Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X China MedTech ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China MedTech Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Global X China MedTech ETF (2841)

Riding on Positive Developments

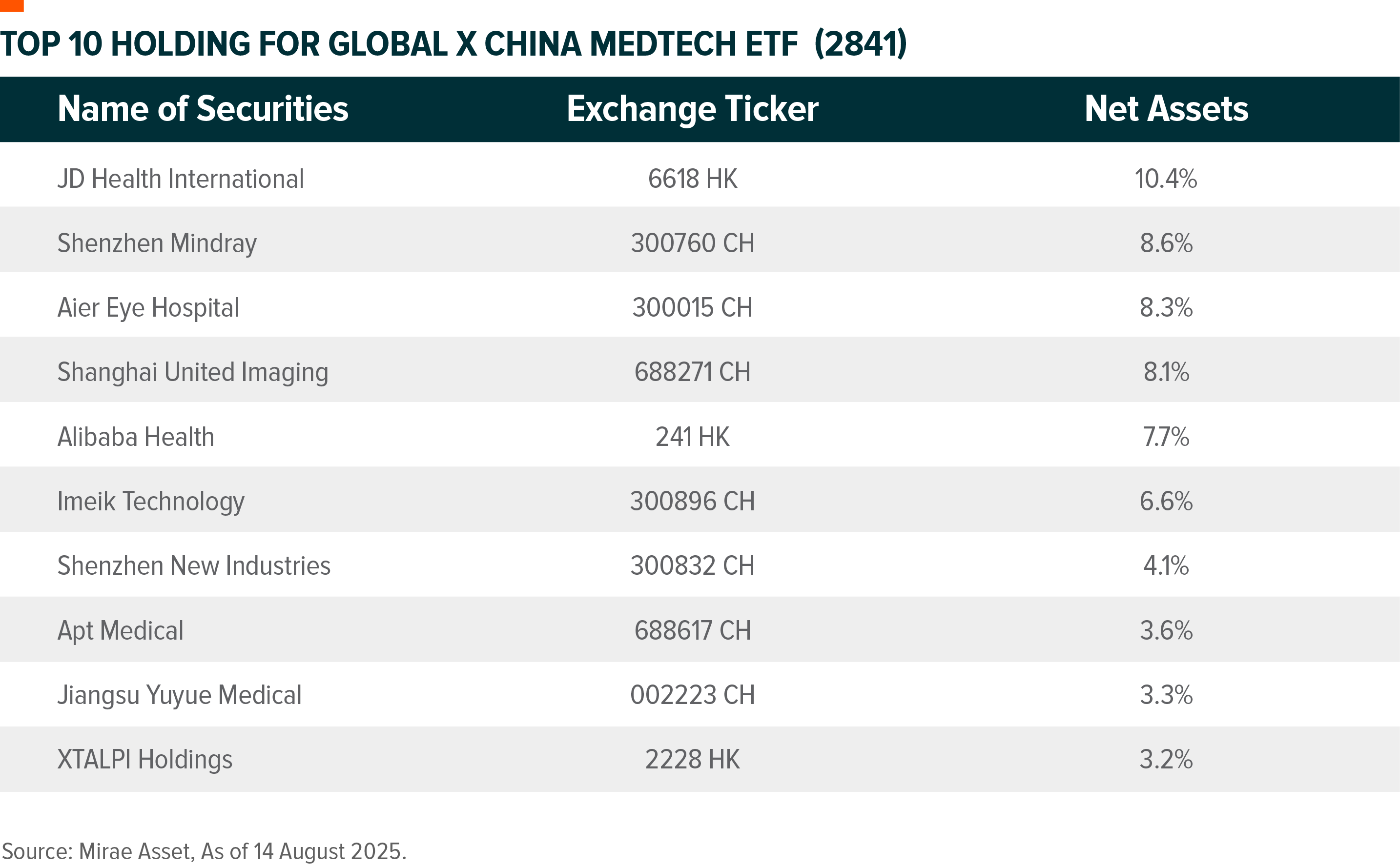

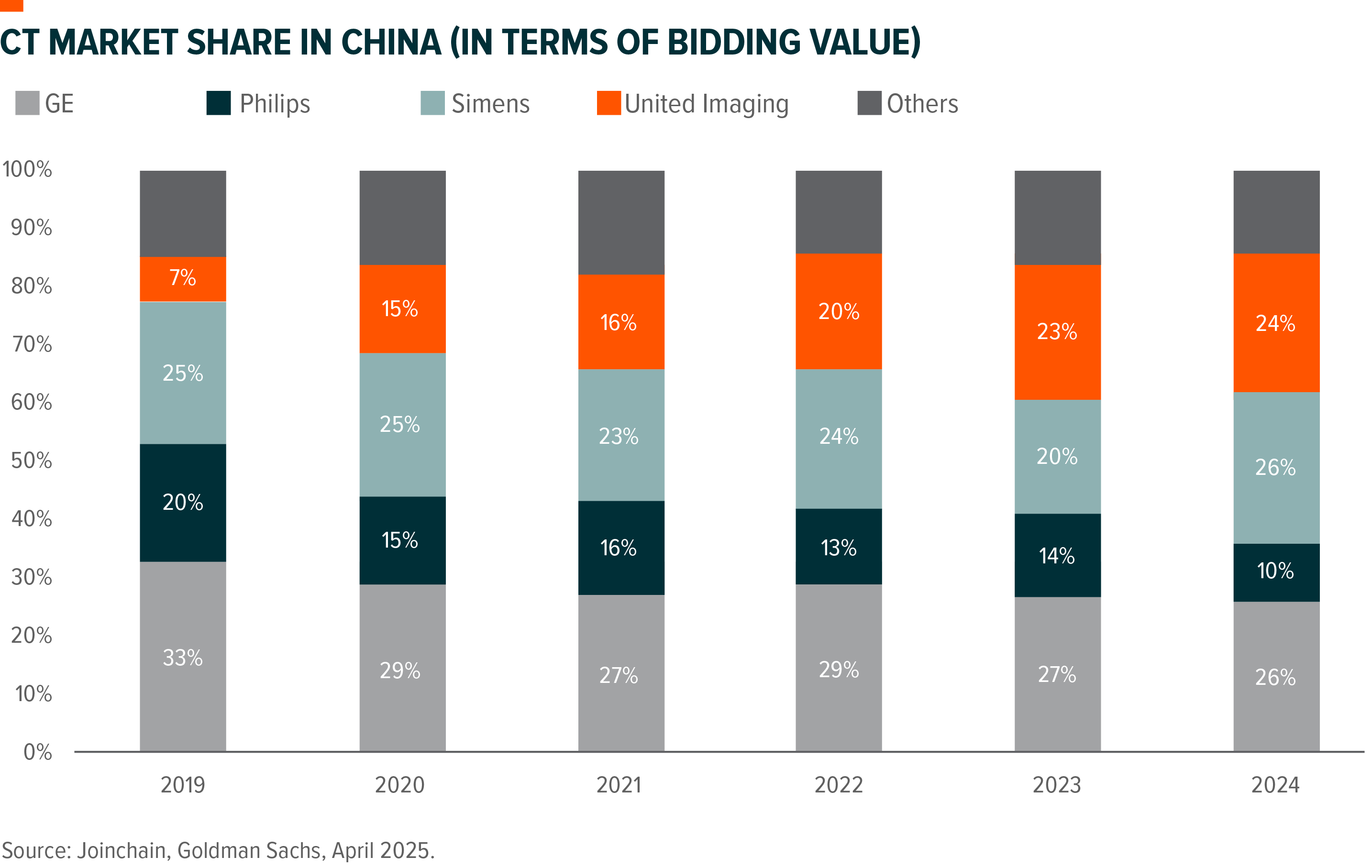

China MedTech sector recorded sector-wise rally over past months, bolstered by several positive factors: 1). Recovery in hospital equipment procurement activity: Hospital equipment procurement activity increased by 34% YoY in 1H25. The tenders recovery in first half of the year could gradually support revenue growth for MedTech companies in 2H25; 2). Ongoing import substitution trend: Domestic leaders such as Mindray and United Imaging continue to gain share from foreign players their respective subsectors; 3) Government funding supports, both at central and local government level. Global X China MedTech ETF (2841) invests in 30 leading China MedTech and online drug retail companies and is well positioned to benefit.

Over the longer term, the potential for overseas expansion presents an additional avenue for leading Chinese MedTech firms, underpinned by their enhanced product competitiveness and China’s sophisticated supply chain. The success of Chinese biotech companies going overseas demonstrated global recognition of China’s innovation capabilities, and we could be seeing similar global expansion potential for China MedTech companies, albeit at a slower pace as they still need to gradually establish overseas distribution channel.

Other than MedTech companies, the Global X China MedTech ETF (2841) also invests in internet drug retail platforms including JD Health, Alibaba Health, and Ping An Health, all recorded substantial return YTD. The sector is supported by policy tailwinds that propel online drug sales, with substantial potential for online penetration of drug sales to increase from low-teens% now. JD Health reported strong 2Q25 results, raising revenue target to 20% YoY as driven by sustainably higher growth for drug sales amid policy tailwinds. Ping An Health also reported better than expectation 1H25 results with revenue of Rmb2,502mn (+19% yoy) and net profit of Rmb134mn (+137% yoy). More importantly, the company recorded strong user base expansion, with total paying users increased by 35.1% yoy to approximately 24.0mn