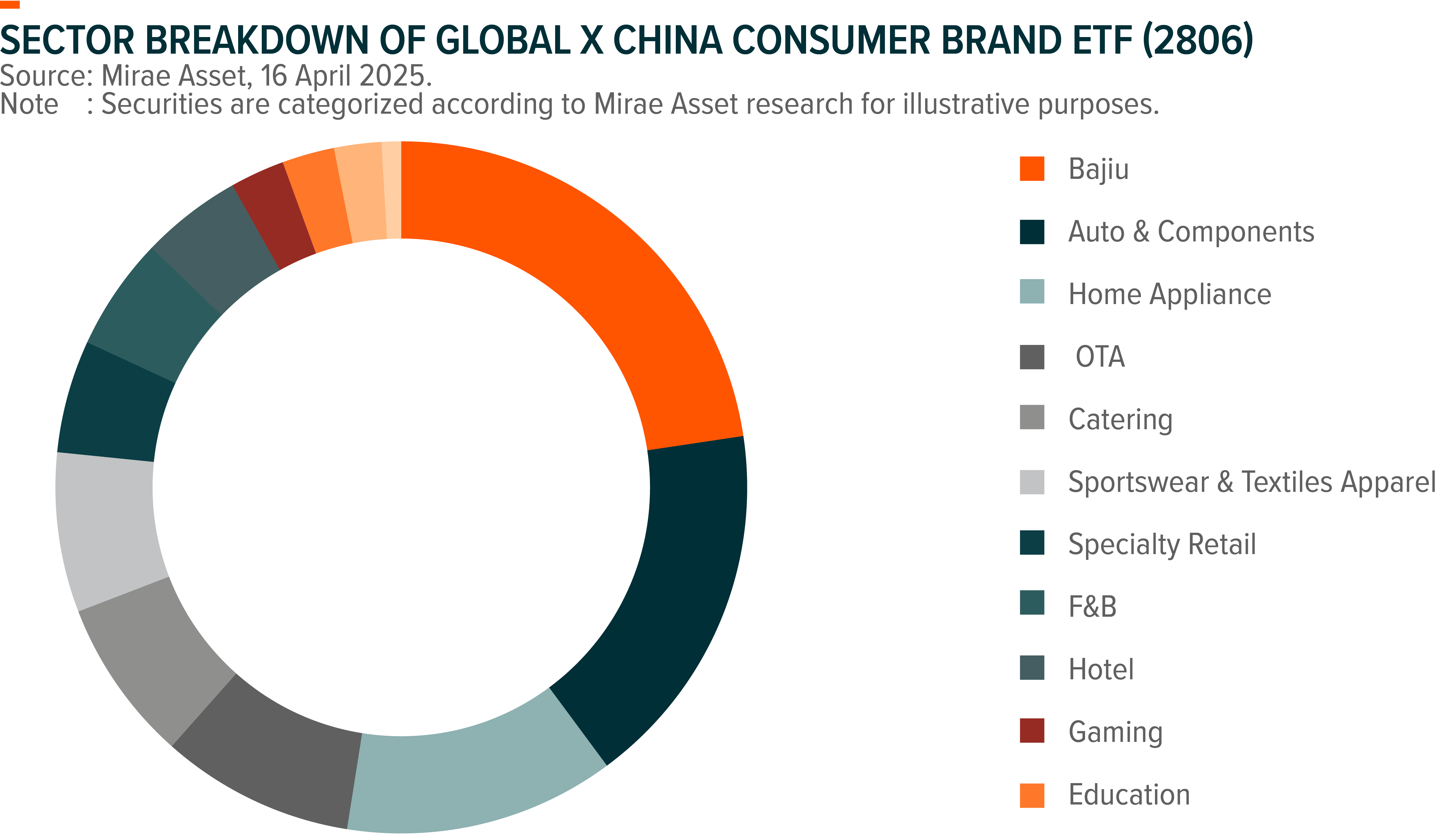

In light of the recent tariff turmoil, China consumer sector tends to be a defensive territory thanks to its limited direct exposure to exports and rising hope of China government to expedite policies to boost domestic consumption. Global X China Consumer Brand ETF (2806) has only a 4% revenue exposure to US (mainly affect home appliance and sportswear OEM sectors), and offers balanced exposure across policy-driven gains, defensiveness (e.g. staples) and growth (e.g. new consumption).

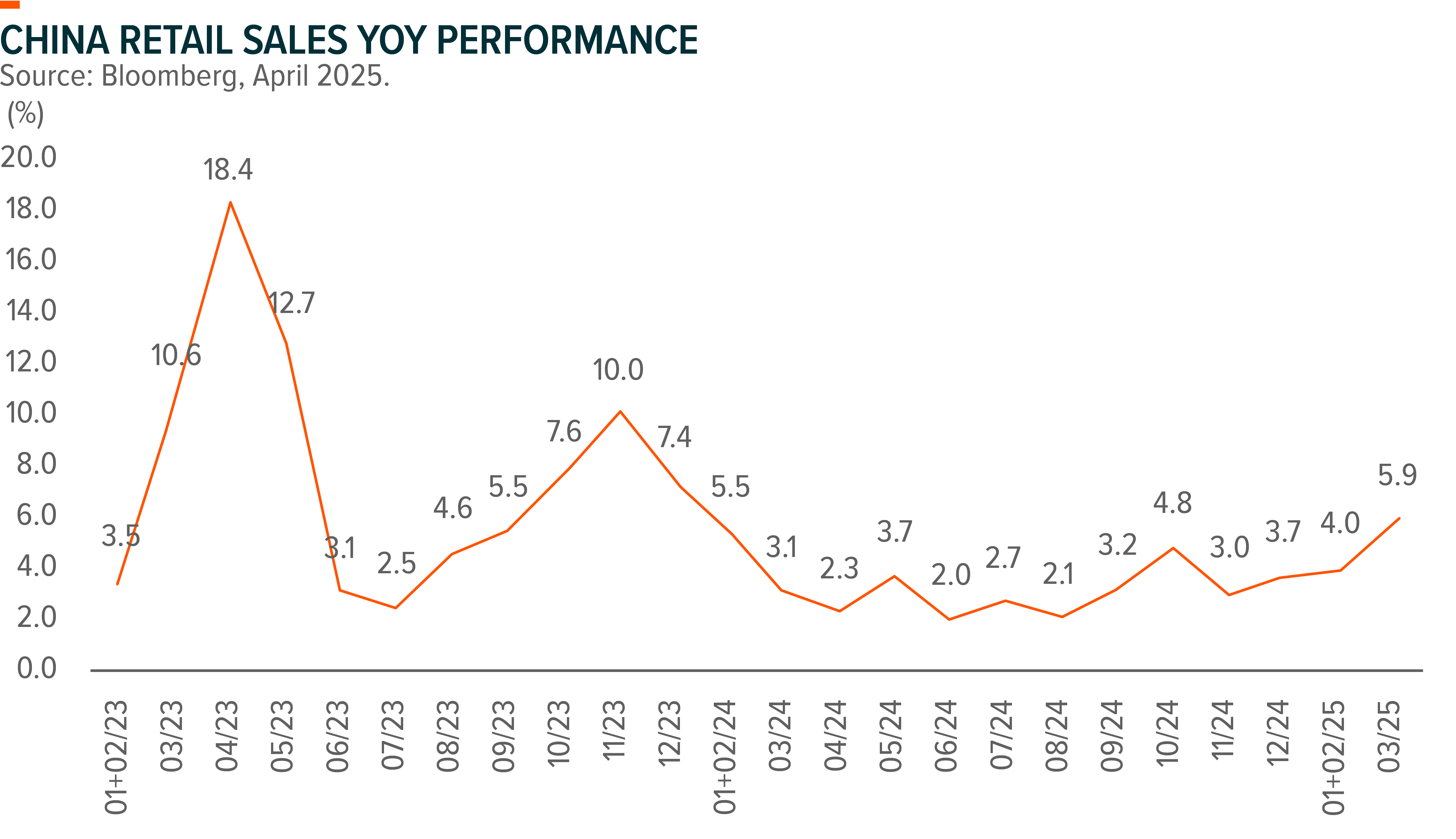

1Q China macro data is pretty solid, supported by front-loading demand. 1Q GDP grew by 5.4% YoY, beat market expectation of 5.2%. Additionally, retail sales in March demonstrated sequential improvement, up 5.9% YoY (vs. +4% in Jan-Feb) and beat consensus at 4.2%. By subsectors, home appliance, furniture, and telecom products emerged as the top-performing categories, bolstered by ongoing trade-in policy.

With intensifying external pressure, market expectations are growing that the Chinese government will roll out accelerated stimulus measures to bolster domestic consumption. We believe potential policies are likely to focus on several areas: 1) childbirth-supportive policies: initiatives such as cash subsidies for new parents, as seen in Hohhot, could benefit IMF and dairy related sectors; 2) consumption vouchers: likely for catering, general consumer merchants and services; 3) service consumption subsidies: could benefit sectors like travel, education, entertainment and housekeeping service; 4) extension of trade-in policies: continue to benefit home appliance, furniture, home improvement, auto and consumer electronics sectors, with the potential to expand into additional categories.

We expect these stimulus policies will lead to instant increases in consumption, enhance earnings growth, and trigger sector re-ratings. Under this context, China Consumer Brand ETF (2806 HK) has a balanced portfolio to capture the revitalization of China consumer industry, with exposure to multiple policy-focused subsectors (e.g. OTA, catering, auto, home appliance), defensive plays with low international exposure (e.g. beverage) as well as new consumption sectors that are experiencing fast growth (e.g. Pop toys).