Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X K-pop and Culture ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive K-pop and Culture Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is KRW but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Capturing the Rally of K-pop

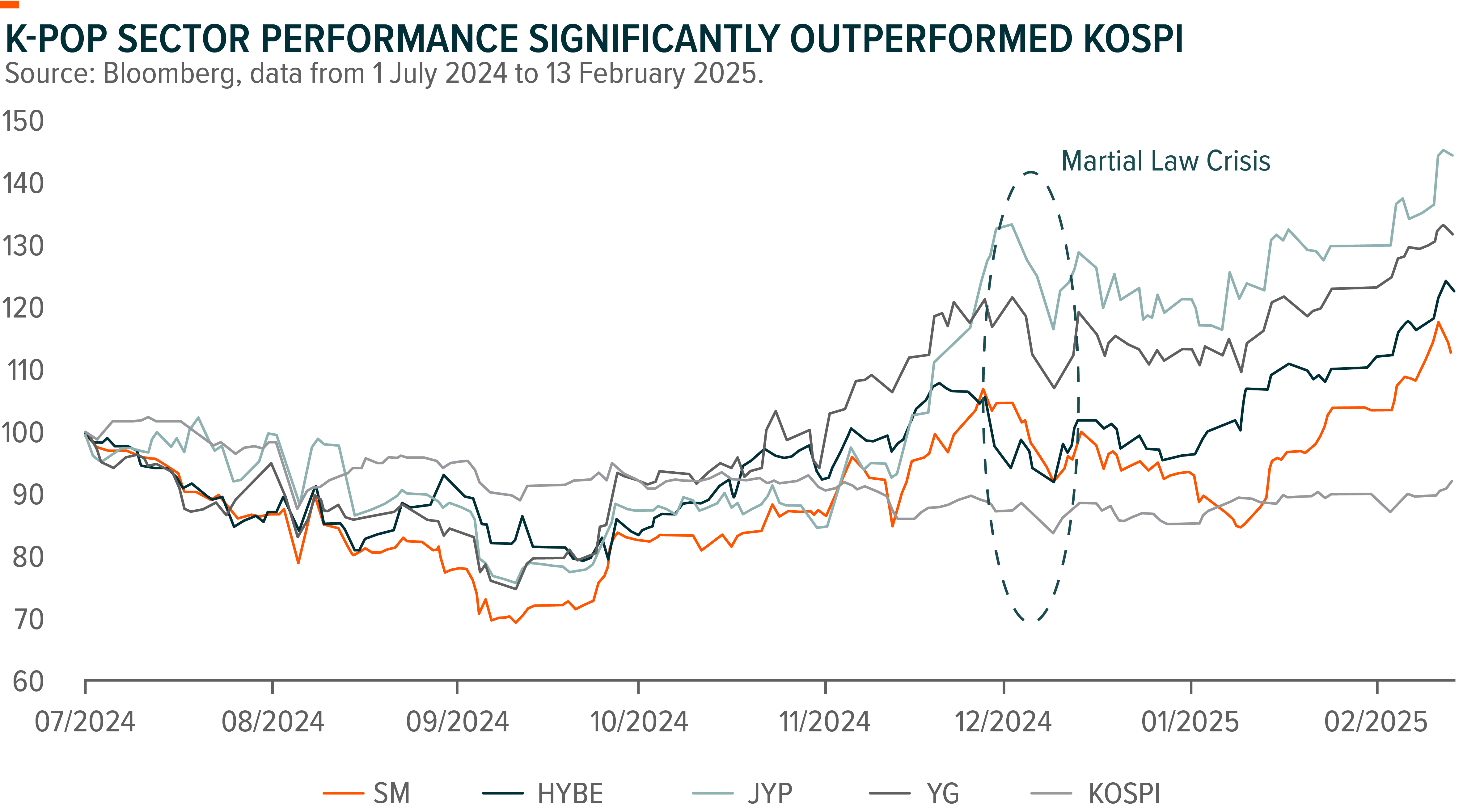

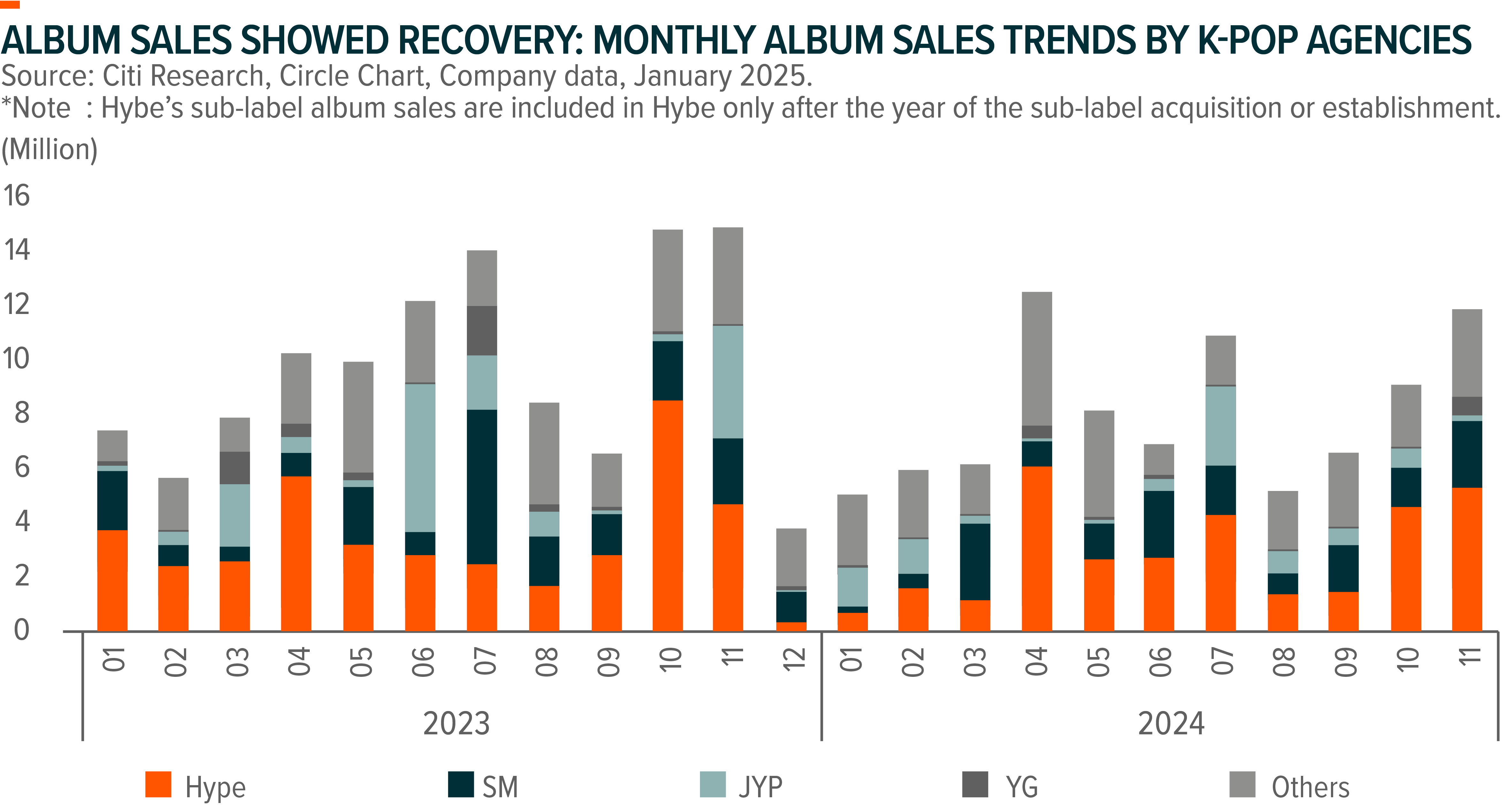

Korean market has rebounded YTD under easing political risks since last Dec, while the K-pop sector has notably outperform Kospi in the past few months. Echoing our previous call on K-pop sector (Korea Entertainment – Ready for Revival), we maintain a positive outlook for the K-pop industry in 2025, fueled by the return of top artists, the rising momentum of emerging artists, the lift of the overhang risk associated with NewJeans and HYBE dispute, as well as China rebound and low base. Comparing with traditional manufacturing goods, we believe that the unique cultural characteristics of K-pop content and its lower tariff risk will drive its sustained growth not only in China but also globally. The four leading Korean entertainment companies (JYP, HYBE, SM and YG) together accounted for 37% of the Global X K-pop and Culture ETF (3158 HK).

We expect robust earnings growth for the leading 4 entertainment companies in 2025, mainly supported by top artist come back and new artist ramp up.

- HYBE (352820 KS): BTS’s comeback, combined the continued growth of fan bases for emerging artists, is poised to support revenue growth. Recently, BTS member J-Hope announced his first solo world tour, featuring 31 concerts across 15 cities. Additionally, BTS is likely to celebrate the 10th anniversary of their album Young Forever with a special release. BTS is also expected to comeback in full group in 2H25 with their military service finished, likely followed by a world tour in 2026. Meanwhile, the US-based girl group Katseye is gaining notable traction and steadily expanding its fan base in US, with Spotify streams in 4Q24 more than doubling QoQ. To leverage this growth, HYBE plans to further refine and strengthen its localization strategies in the US market moving forward.

Additionally, the overhang risks associated with New Jeans have been alleviated, as New Jeans announced their departure in Nov 24. - JYP Entertainment (192820 KS): JYP is experiencing robust growth in the global fandom of its established artists, particularly Stray Kids. The group is anticipated to attract an audience of 1.7 million during their ongoing world tour, dominate (2024-2025), nearly three times larger than their previous tour, MANIAC (2022-2023). Meanwhile, JYP’s new boyband, KickFlip, which debuted on January 20, is also gaining traction, showcasing its improved competitiveness among new artists. KickFlip introduces a unique style not seen in JYP’s existing acts, reducing the likelihood of fan base cannibalization within the company’s artist lineup.

- SM Entertainment (041510 KS): Aespa and NCT Dream are currently key revenue contributors for SM. The company is also gaining momentum with new artist lineup, having recently debuted a girl group called Hearts2Hearts in February. The current competitive landscape appears favourable, particularly in light of the recent slowdown of NewJeans. Additionally, SM has announced a detailed schedule for their upcoming boy group project, SMTR25. This includes their show up in SM Town Global Tour in 1Q25, the release of an introduction film in 2Q, promotional activities in 3Q, and preparations for debut in 4Q, and a final debut likely in 1H26E.

- YG Entertainment (122870 KS): YG has announced Blackpink’s world tour in 2025, and the members have recently released solo songs with global hits such as “APT” by Rose, keeping their fans engaged and excited and gaining traction. Meanwhile, company earnings are also to be supported by legacy group such as 2NE1’s concert and younger group BabyMonster’s positive moment with album sales, and their 2025 World Tour.

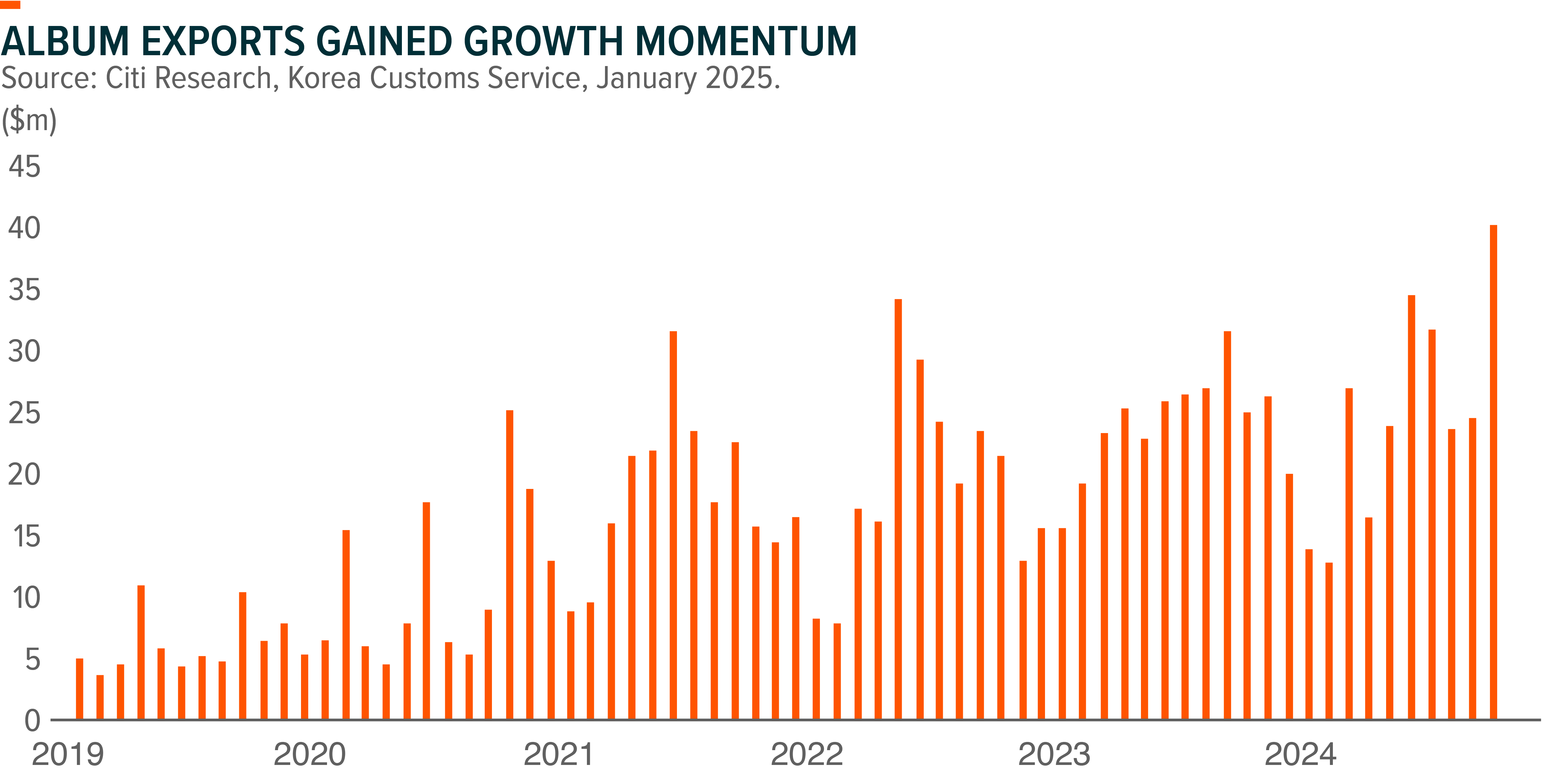

China market is expected to rebound post a challenging 2024. Export data demonstrated a significant recovery in the second half of 2024, after a prolonged period of stagnation since June 2023. Additionally, Chinese government has waived visa requirements for South Koreans, signalling positive signs for improved business conditions. Growing optimism about a potential reopening of the Chinese market has further bolstered investor confidence.

Moreover, we believe that the unique cultural characteristics of K-pop content, along with its relatively low replaceability and minimal tariff risk, will contribute to its sustained growth not only in China but also in the global market, especially when compared to traditional manufacturing goods.

| Global X K-pop and Culture ETF (3158 HKD) |

|

|---|---|

| Listing Date | 19 Mar 2024 |

| Reference Index | Solactive K-pop and Culture Index |

| Primary Exchange | Hong Kong Stock Exchange |

| Total Expense Ratio | 0.68% p.a. |

| Product Page | Link |

Source: Mirae Asset; Data as of February 2025.