China Biotechnology:

Healthcare for

Tomorrow’s World

In A Single Trade,

Gain Access to 30 China Biotech Companies

2820 (HKD) / 9820 (USD)

Stock Code ( Read More )

China Biotech Index^

Underlying Index

HK$ ...

AUM1 (---)

0.68%

Ongoing Charges

Over A Year2

2019/07/24

Inception Date

![]()

The only China

Biotech-Focused ETF

Listed on Stock Exchange

of Hong Kong3

![]()

“Most

Innovative ETF”

by The Asset Triple A

Sustainable Investing

Awards 20204

![]()

Return of Global X

China Biotech ETF#

98.70%

![]()

Average Return of

ETFs in Hong Kong at

the same period*

19.89%

Cumulative Performance (%)#

| 3M% | 1Yr% | 3Yr% | 5Yr% | YTD | Since Listing |

| 7.21 | 69.7 | N/A | N/A | 69.7 | 98.70 |

Calendar Year Performance (%)#

| 2020 | 2019 | 2018 | 2017 | 2016 |

| 69.7 | 17.09^ | N/A | N/A | N/A |

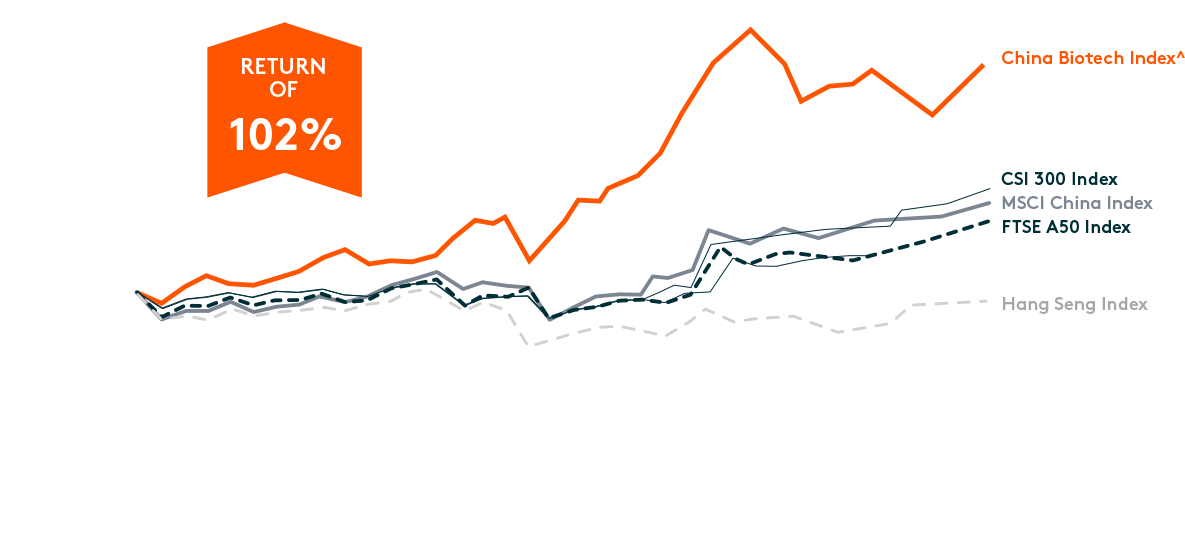

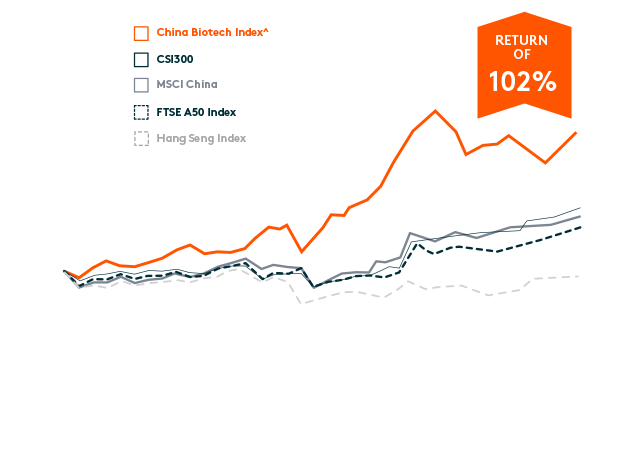

Comparison between China Biotech^ and Various Major Broad Market China

and Hong Kong Indices%

From 25 July 2019 to 31 December 2020

Comparison between China Biotech^ and Various Major Broad Market China and Hong Kong Indices%

From 25 July 2019 to 31 December 2020

1

2

3

4

5

Benefits of

Biotechnological Therapies

Potential Applications of Biotechnology

Stem Cell

A future solution to treat brain diseases and blood diseases by regenerating organs & tissues and bone marrow transplants.

Genetic Diagnosis

and Gene Therapy

Detecting diseases that caused by inherited gene mutations and to cure the disease by altering genetic sequences.

Vaccines and

Cancer Treatment

Use of Biologics (Biological drugs) to activate own immune system, trigger the releases of killer cells to fight malfunctioning cells.

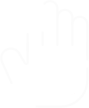

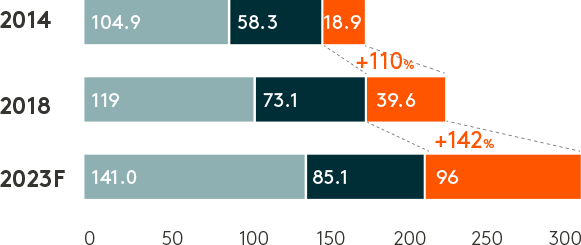

Growth of Biologics in China

China’s pharmaceutical market has been expanding rapidly and the growth in biologics is a major driver of growth.

Chemical Drugs

Traditional Chinese Medicine

Biologics

Chinese Government Support

for the Biotech Industry

Beijing has listed biotechnology as one of 10 key sectors for development6 under

its national strategy and with a plan to transform China into a powerhouse in

high-tech and high-value industries.

Licensing and

commercializing new

drugs & diagnostic

reagents

Increasing access

to health care data

Recruitment of

biotech talent

Building biotech

parks across the

country

RELATED ARTICLES

RELATED VIDEOS

^ Underlying Index: Solactive China Biotech Index

This website is intended for Hong Kong investors only. Your use of this website means you agree to our Terms of use. This website is strictly for information purposes only and does not constitute a representation that any investment strategy is suitable or appropriate for an investor’s individual circumstances. Global X was acquired by Mirae Asset Global Investments and Mirae Asset Global Investments is the holding company of Mirae Asset Global Investments (Hong Kong) Limited with effective date 1 November 2019.

The information contained in this website is for information purposes only and does not, constitute any recommendations, offer or solicitation to buy, sell or subscribe to any securities or financial instruments in any jurisdiction. Investment involves risk. It cannot be guaranteed that the performance of the Product will generate a return and there may be circumstances where no return is generated or the amount invested is lost. Past performance is not indicative of future performance.

Before making any investment decision to invest in the Product, investors should read the Product’s prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Product and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investments.

Certain information contained in this website is compiled from third party sources. Whilst Mirae Asset Global Investments (Hong Kong) Limited (“Mirae Asset HK”), the Manager of the Product, has, to the best of its endeavor, ensured that such, information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information. Mirae Asset HK accepts no liability for, any loss or damage of any kind resulting out of the unauthorized use of this website.

The Products are not sponsored, endorsed, issued, sold or promoted by their index providers. For details of an index provider including any disclaimer, please refer to the relevant Product’s offering documents.

The contents of this website is prepared and maintained by Mirae Asset Global Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

COM-2020-11-19-HK-R-Web_2